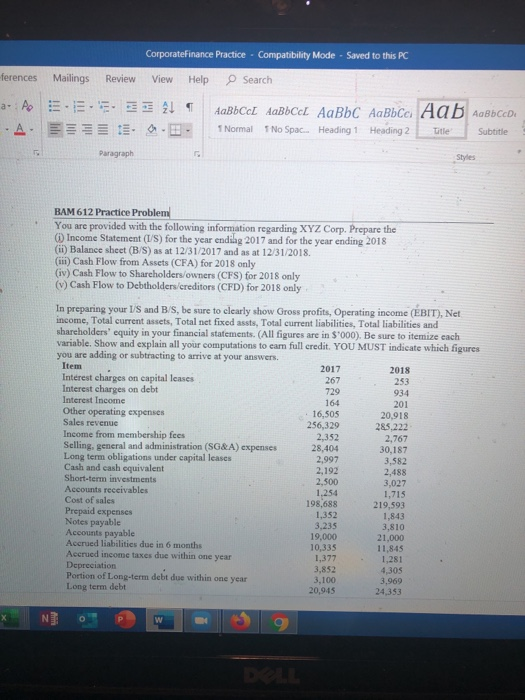

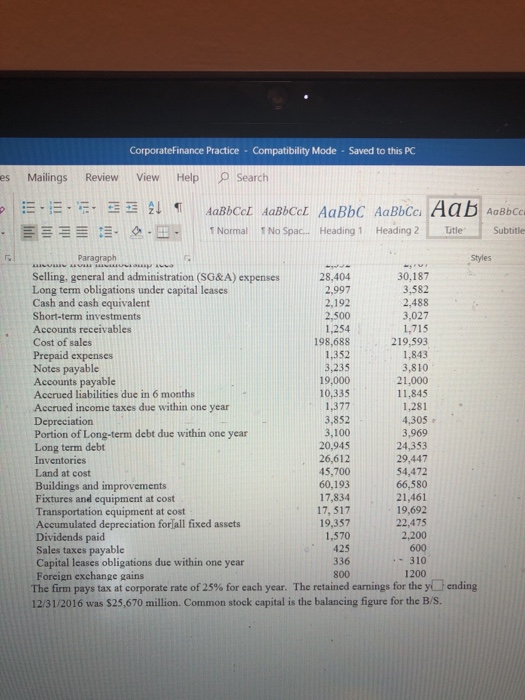

CorporateFinance Practice - Compatibility Mode - Saved to this PC ferences Mailings Review View Help Search a. AoE. ALI . A. : - Normal * No Spac. Heading 1 Heading 2 Title Subtitle Paragraph Styles BAM 612 Practice Problem You are provided with the following information regarding XYZ Corp. Prepare the Income Statement (I/S) for the year ending 2017 and for the year ending 2018 (ii) Balance sheet (B/S) as at 12/31/2017 and as at 12/31/2018 (1) Cash Flow from Assets (CFA) for 2018 only (iv) Cash Flow to Shareholders/owners (CFS) for 2018 only () Cash Flow to Debtholders/creditors (CFD) for 2018 only In preparing your l'S and B/S, be sure to clearly show Gross profits, Operating income (EBIT), Net income, Total current assets, Total net fixed assts, Total current liabilities, Total liabilities and shareholders' equity in your financial statements. (All figures are in S'000). Be sure to itemize each variable. Show and explain all your computations to earn full credit. YOU MUST indicate which figures you are adding or subtracting to arrive at your answers. Item 2017 2018 Interest charges on capital cases 267 253 Interest charges on debt 729 934 Interest Income 164 201 Other operating expenses 16,505 20,918 Sales revenue 256,329 285.222 Income from membership fees 2,352 2,767 Selling, general and administration (SG&A) expenses 28,404 30.187 Long term obligations under capital leases 2,997 3,582 Cash and cash equivalent 2,192 2,488 Short-term investments 2,500 3,027 Accounts receivables 1.254 1,715 Cost of sales 198,688 219,593 Prepaid expenses 1,352 1,843 Notes payable 3,235 3,810 Accounts payable 19,000 21,000 Accrued liabilities due in 6 months 10,335 11,845 Accrued income taxes due within one year 1,377 1,281 Depreciation 3,852 4,305 Portion of Long-term debt due within one year 3,100 3,969 Long term debt 20,945 24,353 X NI Corporate Finance Practice - Compatibility Mode - Saved to this PC es Mailings Review View Help Search E 21 E .. . 1 No Spac... Heading 1 Heading 2 1 Normal Title Subtitle Paragraph LLLL LLLLL LLLL Styles Selling, general and administration (SG&A) expenses 28,404 30,187 Long term obligations under capital leases 2,997 3,582 Cash and cash equivalent 2,192 2,488 Short-term investments 2,500 3.027 Accounts receivables 1,254 1,715 Cost of sales 198,688 219,593 Prepaid expenses 1,352 1,843 Notes payable 3,235 3,810 Accounts payable 19,000 21,000 Accrued liabilities due in 6 months 10,335 11,845 Accrued income taxes due within one year 1,377 1,281 Depreciation 3,852 4,305 Portion of Long-term debt due within one year 3,100 3,969 Long term debt 20,945 24,353 Inventories 26,612 29,447 Land at cost 45,700 54,472 Buildings and improvements 60,193 66,580 Fixtures and equipment at cost 17,834 21,461 Transportation equipment at cost 17, 517 19,692 Accumulated depreciation for all fixed assets 19,357 22,475 Dividends paid 1,570 2,200 Sales taxes payable 425 600 Capital leases obligations due within one year 336 - 310 Foreign exchange gains 800 1200 The firm pays tax at corporate rate of 25% for each year. The retained earnings for the yending 12/31/2016 was $25,670 million. Common stock capital is the balancing figure for the B/S. CorporateFinance Practice - Compatibility Mode - Saved to this PC ferences Mailings Review View Help Search a. AoE. ALI . A. : - Normal * No Spac. Heading 1 Heading 2 Title Subtitle Paragraph Styles BAM 612 Practice Problem You are provided with the following information regarding XYZ Corp. Prepare the Income Statement (I/S) for the year ending 2017 and for the year ending 2018 (ii) Balance sheet (B/S) as at 12/31/2017 and as at 12/31/2018 (1) Cash Flow from Assets (CFA) for 2018 only (iv) Cash Flow to Shareholders/owners (CFS) for 2018 only () Cash Flow to Debtholders/creditors (CFD) for 2018 only In preparing your l'S and B/S, be sure to clearly show Gross profits, Operating income (EBIT), Net income, Total current assets, Total net fixed assts, Total current liabilities, Total liabilities and shareholders' equity in your financial statements. (All figures are in S'000). Be sure to itemize each variable. Show and explain all your computations to earn full credit. YOU MUST indicate which figures you are adding or subtracting to arrive at your answers. Item 2017 2018 Interest charges on capital cases 267 253 Interest charges on debt 729 934 Interest Income 164 201 Other operating expenses 16,505 20,918 Sales revenue 256,329 285.222 Income from membership fees 2,352 2,767 Selling, general and administration (SG&A) expenses 28,404 30.187 Long term obligations under capital leases 2,997 3,582 Cash and cash equivalent 2,192 2,488 Short-term investments 2,500 3,027 Accounts receivables 1.254 1,715 Cost of sales 198,688 219,593 Prepaid expenses 1,352 1,843 Notes payable 3,235 3,810 Accounts payable 19,000 21,000 Accrued liabilities due in 6 months 10,335 11,845 Accrued income taxes due within one year 1,377 1,281 Depreciation 3,852 4,305 Portion of Long-term debt due within one year 3,100 3,969 Long term debt 20,945 24,353 X NI Corporate Finance Practice - Compatibility Mode - Saved to this PC es Mailings Review View Help Search E 21 E .. . 1 No Spac... Heading 1 Heading 2 1 Normal Title Subtitle Paragraph LLLL LLLLL LLLL Styles Selling, general and administration (SG&A) expenses 28,404 30,187 Long term obligations under capital leases 2,997 3,582 Cash and cash equivalent 2,192 2,488 Short-term investments 2,500 3.027 Accounts receivables 1,254 1,715 Cost of sales 198,688 219,593 Prepaid expenses 1,352 1,843 Notes payable 3,235 3,810 Accounts payable 19,000 21,000 Accrued liabilities due in 6 months 10,335 11,845 Accrued income taxes due within one year 1,377 1,281 Depreciation 3,852 4,305 Portion of Long-term debt due within one year 3,100 3,969 Long term debt 20,945 24,353 Inventories 26,612 29,447 Land at cost 45,700 54,472 Buildings and improvements 60,193 66,580 Fixtures and equipment at cost 17,834 21,461 Transportation equipment at cost 17, 517 19,692 Accumulated depreciation for all fixed assets 19,357 22,475 Dividends paid 1,570 2,200 Sales taxes payable 425 600 Capital leases obligations due within one year 336 - 310 Foreign exchange gains 800 1200 The firm pays tax at corporate rate of 25% for each year. The retained earnings for the yending 12/31/2016 was $25,670 million. Common stock capital is the balancing figure for the B/S