Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Correctly complete all parts of question 1 of case study 5.1b. 1A. Simple & Compound Interest: 1B. Finding the interest rate and number of years:

Correctly complete all parts of question 1 of case study 5.1b.

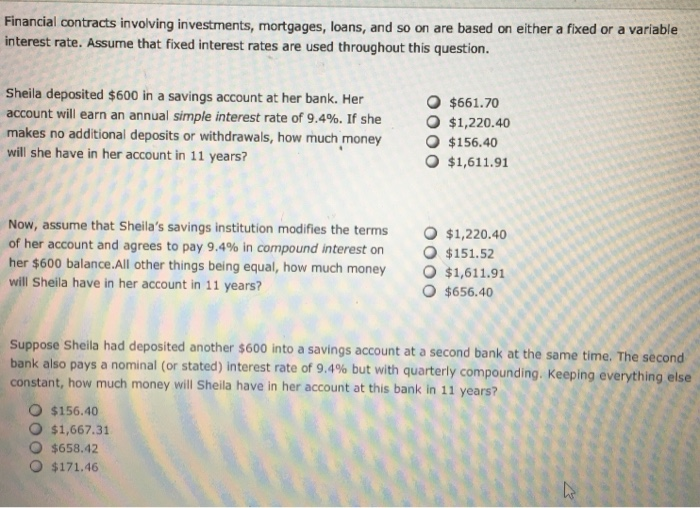

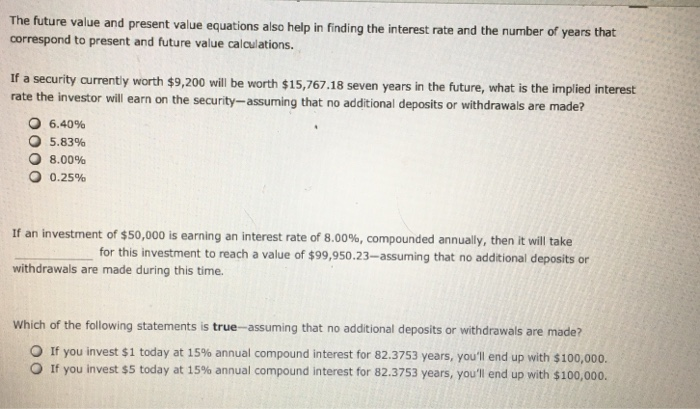

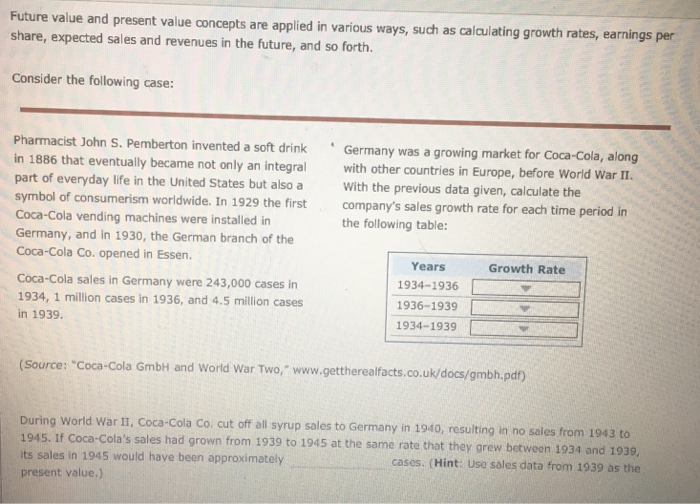

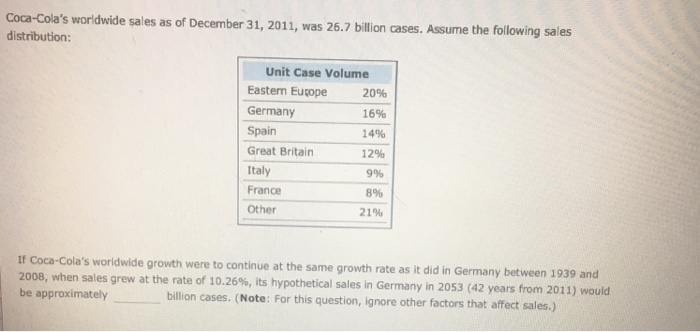

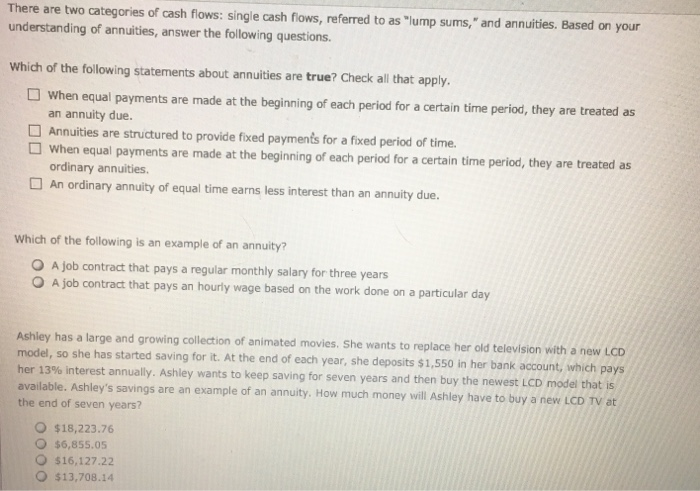

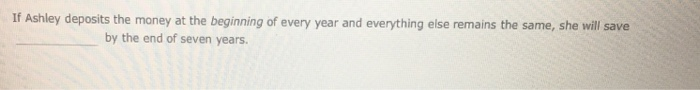

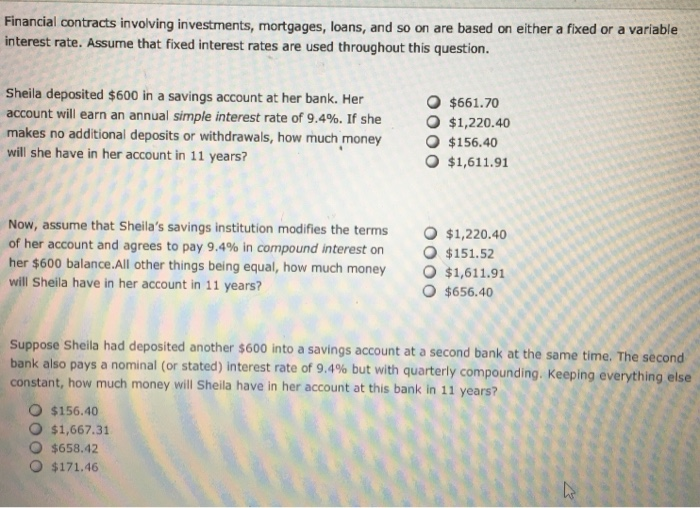

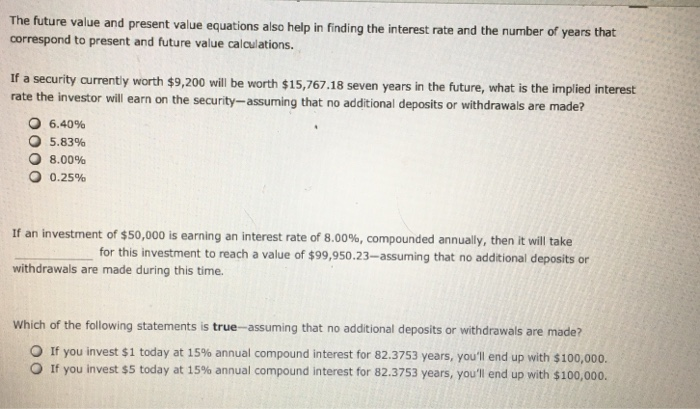

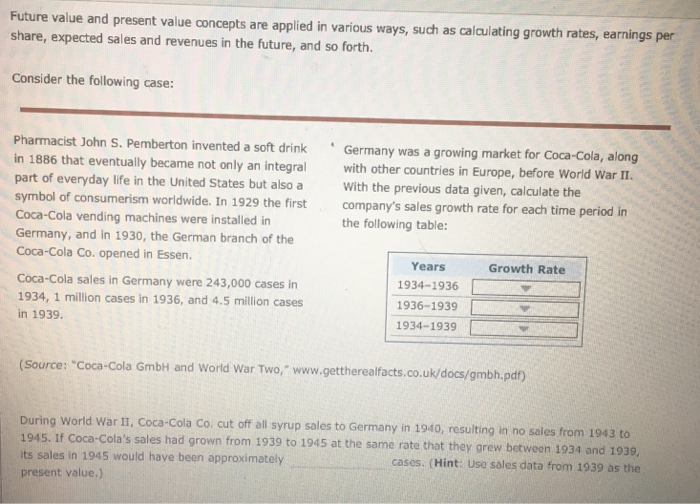

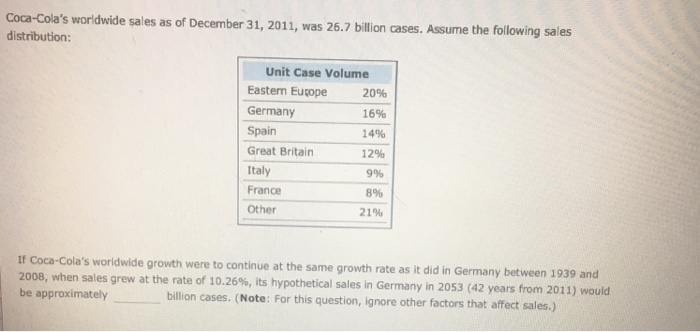

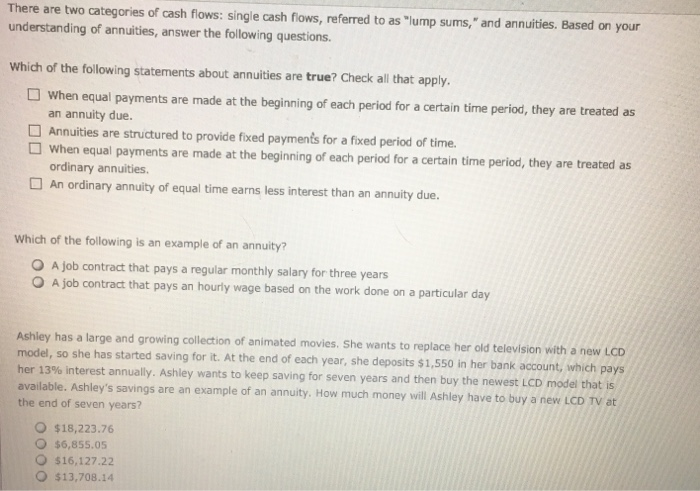

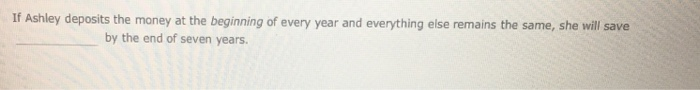

Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Sheila deposited $600 in a savings account at her bank. Her account will earn an annual simple interest rate of 9.4%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 11 years? $661.70 $1,220.40 $156.40 O $1,611.91 Now, assume that Sheila's savings institution modifies the terms $1,220.40 of her account and agrees to pay 9.4% in compound interest on $151.52 her $600 balance.All other things being equal, how much money $1,611.91 will Sheila have in her account in 11 years? O $656.40 Suppose Sheila had deposited another $600 into a savings account at a second bank at the same time. The second bank also pays a nominal (or stated) interes constant, how much money will Sheila have in her account at this bank in 11 years t rate of 9.4% but with quarterly compounding. Keeping everything else O $156.40 O $1,667.31 O $658.42 O $171.46 The future value and present value equations also help in finding the interest rate and the correspond to present and future value calculations. number of years that If a security currentiy worth $9,200 will be worth $15,767.18 seven years in the future, what is the implied interest rate the in vestor will earn on the security-assuming that no additional deposits or withdrawals are made? 6.40% 5.83% 8.00% 0.25% If an investment of $50,000 is earning an interest rate of 8.00%, compounded annually, then it will take for this investment to reach a value of $99,950.23-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? 0 If you invest $1 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000. 0 If you invest $5 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000. Future value and present value concepts are applied in various ways, such as calculating growth rates, earnings per share, expected sales and revenues in the future, and so forth. Consider the following case: Pharmacist John S. Pemberton invented a soft drink Germany was a growing market for Coca-Cola, along in 1886 that eventually became not only an integral with other countries in Europe, before World War II. part of everyday life in the United States but also a With the previous data given, calculate the symbol of consumerism worldwide. In 1929 the first company's sales growth rate for each time period in Coca-Cola vending machines were installed in Germany, and in 1930, the German branch of the Coca-Cola Co. opened in Essen. the following table: Growth Rate Coca-Cola sales in Germany were 243,000 cases in 1934, 1 million cases in 1936, and 4.5 million cases in 1939. Years 1934-1936 1936-1939 1934-1939 (Source: "Coca-Cola GmbH and World War Two, www.gettherealfacts.co.uk/docs/gmbh.pdf) During World War II, Coca-Cola Co. cut off all syrup sales to Germany in 1940, resulting in no sales from 1943 to 1945. If Coca its sales in 1945 would have been approximately present value.) -Cola's sales had grown from 1939 to 1945 at the same rate that they grew between 1934 and 1939, cases. (Hint: Use sales data from 1939 as the Coca-Cola's worldwide sales as of December 31, 2011, was 26.7 bilion cases. Assume the following sales distribution Unit Case Volume Eastem Europe Germany Spain Great Britain Italy France Other 20% 16% 14% 12% 9% 8% 21% s worldwide growth were to continue at the same growth rate as it did in Germany between 1939 and 2008, when sales grew at the rate of 10.26%, its hypothetical sales in Germany in 2053 (42 years from 2011) would be approximately billion cases. (Note: For this question, ignore other factors that affect sales.) There are two categories of cash flows: single cash flows, referred to as "lump sums," and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. when equal payments are made at the beginning of each period for a certain time period, they are treated as an annuity due. Annuities are structured to provide fixed payments for a fixed period of time. When equal payments are made at the beginning of each period for a certain time period, they are treated as ordinary annuities. An ordinary annuity of equal time earns less interest than an annuity due Which of the following is an example of an annuity? O A job contract that pays a regular monthly salary for three years O A job contract that pays an hourly wage based on the work done on a particular day Ashley has a large and growing collection of animated movies. She wants to replace her old television with a new LCD model, so she has started saving for it. At the end of each year, she deposits $1,550 in her bank account, which pays her 13% interest annually. Ashley wants to keep saving for seven years and then buy the newest LCD model that is available. Ashley's savings are an example of an annuity. How much money will Ashley have to buy a newe LCD TV at the end of seven years? $18,223.76 $6,855.05 O $16,127.22 O $13,708.14 If Ashley deposits the money at the beginning of every year and everything else remains the same, she will save by the end of seven years 1A. Simple & Compound Interest:

1B. Finding the interest rate and number of years:

1C. Companies and growth rates:

1D. Future Value and annuities:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started