Correct = upvote - thanks!

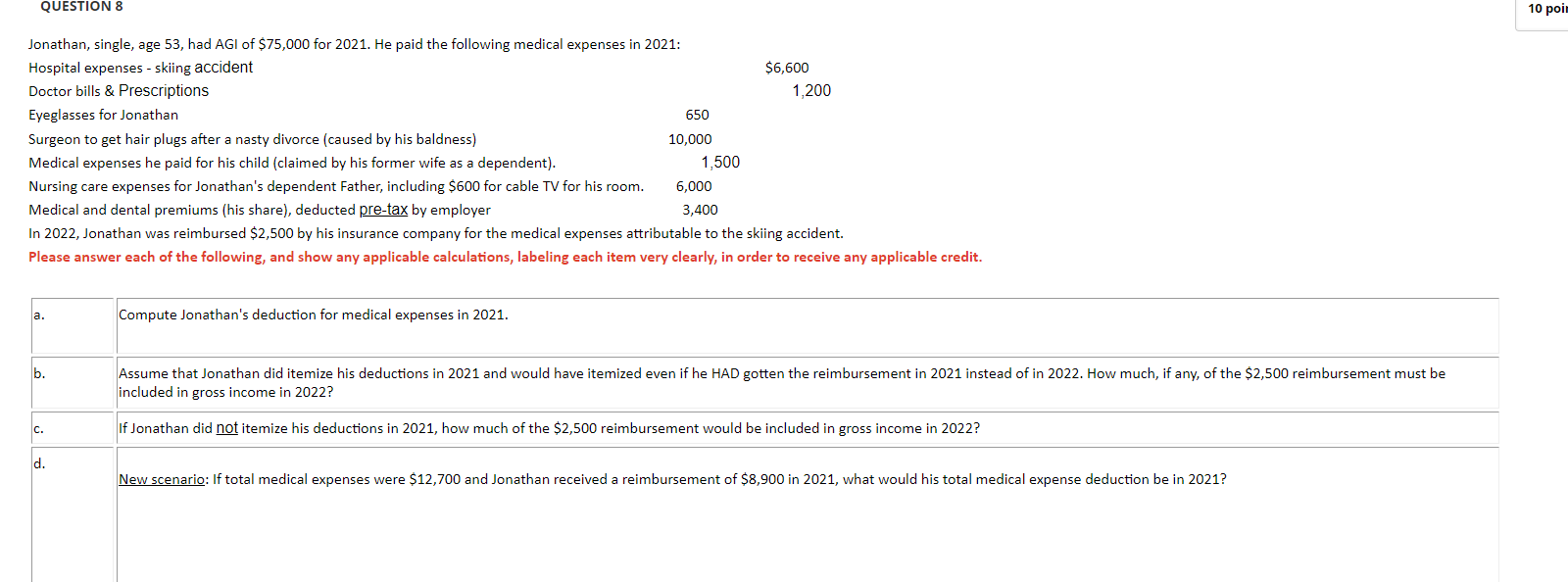

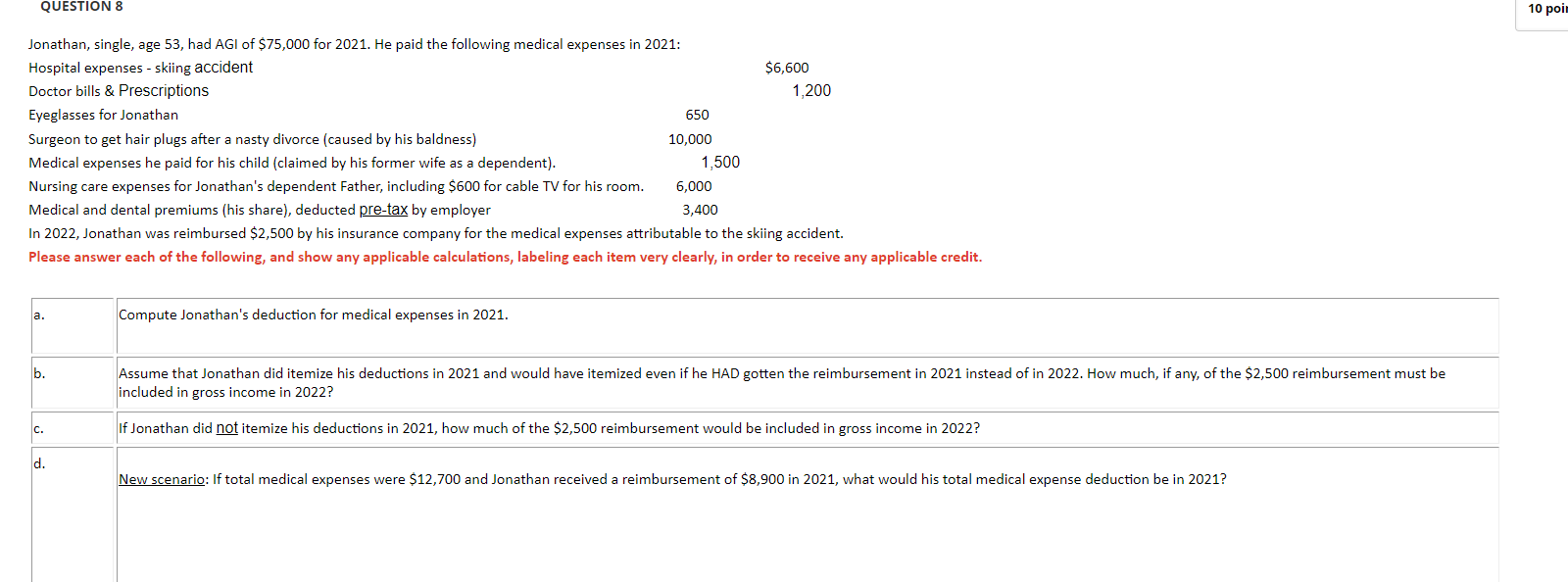

QUESTION 8 10 poit Jonathan, single, age 53, had AGI of $75,000 for 2021. He paid the following medical expenses in 2021: Hospital expenses - skiing accident $6,600 Doctor bills & Prescriptions 1,200 Eyeglasses for Jonathan 650 Surgeon to get hair plugs after a nasty divorce (caused by his baldness) 10,000 Medical expenses he paid for his child (claimed by his former wife as a dependent). 1,500 Nursing care expenses for Jonathan's dependent Father, including $600 for cable TV for his room. 6,000 Medical and dental premiums (his share), deducted pre-tax by employer 3,400 In 2022, Jonathan was reimbursed $2,500 by his insurance company for the medical expenses attributable to the skiing accident. Please answer each of the following, and show any applicable calculations, labeling each item very clearly, in order to receive any applicable credit. a. Compute Jonathan's deduction for medical expenses in 2021. b. Assume that Jonathan did itemize his deductions in 2021 and would have itemized even if he HAD gotten the reimbursement in 2021 instead of in 2022. How much, if any, of the $2,500 reimbursement must be included in gross income in 2022? C. If Jonathan did not itemize his deductions in 2021, how much of the $2,500 reimbursement would be included in gross income in 2022? d. New scenario: If total medical expenses were $12,700 and Jonathan received a reimbursement of $8,900 in 2021, what would his total medical expense deduction be in 2021? QUESTION 8 10 poit Jonathan, single, age 53, had AGI of $75,000 for 2021. He paid the following medical expenses in 2021: Hospital expenses - skiing accident $6,600 Doctor bills & Prescriptions 1,200 Eyeglasses for Jonathan 650 Surgeon to get hair plugs after a nasty divorce (caused by his baldness) 10,000 Medical expenses he paid for his child (claimed by his former wife as a dependent). 1,500 Nursing care expenses for Jonathan's dependent Father, including $600 for cable TV for his room. 6,000 Medical and dental premiums (his share), deducted pre-tax by employer 3,400 In 2022, Jonathan was reimbursed $2,500 by his insurance company for the medical expenses attributable to the skiing accident. Please answer each of the following, and show any applicable calculations, labeling each item very clearly, in order to receive any applicable credit. a. Compute Jonathan's deduction for medical expenses in 2021. b. Assume that Jonathan did itemize his deductions in 2021 and would have itemized even if he HAD gotten the reimbursement in 2021 instead of in 2022. How much, if any, of the $2,500 reimbursement must be included in gross income in 2022? C. If Jonathan did not itemize his deductions in 2021, how much of the $2,500 reimbursement would be included in gross income in 2022? d. New scenario: If total medical expenses were $12,700 and Jonathan received a reimbursement of $8,900 in 2021, what would his total medical expense deduction be in 2021