Answered step by step

Verified Expert Solution

Question

1 Approved Answer

correct solutions please thanks John Happy is a tax resident and works as an independent contractor since 1 July 2020. He provides you with the

correct solutions please thanks

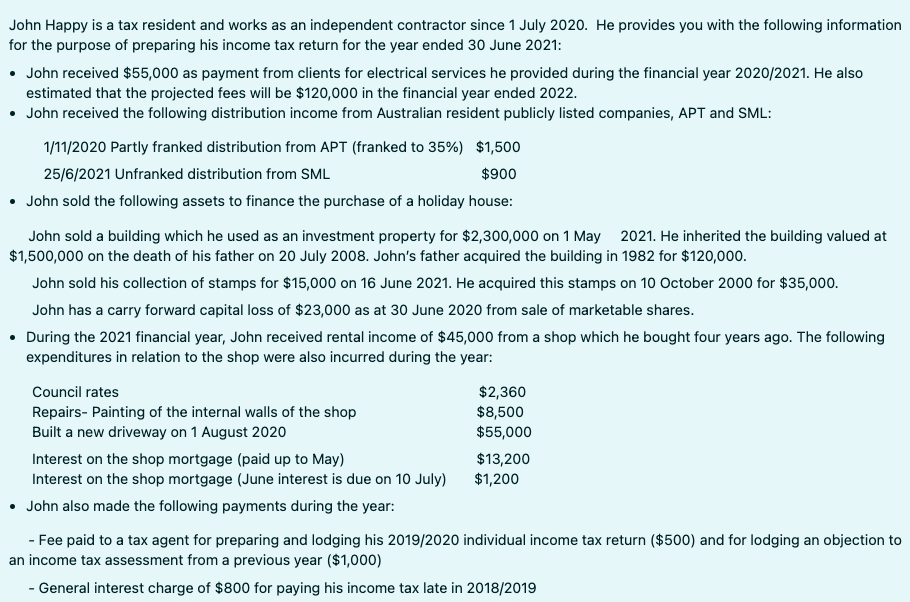

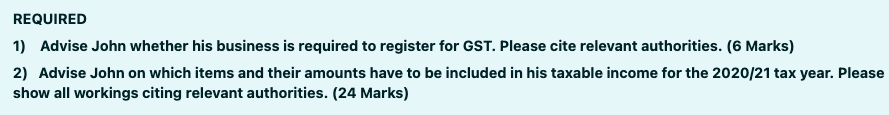

John Happy is a tax resident and works as an independent contractor since 1 July 2020. He provides you with the following information for the purpose of preparing his income tax return for the year ended 30 June 2021: John received $55,000 as payment from clients for electrical services he provided during the financial year 2020/2021. He also estimated that the projected fees will be $120,000 in the financial year ended 2022. John received the following distribution income from Australian resident publicly listed companies, APT and SML: 1/11/2020 Partly franked distribution from APT (franked to 35%) $1,500 25/6/2021 Unfranked distribution from SML $900 John sold the following assets to finance the purchase of a holiday house: John sold a building which he used as an investment property for $2,300,000 on 1 May 2021. He inherited the building valued at $1,500,000 on the death of his father on 20 July 2008. John's father acquired the building in 1982 for $120,000. John sold his collection of stamps for $15,000 on 16 June 2021. He acquired this stamps on 10 October 2000 for $35,000. John has a carry forward capital loss of $23,000 as at 30 June 2020 from sale of marketable shares. During the 2021 financial year, John received rental income of $45,000 from a shop which he bought four years ago. The following expenditures in relation to the shop were also incurred during the year: Council rates Repairs- Painting of the internal walls of the shop Built a new driveway on 1 August 2020 $2,360 $8,500 $55,000 Interest on the shop mortgage (paid up to May) Interest on the shop mortgage (June interest is due on 10 July) $13,200 $1,200 John also made the following payments during the year: - Fee paid to a tax agent for preparing and lodging his 2019/2020 individual income tax return ($500) and for lodging an objection to an income tax assessment from a previous year ($1,000) - General interest charge of $800 for paying his income tax late in 2018/2019 REQUIRED 1) Advise John whether his business is required to register for GST. Please cite relevant authorities. (6 Marks) 2) Advise John on which items and their amounts have to be included in his taxable income for the 2020/21 tax year. Please show all workings citing relevant authorities. (24 Marks) John Happy is a tax resident and works as an independent contractor since 1 July 2020. He provides you with the following information for the purpose of preparing his income tax return for the year ended 30 June 2021: John received $55,000 as payment from clients for electrical services he provided during the financial year 2020/2021. He also estimated that the projected fees will be $120,000 in the financial year ended 2022. John received the following distribution income from Australian resident publicly listed companies, APT and SML: 1/11/2020 Partly franked distribution from APT (franked to 35%) $1,500 25/6/2021 Unfranked distribution from SML $900 John sold the following assets to finance the purchase of a holiday house: John sold a building which he used as an investment property for $2,300,000 on 1 May 2021. He inherited the building valued at $1,500,000 on the death of his father on 20 July 2008. John's father acquired the building in 1982 for $120,000. John sold his collection of stamps for $15,000 on 16 June 2021. He acquired this stamps on 10 October 2000 for $35,000. John has a carry forward capital loss of $23,000 as at 30 June 2020 from sale of marketable shares. During the 2021 financial year, John received rental income of $45,000 from a shop which he bought four years ago. The following expenditures in relation to the shop were also incurred during the year: Council rates Repairs- Painting of the internal walls of the shop Built a new driveway on 1 August 2020 $2,360 $8,500 $55,000 Interest on the shop mortgage (paid up to May) Interest on the shop mortgage (June interest is due on 10 July) $13,200 $1,200 John also made the following payments during the year: - Fee paid to a tax agent for preparing and lodging his 2019/2020 individual income tax return ($500) and for lodging an objection to an income tax assessment from a previous year ($1,000) - General interest charge of $800 for paying his income tax late in 2018/2019 REQUIRED 1) Advise John whether his business is required to register for GST. Please cite relevant authorities. (6 Marks) 2) Advise John on which items and their amounts have to be included in his taxable income for the 2020/21 tax year. Please show all workings citing relevant authorities. (24 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started