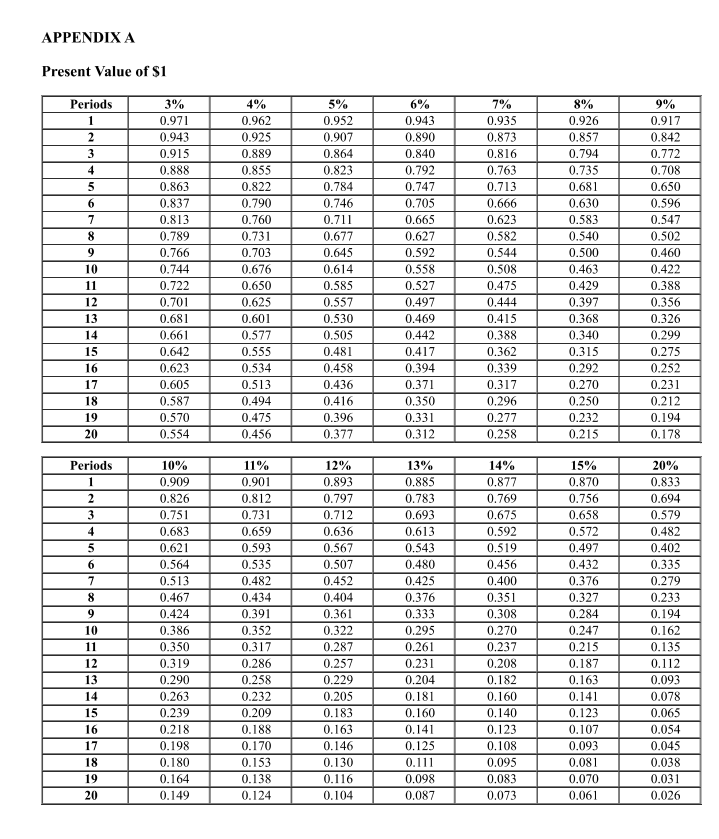

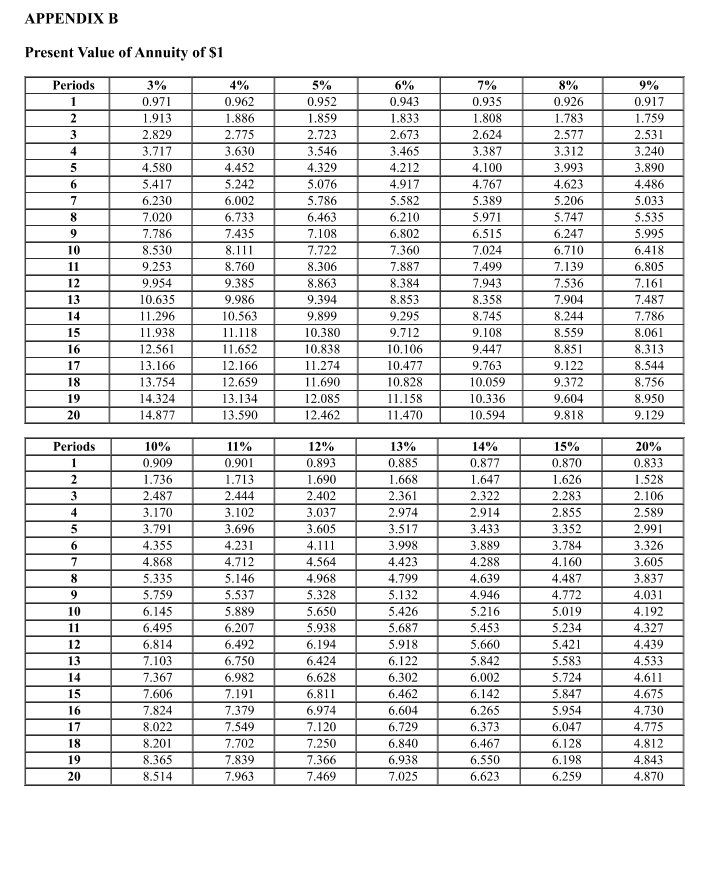

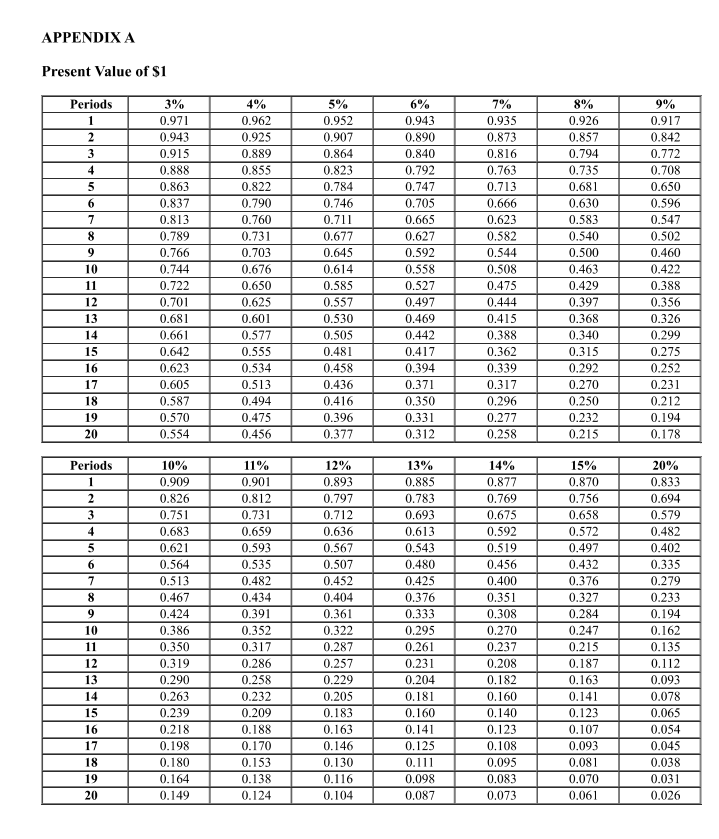

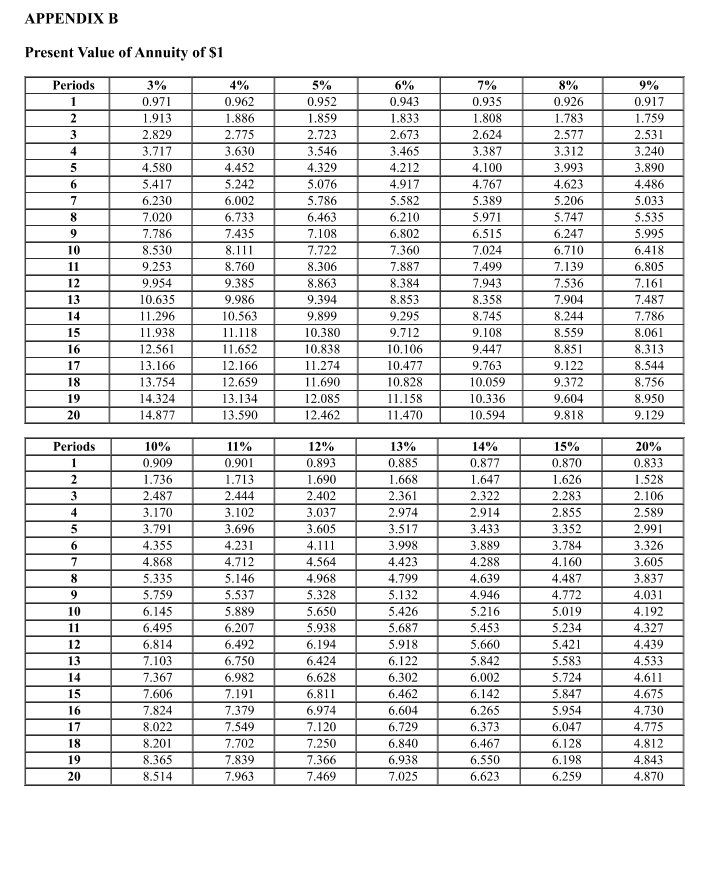

Corporation ABC Invested In a project that will generate $101,000 annual after-tax cash flow in years 0 and 1 and $70,000 annual aftertax cash flow in years 2, 3, and 4 . Use Appendix A and Appendix B. Requlred: a. Compute the NPV of these cash flows assuming that ABC uses a 10 percent discount rate. b. Compute the NPV of these cash flows assuming that ABC uses a 7 percent discount rate. c. Compute the NPV of these cash flows assuming that ABC uses a 4 percent discount rate. Complete this question by entering your answers in the tabs below. Compute the NPV of these cash flows assuming that ABC uses a 10 percent discount rate. Note: Round discount factor(s) to 3 decimal places. Corporation ABC invested in a project that will generate $101,000 annual after-tax cash flow in years 0 and 1 and $70,000 annual aftertax cash flow in years 2, 3, and 4 . Use Appendlx A and AppendixB. Required: a. Compute the NPV of these cash flows assuming that ABC uses a 10 percent discount rate. b. Compute the NPV of these cash flows assuming that ABC uses a 7 percent discount rate. c. Compute the NPV of these cash flows assuming that ABC uses a 4 percent discount rate. Complete this question by entering your answers in the tabs below. Compute the NPV of these cash flows assuming that ABC uses a 7 percent discount rate. Note: Round discount factor(s) to 3 decimal places. Corporation ABC Invested In a project that will generate $101,000 annual after-tax cash flow In years 0 and 1 and $70,000 annual aftertax cash flow in years 2, 3, and 4 . Use Appendix A and AppendixB. Required: a. Compute the NPV of these cash flows assuming that ABC uses a 10 percent discount rate. b. Compute the NPV of these cash flows assuming that ABC uses a 7 percent discount rate. c. Compute the NPV of these cash flows assuming that ABC uses a 4 percent discount rate. Complete this question by entering your answers in the tabs below. Compute the NPV of these cash flows assuming that ABC uses a 4 percent discount rate. Note: Round discount factor(s) to 3 decimal places. Present Value of $1 Present Value of Annuity of $1