Question

Correct Errors; Correct any errors that you made on the journal entries and T Accounts in Part 1, 2 and 3. Both the debits and

Correct Errors; Correct any errors that you made on the journal entries and T Accounts in Part 1, 2 and 3. Both the debits and the credits should equal each other.

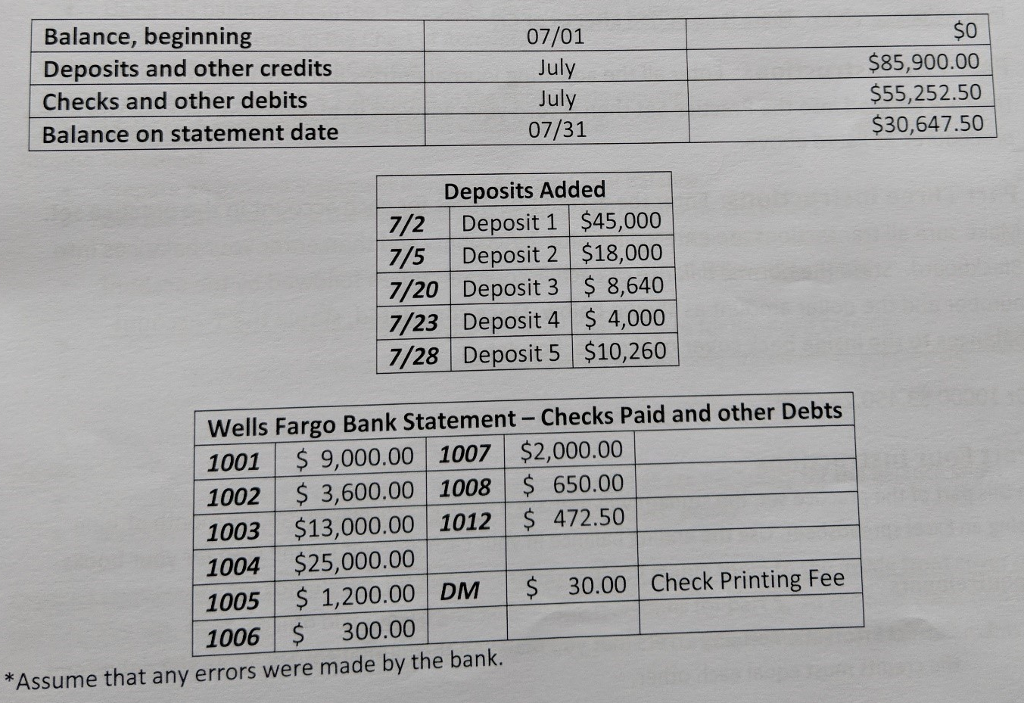

2.Bank Reconciliation: Using the cash balance per books (see the amount on Part III of the T-Accounts) and the Bank statement ending balance, prepare a bank reconciliation. This should be prepared using Exel and must contain the proper heading as well as the reconciliation. (Assume All Errors are made by Bank)

3. Record Bank Reconciliation Adjustments: After you have prepared the bank reconciliation you must make any adjustments to your cash account by recording the journal entery on the Exel spreadsheet with the bank reconciliation and then entering it in the general journal of the practice set so that the general ledger cash agrees with the bank reconciliation.

Part 1 Link

https://www.chegg.com/homework-help/questions-and-answers/university-texas-el-paso-utep-accounting-2301-journal-entrie-question-q30317988

Part 2 Link

https://www.chegg.com/homework-help/questions-and-answers/transaction-particulars-debit-credit-1-entry-2-bank-c-45-00000-common-stock-45-00000-3-pre-q30382016

Part 3 Link

https://www.chegg.com/homework-help/questions-and-answers/journal-entries-adjusting-journal-entries-month-july-date-account-titles-debit-credit-31-j-q30480154

Balance, beginning Deposits and other credits Checks and other debits Balance on statement date 07/01 July July 07/31 $0 $85,900.00 $55,252.50 $30,647.50 Deposits Added 7/2 Deposit 1 $45,000 7/5 Deposit 2 $18,000 7/20 Deposit 3 8,640 7/23 Deposit 4 $4,000 7/28 Deposit 5 $10,260 Wells Fargo Bank Statement Checks Paid and other Debts 1001 $ 9,000.00 1007 $2,000.00 1002 $ 3,600.00 1008 650.00 1003 $13,000.00 1012 472.50 1004 $25,000.00 1005 $ 1,200.00 DM 1006 300.00 30.00 Check Printing Fee *Assume that any errors were made by the bank. Balance, beginning Deposits and other credits Checks and other debits Balance on statement date 07/01 July July 07/31 $0 $85,900.00 $55,252.50 $30,647.50 Deposits Added 7/2 Deposit 1 $45,000 7/5 Deposit 2 $18,000 7/20 Deposit 3 8,640 7/23 Deposit 4 $4,000 7/28 Deposit 5 $10,260 Wells Fargo Bank Statement Checks Paid and other Debts 1001 $ 9,000.00 1007 $2,000.00 1002 $ 3,600.00 1008 650.00 1003 $13,000.00 1012 472.50 1004 $25,000.00 1005 $ 1,200.00 DM 1006 300.00 30.00 Check Printing Fee *Assume that any errors were made by the bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started