Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Correct anwers selking for question 1-3 2. Suppose a company has estimated the following cash flows in each of the next three years for operations

Correct anwers selking for question 1-3

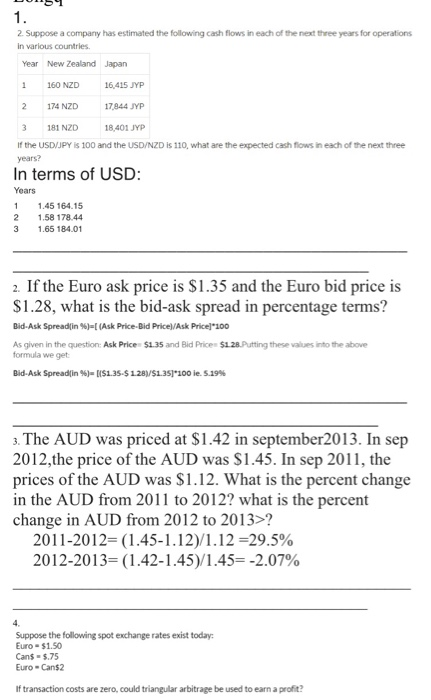

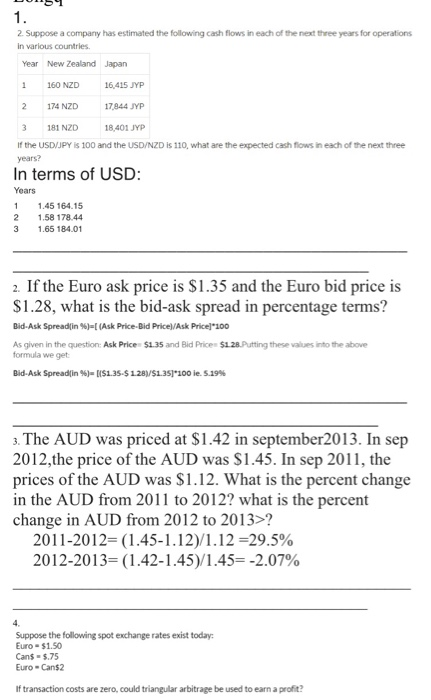

2. Suppose a company has estimated the following cash flows in each of the next three years for operations in various countries Year New Zealand Japan 1 160 NZD 16,415 JYP 2 174 NZD 17844 JYP 3 181 NZD 18.401 JYP if the USD/JPY IS 100 and the USD/NZD is 110, what are the expected cash flows in each of the next three In terms of USD: Years 1 1.45 164.15 2 1.58 178.44 165 184 01 3 2. If the Euro ask price is $1.35 and the Euro bid price is $1.28, what is the bid-ask spread in percentage terms? Bid. Ask Spreadin %)=L(Ask Price-Bid Price)/Ask Price]"100 As given in the question: Ask Price $1.35 and Bid Price $128.Putting these values into the above formula we get Bid Ask Spread in %)-($1.35-5 1.281/$1.35]*100 le.5.19% 3. The AUD was priced at $1.42 in september 2013. In sep 2012, the price of the AUD was $1.45. In sep 2011, the prices of the AUD was $1.12. What is the percent change in the AUD from 2011 to 2012? what is the percent change in AUD from 2012 to 2013>? 2011-2012= (1.45-1.12)/1.12 =29.5% 2012-2013= (1.42-1.45)/1.45= -2.07% Suppose the following spot exchange rates exist today Euro $1.50 Cans-5.75 Euro - Cans if transaction costs are zero, could triangular arbitrage be used to earn a profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started