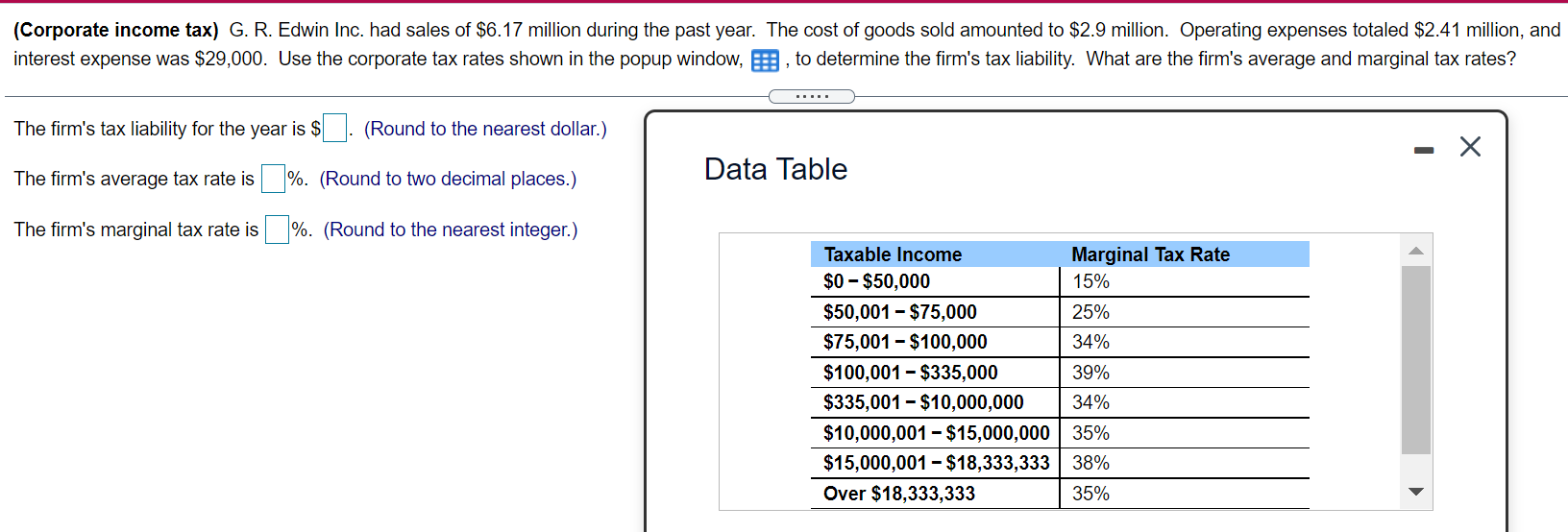

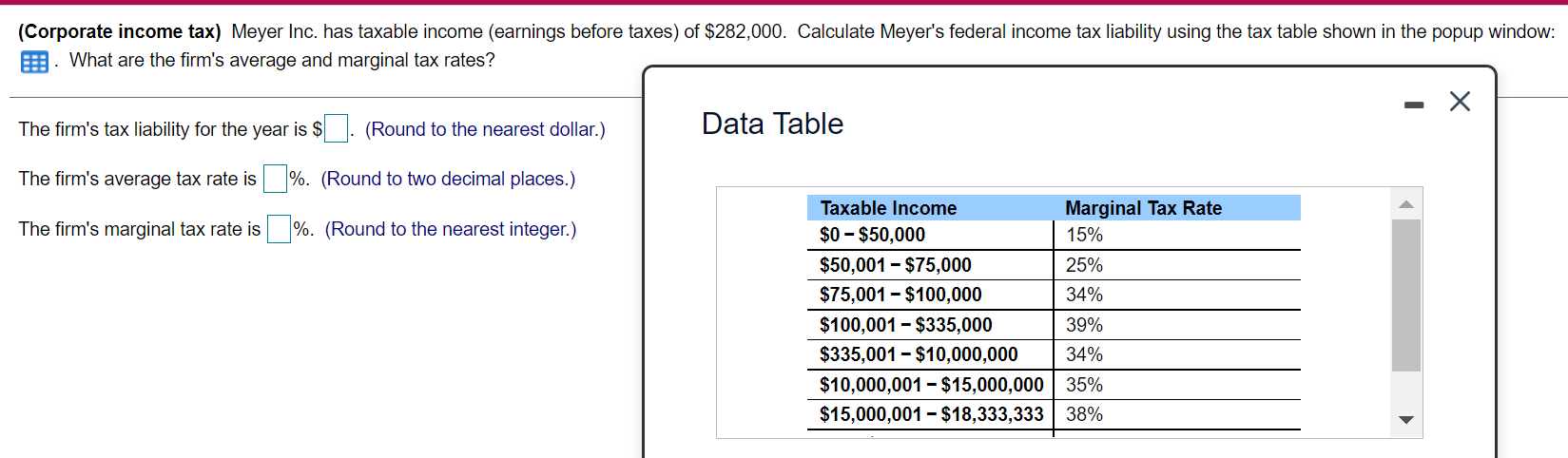

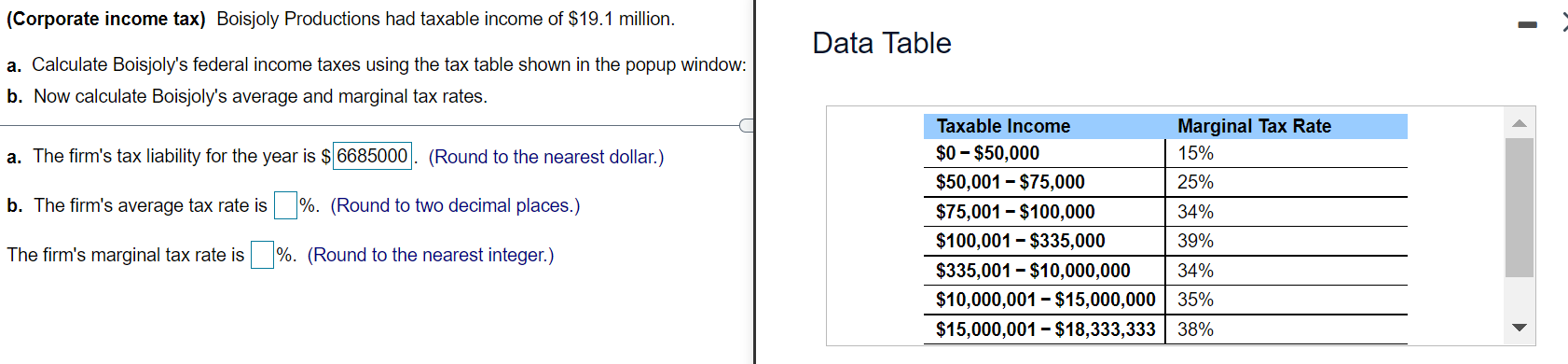

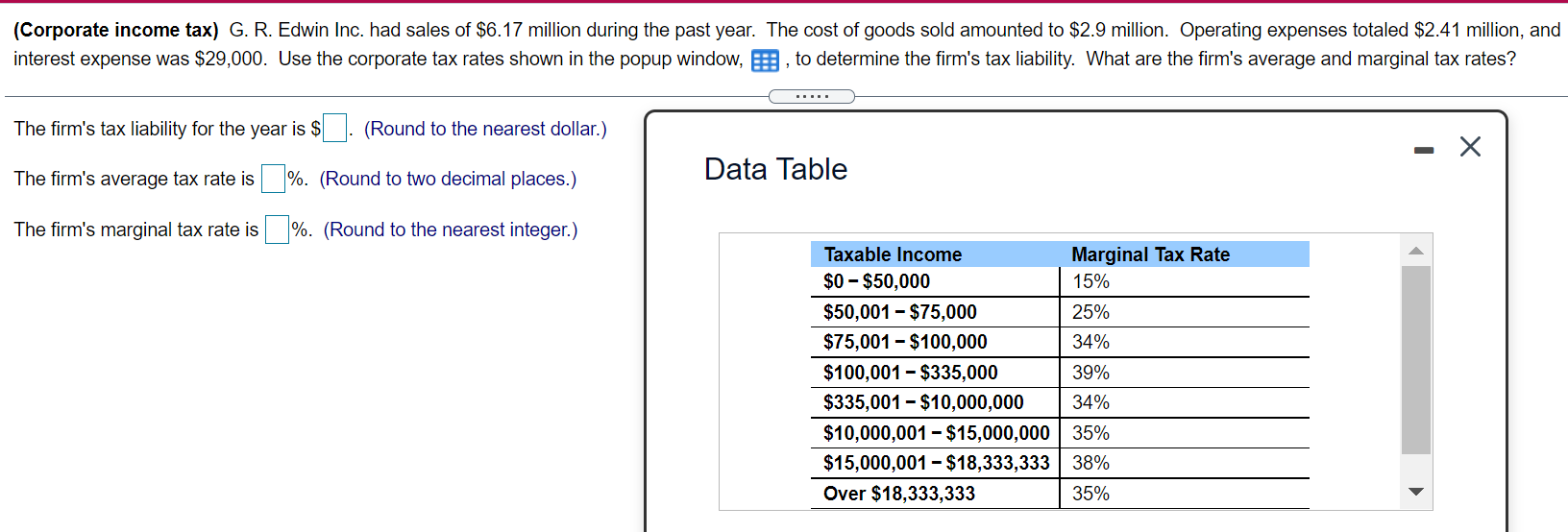

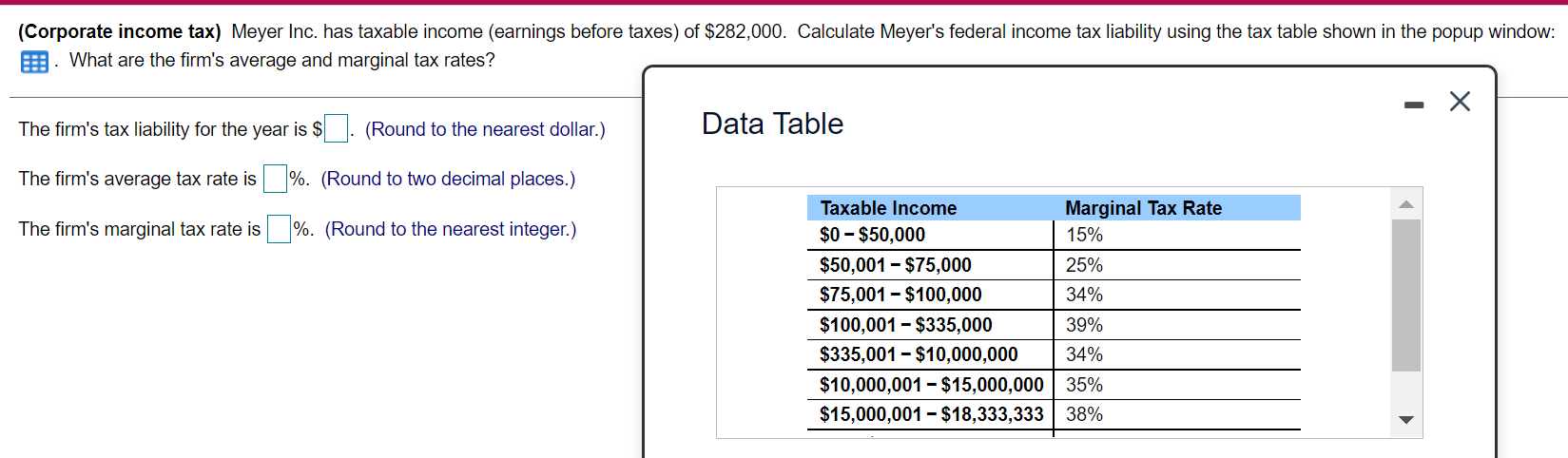

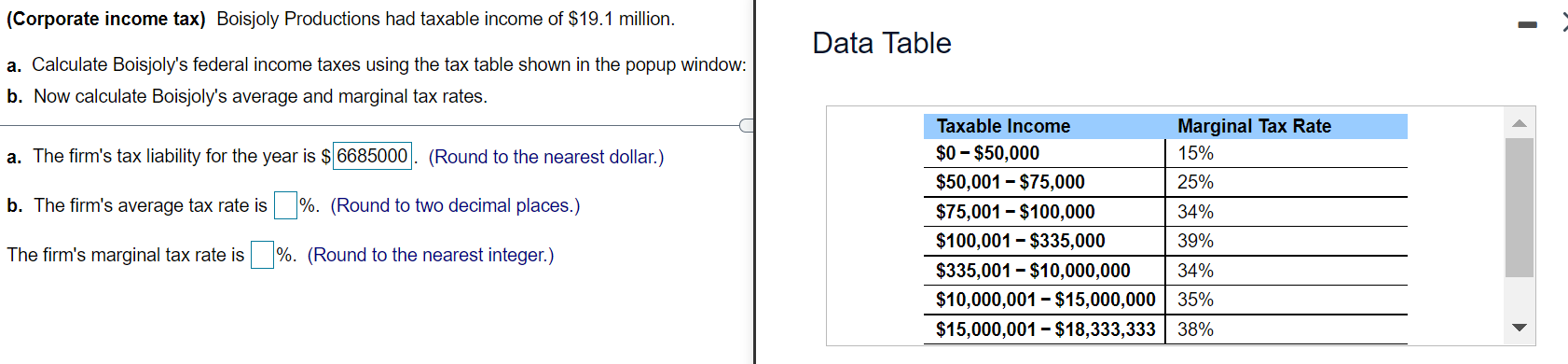

(Corporate income tax) G. R. Edwin Inc. had sales of $6.17 million during the past year. The cost of goods sold amounted to $2.9 million. Operating expenses totaled $2.41 million, and interest expense was $29,000. Use the corporate tax rates shown in the popup window, E, to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.) The firm's average tax rate is %. (Round to two decimal places.) Data Table The firm's marginal tax rate is %. (Round to the nearest integer.) Taxable income Marginal Tax Rate $0-$50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35% FEE (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $282,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) Data Table The firm's average tax rate is %. (Round to two decimal places.) Taxable Income Marginal Tax Rate The firm's marginal tax rate is %. (Round to the nearest integer.) $0-$50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% (Corporate income tax) Boisjoly Productions had taxable income of $19.1 million. Data Table a. Calculate Boisjoly's federal income taxes using the tax table shown in the popup window: b. Now calculate Boisjoly's average and marginal tax rates. a. The firm's tax liability for the year is $ 6685000. (Round to the nearest dollar.) b. The firm's average tax rate is 1%. (Round to two decimal places.) Taxable Income Marginal Tax Rate $0-$50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% The firm's marginal tax rate is %. (Round to the nearest integer.)