Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CORPORATE FINANCE TOPIC : CAPITAL STRUCTURE Blue Ivy Bhd is a manufacturing company that produces solar energy on small scales of production. On average,

\

\

CORPORATE FINANCE

TOPIC : CAPITAL STRUCTURE

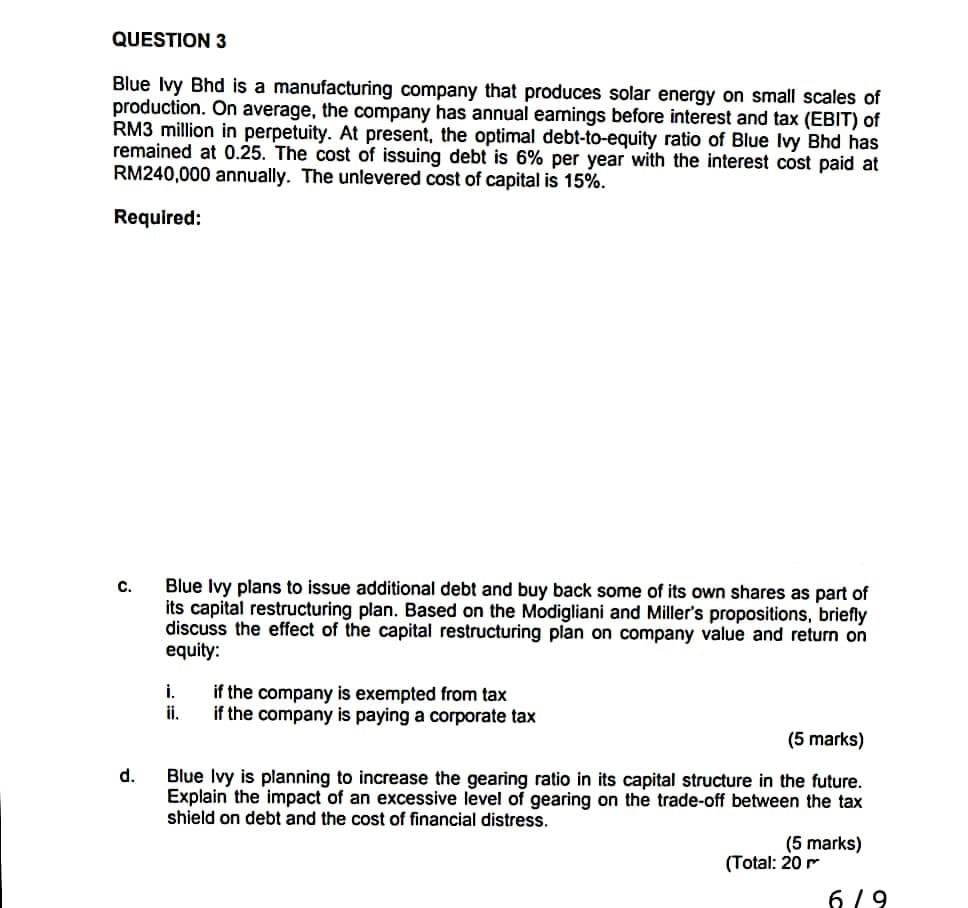

Blue Ivy Bhd is a manufacturing company that produces solar energy on small scales of production. On average, the company has annual eamings before interest and tax (EBIT) of RM3 million in perpetuity. At present, the optimal debt-to-equity ratio of Blue Ivy Bhd has remained at 0.25. The cost of issuing debt is 6% per year with the interest cost paid at RM240,000 annually. The unlevered cost of capital is 15%. Required: c. Blue Ivy plans to issue additional debt and buy back some of its own shares as part of its capital restructuring plan. Based on the Modigliani and Miller's propositions, briefly discuss the effect of the capital restructuring plan on company value and return on equity: i. if the company is exempted from tax ii. if the company is paying a corporate tax (5 marks) d. Blue Ivy is planning to increase the gearing ratio in its capital structure in the future. Explain the impact of an excessive level of gearing on the trade-off between the tax shield on debt and the cost of financial distress. Blue Ivy Bhd is a manufacturing company that produces solar energy on small scales of production. On average, the company has annual eamings before interest and tax (EBIT) of RM3 million in perpetuity. At present, the optimal debt-to-equity ratio of Blue Ivy Bhd has remained at 0.25. The cost of issuing debt is 6% per year with the interest cost paid at RM240,000 annually. The unlevered cost of capital is 15%. Required: c. Blue Ivy plans to issue additional debt and buy back some of its own shares as part of its capital restructuring plan. Based on the Modigliani and Miller's propositions, briefly discuss the effect of the capital restructuring plan on company value and return on equity: i. if the company is exempted from tax ii. if the company is paying a corporate tax (5 marks) d. Blue Ivy is planning to increase the gearing ratio in its capital structure in the future. Explain the impact of an excessive level of gearing on the trade-off between the tax shield on debt and the cost of financial distressStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started