Answered step by step

Verified Expert Solution

Question

1 Approved Answer

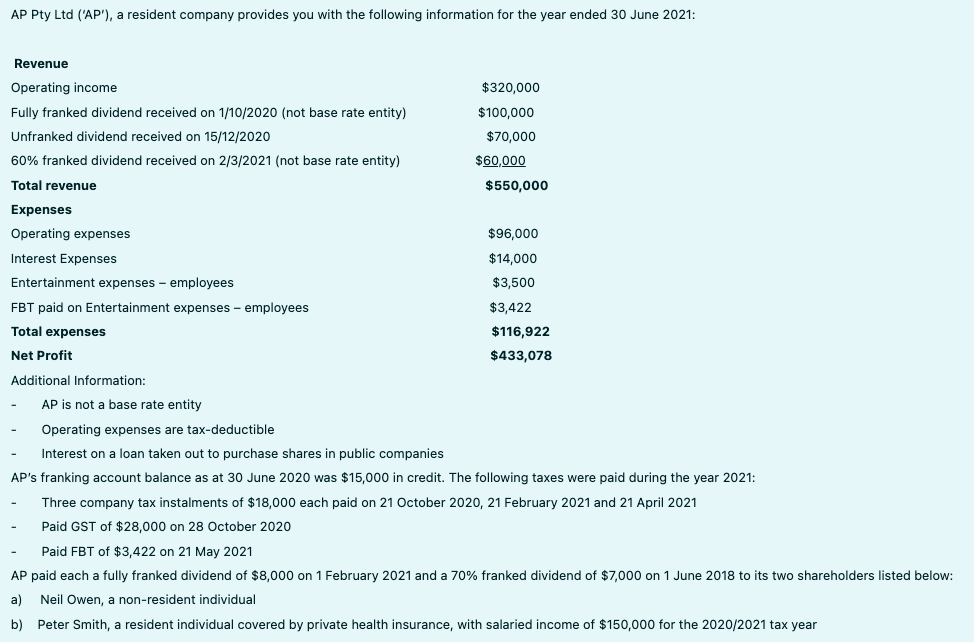

correct solutions please thanks. AP Pty Ltd ('AP'), a resident company provides you with the following information for the year ended 30 June 2021: Revenue

correct solutions please thanks.

AP Pty Ltd ('AP'), a resident company provides you with the following information for the year ended 30 June 2021: Revenue Operating income $320,000 Fully franked dividend received on 1/10/2020 (not base rate entity) $100,000 Unfranked dividend received on 15/12/2020 $70,000 60% franked dividend received on 2/3/2021 (not base rate entity) $60,000 Total revenue $550,000 Expenses Operating expenses $96,000 Interest Expenses $14,000 Entertainment expenses - employees $3,500 FBT paid on Entertainment expenses - employees $3,422 Total expenses $116,922 Net Profit $433,078 Additional Information: AP is not a base rate entity Operating expenses are tax-deductible Interest on a loan taken out to purchase shares in public companies AP's franking account balance as at 30 June 2020 was $15,000 in credit. The following taxes were paid during the year 2021: Three company tax instalments of $18,000 each paid on 21 October 2020, 21 February 2021 and 21 April 2021 Paid GST of $28,000 on 28 October 2020 Paid FBT of $3,422 on 21 May 2021 AP paid each a fully franked dividend of $8,000 on 1 February 2021 and a 70% franked dividend of $7,000 on 1 June 2018 to its two shareholders listed below: a) Neil Owen, a non-resident individual b) Peter Smith, a resident individual covered by private health insurance, with salaried income of $150,000 for the 2020/2021 tax year REQUIRED a) Calculate the taxable income of AP for the year ended 30 June 2021. Please cite relevant authorities. (5 Marks) b) Calculate AP's tax payable (refundable) for the year ended 30 June 2021.(4 Marks) c) Prepare the franking account for AP for the year ended 30 June 2021. Any taxes excluded from the franking account must be explained. (12 Marks) d) Advise each one of AP's shareholders listed in this question on the correct tax treatment of the receipt of their distributions from AP for 2020/2021 tax year.(9 Marks) AP Pty Ltd ('AP'), a resident company provides you with the following information for the year ended 30 June 2021: Revenue Operating income $320,000 Fully franked dividend received on 1/10/2020 (not base rate entity) $100,000 Unfranked dividend received on 15/12/2020 $70,000 60% franked dividend received on 2/3/2021 (not base rate entity) $60,000 Total revenue $550,000 Expenses Operating expenses $96,000 Interest Expenses $14,000 Entertainment expenses - employees $3,500 FBT paid on Entertainment expenses - employees $3,422 Total expenses $116,922 Net Profit $433,078 Additional Information: AP is not a base rate entity Operating expenses are tax-deductible Interest on a loan taken out to purchase shares in public companies AP's franking account balance as at 30 June 2020 was $15,000 in credit. The following taxes were paid during the year 2021: Three company tax instalments of $18,000 each paid on 21 October 2020, 21 February 2021 and 21 April 2021 Paid GST of $28,000 on 28 October 2020 Paid FBT of $3,422 on 21 May 2021 AP paid each a fully franked dividend of $8,000 on 1 February 2021 and a 70% franked dividend of $7,000 on 1 June 2018 to its two shareholders listed below: a) Neil Owen, a non-resident individual b) Peter Smith, a resident individual covered by private health insurance, with salaried income of $150,000 for the 2020/2021 tax year REQUIRED a) Calculate the taxable income of AP for the year ended 30 June 2021. Please cite relevant authorities. (5 Marks) b) Calculate AP's tax payable (refundable) for the year ended 30 June 2021.(4 Marks) c) Prepare the franking account for AP for the year ended 30 June 2021. Any taxes excluded from the franking account must be explained. (12 Marks) d) Advise each one of AP's shareholders listed in this question on the correct tax treatment of the receipt of their distributions from AP for 2020/2021 tax year.(9 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started