Answered step by step

Verified Expert Solution

Question

1 Approved Answer

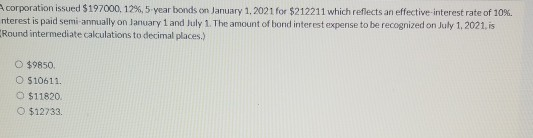

corporation issued $197000. 12%,5 year bonds on January 1, 2021 for $212211 which reflects an effective interest rate of 10%. nterest is paid semi-annually on

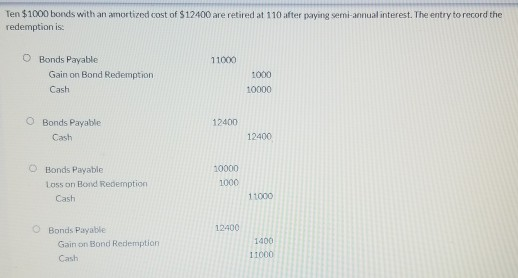

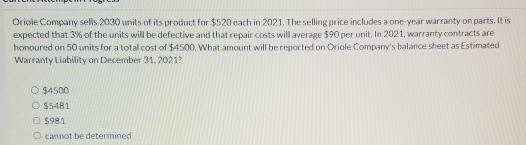

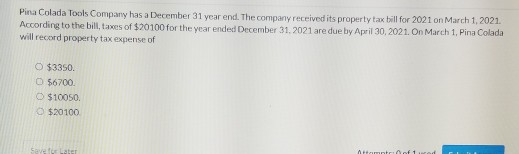

corporation issued $197000. 12%,5 year bonds on January 1, 2021 for $212211 which reflects an effective interest rate of 10%. nterest is paid semi-annually on January 1 and July 1. The amount of bond interest expense to be recognized on July 1, 2021.is Round intermediate calculations to decimal places.) O $9850 O $10611. $11820 O $12733 Ten $1000 bonds with an amortized cost of $12400 are retired at 110 after paying semi-annual interest. The entry to record the redemption is: 11000 O Bonds Payable Gain on Bond Redemption Cash 1000 10000 12400 Bonds Payable Cash 12400 Bonds Payable Loss on Bond Redemption Cash 10000 1000 11000 12400 Bonds Payable Gain on Bond Redemption Cash 1400 11000 Pina Colada Tools Company has a December 31 year end. The company received its property tax bill for 2021 on March 1, 2021. According to the bill, taxes of $20100 for the year ended December 31, 2021 are due by April 30, 2021. On March 1, Pina Colada will record property tax expense of $3350. O $6700 $10050 $20100 FET Art

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started