Answered step by step

Verified Expert Solution

Question

1 Approved Answer

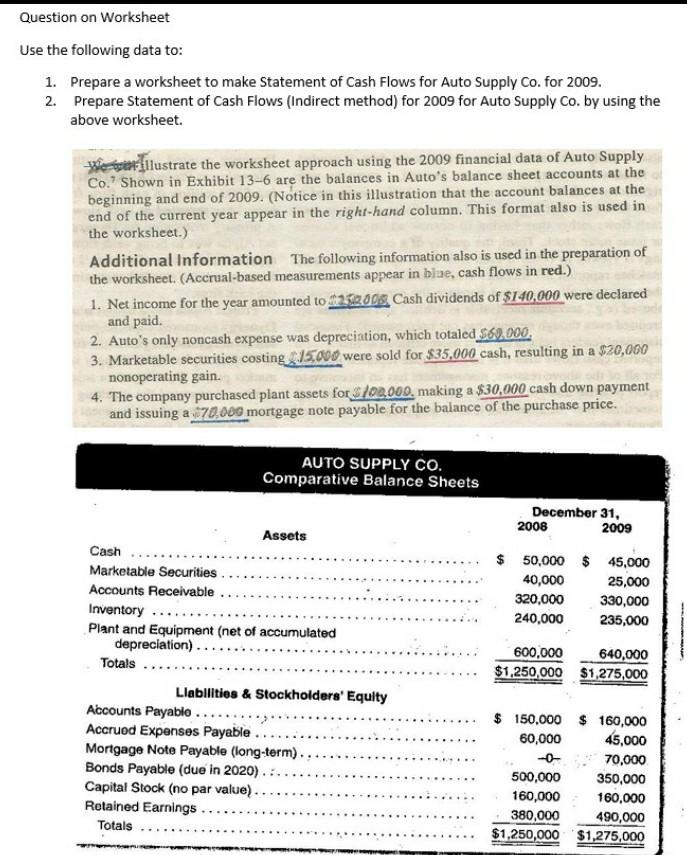

correction additional information 1..... net income for the year amounted to 250,000 2........which totaled 60,000 3 . Marketable securities costing 15,000 Question on Worksheet Use

correction additional information 1..... net income for the year amounted to 250,000 2........which totaled 60,000 3 . Marketable securities costing 15,000

Question on Worksheet Use the following data to: 1. Prepare a worksheet to make Statement of Cash Flows for Auto Supply Co. for 2009. 2. Prepare Statement of Cash Flows (Indirect method) for 2009 for Auto Supply Co. by using the above worksheet. Wetur lllustrate the worksheet approach using the 2009 financial data of Auto Supply Co. Shown in Exhibit 13-6 are the balances in Auto's balance sheet accounts at the beginning and end of 2009. (Notice in this illustration that the account balances at the end of the current year appear in the right-hand column. This format also is used in the worksheet.) Additional Information The following information also is used in the preparation of the worksheet. (Accrual-based measurements appear in blae, cash flows in red.) 1. Net income for the year amounted to $2502008 Cash dividends of $140,000 were declared and paid. 2. Auto's only noncash expense was depreciation, which totaled $60.000, 3. Marketable securities costing 15.000 were sold for $35,000 cash, resulting in a $20,000 nonoperating gain. 4. The company purchased plant assets for $100,000making a $30,000 cash down payment and issuing a $70,000 mortgage note payable for the balance of the purchase price. AUTO SUPPLY CO. Comparative Balance Sheets December 31, 2008 2009 $ 50,000 $ 45,000 40,000 25,000 320,000 330,000 240,000 235,000 Assets Cash Marketable Securities Accounts Receivable Inventory Plant and Equipment (net of accumulated depreciation)... Totals Llabilities & Stockholders' Equity Accounts Payablo ..... Accrued Expenses Payable Mortgage Note Payable (long-term). Bonds Payable (due in 2020). Capital Stock (no par value) Retained Earnings ... Totals 600,000 640,000 $1,250,000 $1,275,000 $ 150,000 $ 160,000 60,000 45,000 70,000 500,000 350,000 160,000 160,000 380,000 490,000 $1,250,000 $1,275,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started