Question

Corporations P, S, and T have the following income and expenses for 2020. In addition, Corporation P is owned 100% by individual A. Corporation S

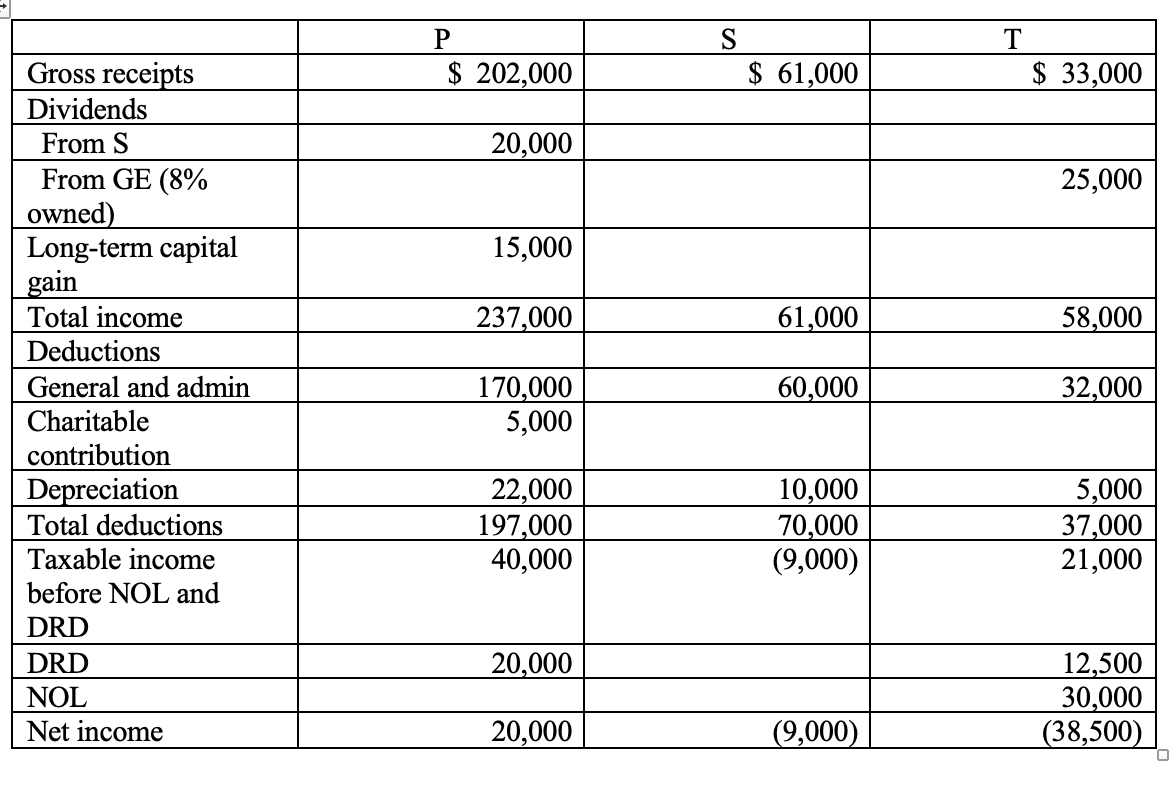

Corporations P, S, and T have the following income and expenses for 2020. In addition, Corporation P is owned 100% by individual A. Corporation S is owned 100% by P. Corporation T was newly purchased on January 12, 2020, by P and S who each own a 50% interest. All corporations keep their books on a calendar year. Corporation S has a capital loss carryforward of $7,000 while Corporation T has a net operating loss carryforward of $30,000 from a separate return year.

Consider the group to be an affiliated group eligible to file a consolidated tax return in answering the following

a. Calculate the consolidated capital loss deduction.

b. Calculate the consolidated charitable contributions deduction.

c. Calculate the consolidated Dividends Received Deduction.

d. Calculate the consolidated Net Operating Loss deduction.

e. Calculate consolidated taxable income

f. Calculate consolidated tax liability.

g. Allocate the tax liability to the members.

P $ 202,000 S $ 61,000 T $ 33,000 20,000 25,000 15,000 237,000 61,000 58,000 Gross receipts Dividends From S From GE (8% owned) Long-term capital gain Total income Deductions General and admin Charitable contribution Depreciation Total deductions Taxable income before NOL and DRD DRD NOL Net income 60,000 32,000 170,000 5,000 22,000 197,000 40,000 10,000 70,000 (9,000) 5,000 37,000 21,000 20,000 12,500 30,000 (38,500) 20,000 (9,000) P $ 202,000 S $ 61,000 T $ 33,000 20,000 25,000 15,000 237,000 61,000 58,000 Gross receipts Dividends From S From GE (8% owned) Long-term capital gain Total income Deductions General and admin Charitable contribution Depreciation Total deductions Taxable income before NOL and DRD DRD NOL Net income 60,000 32,000 170,000 5,000 22,000 197,000 40,000 10,000 70,000 (9,000) 5,000 37,000 21,000 20,000 12,500 30,000 (38,500) 20,000 (9,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started