Question

Corporate Real Estate Finance Question: Lease vs Own Analysis How do we get this basis of $1,050,000 ? (problem below, I just cant figure out

Corporate Real Estate Finance Question: Lease vs Own Analysis How do we get this "basis" of $1,050,000 ? (problem below, I just cant figure out how to get the basis)

Assume that the XYZ Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $1.5 million. The cost of goods sold is estimated to be 50 percent of sales, and corporate overhead would increase by $200,000, which does not include the cost of either acquiring or leasing office space. XYZ will also have to invest $1.3 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. 3 XYZ could purchase a small office building for its sole use at a total price of $1.8 million, of which $225,000 (12.5%) of the purchase price would represent land value, and $1,575,000 (87.5%) would represent building value. The cost of the building would be depreciated over 31.5 years. 4 XYZ is in a 30 percent tax bracket. As an alternative to owning, an investor has approached XYZ and indicated a willingness to purchase the same building and lease it to XYZ for $180,000 per year for a term of 15 years. XYZ would pay all real estate operating expenses (absolute net lease), which are estimated to be 50 percent of the lease payments. XYZ has estimated that the property value should increase over the 15-year lease term, and the building could be sold for $3 million at the end of the 15 years.

XYZ has also determined that if it purchases the property, it could arrange financing with an interest-only mortgage on the property for $1,369,000 (76% of the purchase price) at an interest rate of 10 percent with a balloon payment due after 10 years.

Cash Flow from Leasing

Exhibit 151 shows the calculation of after-tax cash flow associated with opening the office building and obtaining use of the space by leasing. Recall that the initial cash outlay of $1.3 million is the up-front cost of setting up the office. After-tax cash flow of $196,000 is received each year for 15 years. We also assume that XYZ will close the office at the end of the lease, and that the furniture and equipment will have no residual value. An after-tax rate of return of 12.5 percent is assumed to be the opportunity cost, or after-tax reinvestment rate savings of $1.3 million, if XYZ chooses to lease rather than own the office building. This is the rate of return after tax that XYZ can compare with other investment alternatives of equal risk when considering whether it should invest the $1.3 million necessary to open the new office building. Assuming that XYZ believes that it should open a new regional office, the next question is whether the firm should lease or own the property that will house the new operation. One way to answer this question is to calculate the after-tax cash flows and after-tax rate of return assuming that the space is owned rather than leased.

Cash Flow from Owning

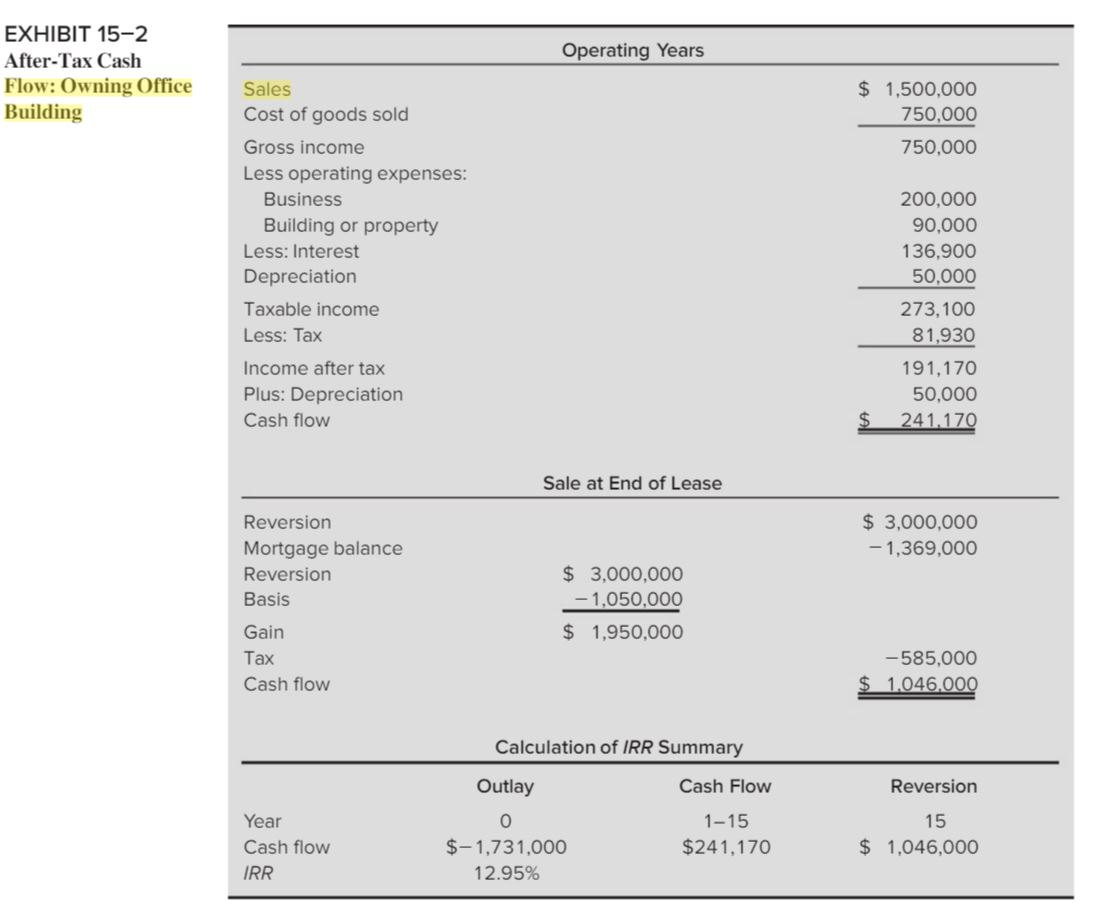

Exhibit 152 shows the after-tax cash flow from opening the office building under the assumption that it is owned. The initial cash outlay of $1,731,000 includes the equity invested in the office building of $431,000 as well as the other up-front costs of $1.3 million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started