Correct all the wrong answers, please.

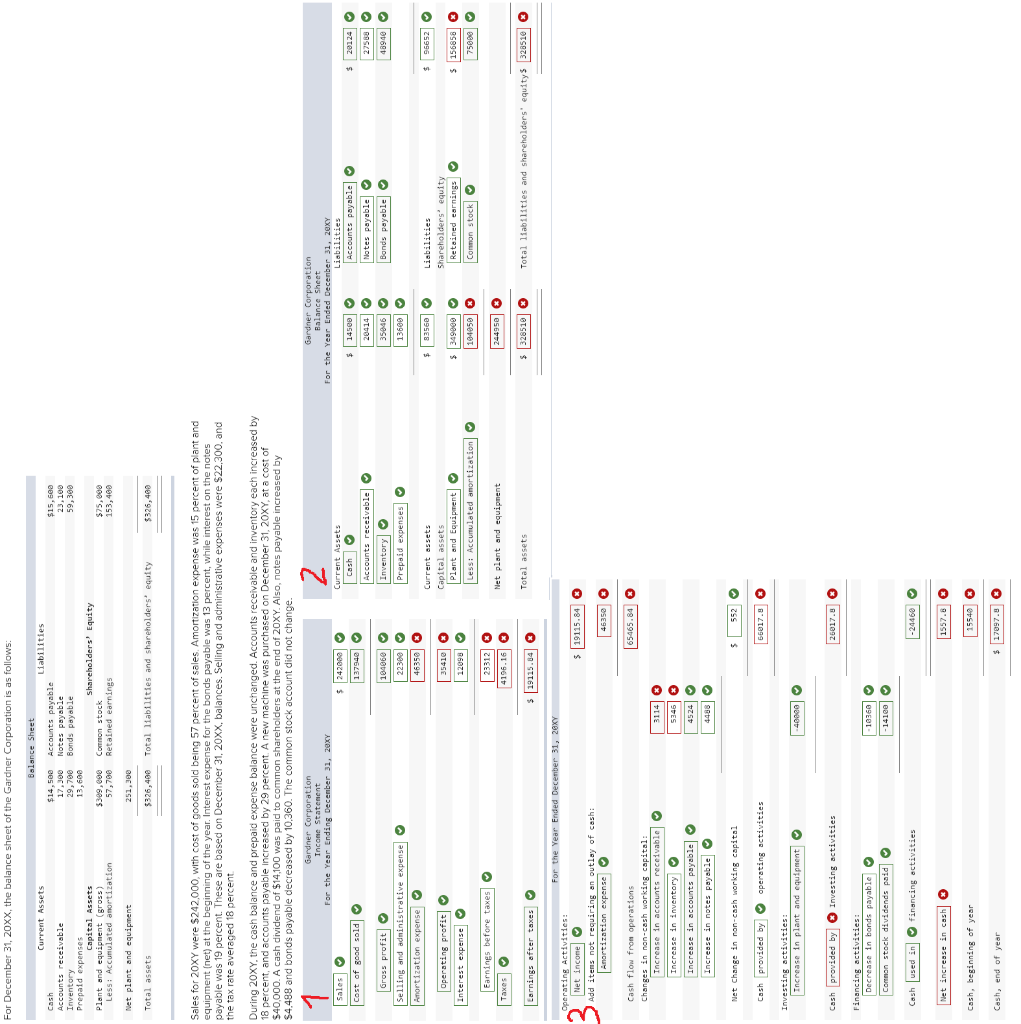

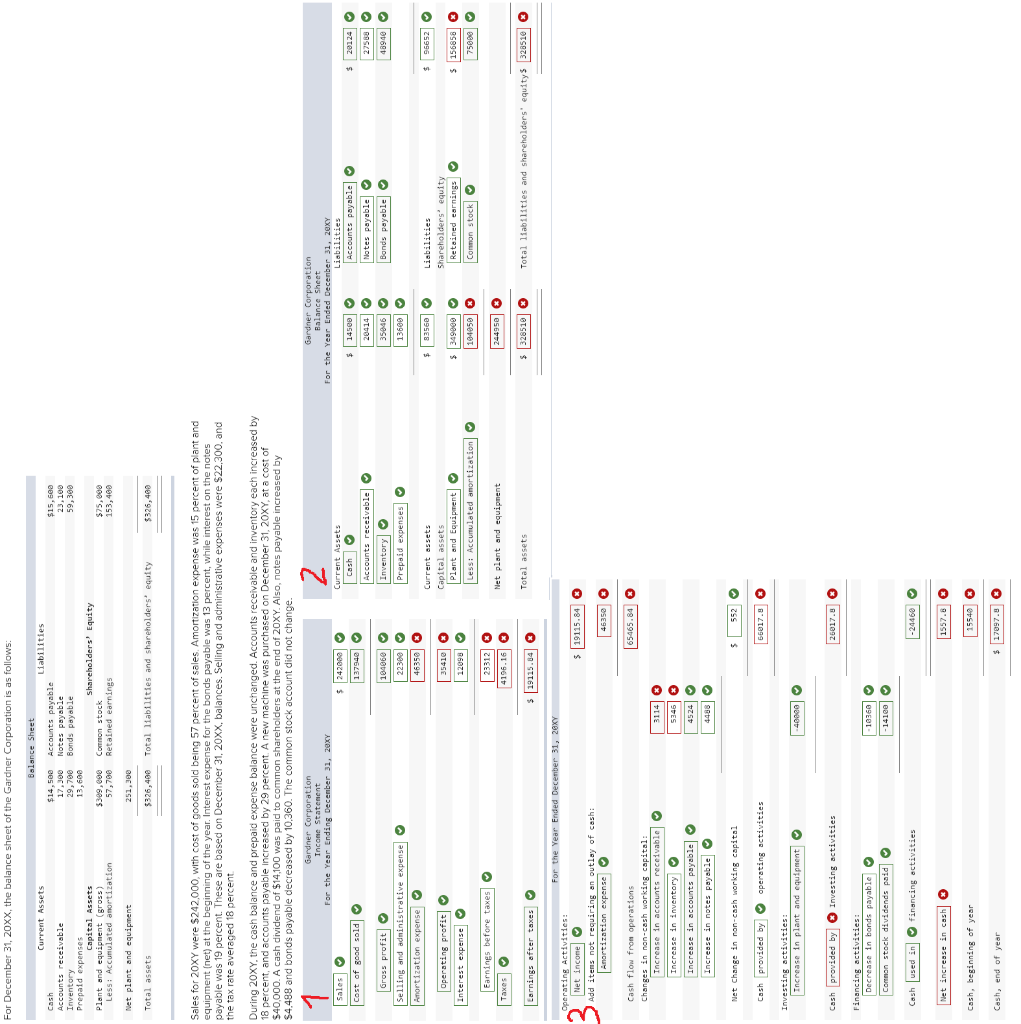

For December 31, 20XX, the balance sheet of the Gardner Corporation is as follows: Balance Sheet Liabilities $14.See 17.300 29,700 13,600 Accounts payable Notes payable Bonds payable Current Assets Cash Accounts receivable Inventory Prepaid expenses Capital Assets Plant and equipment (gross) Less: Accumulated amortization $15,600 23, 100 59,300 $399.000 57,700 Shareholders' Equity Common stock Retained earnings $75.000 153,400 Net plant and equipment 251,300 Total assets 5326,400 Total liabilities and shareholders equity $326,480 Sales for 20XY were $242,000, with cost of goods sold being 57 percent of sales Amortization expense was 15 percent of plant and equipment (net) at the beginning of the year. Interest expense for the bonds payable was 13 percent, while interest on the notes payable was 19 percent. These are based on December 31, 20XX, balances. Selling and administrative expenses were $22,300, and the tax rate averaged 18 percent During 20xY, the cash balance and prepaid expense balance were unchanged. Accounts receivable and inventory each increased by 18 percent, and accounts payable increased by 29 percent. A new machine was purchased on December 31, 20XY, at a cost of $40,000. A cash dividend of $14,100 was paid to common shareholders at the end of 20XY. Also, notes payable increased by $4.488 and bonds payable decreased by 10,360. The common stock account did not change. Gardner Corporation Income Statement For the Year Ending December 31, 20xY Sales Cost of good sold Gardner Corporation Balance Sheet For the Year Ended December 31, 2exy Liabilities $ 14500 Accounts payable Notes payable 35046 Bonds payable Current Assets Cash o Accounts receivable Inventory Prepaid expenses 20124 27588 48940 Gross profit Selling and administrative expense Amortization expense 33558 $ 95652 Operating profit Interest expense Current assets Capital assets Plant and Equipment Less: Accumulated amortization Liabilities Shareholders' equity Retained earnings Common stock 5 $ 349900 104050 156858 75009 23312 Earnings before taxes Taxes Net plant and equipment 244950 4196.16 Earnings after taxes Total assets $ 13115.640 $ 328510 Total liabilities and shareholders' equitys 328510 For the Year Ended December 31, 28XY Operating Activities: Net income Add items not requiring an outlay of cash: Amortization expense $ 19115.84 46350 65465.84 Cash flow from operations Changes in non-cash working capital: Increase in accounts receivable Increase in inventory Increase in accounts payable Increase in notes payable Net Change in non-cash working capital 552 Cash provided by operating activities 55817.8 Investing activities: Increase in plant and equipment - 48000 Cash provided by Investing activities 26817.8 Financing activities: Decrease in bonds payable Common stock dividends paid -1996 Cash used in financing activities -24468 Net increase in cash 1557.8 Cash, beginning of year 15540 $ 17897.8 O Cash, end of year