Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corporative Finance Problem 1-30 points Company expects 2017 sales to increase by 18%. Dividends payout ratio for 2017 will be 35 %. The firm is

Corporative Finance

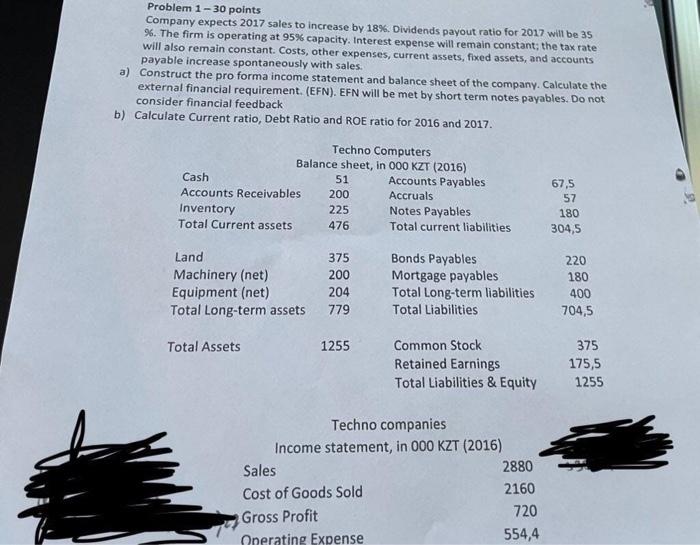

Problem 1-30 points Company expects 2017 sales to increase by 18%. Dividends payout ratio for 2017 will be 35 \%. The firm is operating at 95% capacity. Interest expense will remain constant; the tax rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. a) Construct the pro forma income statement and balance sheet of the company. Calculate the external financial requirement. (EFN). EFN will be met by short term notes payables. Do not consider financial feedback b) Calculate Current ratio, Debt Ratio and ROE ratio for 2016 and 2017. Problem 1-30 points Company expects 2017 sales to increase by 18%. Dividends payout ratio for 2017 will be 35 \%. The firm is operating at 95% capacity. Interest expense will remain constant; the tax rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. a) Construct the pro forma income statement and balance sheet of the company. Calculate the external financial requirement. (EFN). EFN will be met by short term notes payables. Do not consider financial feedback b) Calculate Current ratio, Debt Ratio and ROE ratio for 2016 and 2017 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started