Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Correct me if I am wrong but I believe: 1. T 2. D 3. Sweden?? (or Ireland???) 4. C?? True or False _ 1. From

Correct me if I am wrong but I believe:

1. T

2. D

3. Sweden?? (or Ireland???)

4. C??

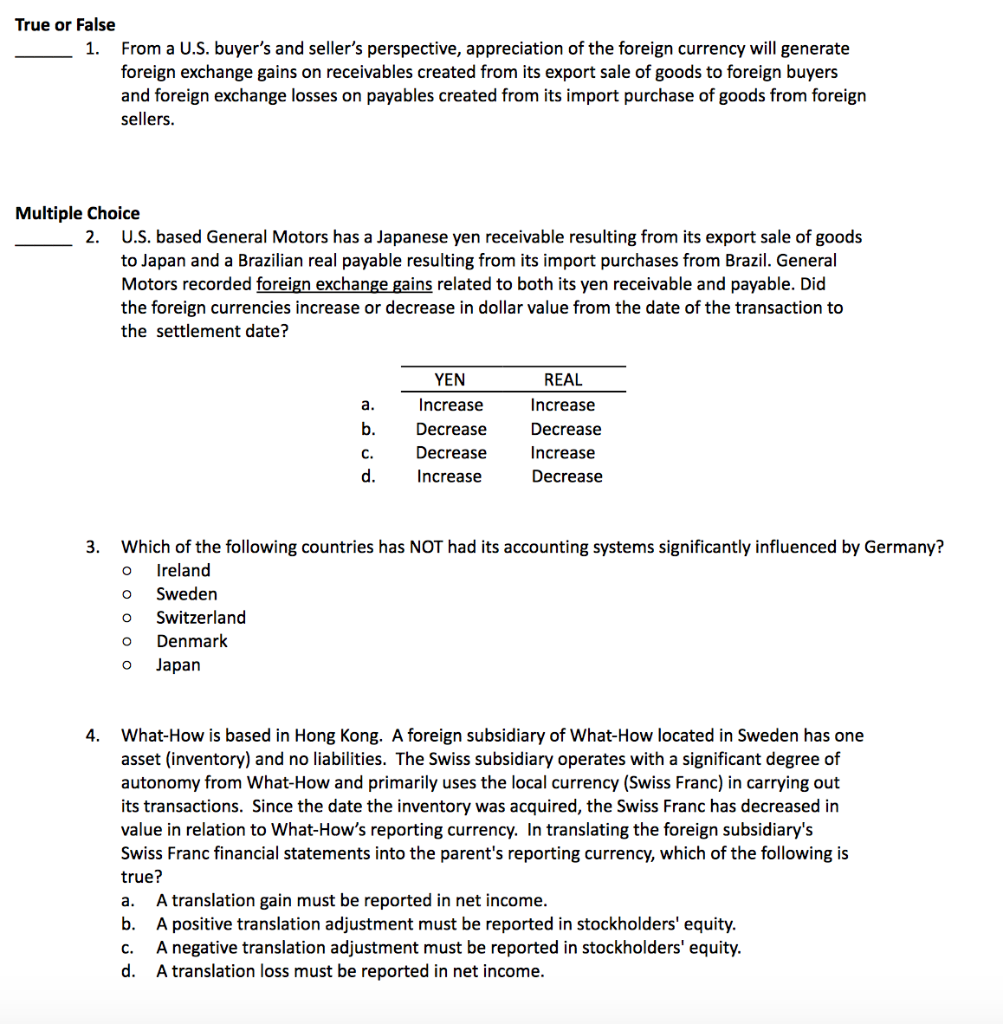

True or False _ 1. From a U.S. buyer's and seller's perspective, appreciation of the foreign currency will generate foreign exchange gains on receivables created from its export sale of goods to foreign buyers and foreign exchange losses on payables created from its import purchase of goods from foreign sellers. Multiple Choice 2. U.S. based General Motors has a Japanese yen receivable resulting from its export sale of goods to Japan and a Brazilian real payable resulting from its import purchases from Brazil. General Motors recorded foreign exchange gains related to both its yen receivable and payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date? rosoo YEN Increase Decrease Decrease Increase REAL Increase Decrease Increase Decrease 3. Which of the following countries has NOT had its accounting systems significantly influenced by Germany? o Ireland Sweden O Switzerland o Denmark o Japan 4. What-How is based in Hong Kong. A foreign subsidiary of What-How located in Sweden has one asset (inventory) and no liabilities. The Swiss subsidiary operates with a significant degree of autonomy from What-How and primarily uses the local currency (Swiss Franc) in carrying out its transactions. Since the date the inventory was acquired, the Swiss Franc has decreased in value in relation to What-How's reporting currency. In translating the foreign subsidiary's Swiss Franc financial statements into the parent's reporting currency, which of the following is true? a. A translation gain must be reported in net income. b. A positive translation adjustment must be reported in stockholders' equity. C. A negative translation adjustment must be reported in stockholders' equity. d. A translation loss must be reported in net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started