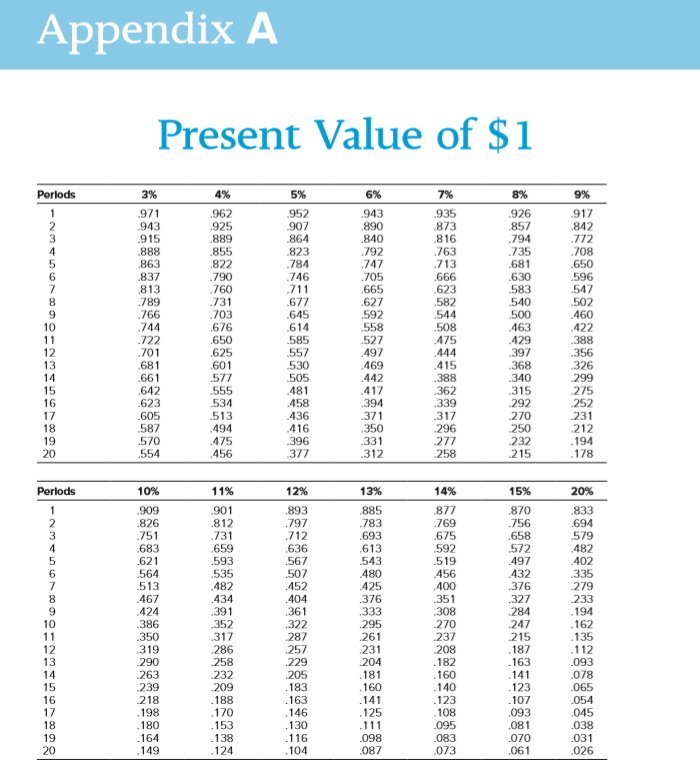

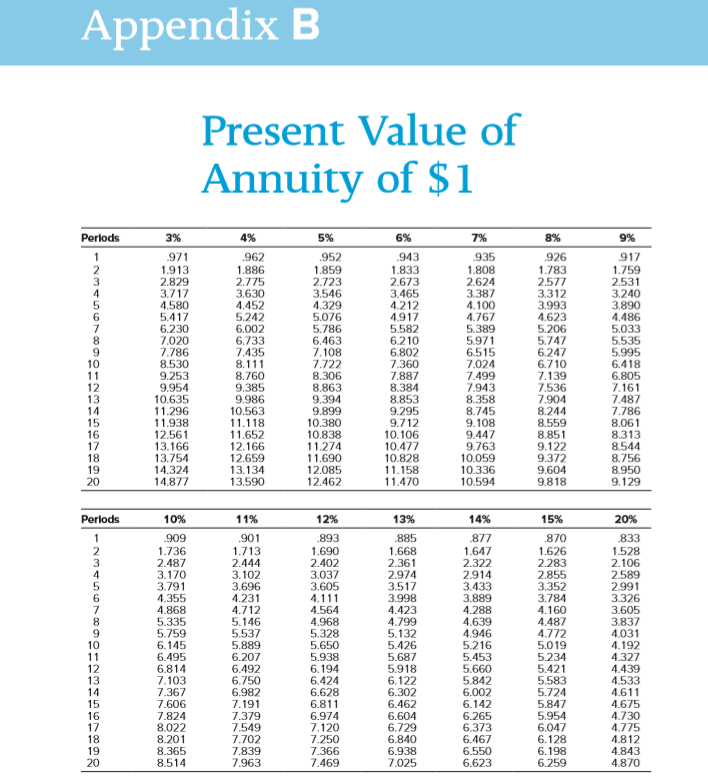

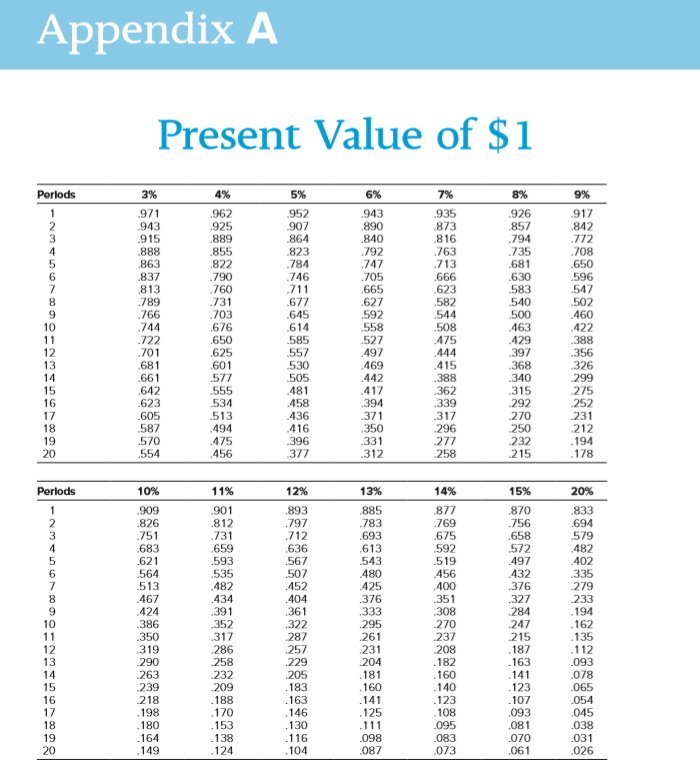

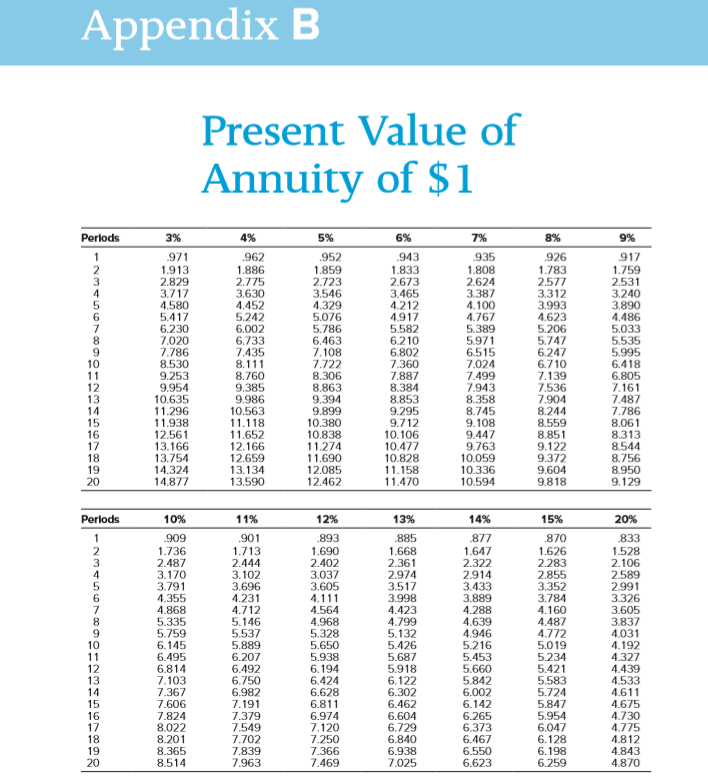

Corporation ABC invested in a project that will generate $81,000 annual after-tax cash flow in years 0 and 1 and $54,000 annual after-tax cash flow in years 2, 3, and 4. Use Appendix A and Appendix B. a. Compute the NPV of these cash flows assuming that ABC uses a 10 percent discount rate. b. Compute the NPV of these cash flows assuming that ABC uses a 7 percent discount rate. c. Compute the NPV of these cash flows assuming that ABC uses a 4 percent discount rate. Appendix A Present Value of $1 Periods 7% 8% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 3% .971 943 .915 888 .863 .837 813 .789 .766 .744 .722 701 .681 .661 .642 .623 .605 587 .570 .554 4% .962 925 .889 .855 .822 .790 .760 .731 .703 .676 .650 .625 .601 .577 .555 .534 .513 .494 .475 456 5% 1952 907 .864 823 .784 .746 .711 .677 .645 .614 .585 .557 530 .505 481 6% .943 .890 .840 .792 .747 .705 .665 .627 .592 .558 .527 497 .469 .442 .417 .394 .371 350 .331 .312 935 .873 .816 .763 .713 .666 .623 .582 .544 508 .475 444 415 388 .362 .339 317 296 .277 258 926 857 .794 .735 .681 .630 583 540 500 463 .429 .397 368 .340 315 292 270 250 232 215 9% 1917 842 .772 .708 .650 .596 .547 .502 460 422 .388 356 326 .299 275 .252 .231 212 .194 .178 .458 436 .416 .396 377 Periods 10% 11% 13% 14% 15% 20% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 .909 .826 .751 .683 .621 .564 .513 .467 .424 .386 .350 319 .290 .263 239 218 .198 .180 . 164 .149 901 .812 .731 .659 .593 .535 .482 .434 .391 .352 .317 .286 .258 .232 209 .188 .170 .153 .138 .124 12% .893 .797 .712 .636 .567 .507 .452 .404 361 322 287 257 .229 205 .183 .163 .146 .130 .116 . 104 885 .783 .693 .613 .543 480 .425 .376 333 .295 .261 .231 204 .181 . 160 .141 .125 .111 .098 877 .769 .675 592 .519 456 .400 .351 308 270 237 208 .182 .160 .140 .123 . 108 .095 .083 .073 .870 756 .658 572 497 .432 376 .327 284 247 .215 .187 .163 .141 .123 .107 .093 .081 .070 .061 833 .694 .579 482 .402 335 .279 .233 .194 .162 .135 .112 .093 .078 .065 .054 .045 .038 .031 .026 .087 Appendix B. Present Value of Annuity of $1 Periods 3% 4% 6% 7% 8% 9% 4 5 6 8 9 10 11 12 13 14 15 16 17 18 19 20 971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 .962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 5% .952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 .935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 Periods 11% 14% 15% 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 10% .909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 .901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 12% .893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% .885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 .877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 .870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 20% .833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4.870