Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corporate Income Tax Course SHOW WORK PREFERABLY ON EXCEL, if not that's okay too B Co Inc., C Co Inc., and A Co Inc., are

Corporate Income Tax Course

SHOW WORK PREFERABLY ON EXCEL, if not that's okay too

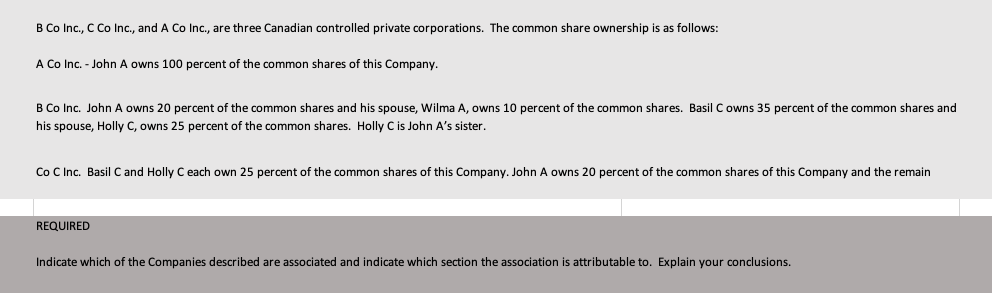

B Co Inc., C Co Inc., and A Co Inc., are three Canadian controlled private corporations. The common share ownership is as follows: A Co Inc. - John A owns 100 percent of the common shares of this Company. B Co Inc. John A owns 20 percent of the common shares and his spouse, Wilma A, owns 10 percent of the common shares. Basil Cowns 35 percent of the common shares and his spouse, Holly C, owns 25 percent of the common shares. Holly C is John A's sister. Co C Inc. Basil Cand Holly C each own 25 percent of the common shares of this Company. John A owns 20 percent of the common shares of this Company and the remain REQUIRED Indicate which of the Companies described are associated and indicate which section the association is attributable to. Explain your conclusionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started