Answered step by step

Verified Expert Solution

Question

1 Approved Answer

corporate finance P1,P2,P3,P4 Problem: 1 Brandon runs a shoe company that has been performing well, and he wants to work out his gross profit margin

corporate finance P1,P2,P3,P4

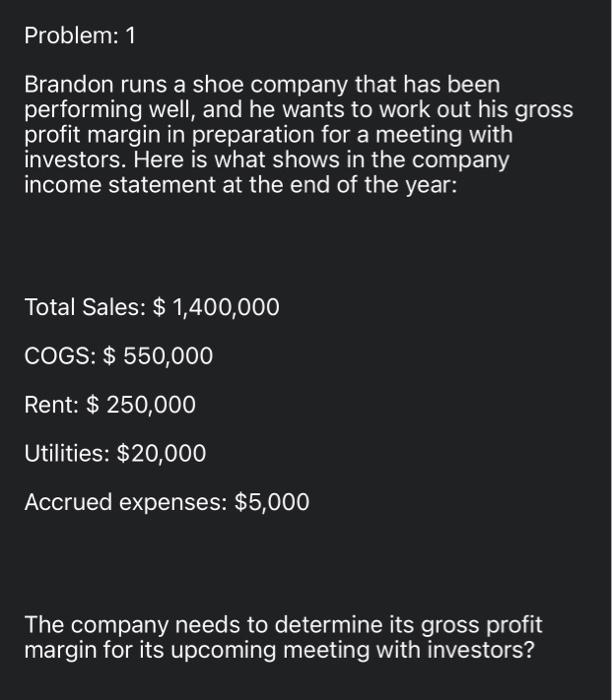

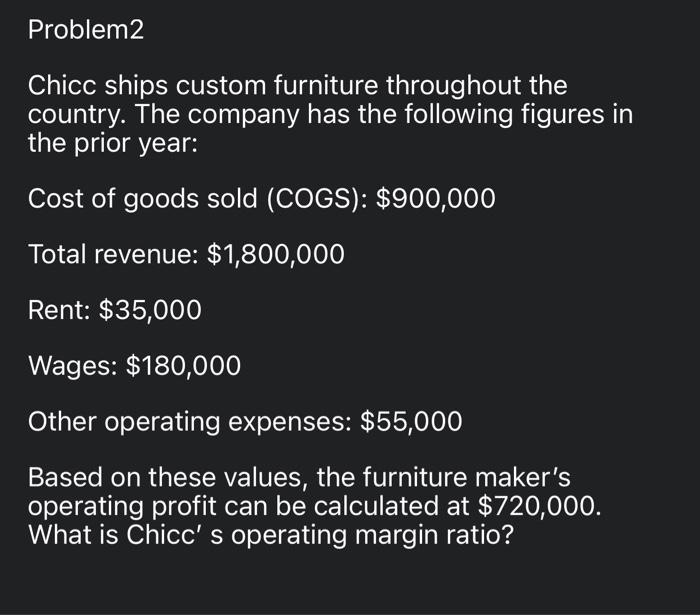

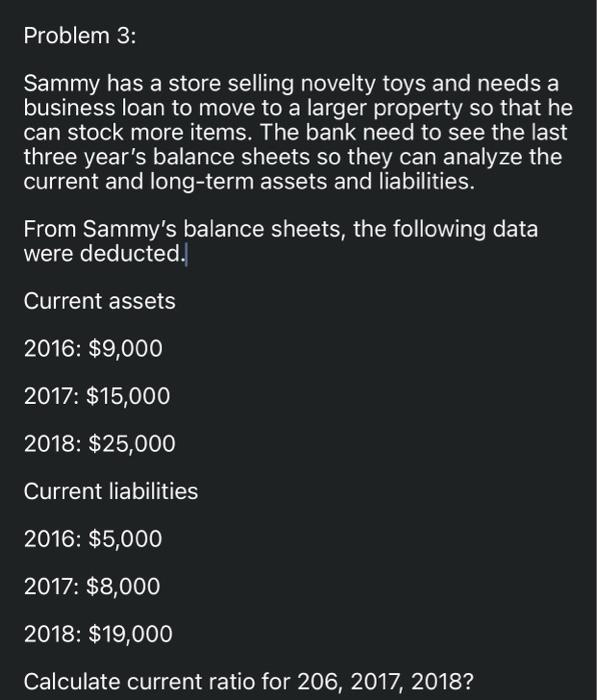

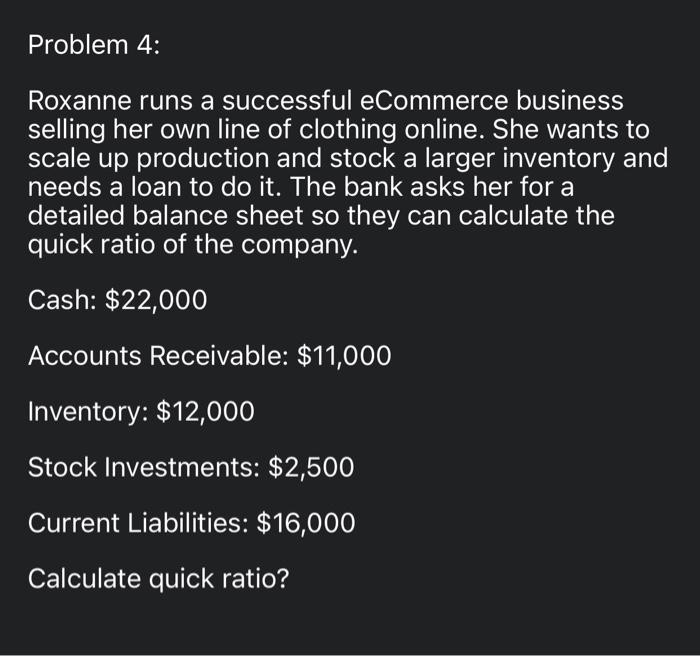

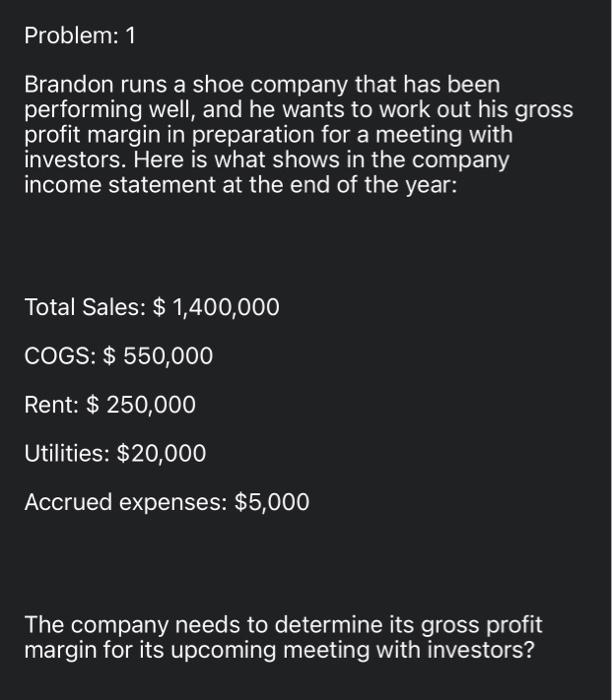

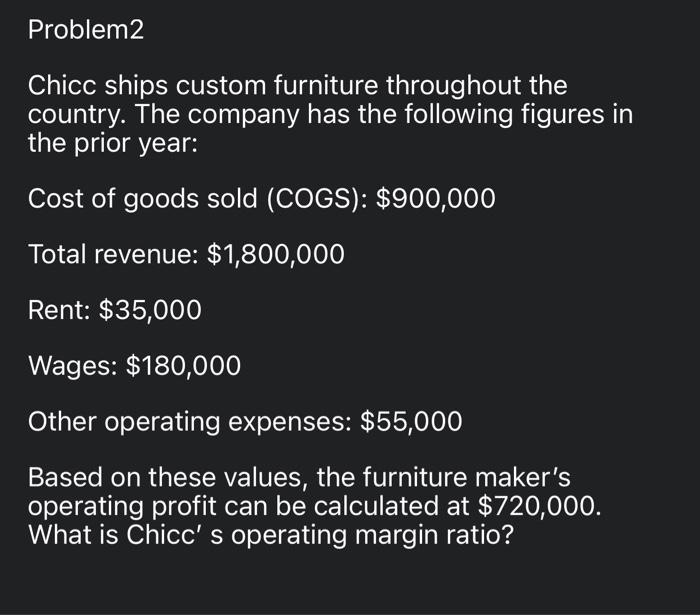

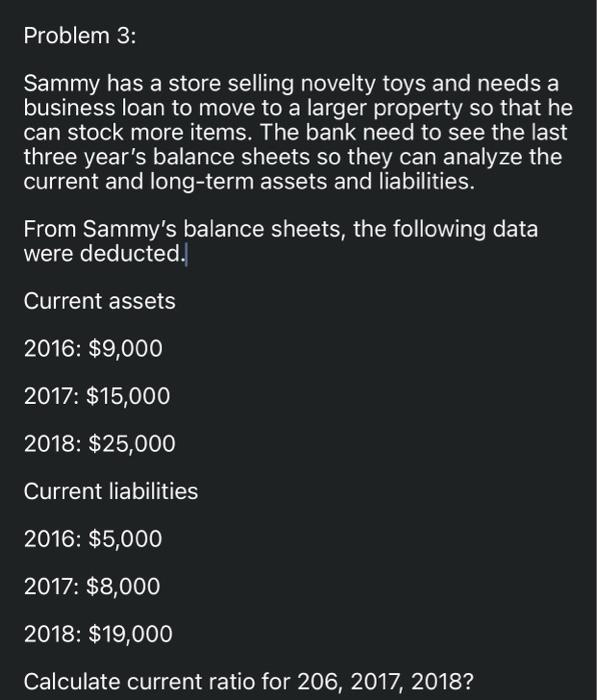

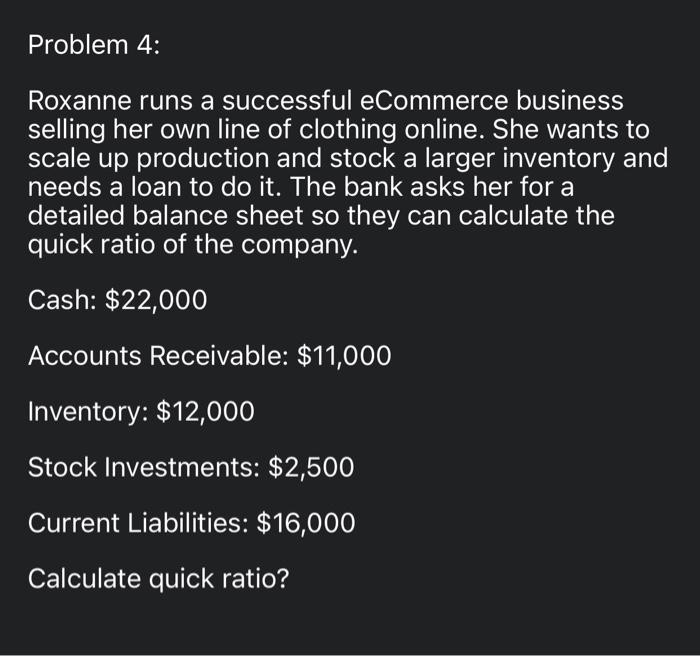

Problem: 1 Brandon runs a shoe company that has been performing well, and he wants to work out his gross profit margin in preparation for a meeting with investors. Here is what shows in the company income statement at the end of the year: Total Sales: $ 1,400,000 COGS: $ 550,000 Rent: $ 250,000 Utilities: $20,000 Accrued expenses: $5,000 The company needs to determine its gross profit margin for its upcoming meeting with investors? Problem2 Chicc ships custom furniture throughout the country. The company has the following figures in the prior year: Cost of goods sold (COGS): $900,000 Total revenue: $1,800,000 Rent: $35,000 Wages: $180,000 Other operating expenses: $55,000 Based on these values, the furniture maker's operating profit can be calculated at $720,000. What is Chicc' s operating margin ratio? Problem 3: Sammy has a store selling novelty toys and needs a business loan to move to a larger property so that he can stock more items. The bank need to see the last three year's balance sheets so they can analyze the current and long-term assets and liabilities. From Sammy's balance sheets, the following data were deducted. Current assets 2016: $9,000 2017: $15,000 2018: $25,000 Current liabilities 2016: $5,000 2017: $8,000 2018: $19,000 Calculate current ratio for 206, 2017, 2018? Problem 4: Roxanne runs a successful eCommerce business selling her own line of clothing online. She wants to scale up production and stock a larger inventory and needs a loan to do it. The bank asks her for a detailed balance sheet so they can calculate the quick ratio of the company. Cash: $22,000 Accounts Receivable: $11,000 Inventory: $12,000 Stock Investments: $2,500 Current Liabilities: $16,000 Calculate quick ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started