Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corporate bonds are rated based on their likelihood of default. Instead of investing in just one low grade, you want to examine the effect on

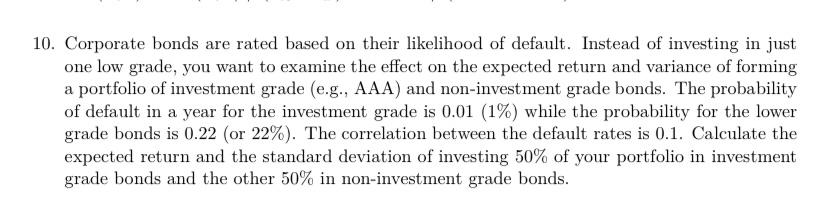

Corporate bonds are rated based on their likelihood of default. Instead of investing in just

one low grade, you want to examine the effect on the expected return and variance of forming

a portfolio of investment grade eg AAA and noninvestment grade bonds. The probability

of default in a year for the investment grade is while the probability for the lower

grade bonds is or The correlation between the default rates is Calculate the

expected return and the standard deviation of investing of your portfolio in investment

grade bonds and the other in noninvestment grade bonds and also the variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started