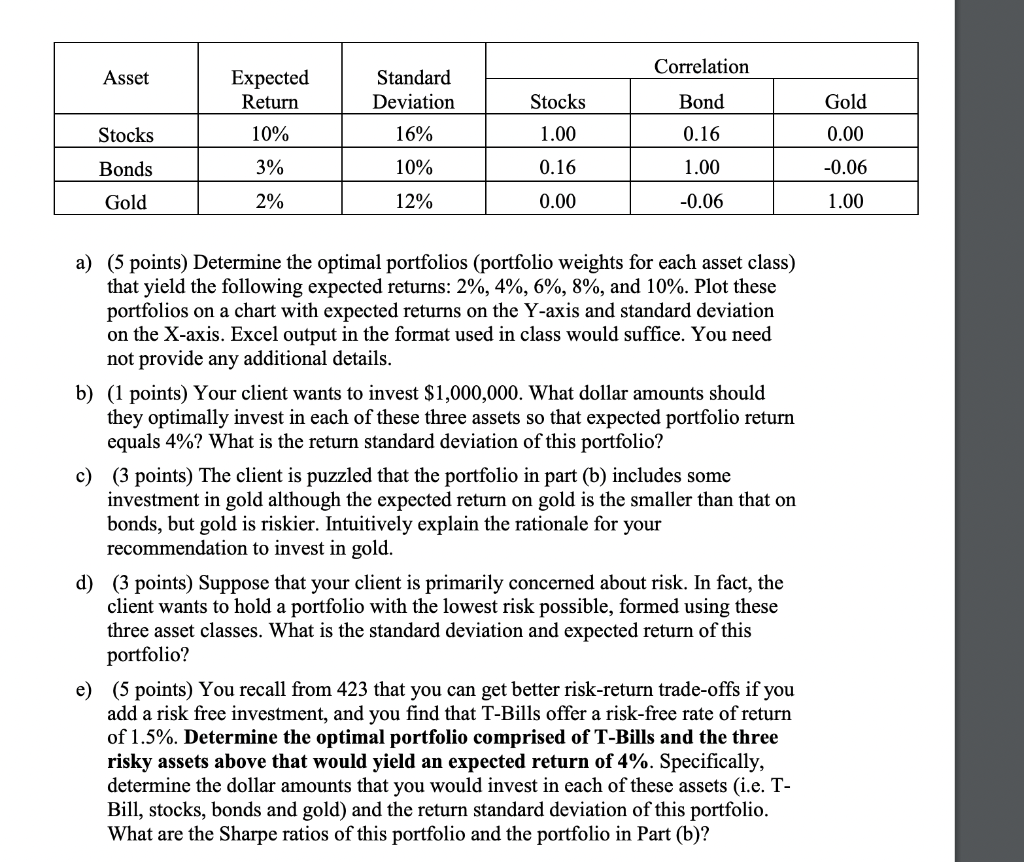

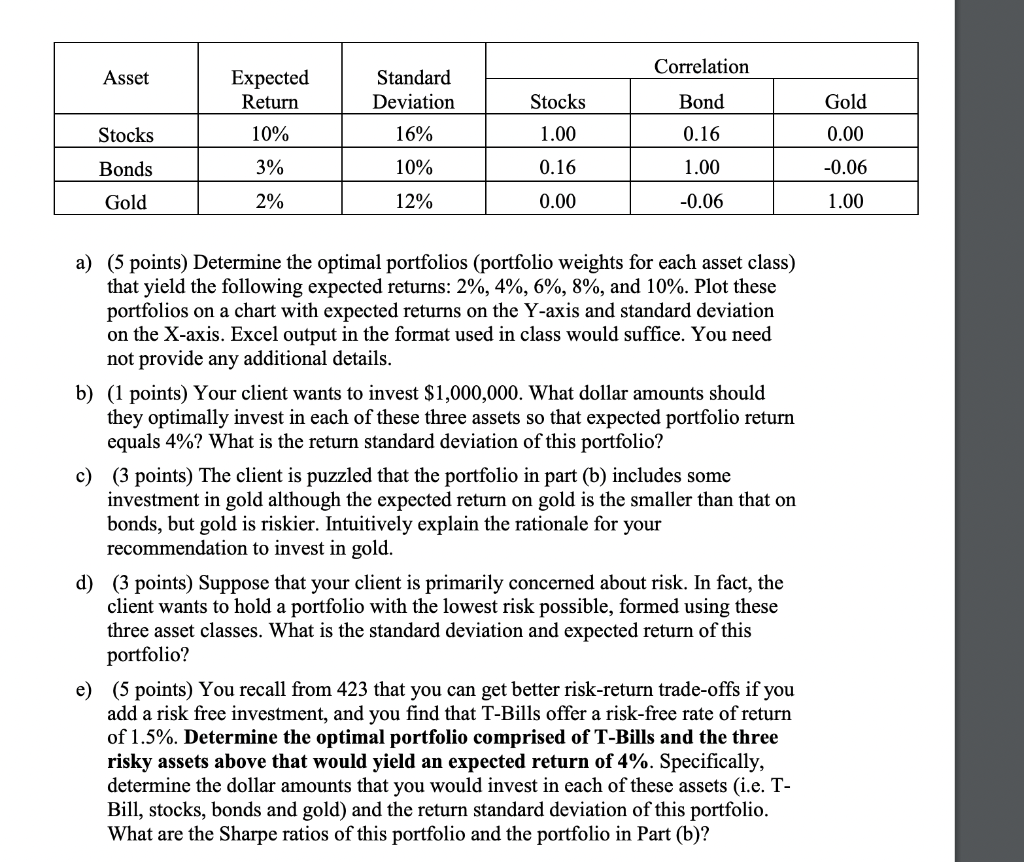

Correlation Asset Expected Return 10% Standard Deviation Bond Gold Stocks 1.00 Stocks 16% 0.16 0.00 Bonds 3% 10% 0.16 1.00 -0.06 Gold 2% 12% 0.00 -0.06 1.00 a) (5 points) Determine the optimal portfolios (portfolio weights for each asset class) that yield the following expected returns: 2%, 4%, 6%, 8%, and 10%. Plot these portfolios on a chart with expected returns on the Y-axis and standard deviation on the X-axis. Excel output in the format used in class would suffice. You need not provide any additional details. b) (1 points) Your client wants to invest $1,000,000. What dollar amounts should they optimally invest in each of these three assets so that expected portfolio return equals 4%? What is the return standard deviation of this portfolio? c) (3 points) The client is puzzled that the portfolio in part (b) includes some investment in gold although the expected return on gold is the smaller than that on bonds, but gold is riskier. Intuitively explain the rationale for your recommendation to invest in gold. d) (3 points) Suppose that your client is primarily concerned about risk. In fact, the client wants to hold a portfolio with the lowest risk possible, formed using these three asset classes. What is the standard deviation and expected return of this portfolio? e) (5 points) You recall from 423 that you can get better risk-return trade-offs if you add a risk free investment, and you find that T-Bills offer a risk-free rate of return of 1.5%. Determine the optimal portfolio comprised of T-Bills and the three risky assets above that would yield an expected return of 4%. Specifically, determine the dollar amounts that you would invest in each of these assets (i.e. T- Bill, stocks, bonds and gold) and the return standard deviation of this portfolio. What are the Sharpe ratios of this portfolio and the portfolio in Part (b)? Correlation Asset Expected Return 10% Standard Deviation Bond Gold Stocks 1.00 Stocks 16% 0.16 0.00 Bonds 3% 10% 0.16 1.00 -0.06 Gold 2% 12% 0.00 -0.06 1.00 a) (5 points) Determine the optimal portfolios (portfolio weights for each asset class) that yield the following expected returns: 2%, 4%, 6%, 8%, and 10%. Plot these portfolios on a chart with expected returns on the Y-axis and standard deviation on the X-axis. Excel output in the format used in class would suffice. You need not provide any additional details. b) (1 points) Your client wants to invest $1,000,000. What dollar amounts should they optimally invest in each of these three assets so that expected portfolio return equals 4%? What is the return standard deviation of this portfolio? c) (3 points) The client is puzzled that the portfolio in part (b) includes some investment in gold although the expected return on gold is the smaller than that on bonds, but gold is riskier. Intuitively explain the rationale for your recommendation to invest in gold. d) (3 points) Suppose that your client is primarily concerned about risk. In fact, the client wants to hold a portfolio with the lowest risk possible, formed using these three asset classes. What is the standard deviation and expected return of this portfolio? e) (5 points) You recall from 423 that you can get better risk-return trade-offs if you add a risk free investment, and you find that T-Bills offer a risk-free rate of return of 1.5%. Determine the optimal portfolio comprised of T-Bills and the three risky assets above that would yield an expected return of 4%. Specifically, determine the dollar amounts that you would invest in each of these assets (i.e. T- Bill, stocks, bonds and gold) and the return standard deviation of this portfolio. What are the Sharpe ratios of this portfolio and the portfolio in Part (b)