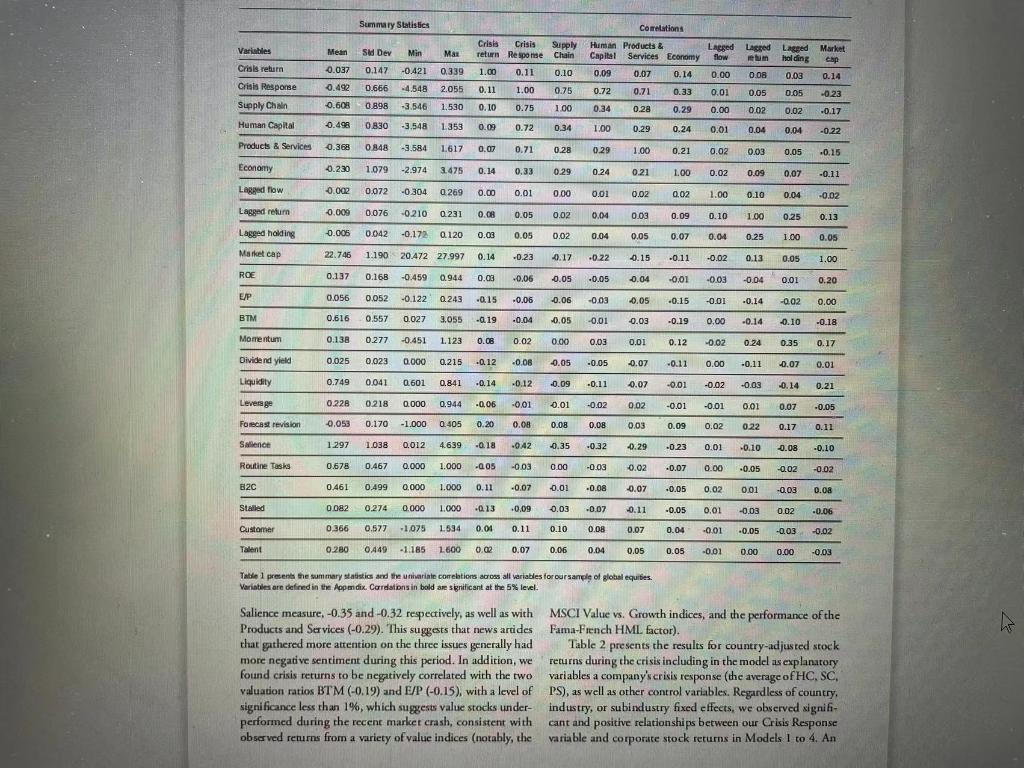

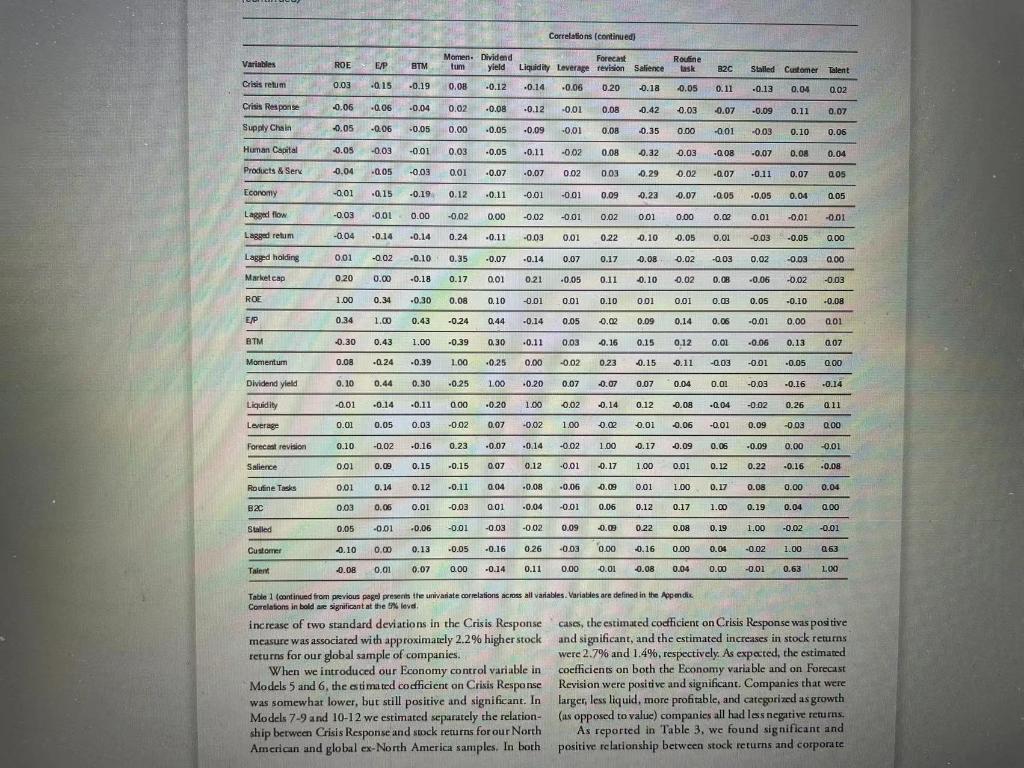

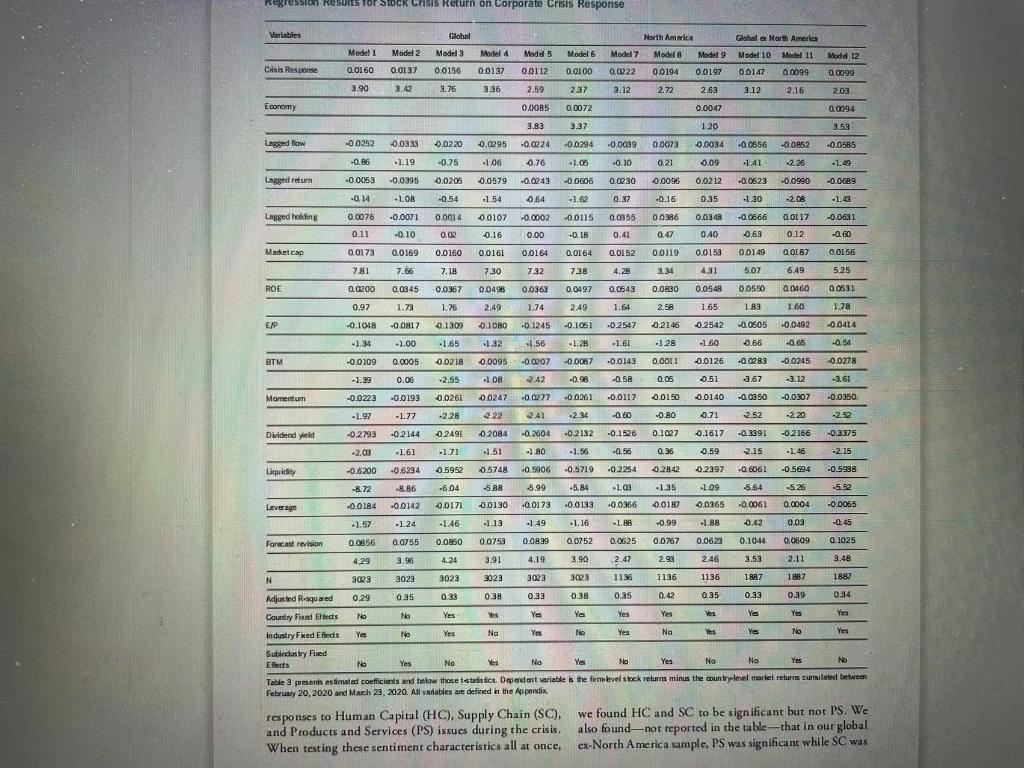

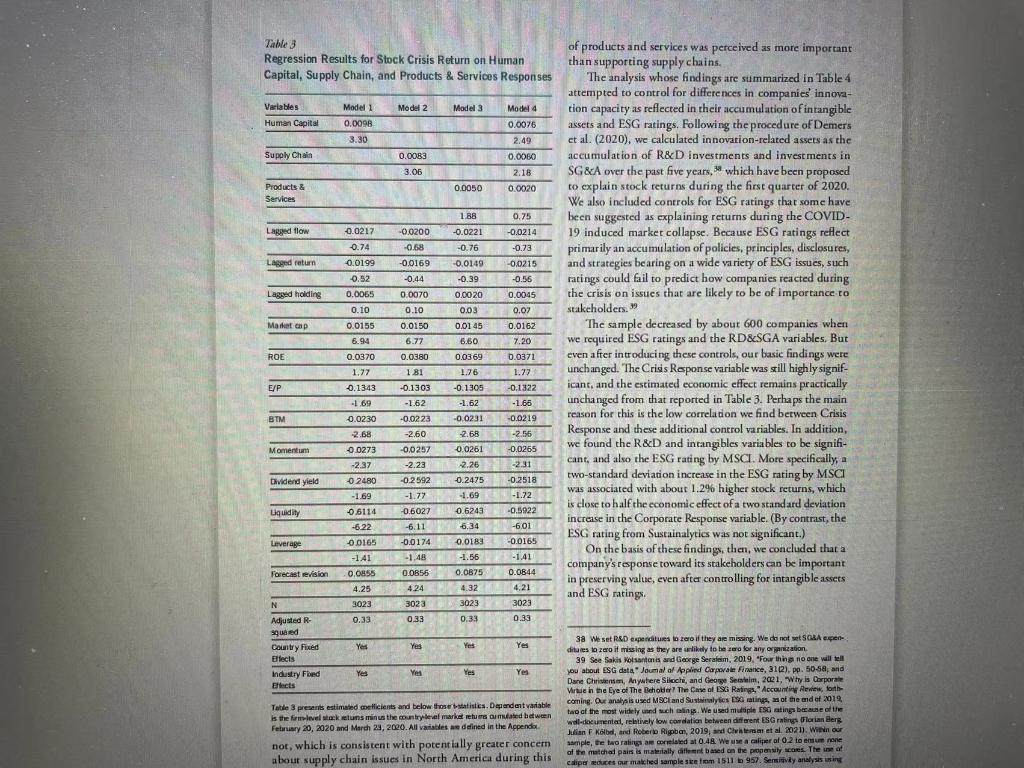

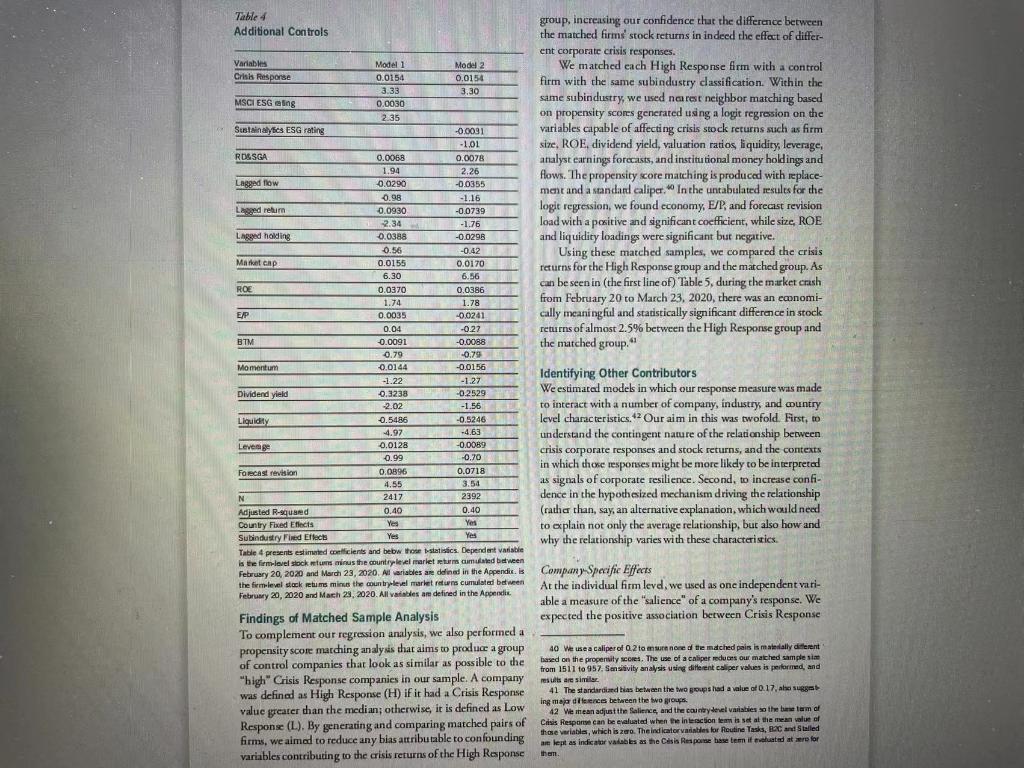

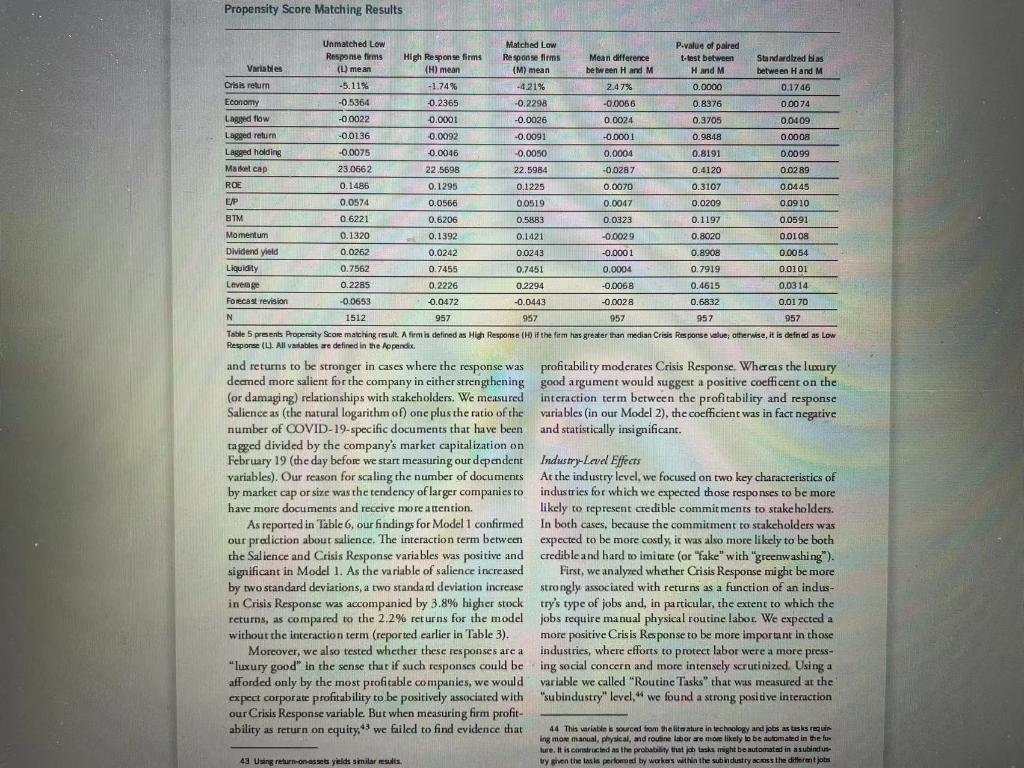

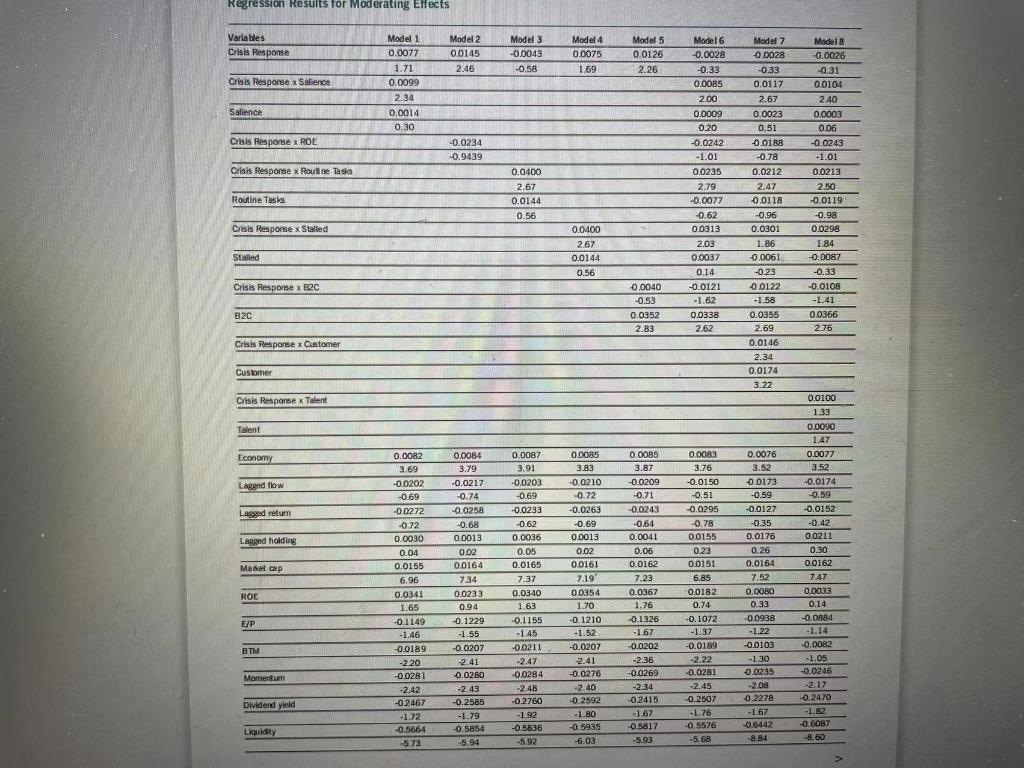

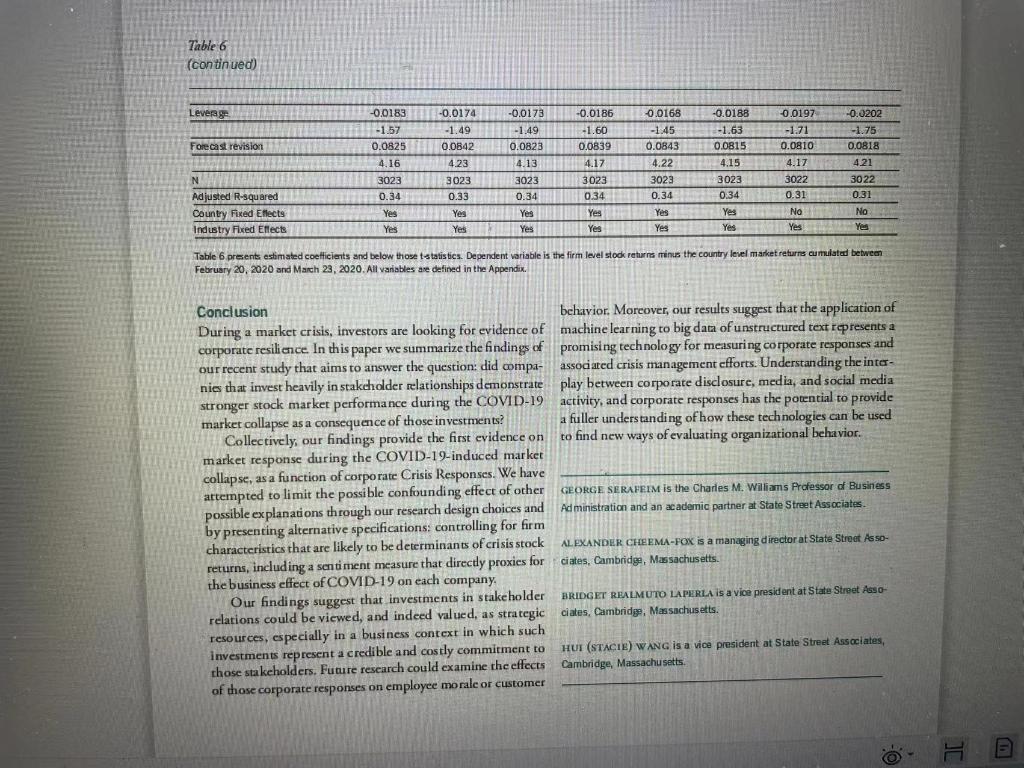

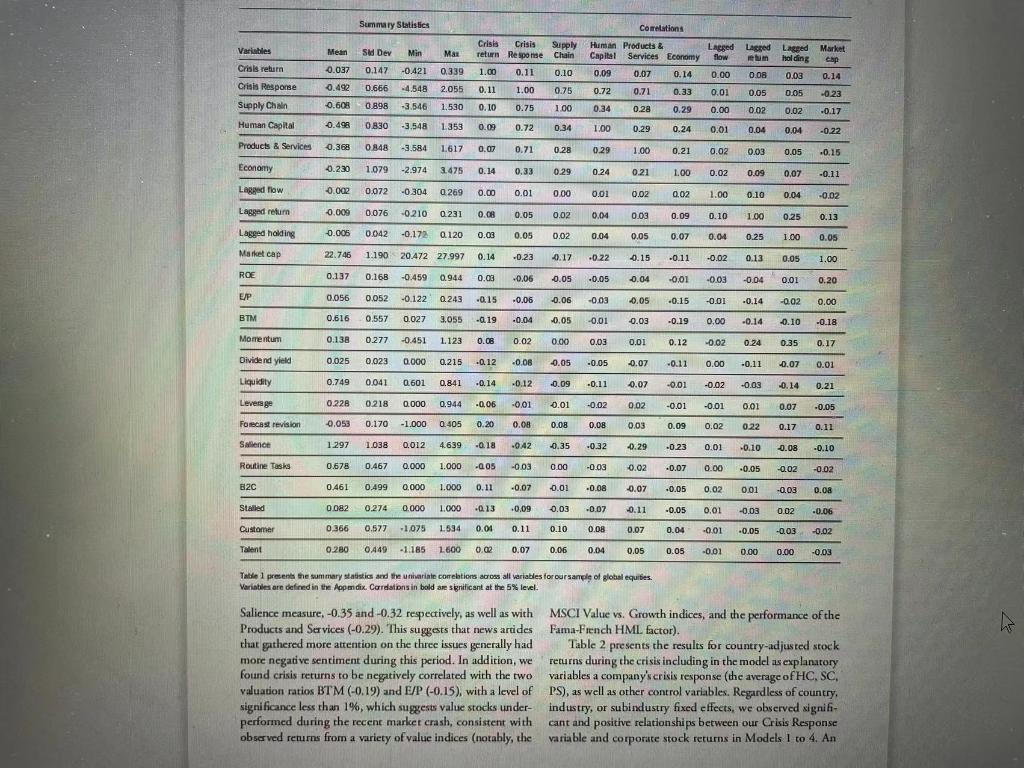

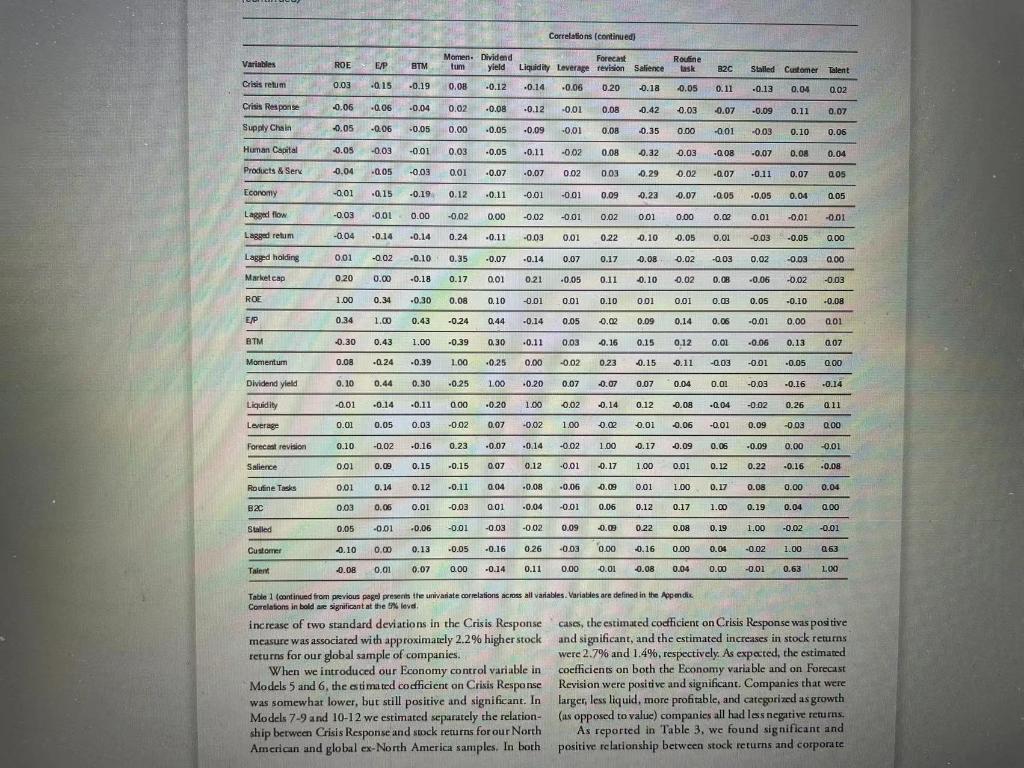

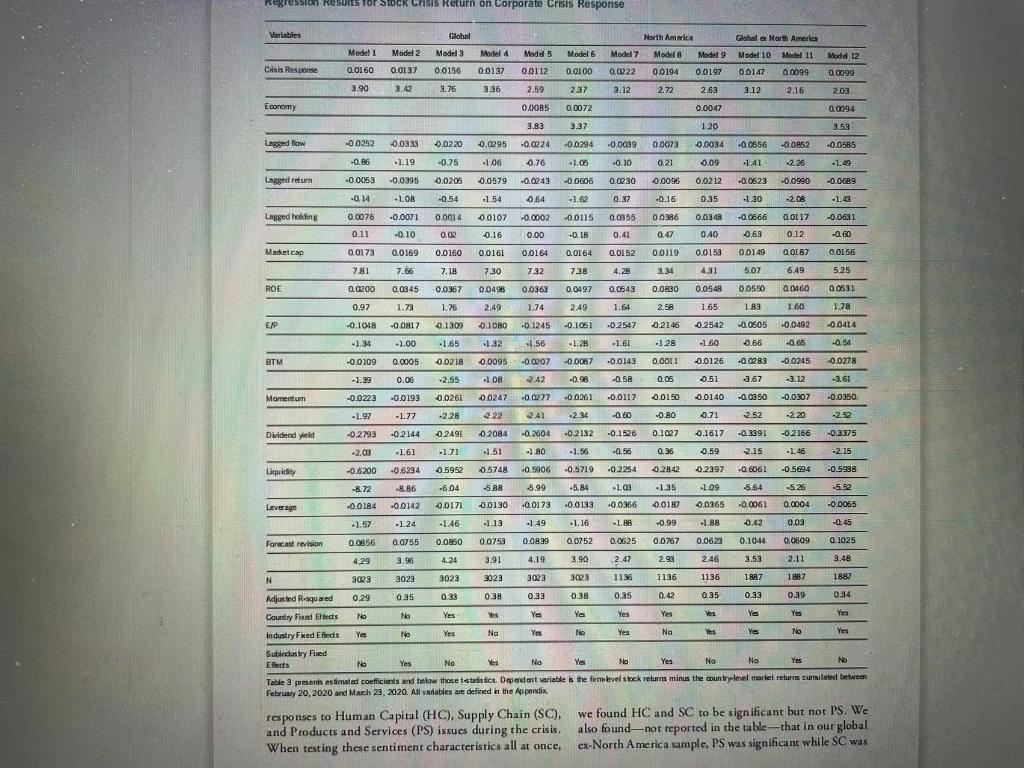

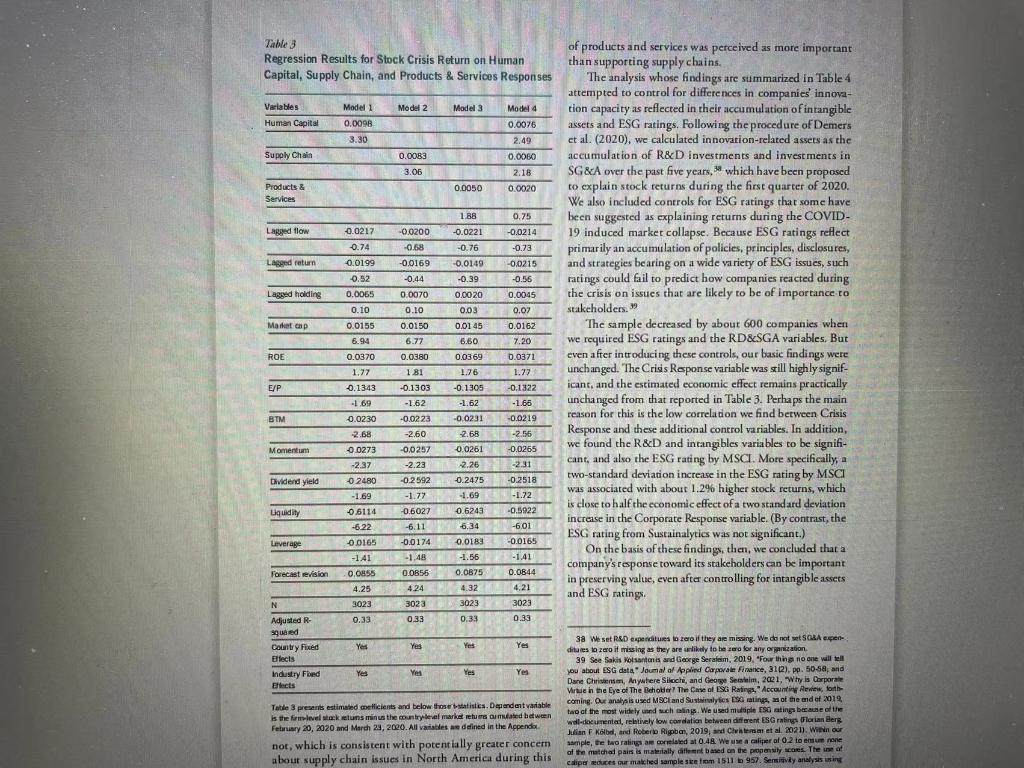

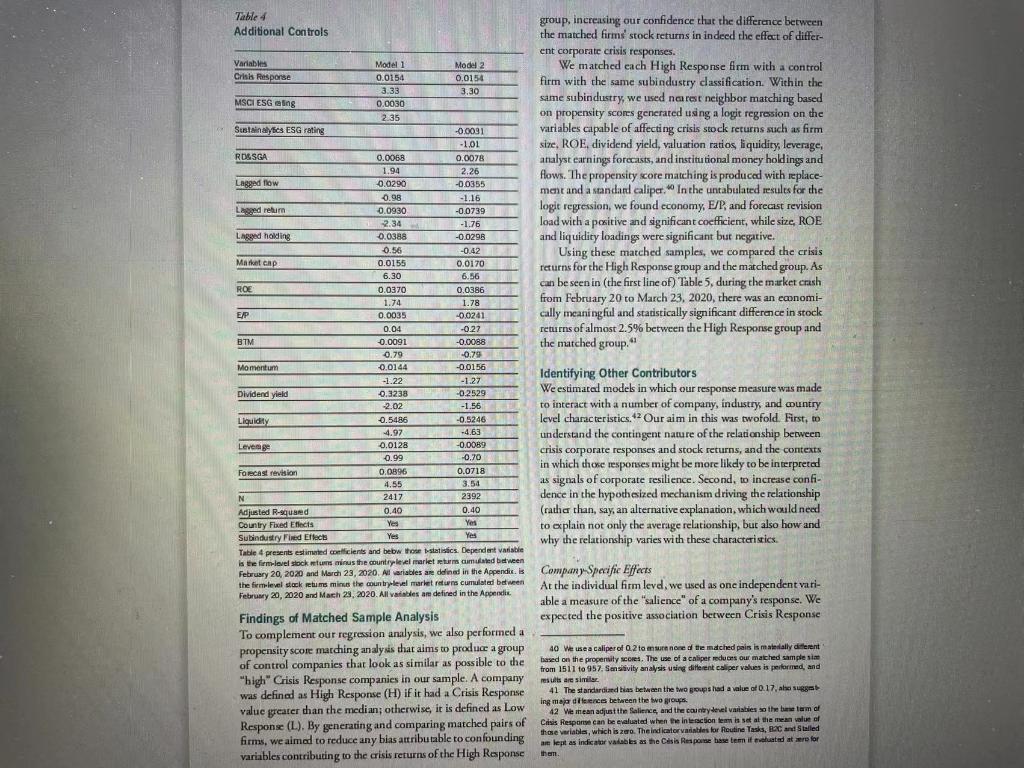

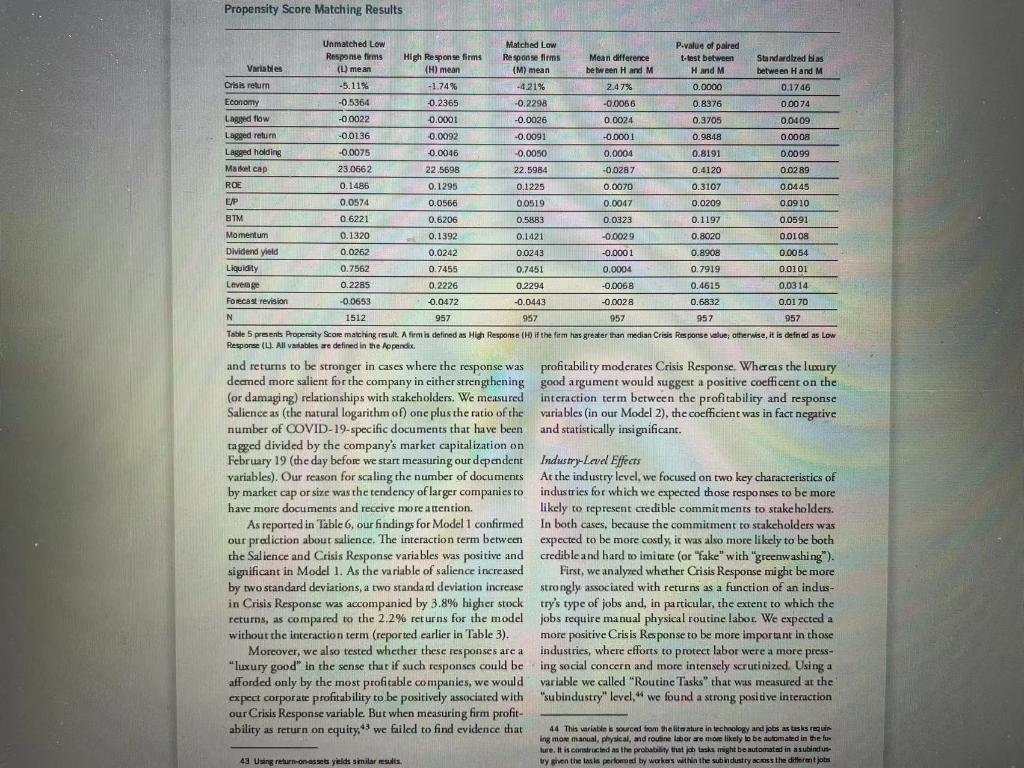

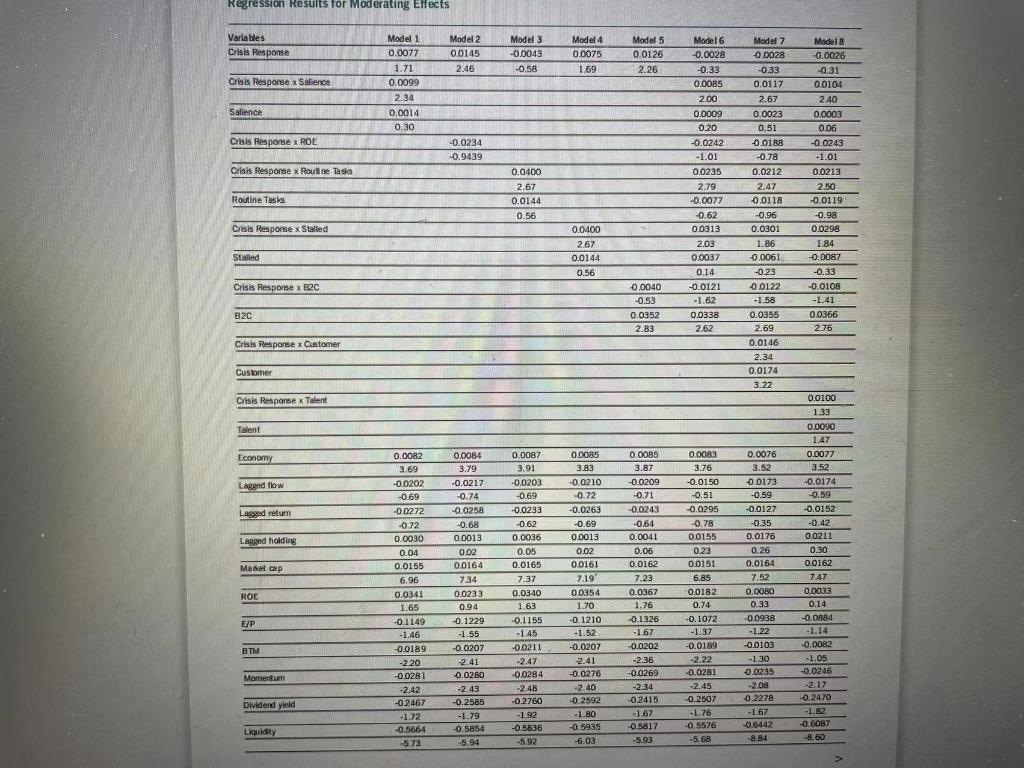

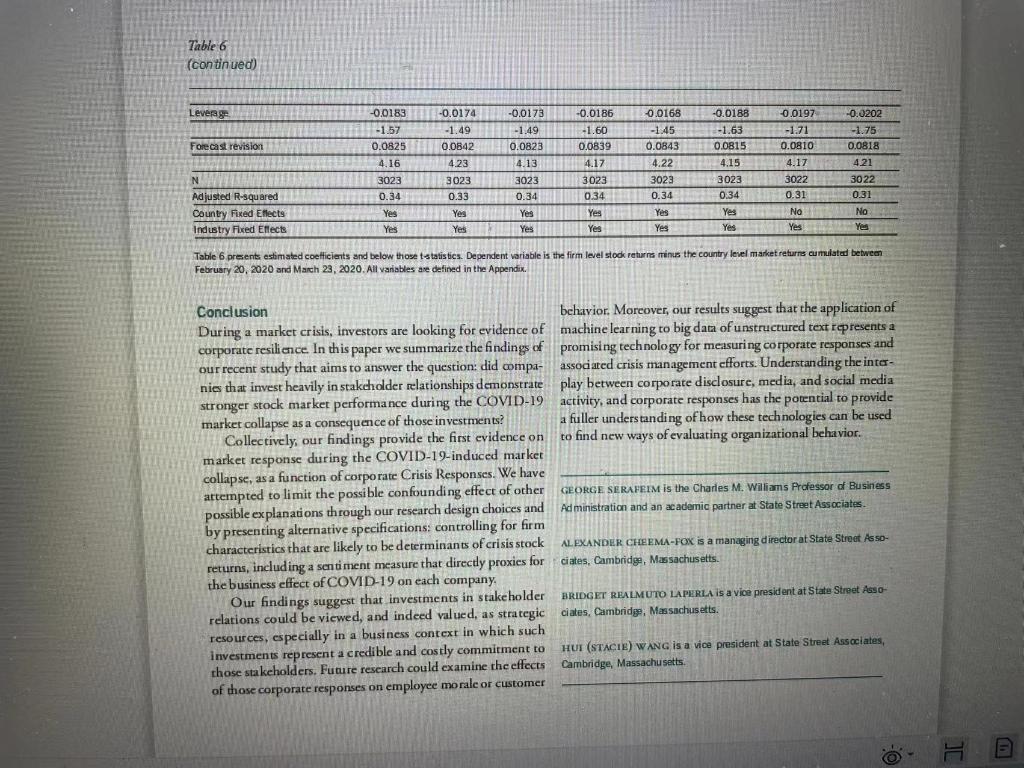

Corporate Resilience and Response to COVID-19 by Alex Cheema-Fox, Bridget R. LaPerla, and Hul (Stacie) Wang, State Street Associates; and George Serafeim, Harvard Business School he coronavirus pandemic of 2020 took the world by storm, disrupting economies U the rapid spread and economic impact of the coronavirus. A month after the World Health Organization (WHO) fielded the first reports of pneumonia from an unknown cause in China, the coronavirus (now referred to as COVID-19) was declared a public health emergency by the end of January 2020, with 9,826 confirmed cases in 19 countries. By February 19, the WHO reported 2,009 deaths, 75,204 confirmed cases in 25 countries, and a startling 1,872 new cases from the previous day.? supply chains and practices , supply To limit the spread of COVID-19, many governments (the day after the S&P 500 reached a "local high) to the market mandated social distancing and instituted severe travel restric- low on March 23. during which the S&P 500 experienced tions, including quarantines. This had an immediate impact a nearly 30% drop. Given the impact on on the labor force, supply chains, and sales of products and labor, we focused on these characteristics as likely drivers of services, After the S&P 500 reached record highs on Febru- stock returns during this period, as well as possible corporate ary 19, it experienced its largest one-week declines since the responses to COVID-19 in the form of changes in operations, 2008 financial crisis. In the study y described in these pages, we looked at the induding the repurposing of products and services. As our measures of corporate responsiveness to the crisis, association between corporate responses we see as plausibly we used big data from natural language processing that detect important during this crisis-specifically, those related to labor the relative strength of positive and negative public sentiment y chain, and repurposing of operations (products about those corporate responses. Our working hypothesis was and services)to determine the extent it to which companies that companies with more with more positive media sentiment around their responses to their responses to the pandemic and their effects on employ- With more positive public sentiment about the crisis experienced less negative returns during the market ces, suppliers, and custome and customers would be valued more highly collapse. We defined the analysis period as from February 20 stock market investors than their less favorably viewed corporate counterparts during the market collapse. One inter- *George Beratim lag steful for financial support from the Division of Faculty and pretation of such a its confirmation of investors Research Development of the Harvard Business School. The material presented is for informational purposes only. The views apre in this material are those of the authors tendency to view a company's commitment to its stakehold- and provided is at the time of first publication, are not intended for distribution to ers--notably, its customers, suppliers, and employees as a to applicable law, and are not an other or solicitation to buy or sell sealities or any strategic resource that expected to provide a competitive advantage. But such a commitment is likely 1 Novel Coronavirus (2019-CoV) Sion Report - 11. World Health Organiza 4 Mejor international merlet indices de collapsed during the same period. For 2 "Coronavins disease 2019 (COVO-19) Situation Report - 20. Wald Health example, the FTSE 100 declined by 33%, the DAX Performance Index by 34%, the Hang Organization. February 19, 2020 Seng index by 22% and the TOPIK by 26% fin Srim 2920. Pola Sentiment and the Priat of Corporate Sus- colouch a finding is its any person or entity in any jurisdiction where such distribution or use would be contrary piedurt. This article reflects the views of the authors and does not necessarily represent the views of State Sweet Corporation or its affiliate generate tion January 31, 2020. strategic resources only to the extent it is deemed credible, control variables that were expected to contribute to the relation leading to higher levds of trust and stronger relationships with those stakeholders. The COVID-19 crisis represents a setting ing our confidence that the relationship we document was not between corporate responses and stock returns, further increas- in which a company's stakeholder response is more likely to be driven by an omitted variable expected to be correlated with a perceived as a credible commitment than "cheap talk" since company's vulnerability to COVID-19. it comes at a time when the world economy is experiencing As summarized in the pages that follow, our findings a severe contraction, making such a commitment especially provide clear evidence of notable differences among corpo- costly. And the fact that most of the companies in our sample rate stakeholder responses to the COVID-19 crisis, and of ended up with negative sentiment scores suggests that inves- the stock market's positive reaction to those responses that tors exercised considerable skepticism and such commitments were expected to be effective both in reinforcing stakeholder were not easy to "fake." relationships and in increasing long-run efficiency and Empirically, our setting does not provide a natural experi- value. We view such evidence as contributing to the growing ment that would allow us to attribute causality to our results. literature on stakeholder management and corporate social A competing alternative explanation is that our corporate responsibility, and to studies of the redeployment of strategic response measures reflect how the COVID-19 crisis affects a resources following changes in the external environment. In company's business, with more positive sentiment being associ- addition, our finding that organizations committing to their ated with more positive business effects from COVID-19, and stakeholder relations during a crisis are perceived as more resil- negative sentiment reflecting reduced economic prospects. We ient provides evidence in support of an increasingly popular attempted to limit the probability that this alternative explana- concept of organizational adaptabilitynamely, the capacity tion might generate our results through our research design. to adjust responses to changing external drivers and thereby We estimated all relations within the 69 GICS industries, since connect to the literature on dynamic capabilities and organi- different industries have different exposures and effects from zational routines. 12 COVID-19, and included results that control for some 158 industry and sub-industry effects. In addition, we controlled Background, Motivation and Relevant Literature for revisions in analyst EPS forecasts during the crisis period, The spread of COVID-19 and the associated health and which we viewed as proxics for the expected short-term effects economic pain saw governments take unprecedented measures from COVID-19 on the company. What's more, we used a to stabilize the economy. At the same time, corporate prac- sentiment-based measure that was constructed using the exact tices and efforts came into the spodight. Significant emphasis same process as the other sentiment measures, with the key was placed on labor practices, such as paid sick leave, lay- difference that it used keywords reflecting the company's offs, or hiring of workers in large corporate employers such economic prospects rather than its stakeholder response. We as Walmart, Home Depot, and UPS. Another prominent also complemented and confirmed our results, implementing response was the repurposing of corporate operations and a matched sample analysis, while controlling for other factors skills to create much needed products such as masks and venti- that might affect a company's crisis stock returns, such as fim lators by companies like General Motors, Ford, GE, and 3M. size, profitability (ROE), dividend yidd, valuation ratios, liquid- ity, institutional money holdings and flows, momentum, and 9 See Freeman (2010), Robert G. Eccles, bamistoannou, and George Seratem leverage. In addition, we showed that our results were robust "The Impact of Corporate Sustainability on Organizational Processes and performance when using controls for a measure of a company's innovation Maviagement Science, Volume 60, sue 11, pp. 2835-2857, February 2014, and Colin Mayer, 2013, Firm commitment Why the corporation is faiting us and how to capacity and intangible assets as well as ESG ratings that reflect restore trust in it. OUP Oxford; and Henderson (2020), the firm's policies, principles, and disclosures on ESG issues, 10 See Laurence Capron, Pierre Dussage, and we Mithell, 1998, "Resource Re deployment Following Horizontal Acquisitions in Europe and North America. 1988- Finally, we introduced a series of fim, industry, and country 1992. Strategic Management Jaumal, 1967), pp. 631-661, and Marina Limberman Gwendolyn K Lee, Timothy B. Folta, 2017 Entry, Edt, and the potential for Resource Management Joum, 33/3), pp. 526-544 proach. Cambridge University Press Redeployment Straten Het antiari 2013 "The Ton Tum A third focus of intense scrutiny was the exposure of global Avoiding lay-offs, providing flexible work schedules, supply chains that were disrup red as economies were closing and offering paid sick leave could all allow companies to be down and workers were at risk of getting infected due to a lack more resilient in the face of adversity, helping them maintain of protective equipment and appropriate distancing policies, high employee productivity while mitigating costs by avoid- leading to production halts and shortages." ing employee churn. Similarly, companies committed to The main hypothesis of our study was that companies their supply chain relations might be able to respond more making significant and credible commitments to their stake- quickly by adapting their supply chain to avoid costly produc holder relations during the COVID-19 crisis provided signals tion halts and secure the supply of important materials. 19 of resilience to investors, leading to less negative stock retums Finally, companies that divert their operations to provide during the market collapse. Resilience is a concept that is not needed products and services thereby demonstrate a degree of only applicable in a business setting, but a much-discussed customer focus that could forge stronger customer and brand concept in the health, psychology, and infrastructure litera- loyalty. For all the above reasons, we expect companies that tures as well. Consistent with one definition as "the capacity exhibit more positive sentiment around their human capital, to recover quickly from difficulties," resilience at the most supply chain, and operational crisis response (in-demand basic level is the ability to withstand the effects of a negative products and services) might earn investor confidence and event. In this sense, resilience is related to the literature on experience less negative retums during the crisis.20 dynamic capabilities and organizational routines and, more Nevertheless, there is an underlying tension built into this specifically, to the ability of organizations to adapt to changes hypothesis. Because companies in time of crisis significantly in the external environment. cut investments to their stakeholders, 21 investors may well Of course, not all corporate responses are likely to be view responses that harm stakeholders as necessary for corpo- important in the context of COVID-19. As just noted, rate survival, and the absence of such measures as detrimental employment and supply chain practices are likely to be focal to the long-term success of the organization in a competitive areas. In addition, the ways that companies find to reposition market. To the extent this is so, companies with more positive their operations to provide products and services to custom- sentiment around their response might actually be expected crs will likely be important considerations. Collectively, to experience more negative returns. those three responses can be viewed as shaping a company's commitment to its relationships with three key stakeholders: Data and Sample employees, suppliers, and customers. We used a combination of multiple datasets to understand Stakeholder management theory suggests that better stake- drivers of stock returns during the COVID-19 crisis. (See the holder relations could translate into better corporate business Appendix for precise definitions of variables.) outcomes as these relations become strategic resources. For example, companies that succeed in building and sustaining Corporate Response Data relational contracts with their employees could experience in assessing media sentiment toward companies, we used improved employee engagement and productivity." However , Truvalue Labs environmental, social, and governance (ESG) to achieve stakeholder relations strong enough to be viewed as data, which applies machine learning and natural language strategic resources capable of improving business outcomes, processing in eleven languages to thousands of news sources, companies must make credible commitments. 16 And such such as traditional media, blogs , and industry publications. credibility comes from making investments to relationship Truvalue Labs (hereafter "Truevalue") sources big data from a when such investments might be more costly for an organi- series of vetted outlets to improve the credibility and accuracy zation, such as during a market collapse. In this way, the of processed information. Moreover, Truvalue has avoided the COVID-19 crisis represents a setting that allows us to observe approach of relying on corporate self-reported data to evaluate differential corporate responses and link those to stock returns. companies. Instead, they assess how society at large perceives and is affected by corporate behavior by gathering data from this article was captured as-2.22. A positive example of a over 100,000 data sources.22 company's Products and Services response during this period For the purposes of this study, we focused on the senti- was provided in an article quoting 3M's announcement of a ment scores that specifically identified when COVID-19 was shipment of N95 masks to high-risk cities in the U.S. and being discussed in relation to companies within unstructured outlined the increase production of masks to an annual rate text.2 Truvalue scores how positive or negative the COVID. of two billion worldwide.29 Truvalue assigned this positive 19 content tone is within each article and provides sentiment sentiment a score of 1.45. measures for each weck starting in January 2020. For example, In addition, we used as a control variable a sentiment news stories that mention layoffs or absence of paid sick measure that we called "Economy" that served as a proxy leave are usually accompanied by negative commentary and for the COVID-19's effect on the economic prospects of thereby receive negative sentiment scores. In contrast, news a company during this crisis period. For an example of a that pertains to avoiding layoffs or keeping workers safe tends negative trend linked to a company during our study period, to receive positive commentary and thereby receives positive one article cited Lyft's link to social distancing as initiat- sentiment scores. Because of the lack of relevant data in the ing a countertrend against ride-sharing. 30 The tone of the first few weeks, we used data for the period between February section is negative, since Lyft and its ride-sharing competitors 12 and March 24, when COVID-19 became an important were grappling with new norms from social distancing. The topic of conversation. We constructed a firm-level measure company's Economy score in this article was captured as -2.35. over the period of study by calculating separately the median We observed a positive example of a company's Economy value of Human Capital, Supply Chain, and Products and in an article mentioning FedEx's anticipation of a positive Services sentiment for a given firm across the six weeks.45 earnings effect since the company serves a growing population For an example involving Human Capital, one article of people living and working at home, ordering online and cited Emirates Group's enforcing of a temporary 25% to 50% shipping packages Along with stock analysts' statements reduction in base salary for the majority of its employees as projecting earnings increases, FedEx's statements were scored well as required unpaid leave for its staff. 26 The company's by Truvalue as positive sentiments with a value of 4.59. Human Capital response in this article was evaluated and We used stock prices, security features, and (free-float) recorded as -1,95. We observed a positive example of a compa- market capitalizations from the MSCI's ACWI IMI universe, ny's Human Capital response in an article reporting Husky and classified industries and sub-industries in line with the Energy's announcement to keep employees and construction Global Industry Classification Standard (GICS). Returns are sites safe, where staff are working remotely and non-essential calculated in USD employees are asked to stay home. The company's statement Our sample covered global listed equities with a market spoke to protecting employees, and Truvalue captured this capitalization of at least $1 billion as of January 1, 2020, and positive sentiment with a score of 1.25. included the intersection of the datasets provided by Truvalue Moving on to a company's response to changes in Labs, MSCI, and State Street Corporation. We used lagged Products and Services, during our study period, one article 20-day cumulative flows, *2 lagged 20-day cumulative returns, discussed Amazon's failure to respond effectively to the high and lagged holdings before and including February 19, 2020 demand for masks, as the global public began wearing masks to study the period from February 20, 2020 through March daily,28 The company's Products and Services response in 23, 2020. The 3,023 companies in our sample, as reported in Table 1, had an average market cap of $18.9 billion (on February 22 for a long discussion of the Tuvalue Labs data were for the interested readerb 19), as well as an average ROE of 13.7%, price-to-carnings of 17.7, book-to-market of 0.62, and dividend yield of 2.5%. Our 3,000 plus companies represented some $57 willion in prioriterature (Serfelm 2020). 2a For more information on True Labs COVID-19 dataset see here: https//coro- navinus suvaluelabs.com 24 Sentiment scores are sealed to vary from -20 to +20 More liquid market value across 47 countries, suggesting that our analysis collapse since investors would be likely to view them as less represents a sample representative of the global listed firm risky. The two valuation ratios, earnings-to-price ratio and universe. All response measures had a negative average value, book-co-market, were used to control for differences in the which reflects the generally negative tone of news coverage of duration of cash flows on the premise that "value" firms might these corporate responses and COVID-19. be expected to experience more negative returns given more of the firm value is coming from more immediate cash flows Research Design that are now being impaired due to the COVID-19 crisis. Since our sample was global, we subtracted from each compa- We also controlled for liquidity, measured as share turnover. ny's stock k returns during the period February 20-March 23 stocks might experience larger price declines since the value-weighted return on the marker index asociated with they can be sold more readily to meet redemptions during a the country of the firm's primary trading venue. We classified market collapse. In addition, we controlled for analyst EPS all the corporate response measures in our sample into one of forecast revisions during the crisis, a variable that proxies for three categories: Supply Chain (SC). Human Capital (HC), the immediate business effects of COVID-19 on different and Products and Services (PS). Because each of these response organizations. (As noted earlier, definitions of all variables can measures as well as the stock reture could vary systemati- be found in the Appendix.) cally across industries, we included in all our models industry At a company level, we used the average of Human Capital fixed effects using the six-digit GICS industry code " There- (HC), ), Supply Chain (SC), and Products and Services (PS) to fore, estimates were derived from within-industry, rather than create a composite "Crisis Response" measure, which is our across-industry, differences. Moreover , in different specifica: main variable of interest in the following regression model: tions we also induded country and subindustry fixed effects 35 Then, to see if market investors appeared to be influenced by Crisis Return, (at least the media's view of) corporate responses to COVID- =a+, Crisis Response(HC+SC+PS), 19, we used regression analysis to measure the relationship +B, Laggad flow.B, Lagged return, +6, Lagged holding B, between those responses and the cumulative stock returns ROE+BE/P-B, BTM from the day after the market peak on February 20 through +B. Momentum +B, Dividend yield, +, Marka Cap. the trough on March 23. +B. Leverags +B.. EPS Forecast revision+, Liquidity, Each ordinary least squares regression was conducted Country, Industry or Subindustry Fixed Effects+E, with a set of control variables that included dividend yield, carnings-to-price ratio, book-to-market, market capitaliza As discused above, the efficient of interest in this model tion, return on equity and leverage alongside lagged Hows, i, which is a measure of the which a compan Tagged returns, and lagged holdings. We controlled for 36 crisis response (positive or negative) appears correlated with lagged returns, institutional money holdings and flows as its stock market return during the market collapse. they have been found to correlate with future returns. We expected larger, more profitable, less leveraged, and higher Findings: Regression Analysis dividend yidd stocks to have higher returns during a market Table 1 presents results from univariate correlations We observe a significant positive correlation between Supply Chain and 33 All variable ae wiriad at 1% and 99% except market cap, dummy variables Human Capital (0.34), suggesting that companies with posi- such as 12C Routine Tasks and Stalled, as well as countryde varisbles including tive public sentiment about their supply chain responses also Customer and T. Net wisariding stock turns produces very similar results to the tended to generate positive public sentiment about their treat- 34 We lo estimated all our models including tired leds for the digitsub-indus ment of employees (paid sick leave, commitments to no or trycode. In ore Industdes there could be significant diferentes cos sub-industrie, limited layoffs, etc.). Products and Services also exhibited not only how companies respond but also perform during this period. Ni the results was vwy similar, suggesting atatkan aroms sub-indaby membership within industries significant positive correlations with Supply Chain (0.28) and is unlikely to explain our results Human Capital (0,29). These positive correlations suggest 95 Including industry lects have few toms within each industry for some industries forcing most a the estimation to be derived from a ne number of that corporate responses were generally consistent across the sutindustries with a large number of time. For that is on, we report us both sing different themes or stakeholder groups. At the same time, the indulty and sincetry des 36 Standard ers are ob to heredasticity Clustering standard erros at moderate correlations also suggest significant variation among Industry or country level leaves all interes sound statistical lance unchanged corporate response, which in turn allowed us to model all three 27 Mareth A. Frat, Paul GIOConnell, and Mark S Shoes, 2001. "The variables simultaneously. We observed significant negative come- Pottolio How of heternational Inston, Jumat of Financial Economics 1213),441 lations between both Supply Chain and Human Capital to our tabulad salls in the paper 463 Summary Statistics Variables Mean Min SM Dev 0.147 Larged Lacged Laped flow holding Comelations Human Products & Capital Services Economy 0.09 0.07 0.14 0.72 0.71 0.33 Market cap Crisis return 0.037 Crisis Crisis Supply Max return Response Chain 0.339 1.00 0.11 0.10 2.055 0.11 1.00 0.75 1.530 0.10 0.75 1.00 -0.421 0.00 0.08 0.03 0.14 Crisis Response 0.492 -4.548 0.666 0.898 0.01 0.05 0.05 -0.23 0.608 -3.546 0.34 0.28 0.29 0.00 0.02 0.02 Supply Chain Human Capital -0.17 0.498 0830 -3.548 1353 0.09 0.72 0.34 1.00 0.29 0.24 0.01 0.04 0.04 -0.22 Products & Services 0.368 0.848 -3.584 1617 0.07 0.71 0.28 0.29 1.00 0.21 0.02 0.03 0.05 -0.15 Economy 0.230 1.079 -2.974 3.675 0.14 0.33 0.29 0.24 0.21 1.00 0.02 0.09 0,07 -0.11 Lagged flow -0.002 0.072 -0.304 0269 0.00 0.01 0.00 0.01 0.02 0.02 1.00 0.10 0.04 -0.02 Lagend return 0.000 0.076 -0.210 0.231 0.08 0.05 0.02 0.04 0.03 0.09 0.10 1.00 0.25 0.13 Lagged holding -0.005 0.042 -0.172 0.120 0.03 0.05 0.02 0.04 0.05 0.07 0.04 0.25 1.00 0.05 Market cap 22.746 1.190 20.472 27.997 0.14 -0.23 0.17 -0.22 -0.15 -0.11 -0.02 0.13 0.05 1.00 ROE 0.137 0.168 -0.459 0.944 0.03 -0,06 -0.05 -0.05 -0.04 -0.01 -0.03 -0.04 0.01 0.20 E/P 0.056 0.052 -0.122 0243 -0.15 -0.06 -0.06 -0.03 0.05 -0.15 -0.01 -0.14 -0.02 0.00 BTM 0.616 0.557 0.027 3.055 -019 -0.04 -0.05 -0.01 -0.03 -0.19 0.00 -0.14 -0.10 -0.18 Momentum 0.138 0.277 -0.451 1.123 0.08 0.02 0.00 0.03 0.01 0.12 -002 0.24 0.35 0.17 Dividend yield 0.025 0.023 0.000 0.215 -0.12 0 0 -0.05 -0.05 -0.07 -0.11 0.00 -0.11 -0.07 0.01 Liquidity 0.749 0.041 0.601 0.841 -0.14 -0.12 -0.09 -0.11 1.07 -0.01 -0.02 -0.03 -0.14 0.21 Leverage 0.228 0218 0.000 0.944 -0.06 -0.01 0.01 -0.02 002 -0.01 -0.01 0.01 0.07 -0.05 Forecast revision 0.053 0.170 -1.000 0.405 0.20 0.08 0.08 0.08 0.03 0.09 0.02 0.22 0.17 0.11 Salieno 1.297 1.038 0.012 4.639 -0.18 -0.42 -0.35 -0.32 -0.29 -0.23 0.01 -0.10 -0.08 -0.10 Routine Tasks 0.678 0.467 0.000 1.000 -205 -003 0.00 -0.03 0.02 -0.07 0.00 -0.05 -0.02 -0.02 B2C 0.461 0.499 0.000 1.000 0.11 -0.07 -0.01 -0.08 -0.07 -0.05 0.02 0.01 -0.03 0.08 Stalled 0.082 0.274 0.000 1.000 -0.13 -0.09 0.03 -0.07 -0.11 -0.05 0.01 -0.03 0.02 -0.06 Customer 0366 0.577 -1075 1534 0.01 0.11 0.10 0.08 0.07 0.04 -0.01 -0.05 -0.03 -0.02 Talent 0.280 0449 -1.185 1.600 0.02 0.07 0.06 0.04 0.05 0.05 -0.01 0.00 0.00 -0.03 Table 1 presents the summary stadistics and the unitarinte cometions across all variables for cursanele of global equites Variables are defined in the Appendix. Cardations in bold are significant at the 5% level Salience measure. -0.35 and -0.32 respectively, as well as with MSCI Value vs. Growth indices, and the performance of the , Products and Savices (-0.29). This suggests that news artides Fama-French HML factor). that gathered more attention on the three issues generally had Table 2 presents the results for country-adjusted stock more negative sentiment during this period. In addition, we returns during the crisis including in the model as explanatory found crisis returns to be negatively correlated with the two variables a company's crisis response (the average of HC, SC. valuation ratios BTM (-0.19) and E/P (-0.15), with a level of PS), as well as other control variables. Regardless of country, significance less than 1%, which suggests value stocks under- industry, or subindustry fixed effects, we observed signifi- performed during the recent market crash, consistent with cant and positive relationships between our Crisis Response observed returns from a variety of value indices (notably, the variable and corporate stock returns in Models 1 to 4. An ( a Correlations (continued) Variables ROE EXP BTM Momen: Divided Forecast tum yield Liquidity leverage revision Salience 0.08 -0.12 -0.14 -0.06 0.20 -0.18 Routine task B2C Stailed Customer Talent Crisis retum 0.03 0.15 -0.19 -0.05 0.11 -0.13 0.04 0.02 Crisis Response -0.06 -0.06 -0.04 0.02 -0.08 -0.12 -0.01 0.08 -0.42 0.03 -0.07 -0.09 0.11 0.07 Supply Chain -0.05 -0.06 -0.05 0.00 -0.05 -0.09 -0.01 0.08 -0.35 0.00 -0.01 -0.03 0.10 0.06 Human Capital -0.05 -0.03 -0.01 0.03 -0.05 .0.11 -0.02 0.08 -0.32 -0.03 -0.08 -0.07 0.08 0.04 Products & Serv -0.04 -0.05 -0.03 0.01 -0.07 -0.07 0.02 003 0.29 0.02 -0.07 -0.11 0.07 DOS Economy -0.01 -0.15 -0.19 0.12 -0.11 -0.01 -0.01 0.09 -0.23 -0.07 -005 -0.05 0.04 0.05 Lagoa flow -0.03 -0.01 0.00 -0.02 0.00 -0.02 -0.01 0.02 001 0.00 0.02 0.01 -0,01 -001 Lagged retum -0.04 -0.14 -0.14 0.24 -0.11 -0.03 0.01 0.22 0.10 -0.05 0.01 -0.03 -0.05 0.00 Lagged holding 0.01 -0.02 -0.10 0.35 -0.07 -0.14 0.07 0.17 1.08 0.02 -0.03 0.02 -0.03 0.00 Marketcap 0.20 0.00 -0.18 0.17 0.01 0.21 -0.05 0.11 -0.10 0.02 0.08 -0.06 -0.02 -0.03 ROE 1.00 0.34 -0.30 0.08 0.10 -0.01 0.01 0.10 0.01 0.01 0.03 0.05 -0.10 -0.08 0.34 1.00 0.43 -0.24 0.44 -0.14 0.05 0.02 0.09 0.14 0.06 -0.01 0.00 0.01 BTM -0.30 0.43 1.00 -0.39 0.30 -0.11 0.03 -0.16 0.15 0.12 0.01 -0.06 0.13 007 Momentum 0.08 -0.24 -0.39 1.00 -0.25 0.00 -0.02 0.23 -0.15 -0.11 -0.03 -0.01 -0.05 0.00 Dividend yield 0.10 0.44 0.30 -0.25 1.00 -0.20 0.07 -0.07 0.07 0.04 0.0! -0.03 -0.16 -0.14 Liquidity -0.01 -0.14 -0.11 0.00 .020 1.00 -0.02 -0.14 0.12 -0.08 -0.04 -0.02 0.26 011 Leverage 0.02 0.05 0.03 -0.02 0.07 -0.02 1.00 0.02 -0.01 -0.06 -0.01 0.09 -0.03 0.00 Forecast revision 0.10 -0.02 -0.16 0.23 -0.07 -0.14 -0.02 1.00 -0.17 -0.09 0.05 -0.09 0.00 -0.01 Salience 0.01 0.09 0.15 -0.15 0.07 0.12 -0.01 -0.17 1.00 0.01 0.12 0.22 -0.16 -0.08 Routine Tasks 0.01 0.14 0.12 -0.11 0.04 -0.08 -0.06 -0.09 0.01 1.00 0.17 0.08 0.00 0.04 B2C 003 0.06 0.01 -0.03 0.01 -0.04 -0.01 0.06 0.12 0.17 1.00 0.19 0.04 0.00 Stalled 0.05 -0.01 -0.06 -0.01 -0.03 -0.02 0.09 -0.08 0.22 0.08 0.19 1.00 -0.02 -0.01 Custom -0.10 0.00 0.13 -0.05 -0.16 0.26 -0.00 0.00 -0.16 0.00 0.04 -0.02 1.00 053 Tai -0.08 0.01 0.07 0.00 -0.14 0.11 0.00 0.01 -0.08 0.04 0.00 -0.01 0.63 LOX Table 1 (continued from previous page present the univariate correlations across all variables. Variables are defined in the Appendit Correlations in bold a significant at the level increase of two standard deviations in the Crisis Response cases, the estimated coefficient on Crisis Response was positive measure was associated with approximately 2.2% higher stock and significant, and the estimated increases in stock returns returns for our global sample of companies. were 2.7% and 1.4%, respectively. As expected, the estimated When we introduced our Economy control variable in coefficients on both the Economy variable and on Forecast Models 5 and 6 the estimated cofficient on Crisis Response Revision were positive and significant. Companies that were , was somewhat lower, but still positive and significant. In larger, less liquid, more profitable, and categorized as growth Models 7-9 and 10-12 we estimated separately the relation- (as opposed to value) companies all had les negative returns. . ship between Crisis Response and stock returns for our North As reported in Table 3. we found significant and American and global ex-North America samples. In both positive relationship between stock returns and corporate Regression Results for Stock Cris Return on Corporate Crisis Response Variables Global North America Model 1 Model 2 Model 7 Model 8 Model 9 Model 3 0.0156 Modd 12 Model 4 0.0137 Modd 5 0.0112 Global North America Model 10 Model 11 0.0147 0.0099 Model 6 0.0100 Crisis Response 0.0260 0.0137 0.0222 0.0194 0.0197 0.0099 3.90 3.42 3.76 3.35 2.59 2.37 3.12 2.72 2.63 2.12 2.16 2.03 Economy 0.00BE 0.0072 0.0047 0.0094 3.83 3.37 1.20 3.53 Lagged flow -0.0252 0.0333 0.0220 -0.02.24 -0.0294 -0.0039 0.0023 0.0034 -0.0556 00852 -0.0585 0.0295 -106 -0.86 -0.75 0.76 -1.05 -0.10 0.21 0.09 -141 -2.26 -1.49 -1.19 -0.0395 Lagged return -0.0053 0.0206 0.0579 -0.0243 -0.0606 0.0230 0.0096 0.0212 -0.0623 -0.0990 -0.0689 -0.14 -LOB -0.54 -1.54 0.64 I. 0.37 -0.16 0.35 -1.30 -208 -1.43 Lagged holding 0.0076 -0.0071 0.0014 0.0107 -0.0002 -0.0115 0.0855 0.0386 0.0348 -0.0666 0.01 17 -0.0631 0.11 -0.10 0.02 0.16 0.00 -0.18 0.41 0.47 0.40 0.69 0.12 -0.60 Marketcap 0.0173 0.0169 0.0160 0.0161 0.0184 0.0164 0.0152 0.0119 0.0149 0.0187 0.0156 0.0153 431 7.81 7.66 7.18 7.30 7.32 7.38 4.28 3.34 5.02 6.49 5.25 ROE 0.0200 0.0845 0.0367 0.0368 0.0497 0.0643 0.0548 0.0550 0.0531 0.0498 2.49 0.0830 2.58 0.0160 1,60 0.97 1.73 1.76 1.74 2.49 1.64 1.65 1.83 1.78 EIP -0.1018 -0.0817 0.1300 0.1080 -0.1245 -0.1051 -0.2547 0.2146 02542 -0.0505 -0.0492 -0.0414 -1.34 -1.00 -1.65 -1.32 -1.56 -1.28 -1.61 -1.28 -1.60 0.66 -0.05 -0.54 BTM -0.0109 0.0005 0.0218 0.0098 -0.0207 -0.0087 -0.0143 0.0011 0.0126 -0.0283 -0.0245 -0.0278 -1.39 0.06 -2.55 -1.08 2.42 -0.98 -0.58 0.05 0.51 3.67 3.12 -3.61 Momentum -0.0223 -0.0193 0.0261 00247 -0.0277 -0.0261 -0.0117 0.0150 0.0140 -0.0350 -0.0307 -0.0350 -1.97 -1.77 -228 2.22 2.41 *2.34 -0.60 -0.80 -0.71 2.52 -2.20 -2.52 Dividend yield -0.2793 -0.2144 0.2491 02084 -0.2604 -02132 -0.1526 0.1027 0.1617 -0.3391 -0.2166 -0.3375 -2.03 -1.61 -1.71 -1.51 -1.80 -1.56 -0.56 0.36 0.59 2.15 -1.46 -2.15 Liquidity -0.6200 -0.6234 0.5952 05748 -0.5906 -0.5719 -0.2254 0.2842 0.2397 -0.6061 -0.5694 -0.5988 -8.72 8.86 -6.04 5.88 -5.99 -5.84 -1.09 -135 1.09 6.64 -5.25 -6.52 Leverage -0.0184 -0.0142 0.0171 -0.0130 -0.0178 -0.0133 -0.0366 0.0182 0.0365 -0.0061 0.0004 -0.0065 -1.57 -1.24 -1.46 1.19 1.49 1.16 1.88 -0.99 1.88 0.42 0.03 -0.45 0.0856 Forecast revision 0.0755 0.0850 00753 0.0839 0.0752 0.0767 0.0623 0.1044 0.0609 0.1025 0.0625 2.47 4.29 3.96 4.24 3.91 4.19 3.90 2.99 2.46 3.53 2.11 3.48 N 9023 3029 3023 3029 3023 3023 1136 1136 1136 1887 1887 1887 0.29 0.35 0.33 0.38 0.38 0.33 035 Adjusted Reused 0.42 0.35 0.33 0.39 0:34 Yes Yes Yes Ye NO Country Fial Elects No No Yes Yos Yes Yes Yes Industry Fied Etieds Yes No Yes Na Ya No Yes No Yes Yes Yes Sutindustry Foed Efieds No Yes No We No Yes No Yes No No Yes No Table 3 presents estimated coefficients and below these statistics. Dependent variable is the firm.kevel back returns minus the country level market returns cumulated between February 20, 2020 and Mach 23, 2020. All viables are defined in the Appendix responses to Human Capital (HC), Supply Chain (SC), we found HC and SC to be significant but not PS. We and Products and Services (PS) issues during the crisis. also found not reported in the table that in our global When testing these sentiment characteristics all at once, ex-North America sample, PS was significant while SC was Table 3 Regression Results for Stock Crisis Return on Human Capital, Supply Chain, and Products & Services Responses Model 2 Model 3 Variables Human Capital Model 1 0.0098 3.30 Model 4 0.0076 2.49 0.0060 2.18 0.0020 Supply Chain 0.0083 3.06 Products & Services 0.0050 1 B8 0.75 -0.0214 Lagged flow -0.0200 -0.68 -0.0221 -0.76 . -0.0149 -0.39 Lagend return -0.0169 10 -0.44 -0.0217 OCH 0.74 -0.0199 0.52 0.0065 0.10 0.0155 6.94 Lagged holding 0.0070 0.10 0.0020 0.03 0.0145 6.50 -0.73 -0.0215 MACIE -0.56 0.0045 0.02 0.0162 7.20 of products and services was perceived as more important than supporting supply chains The analysis whose findings are summarized in Table 4 attempted to control for differences in companies innova- tion capacity as reflected in their accumulation of intangible assets and ESG ratings. Following the procedure of Demers et al. (2020), we calculated innovation-related assets as the e accumulation of R&D investments and investments in SG&A over the past five years, which have been proposed to explain stock returns during the first quarter of 2020. We also included controls for ESG ratings that some have been suggested as explaining returns during the COVID- 19 induced market collapse. Because ESG ratings reflect primarily an accumulation of policies, principles, disclosures, and strategies bearing on a wide variety of ESG issues, such ratings could fail to predict how companies reacted during the crisis on issues that are likely to be of importance to stakeholders." The sample decreased by about 600 companies when we required ESG ratings and the RD&SGA variables. But even after introducing these controls, our basic findings were unchanged. The Crisis Response variable was still highly signif- icant, and the estimated economic effect remains practically unchanged from that reported in Table 3. Perhaps the main reason for this is the low correlation we find between Crisis Response and these additional control variables. In addition, we found the R&D and intangibles variables to be signifi- cant, and also the ESG rating by MSC. More specifically, a two-standard deviation increase in the ESG rating by MSC was associated with about 1.2% higher stock returns, which is close to half the economic effect of a two standard deviation increase in the Corporate Response variable. (By contrast, the ESG rating from Sustainalytics was not significant.) On the basis of these findings, then, we concluded that a company's response toward its stakeholders can be important in preserving value, even after controlling for intangible assets and ESG ratings. Makap 0.0150 6.77 ROE 0.0370 0.0380 1 81 E/P / -0.1303 1.77 0.1343 -1.69 0.0230 2.68 -0.0273 0.03 69 1.76 -0.1305 -1.62 -0.0231 -1.62 -0.0223 0.0371 1.77 -0.1322 -1.65 -0.0219 3 -2.56 -0.0265 BTM 2.68 Momentum -2.37 Dividend yield 0.0251 2.26 0.2475 -1.69 0.6243 5.34 -2.60 -0,0257 -2.23 -0.2592 -1.77 -0.5027 -6.11 -0.0174 -1.48 0.0856 4.24 3023 -0.2518 -1.72 -0.5922 wa -6.01 Liquidity 0 2480 -1.69 0.6114 -6.22 0165 -1.41 0.0855 4.25 3023 Leverage Forecast winton 0.0183 -1.56 0.0875 4.32 3023 -0.0165 -1.41 0.0844 4.21 3023 N 0.33 0.33 0.33 0.33 Yes Yes Yes Yes Adjusted R- squared Country Fixed Elects Industry Foed Effects Yes Yes Yes Yes 3a We set RRD expectes torero if they are missing. We do not set SG&A expen- ditures to zero i missing as they are likely to be ser for any organization 39 See Sakis Motos and George Serafim, 2019. "Fou thing no one will tell you about ESG data Jumal of Applied Corporate Finance, 31(2), pp. 50-58, and Dane Christensen, Anywhere Silocite, and George Selim, 2021, "Why is Corporate Viruse in the Eye of The Bear The Case of ISG Ratings Account Alewe, forth coming. Our analysis used MSC and Sustainlysos Gratings at the end of 2019 two of the most widely uned such eing. We used multiple ESG ating banne of the well-documented relatively low condation between different ES Gratis Morialerg Julian F Kobel, and Roberto Rigban, 2019, and Cheatral et al. 202 13. Win our sample, the two ratings are created at 0.48. We use a caliger of 2 to em none of the matched pairs is meally different based on the propensity scores. The sea calipa ces our matched samples from 1511 to 952. Sensiy analysis using Table 3 presents estimated coefficients and below these statistics. Dendant variable is the firm level workeus minus the country level market reus mutated between February 20, 2020 and March 29, 2000. All vides as defined in the Appendix not, which is consistent with potentially greater concern about supply chain issues in North America during this Table 4 group, increasing our confidence that the difference between Additional Controls the matched firms stock returns in indeed the effect of differ- ent corporate crisis responses. Variables Modell Model 2 We matched each High Response firm with a control Crist Response 0.0154 0.0154 firm with the same subindustry classification. Within the 3.33 3.30 MSCI ESG eing 0.0030 same subindustry, we used naarest neighbor matching based 2.35 on propensity scores generated using a logit regression on the Sustainly ca ESG rating -0.0091 variables capable of affecting crisis stock returns such as firm -1.01 size, ROE, dividend yield, valuation ratios, liquidity leverage, RDESGA 0.0068 0.0078 analyst earnings forecasts, and institutional money holdings and 1.94 2.26 Laggad low flows. The propensity score matching is produced with replace- 0.0290 -0.0355 -0.98 ment and a standard caliper. In the untabulated results for the -1.16 Lagedrer 0.0930 -0.0739 logit regression, we found economy, E/P, and forecast revision 2.34 -1.76 load with a positive and significant coefficient, while size, ROE Lagged holding 0.0388 -0.0296 and liquidity loadings were significant but negative. 0.56 -0.42 Using these matched samples, we compared the crisis Macap 0.0155 0.0170 returns for the High Response goup and the matched group. As 6.30 6.56 ROE can be seen in the first line of) Table 5 during the muket crash 0.0370 0.0386 1.74 1.78 from February 20 to March 23, 2020, there was an economi- E/P 0.0035 -0.0241 cally meaningful and statistically significant difference in stock 0.04 -0.27 returns of almost 2.5% between the High Response group and BTM 0.0091 -0.0088 the matched group. 0.79 -0.79 Momentum -0.0144 -0.0156 Identifying Other Contributors -1.22 -1.27 Dividend yield 0.3238 We estimatel models in which our response measure was made -0.2529 2.02 -1.56 to interact with a number of company, industry and country Liquidity 0.5486 -0.5246 level characteristics. 2 Our aim in this was twofold. First, to 420 -4.97 -4.63 understand the contingent nature of the relationship between Leverage 0.0128 -0.0089 0.99 -0.70 crisis corporate responses and stock returns, and the contexts in which those responses might be more likely to be interpreted FORECAST revision 0.0896 0.0718 4,55 3.54 as signals of corporate resilience. Second, to increase confi- N 2417 2392 dence in the hypothesized mechanism driving the relationship Adjusted R-squared R 0.40 0.40 (rather than, say, an alternative explanation, which would need Country Fixed Effects Yes Yerli to explain not only the average relationship, but also how and Subindustry Fired Effect Yes Yes why the relationship varies with these characteristics. Table 4 presents estimated conficients and be the statistics. Dependent variable is the firm-level stock tuns minus the country level marketurm cumulated between February 20, 2020 and March 23, 2020. Al variables are defined in the Appendix.is Company Specific Effects the firm.level stock retums minus the country level market returns cumulated between At the individual firm levd, we used as one independent vati- February 20, 2020 and Mach 28, 2020. All variables an defined in the Appendit. able a measure of the "salience" of a company's response. We Findings of Matched Sample Analysis expected the positive association between Crisis Response To complement our regression analysis, we also performed a propensity score marching analysis that aims to produce a group 40 We use a caliper of 0.2 to surnamed the matched pairs is matally different of control companies that look as similar as possible to the based on the property score. The use of a caliper reduces our matched sample size from 1511 to 957. Sensitivity analysis using different caliper values is performed, and "high" Crisis Response companies in our sample. A company results are similar was defined as High Response (H) if it had a Crisis Response 41 The standardized has between the two groups had a value of 0.17. aug ing maja ees between the two groups. value greater than the median; otherwise, it is defined as Low 42 We mean adjust the sale, and the connevel variables so the beam of Response (L). By generating and comparing matched pairs of Crisis Response can be evaluated when the interactionem is set at the mean value of those variabils, which is zero. The indicatorvaaties for Routine Tasks, BC and Stalled firms, we aimed to reduce any bias attributable to confounding are le as indicator valuables the Cesis Respore have been it and are for variables contributing to the crisis returns of the High Response than Propensity Score Matching Results P-value of paired t-test between HandM 0001 -0.0066 -0.0136 0.9848 0.8191 22.5698 0.4120 0.0445 0.3107 0.0209 BTM 0.6206 0.1197 Momentum Dividend viela 0.8020 0.8908 0.7919 0.4615 Unmatched Low Matched Low Response firms High Response firms Response firms Mean difference Standardized blas Variables (L) mean (H) mean (M) mean between Hand M between Hand M Crisis retur -5.11% -1.74% -4.21% 2.47% 0.0000 0.1746 Economy -0.5364 -0.2365 -0.2298 0.8376 0.00 74 Lagged flow -0.0022 0.0001 -0.0026 0.0024 0.3705 0.0409 Lagged return 0.0092 -0.0091 -0.0001 0.0008 Lagged holding -0.0075 0.0046 -0.0050 0.0004 0.0099 Maket 23.0662 22.5984 -0.0287 0.0289 ROE 0.1486 0.1295 0.1225 0.0070 0.0574 0.0556 0.0519 0.0047 0.0910 0.6221 0.5883 0.0323 0.0591 0.1320 0.1392 0.1421 -0.0029 0.0108 0.0262 0.0242 0.0243 -0.0001 0.0054 Liquidity 0.7562 0.7455 0.7451 0.0004 0.0101 Levenge 0.2285 0.2226 0.2294 -0.0068 0.0314 Forecast revision -0.0653 -0.0472 -0.0443 -0.0028 0.6832 0.01 70 N 1512 957 957 424 957 957 957 Table 5 presents Propensity Score matching result. A firm is defined as High Response (10 the firm has greater than median Crisis Response value; otherwise, it is defined as Low Response (L). All vetables are defined in the Appende and returns to be stronger in cases where the response was profitability moderates Crisis Response. Wheas the luxury deemed more salient for the company in either strengthening good argument would suggest a positive coefficent on the (or damaging) relationships with stakeholders. We measured interaction term between the profitability and response Salience as the natural logarithm of) one plus the ratio of the variables (in our Model 2), the coefficient was in fact negative ( number of COVID-19-specific documents that have been and statistically insignificant. tagged divided by the company's market capitalization on February 19 (the day before we start measuring our dependent Industry-Leve Effects variables). Our reason for scaling the number of documents At the industry level , we focused on two key characteristics of ) by market cap or size was the tendency of larger companies to industries for which we expected those responses to be more have more documents and receive more attention. likely to represent credible commitments to stakeholders. As reported in Table 6, our findings for Model 1 confirmed In both cases, because the commitment to stakeholders was our prediction about salience. The interaction term between The interaction term between expected to be more costly, it was also more likely to be both the Salience and Crisis Response variables was positive and credible and hard to imitate (or Take" with "greenwashing). ("" significant in Model 1. As the variable of salience increased First, we analyzed whether Crisis Response might be more by two standard deviations, a two standard deviation increase strongly associated with returns as a function of an indus- in Crisis Response was accompanied by 3.8% higher stock try's type of jobs and, in particular, the extent to which the returns, as compared I to the 2.2% returns for the model jobs require manual physical routine labor . We expected a without the interaction term (reported carlier in Table 3). more positive Crisis Roponse to be more important in those Moreover, we also tested whether these responses area industries , where efforts to protect labor were a more press- "luxury good" in the sense that if such responses could be ing social concern and more intensely scrutinized. Using a afforded only by the most profitable companies, we would variable we called "Routine Tasks" that was measured at the expect corporate profitability to be positively associated with "subindustry" level, we found a strong positive interaction our Crisis Response variable. But when measuring firm profit- ability as return on equity, we failed to find evidence that 44 This variable sourced from the literature in technology and jobs astusis requir ing mon manual, physical, and routine laborare more likely to be automated in the for lure. It is constructed as the probability that ch tasks might be automated in a subind us 43 Using return-on-assets yleis similar results wygiven the tas is perfomed by works within the sub industry is the different jos a (in our Model 3) between our response variable and stock business-to-consumer settings. To capture this characteristic, returns in those industries where Routine Tasks takes a high we used an indicator variable (B2) assessed at the subindus- value automobile manufacturers, textiles, steel, insurance try level that takes relatively higher values for industries like brokers, electrical components, and equipment. At the same soft drinks, household products, and broadcasting. Examples time, we found no detectable association between Response of subindustries that are not B2C are chemicals and advertis- and stock returns in industries where Routine Tasks have a low ing. As reported under Model 5 in Table 6, the interaction value induding systems software, advertising, electric utilities, term was not significant, suggesting that, when assessing the cable, and satellite effectiveness of corporate responses to stock returns during Second, we looked for a stronger association between COVID, the market did not discriminate between companies Crisis Response and stock returns in industries that were in B2C and B2B industries. Model 6 includes all the interac- disproportionately affected by major changes in the tion terms together and reaches similar conclusions. global economy, such as travel bans, social distancing, and lockdowns. To identify industries that were more severely Country-level Effects impacted by this crisis, we introduce an indicator variable At the country level, we looked at two characteristics. We ("Stalled"), which takes the value of one for industries with a expected the relationship between crisis response and stock drastic increase in unemployment over the crisis and subin- returns to be strongest for companies headquartered in dustries directly and negatively impacted by travel bans. countries where stakeholder relations are deemed to be most Examples of Stalled sub industries are airlines, airport services, important. The country-level data are coming from the IMD leisure facilities, hotels, resorts, and cruise lines. Examples of World Competitiveness reports that assesses cach country's subindustries not "Stalled according to this indicator are food competitiveness. The assessment includes surveys of manag- retailers and pharmaceuticals. As reported using our Model 4 ers in each country we found the interaction between Response and stock retums We measured the importance of stakeholder reations in a to be significantly positive in "Stalled" industries. given country using a variable that measures if companies in Finally, we examined the association of Crisis Response the country focus on customer satisfaction (Customer) and a and stock returns across companies with two different kinds variable that measures if companies in the country focus on of business models: (1) direct to consumer sales models, in attracting and retaining talent (Talent). This reflects two of which building brands that people feel emotionally tied to the stakeholders included in our corporate response measures; but which also entail making relatively quick decisions; and in the case of the third group, suppliers, there is no measure (2) business-to-business models, where the decision-making available in the dataset. 7 process around sales is more elaborate and longer-term, As reported in Model 7, we found the interaction term involving many more stakeholders with stickier, longer- with customers to be positive and significant. In countries term contracts. For example, whereas online retailers and deemed to have greater corporate focus on customer satis- restaurants sell directly to consumers and those purchases in faction (two standard deviation increase in these measures). some instances are received within moments, semiconductor a two standard deviation increase in the Crisis Response companies selling to tech hardware companies are intent on measure was associated with 3.52% and 3.92% higher stock building and maintaining even longer-term relationships with returns, respectively. In Model 8, we found the interaction specific customers. term between talent and crisis response to be positive but To the extent the market raction to corporate responses insignificant. (We did not add the two country variables reflects differences in how COVID-19 affects the economics of in the same model because of their high positive correlation different businesses, one might expect more norable effects in between the variables.) Trend Michst 2017 The Fun ment How Suscep- 46 IMD Worla apei diveness Nearbook, 2019. Regression Results for Moderating Effects Model 7 Variables Crisis Response Model 2 0.0145 2.46 Model 3 -0.0043 -0.58 Model 4 0.0075 1.59 Model 5 0.0126 2.26 Crisis Response x Salence Model 1 0.0077 1.71 0.0099 2.34 0.0014 0.30 0.0028 -0.33 0.0117 2.67 0.0023 0.51 -0.0188 -0.78 Salience Crisis Resome X ROE -0.0234 -0.9439 Crisis Response x Routine Tasks Model 6 -0.0028 -0.33 0.0085 2.00 0.0009 0.20 -0.0242 -1.01 0.0235 2.79 -0.0077 -0.62 0.0313 2.03 0.0037 0.14 -0.0121 -1.62 0.0338 2.62 0.0400 2.67 0.0144 0.56 Routine Tasks Model B -0.0026 -0.31 0.0104 2.40 0.0003 0.06 -0.0243 -1.01 0.0213 2.50 -0.0119 -0.98 0.0298 1.84 -0.0087 -0.33 -0.0108 -1.41 0.0366 2.76 Crisis Response x Stalled 0.0400 267 0.0144 0.56 0.0212 2.47 0.0118 -0.96 0.0301 1.86 -0.0061 -0.23 0.0122 -1.58 0.0355 2.69 0.0146 2.34 0.0174 3.22 Stalled Crisis Response x B2C 0.0040 -0.53 0.0352 2.83 B2C Crisis Response Customer Customer Crisis Response x Twent Talent 0.0085 Economy 3.83 Lagend tow Lagged return Lagged holding Masket cap 0.0082 3.69 -0.0202 -0.69 -0.0272 -0.72 0.0030 0.04 0.0155 6.96 0.0341 1.65 -0.1149 -1.46 -0.0189 -2 20 -0.0281 -2.42 -0.2467 -1.72 -0.5664 -5.73 ROE 0.0084 3.79 -0.0217 -0.74 -0.0258 -0.68 0.0013 0.02 0.0164 734 0.0233 0.94 -0.1229 -1.55 -0.0207 -2.41 0.0280 -2.43 -0.2586 -1.79 -0.5854 -5.94 0.0087 3.91 -0.0203 -0.69 -0.0233 -0.62 0.0036 0.05 0.0169 7.37 0.0340 1.63 -0.1155 -1.45 -0.0211 -2.47 -0.0284 -2.48 -0.2760 -1.92 -0.5836 -5.92 -0.0210 -0.72 -0.0263 -0.69 0.0013 0.02 0.0161 7.19 0.0354 1.70 -0.1210 -1.52 -0.0207 -2.41 -0.0276 -2.40 -0.2592 -1.80 -0.5935 -6.03 0.0085 3.87 -0.0209 -0.71 -0.0243 -0.64 0.0041 0.06 0.0162 7.23 0.0367 1.76 -0.1326 -1.67 -0.0202 -2.36 -0.0269 -2.34 -0.2415 -1.67 -0.5817 -5.93 0.0100 133 0.0090 1.47 0.0077 3.52 -0.0174 -0.59 -0.0152 -0.42 0.0211 0.30 0.0162 7.47 0.0033 0.14 -0.0884 -1.14 -0.0082 -1.05 -0.0246 -2.17 0.2470 0.0083 3.76 -0.0150 -0.51 -0.0295 -0.78 0.0155 0.23 0.0151 6.85 0.0182 0.74 -0.1072 -1.37 -0.0189 -2.22 -0.0281 -2.45 -0.2507 -1.76 -0.5576 -5.68 0.0076 3.52 -0.0173 -0.59 -0.0127 -0.35 0.0176 0.26 0.0164 7.52 0.0080 0.33 -0.0938 -1.22 -0.0103 -1.30 -0.0235 -2.a 0.2278 -1167 -0.6442 -8.84 E/P BTM Momentum Dividend yield Liquidity -0.6087 -8.60 Table 6 (continued) Leverage Forecast revision -0.0183 -1.57 0.0825 4.16 3023 0.34 Yes Yes -0.0174 -1.49 0.0842 4.23 3023 0.33 Yes Yes -0.0173 -1.49 0.0823 4.13 3023 0.34 Yes Yes -0.0186 -1.60 0.0839 4.17 3023 0.34 Yes Yes 0.0168 -1.45 0.0843 4.22 3023 0.34 Yes Yes -0.0188 -1.63 0.0815 4.15 3023 0:34 Yes Yes -0.0197 -1.71 0.0810 4.17 3022 0.31 No Yes -0.0202 -1.75 0.0818 421 3022 0.31 NE Adjusted R-squared Country Fixed Efects Industry Fixed Effects No Yes Table 6 presents estimated coefficients and below those statistics. Dependent variable is the firm level stock returns minus the country level market returns cumulated between February 20, 2020 and March 23, 2020. All variables are defined in the Appendix. Conclusion behavior. Moreover, our results suggest that the application of During a market crisis, investors are looking for evidence of machine learning to big data of unstructured text represents a corporate resilience. In this paper we summarize the findings of promising technology for measuring corporate responses and our recent study that aims to answer the question: did compa- associated crisis management efforts. Understanding the inter- nies that invest heavily in stakeholder relationships demonstrate play between corporate disclosure, media, and social media stronger stock market performance during the COVID-19 activity, and corporate responses has the potential to provide market collapse as a consequence of those investments? a fuller understanding of how these technologies can be used Collectively, our findings provide the first evidence on to find new ways of evaluating organizational behavior. market response during the COVID-19-induced market collapse, as a function of corporate Crisis Responses. We have attempted to limit the possible confounding effect of other GEORGE SERAFEIM is the Charles M. Williams Professor of Business possible explanations through our research design choices and Administration and an academic partner at State Street Associates by presenting alternative specifications: controlling for firm characteristics that are likely to be determinants of crisis stock ALEXANDER CHEEMA-FOX is a managing director at State Street Asso- returns, including a sentiment measure that directly proxies for ciates, Cambridge, Massachusetts the business effect of COVID-19 on each company. Our findings suggest that investments in stakeholder BRIDGET REALMUTO LAPERLA is a vice president at State Street Asso relations could be viewed, and indeed valued, as strategic ciates, Cambridge, Massachusetts. resources, especially in a business context in which such investments represent a credible and costly commitment to HUI (STACIE) WANG is a vice president at State Street Associates, those stakeholders. Future research could examine the effects Cambridge, Massachusetts. of those corporate responses on employee morale or customer H 3. From Table 2 (page 31) of the article, what do you make of the findings regarding *Market cap' and 'BTM? (Tips: A review/look into a classical article in finance - Fama and French (*The cross-section of expected stock returns - Journal of Finance 1992) could be useful. This question should be not more than two double-spaced pages.) (1.4 points) Corporate Resilience and Response to COVID-19 by Alex Cheema-Fox, Bridget R. LaPerla, and Hul (Stacie) Wang, State Street Associates; and George Serafeim, Harvard Business School he coronavirus pandemic of 2020 took the world by storm, disrupting economies U the rapid spread and economic impact of the coronavirus. A month after the World Health Organization (WHO) fielded the first reports of pneumonia from an unknown cause in China, the coronavirus (now referred to as COVID-19) was declared a public health emergency by the end of January 2020, with 9,826 confirmed cases in 19 countries. By February 19, the WHO reported 2,009 deaths, 75,204 confirmed cases in 25 countries, and a startling 1,872 new cases from the previous day.? supply chains and practices , supply To limit the spread of COVID-19, many governments (the day after the S&P 500 reached a "local high) to the market mandated social distancing and instituted severe travel restric- low on March 23. during which the S&P 500 experienced tions, including quarantines. This had an immediate impact a nearly 30% drop. Given the impact on on the labor force, supply chains, and sales of products and labor, we focused on these characteristics as likely drivers of services, After the S&P 500 reached record highs on Febru- stock returns during this period, as well as possible corporate ary 19, it experienced its largest one-week declines since the responses to COVID-19 in the form of changes in operations, 2008 financial crisis. In the study y described in these pages, we looked at the induding the repurposing of products and services. As our measures of corporate responsiveness to the crisis, association between corporate responses we see as plausibly we used big data from natural language processing that detect important during this crisis-specifically, those related to labor the relative strength of positive and negative public sentiment y chain, and repurposing of operations (products about those corporate responses. Our working hypothesis was and services)to determine the extent it to which companies that companies with more with more positive media sentiment around their responses to their responses to the pandemic and their effects on employ- With more positive public sentiment about the crisis experienced less negative returns during the market ces, suppliers, and custome and customers would be valued more highly collapse. We defined the analysis period as from February 20 stock market investors than their less favorably viewed corporate counterparts during the market collapse. One inter- *George Beratim lag steful for financial support from the Division of Faculty and pretation of such a its confirmation of investors Research Development of the Harvard Business School. The material presented is for informational purposes only. The views apre in this material are those of the authors tendency to view a company's commitment to its stakehold- and provided is at the time of first publication, are not intended for distribution to ers--notably, its customers, suppliers, and employees as a to applicable law, and are not an other or solicitation to buy or sell sealities or any strategic resource that expected to provide a competitive advantage. But such a commitment is likely 1 Novel Coronavirus (2019-CoV) Sion Report - 11. World Health Organiza 4 Mejor international merlet indices de collapsed during the same period. For 2 "Coronavins disease 2019 (COVO-19) Situation Report - 20. Wald Health example, the FTSE 100 declined by 33%, the DAX Performance Index by 34%, the Hang Organization. February 19, 2020 Seng index by 22% and the TOPIK by 26% fin Srim 2920. Pola Sentiment and the Priat of Corporate Sus- colouch a finding is its any person or entity in any jurisdiction where such distribution or use would be contrary piedurt. This article reflects the views of the authors and does not necessarily represent the views of State Sweet Corporation or its affiliate generate tion January 31, 2020. strategic resources only to the extent it is deemed credible, control variables that were expected to contribute to the relation leading to higher levds of trust and stronger relationships with those stakeholders. The COVID-19 crisis represents a setting ing our con