Answered step by step

Verified Expert Solution

Question

1 Approved Answer

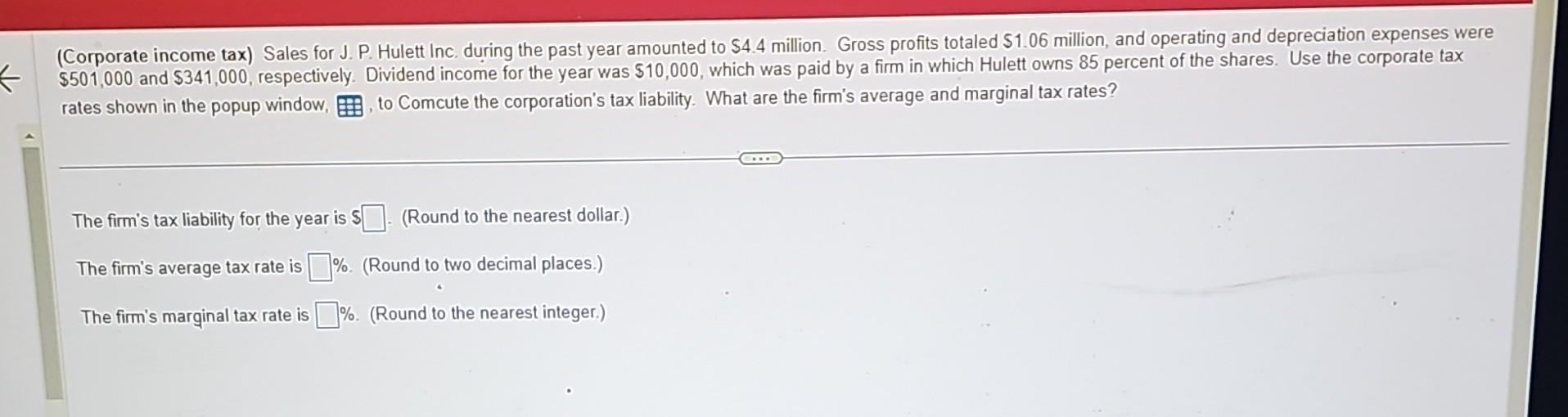

(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $4.4 million. Gross profits totaled $1.06 million, and operating and

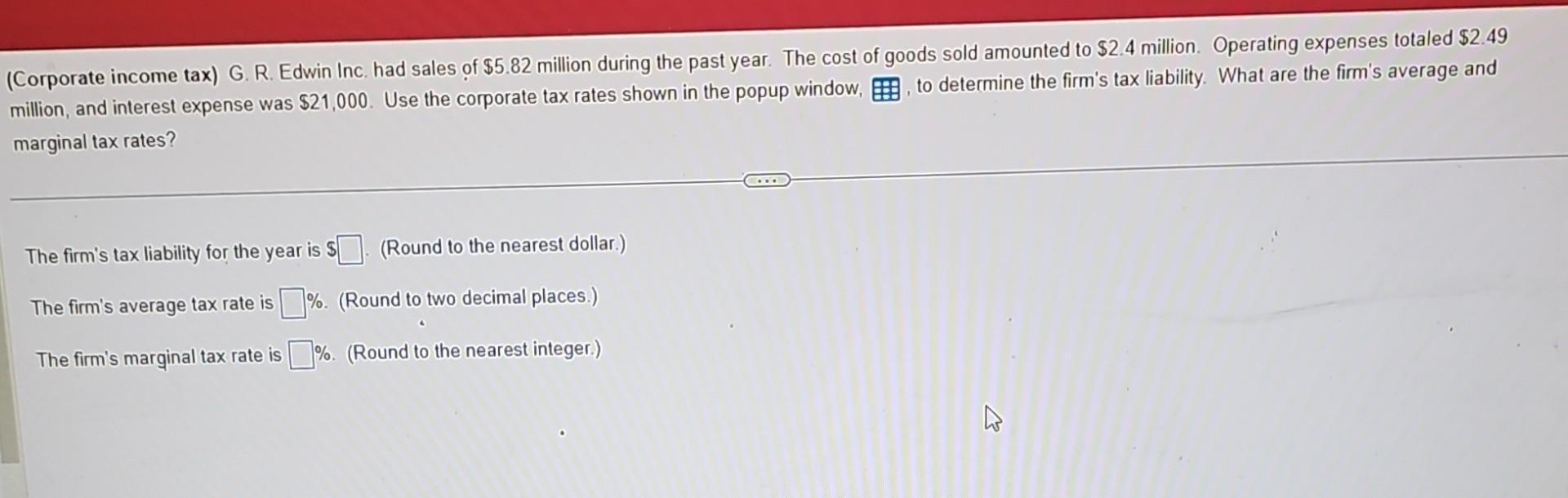

(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $4.4 million. Gross profits totaled $1.06 million, and operating and depreciation expenses were $501,000 and $341,000, respectively. Dividend income for the year was $10,000, which was paid by a firm in which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window, , to Comcute the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) The firm's average tax rate is %. (Round to two decimal places.) The firm's marginal tax rate is %. (Round to the nearest integer.) (Corporate income tax) G. R. Edwin Inc. had sales of $5.82 million during the past year. The cost of goods sold amounted to $2.4 million. Operating expenses totaled \$2.49 million, and interest expense was $21,000. Use the corporate tax rates shown in the popup window, , to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) The firm's average tax rate is \%. (Round to two decimal places.) The firm's marginal tax rate is %. (Round to the nearest integer.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started