Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corrected Journal Entries, Corrected Inventory, Ledger Accounts, Income Statement, and Balance Sheet. The Ledger Accounts, Income Statement, and Balance Sheet tabs should be based on

Corrected Journal Entries, Corrected Inventory, Ledger Accounts, Income Statement, and Balance Sheet. The Ledger Accounts, Income Statement, and Balance Sheet tabs should be based on the Corrected Journal Entries and Corrected Inventory tabs.

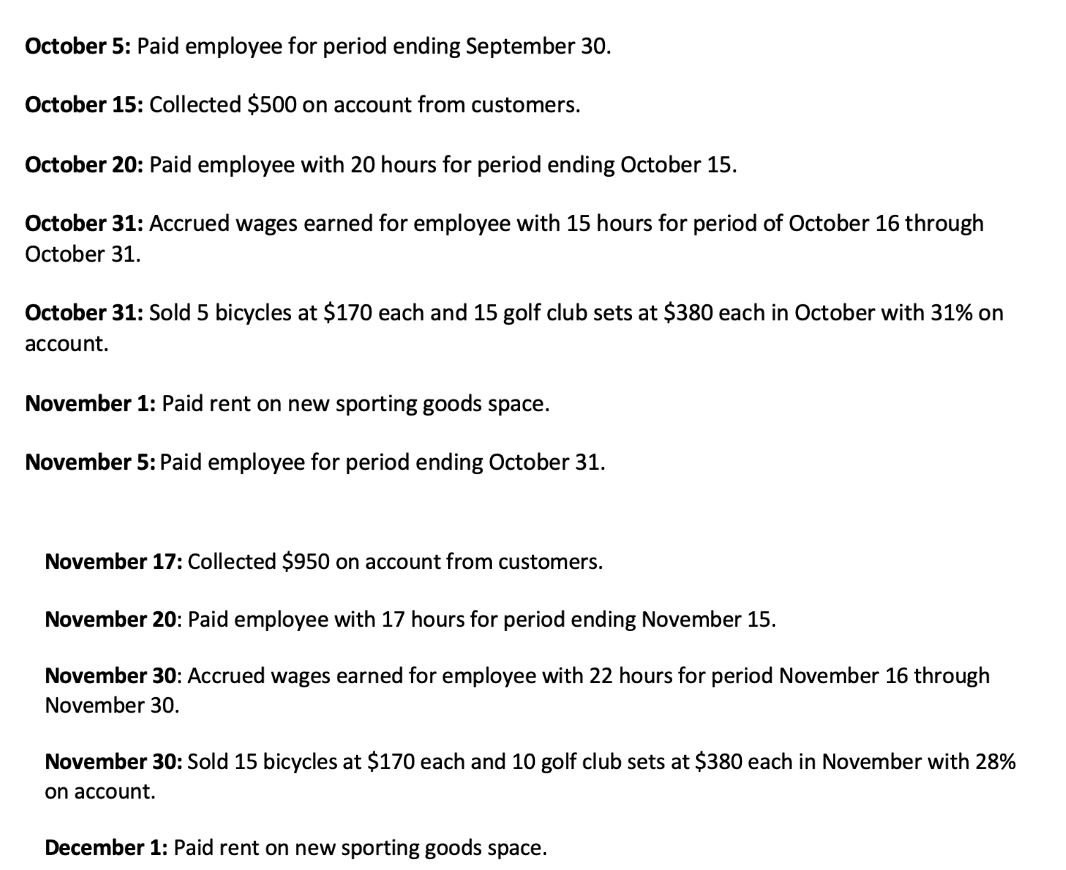

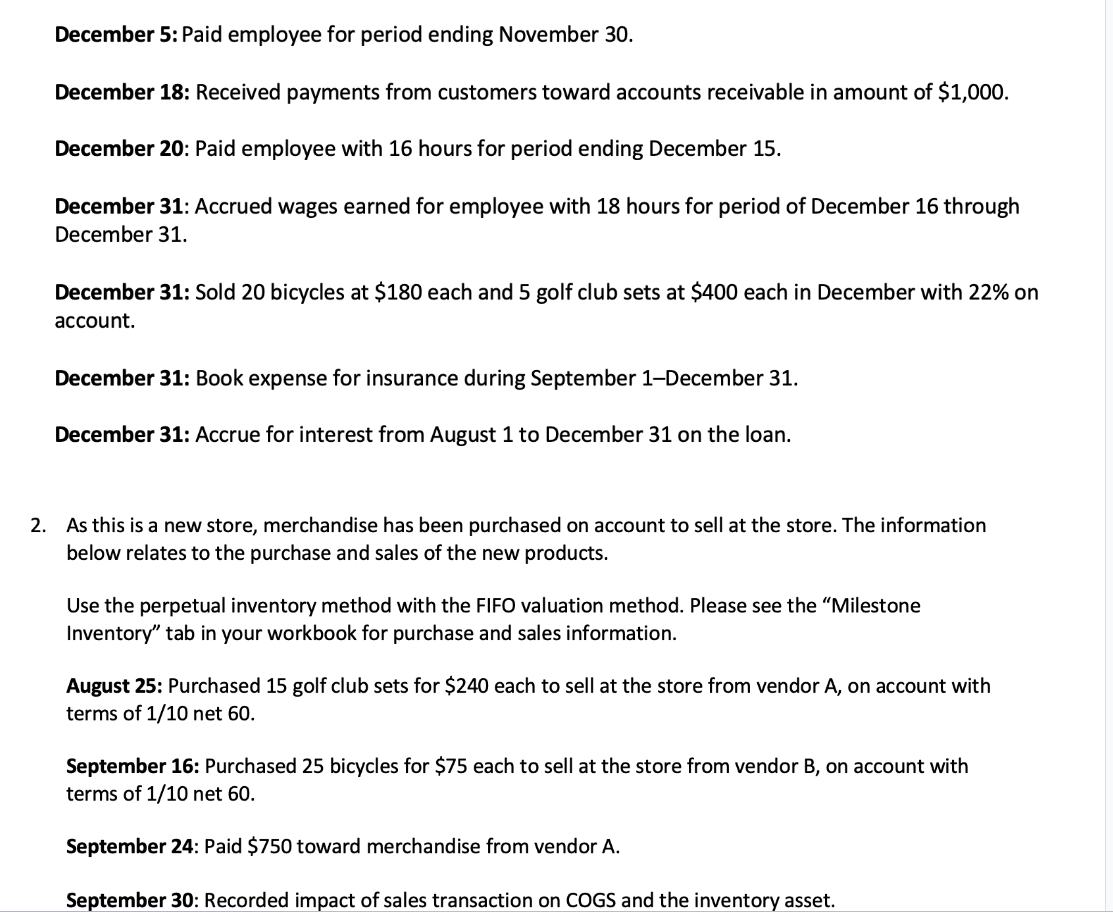

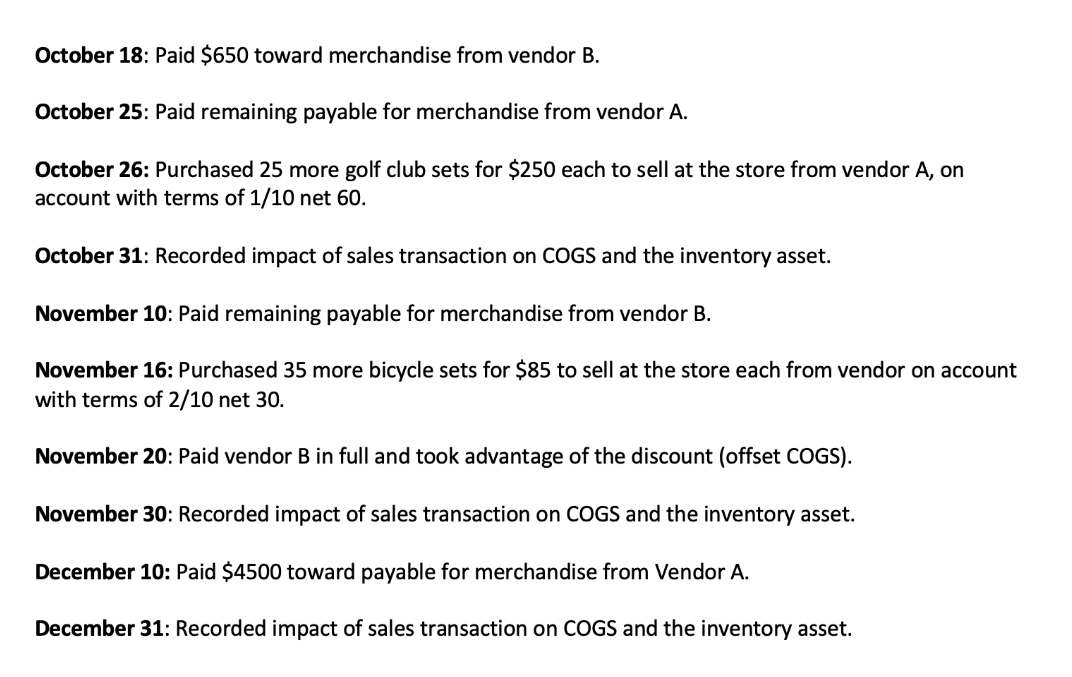

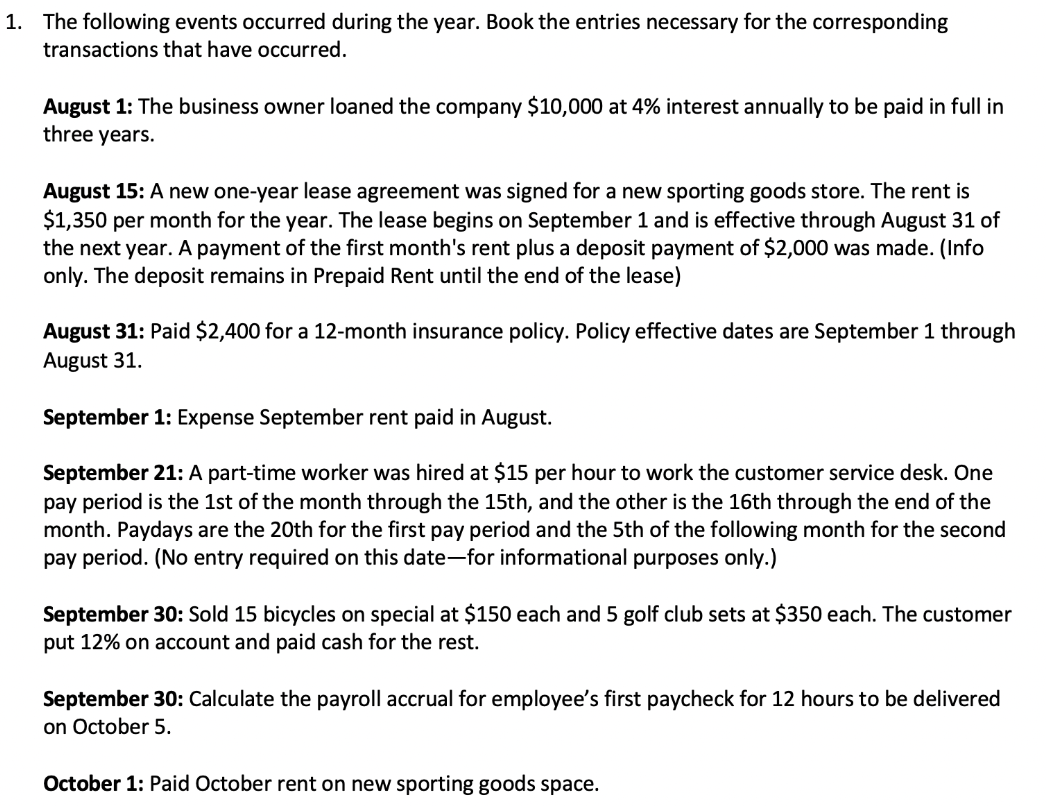

October 5: Paid employee for period ending September 30. October 15: Collected $500 on account from customers. October 20: Paid employee with 20 hours for period ending October 15. October 31: Accrued wages earned for employee with 15 hours for period of October 16 through October 31. October 31: Sold 5 bicycles at $170 each and 15 golf club sets at $380 each in October with 31% on account. November 1: Paid rent on new sporting goods space. November 5: Paid employee for period ending October 31. November 17: Collected $950 on account from customers. November 20: Paid employee with 17 hours for period ending November 15. November 30: Accrued wages earned for employee with 22 hours for period November 16 through November 30. November 30: Sold 15 bicycles at $170 each and 10 golf club sets at $380 each in November with 28% on account. December 1: Paid rent on new sporting goods space.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journal Entries Date Account Debit Credit Dec 5 Wages Expense 200 Cash 200 Dec 18 Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started