Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corporation A has issued corporate bonds that pay 1 each if the corporation stays in business. If it goes bankrupt the liquidation of the

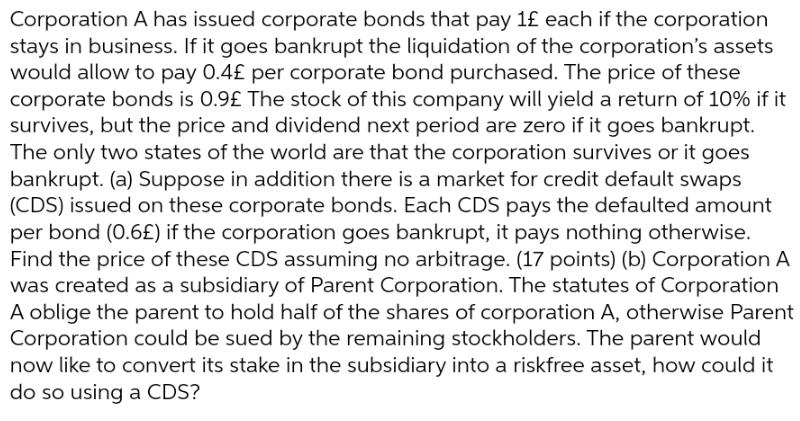

Corporation A has issued corporate bonds that pay 1 each if the corporation stays in business. If it goes bankrupt the liquidation of the corporation's assets would allow to pay 0.4 per corporate bond purchased. The price of these corporate bonds is 0.9 The stock of this company will yield a return of 10% if it survives, but the price and dividend next period are zero if it goes bankrupt. The only two states of the world are that the corporation survives or it goes bankrupt. (a) Suppose in addition there is a market for credit default swaps (CDS) issued on these corporate bonds. Each CDS pays the defaulted amount per bond (0.6) if the corporation goes bankrupt, it pays nothing otherwise. Find the price of these CDS assuming no arbitrage. (17 points) (b) Corporation A was created as a subsidiary of Parent Corporation. The statutes of Corporation A oblige the parent to hold half of the shares of corporation A, otherwise Parent Corporation could be sued by the remaining stockholders. The parent would now like to convert its stake in the subsidiary into a riskfree asset, how could it do so using a CDS?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started