Corporate tax rate is 21%

Corporate tax rate is 21%

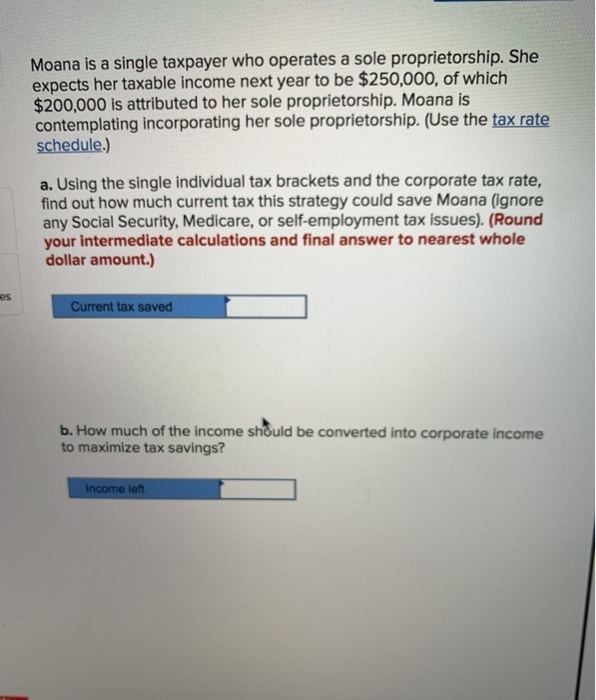

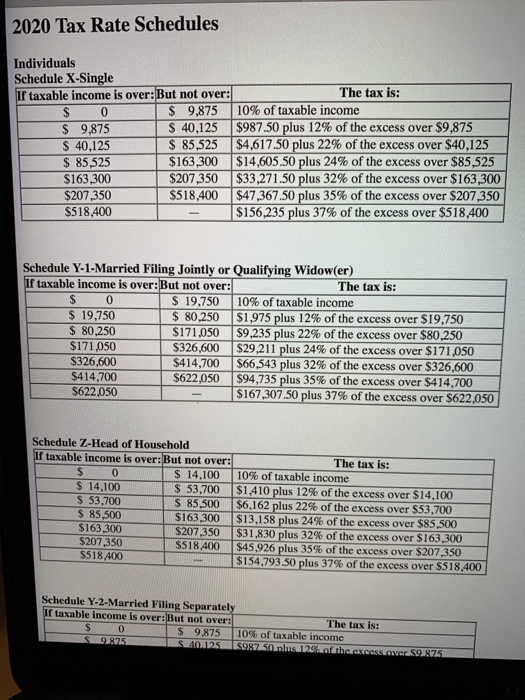

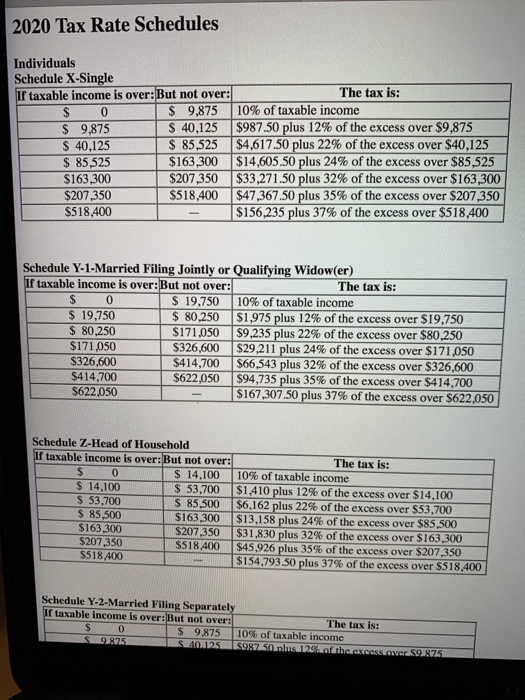

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed to her sole proprietorship. Moana is contemplating incorporating her sole proprietorship. (Use the tax rate schedule.) a. Using the single individual tax brackets and the corporate tax rate, find out how much current tax this strategy could save Moana (ignore any Social Security, Medicare, or self-employment tax issues). (Round your intermediate calculations and final answer to nearest whole dollar amount.) es Current tax saved b. How much of the income shuld be converted into corporate income to maximize tax savings? Income left 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $ 163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 14,100 $ 14,100 $ 53,700 $ 53,700 $ 85,500 $ 85,500 $163,300 $163,300 $207,350 $207,350 $518.400 $518,400 The tax is: 10% of taxable income $1.410 plus 12% of the excess over $14,100 $6,162 plus 22% of the excess over $53,700 $13,158 plus 24% of the excess over $85,500 $31,830 plus 32% of the excess over $163,300 $45,926 plus 35% of the excess over $207,350 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately Ir taxable income is over: But not over: The tax is: 0 $ 9.875 10% of taxable income S 9.875 S401125 S987.50nius 120therOSSOWS9.875

Corporate tax rate is 21%

Corporate tax rate is 21%