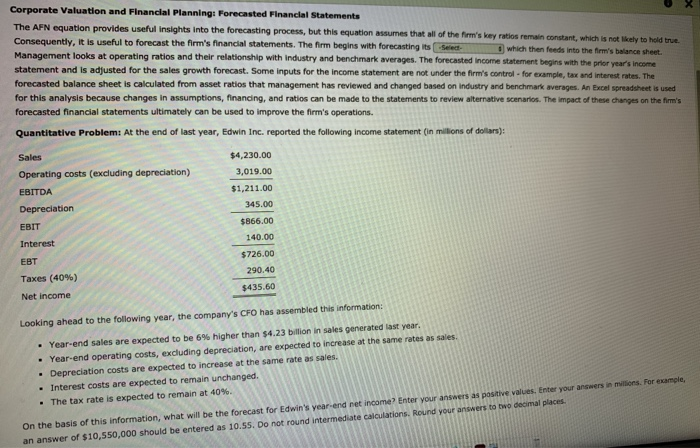

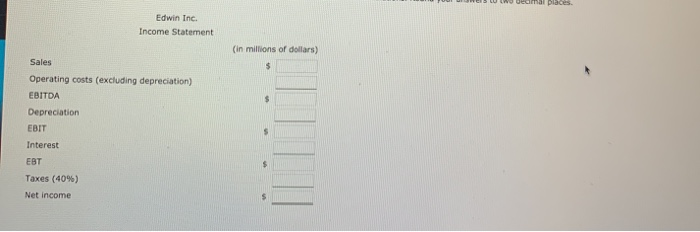

Corporate Valuation and Financial Planningi Forecasted Financial Statements The AFN equation provides useful insights into the forecasting process, but this equation assumes that of the firm's key to remain constant, which is not to hold true Consequently. It is useful to forecast the firm's financial statements. The firm begins with forecasting it em which then the firm's w a t Management looks at operating ratios and their relationship with industry and benchmark averages. The forecasted income Matement begins with the rear's income statement and is adjusted for the sales growth forecast. Some inputs for the income statement are not under the firm's control for example, tax and interest rates. The forecasted balance sheet is calculated from asset ratios that management has reviewed and changed based on industry and benchmark everages. An bol spreadsheet is used for this analysis because changes in assumptions, financing, and ratios can be made to the statements to review alternative scenarios. The impact of these changes on the firm's forecasted financial statements ultimately can be used to improve the firm's operations. Quantitative Problemi At the end of last year, Edwin Inc. reported the following income statement in millions of dollars) $4,230.00 3,019.00 $1,211.00 345.00 Sales Operating costs (excluding depreciation) EBITDA Depreciation EBIT Interest EBT Taxes (40%) Net income $866.00 140.00 $726.00 290.40 $435.60 Looking ahead to the following year, the company's CFO has assembled this information: Year-end sales are expected to be 6% higher than $4.23 billion in sales generated last year Year-end operating costs, excluding depreciation, are expected to increase at the same rates as a Depreciation costs are expected to increase at the same rate assores . Interest costs are expected to remain unchanged. The tax rate is expected to remain at 40% r s poste aventer your answe to the complaces On the basis of this information, what will be the forecast for Edwin's year-end net income Enter your an an answer of $10,550,000 should be entered as 10.55. Do not round intermediate cations. Round you Dnes Uw bedmal places Edwin Inc. Income Statement (in millions of dollars) Sales Operating costs (excluding depreciation) EBITDA Depreciation EBIT Interest EBT Taxes (40%) Net income