Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Corporate income tax) The William B. Waugh Corporation is a regional Toyota dealer. The firm sells new and used trucks and is actively involved

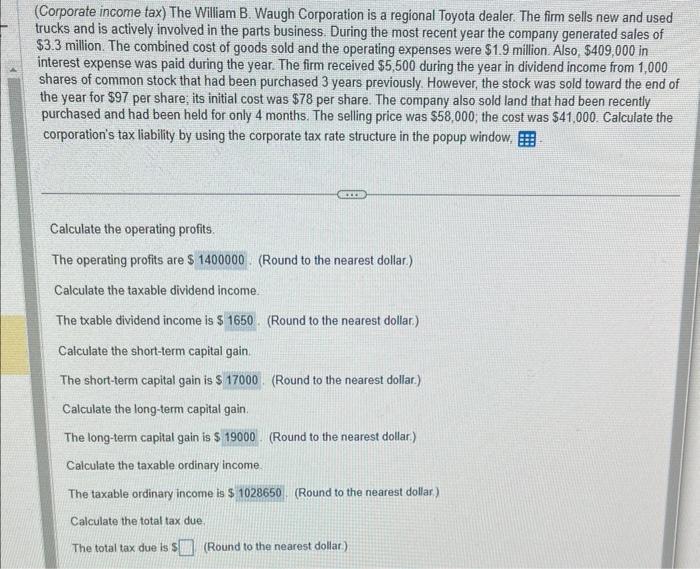

(Corporate income tax) The William B. Waugh Corporation is a regional Toyota dealer. The firm sells new and used trucks and is actively involved in the parts business. During the most recent year the company generated sales of $3.3 million. The combined cost of goods sold and the operating expenses were $1.9 million. Also, $409,000 in interest expense was paid during the year. The firm received $5,500 during the year in dividend income from 1,000 shares of common stock that had been purchased 3 years previously. However, the stock was sold toward the end of the year for $97 per share; its initial cost was $78 per share. The company also sold land that had been recently purchased and had been held for only 4 months. The selling price was $58,000; the cost was $41,000. Calculate the corporation's tax liability by using the corporate tax rate structure in the popup window, Calculate the operating profits. The operating profits are $ 1400000 (Round to the nearest dollar.) Calculate the taxable dividend income. The txable dividend income is $ 1650 (Round to the nearest dollar.) Calculate the short-term capital gain. The short-term capital gain is $ 17000 (Round to the nearest dollar.) Calculate the long-term capital gain. The long-term capital gain is $ 19000 (Round to the nearest dollar.) Calculate the taxable ordinary income. The taxable ordinary income is $ 1028650 (Round to the nearest dollar) Calculate the total tax due. The total tax due is $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer William B Waugh Corporation Tax Liability Calculation 1 Operating Profits Sales 3300000 Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started