Answered step by step

Verified Expert Solution

Question

1 Approved Answer

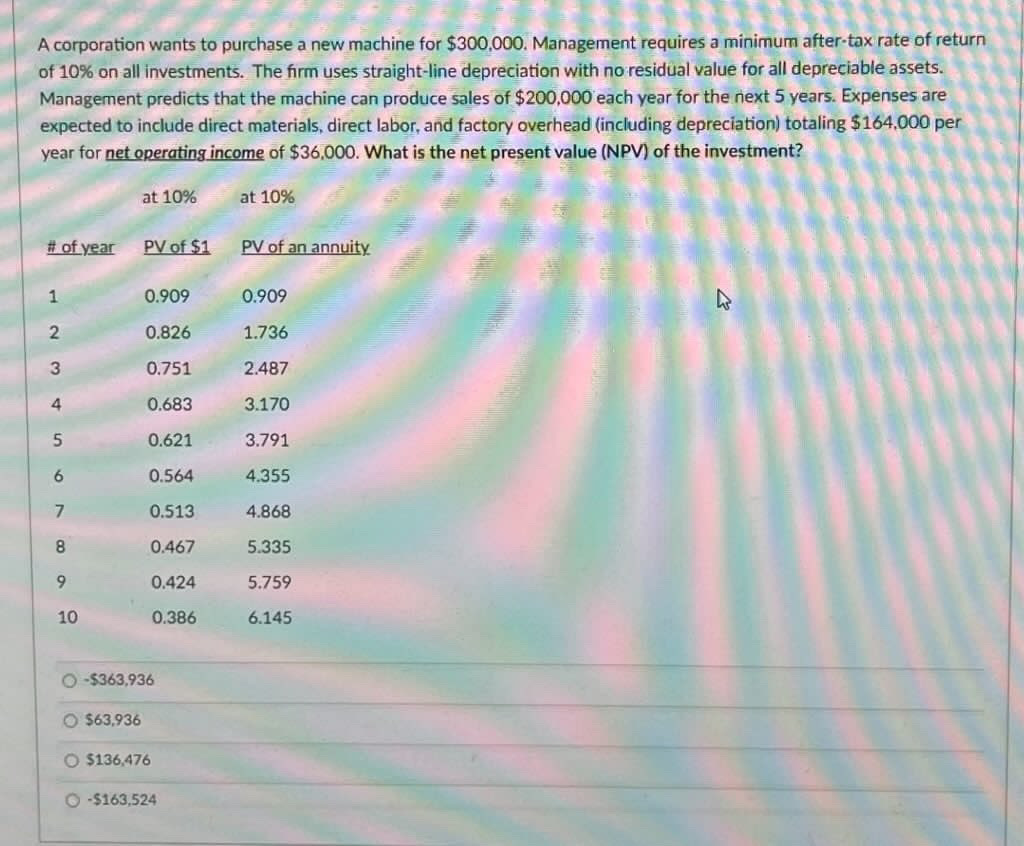

corporation wants to purchase a new machine for $ 3 0 0 , 0 0 0 . Management requires a minimum after tax rate of

corporation wants to purchase a new machine for $ Management requires a minimum aftertax rate of return of on all investments. The firm uses straightline depreciation with no residual value for all depreciable assets.

Management predicts that the machine can produce sales of $ each year for the next years. Expenses are expected to include direct materials, direct labor, and factory overhead including depreciation totaling $ per year for net operating income of $ What is the net present value NV of the investment?

at

# ofyear

PV of $

at

PV of an annuity

O $

O

O $

$A corporation wants to purchase a new machine for $ Management requires a minimum aftertax rate of return

of on all investments. The firm uses straightline depreciation with no residual value for all depreciable assets.

Managernent predicts that the machine can produce sales of $ each year for the next years. Expenses are

expected to include direct materials, direct labor, and factory overhead including depreciation totaling $ per

year for net operating income of $ What is the net present value NPV of the investment?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started