Answered step by step

Verified Expert Solution

Question

1 Approved Answer

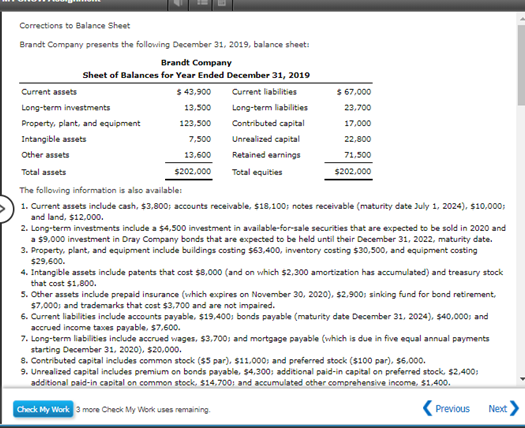

Corrections to Balance Sheet Brandt Company presents the following December 31, 2019, balance sheet: Corrections to Balance Sheet Brandt Company presents the following December 31,

Corrections to Balance Sheet

Brandt Company presents the following December 31, 2019, balance sheet:

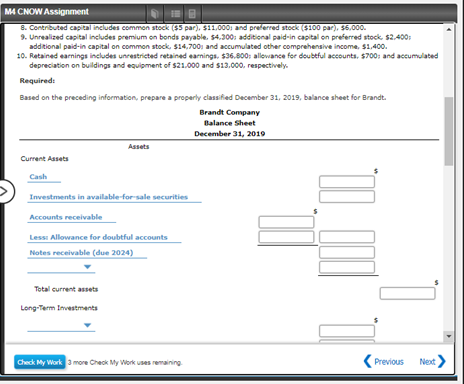

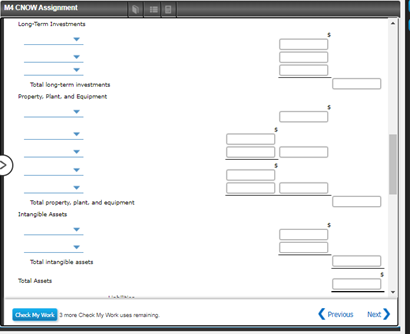

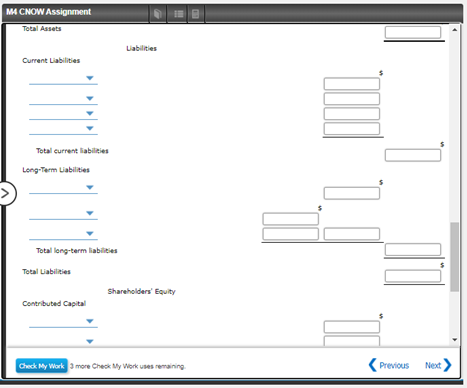

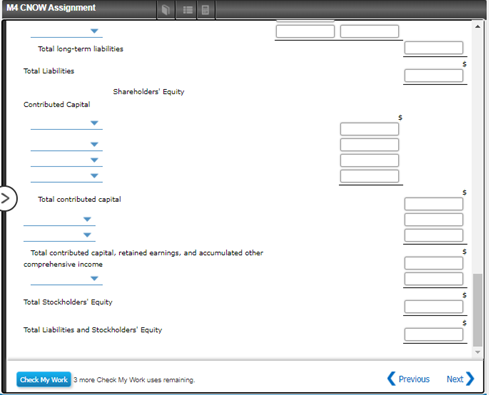

Corrections to Balance Sheet Brandt Company presents the following December 31, 2019, balance sheet: Brandt Company Sheet of Balances for Year Ended December 31, 2019 Current assets 5 43.900 Current liabilities $ 67,000 Long-term investments 13,500 Long-term liabilities 23.700 Property, plant, and equipment 123.500 Contributed capital 17,000 Intangible assets 7,500 Unrealized capital 22.800 Other assets 13,600 Retained earnings 71.500 Total assets $202.000 Total equities $202.000 The following information is also available: 1. Current assets include cash, $3,800; accounts receivable, $18,100; notes receivable (maturity date July 1, 2024), $10,000; and land, $12.000. 2. Long-term investments include a $4,500 investment in available-for-sale securities that are expected to be sold in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December 31, 2022, maturity date. 3. Property, plant, and equipment include buildings costing 563,400, inventory costing $30,500, and equipment costing $29,600. 4. Intangible assets include patents that cost $8,000 (and on which $2,300 amortization has accumulated) and treasury stock that cost $1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2020). $2,900 sinking fund for bond retirement $7.000s and trademarks that cost $3.700 and are not impaired. 6. Current liabilities include accounts payable. $19,400, bonds payable (maturity date December 31, 2024), $40.000; and accrued income taxes payable, $7,600. 7. Long-term liabilities include accrued wages. $3.700, and mortgage payable (which is due in five equal annual payments starting December 31, 2020), $20.000. 8. Contributed capital includes common stock (55 par), $11,000, and preferred stock ($100 par), 56.000. 9. Unrealized capital includes premium on bonds payable, 54,300: additional paid-in capital on preferred stock. $2,400 additional paid-in capital on common stock, 514,700; and accumulated other comprehensive income $1,400. Check My Work 3 more Check My Work uses remaining. Previous Next > MCNOW Assignment 8. Contributed capital includes common stock (55 par), $11,000: and preferred stock ($100 par), $5,000. 9. Unrealized capital includes premium on bonds payable. 54.300: additional paid-in capital on preferred stock. $2,400 additional paid-in capital on common stock. $14.7001 and accumulated other comprehensive income, $1,400. 10. Retained earnings includes unrestricted retained earnings. $36.800; allowance for doubtful accounts, $700 and accumulated depreciation on buildings and equipment of $21.000 and $13,000. respectively Required: Based on the preceding information, prepare a properly classified December 31, 2019, balance sheet for Brandt. Brandt Company Balance Sheet December 31, 2019 Assets Current Assets Cash Investments in available for sale securities Accounts receivable II. II C Lessi Allowance for doubtful accounts Notes receivable (due 2024) Total current assets Long-Term Investments Check My Work more Check My Works remaining Previous Next > MCNOW Assignment Long-Term Investments Total long-term investments Property, plant and loviment 10.01 . Total property, plant, and equipment Intangible Assets Total intangible assets Total Assets Check My Virkmore Check My Workestraining Previous Next MCNOW Assignment Total Assets Liabilities Current Liabilities Total current liabilities Long-Term Liabilities Total long-term liabilities Total Liabilities Shareholders' Equity Contributed Capital DID Check My Work more Check My Work uses remaining Previous Next > MCNOW Assignment Total long-term liabilities Total Liabilities Shareholders' Equity Contributed Capital Total contributed capital Total contributed capital, retained earnings, and accumulated other comprehensive income Total Stockholders' Equity Total Liabilities and Stockholders' Equity Check My Work 3 more Check My Works remaining ( Previous Next) Previous NextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started