Answered step by step

Verified Expert Solution

Question

1 Approved Answer

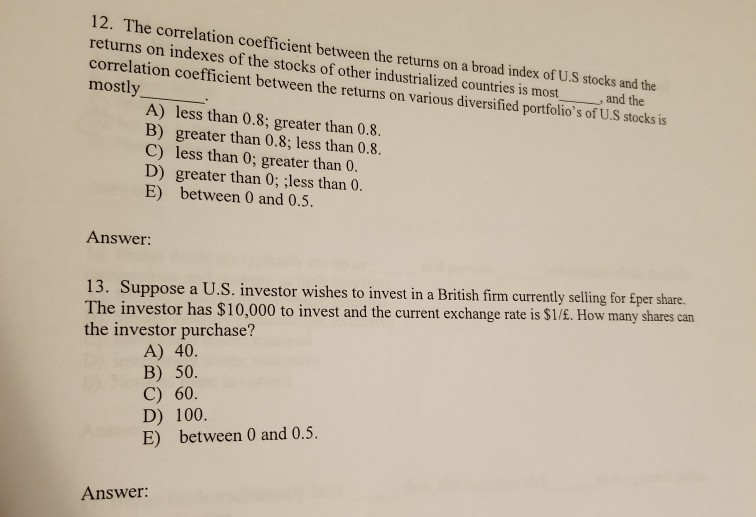

correlation coefficient between the returns on a broad index of U.S stocks and the returns on indexes of the stocks of other industrialized countries is

correlation coefficient between the returns on a broad index of U.S stocks and the returns on indexes of the stocks of other industrialized countries is most correlation coefficient between the returns on various diversified portfolio's of U.S stocks is mostly , and A) less than 0.8; greater than 0.8. B) greater than 0.8; less than 0.8. C) less than 0; greater than 0. D) greater than 0; ;less than 0 E) between 0 and 0.5. Answer: 13. Suppose a U.S. investor wishes to invest in a British firm currently selling for fper share. The investor has $10,000 to invest and the current exchange rate is $1/. How many shares can the investor purchase? A) 40. B) 50. C) 60 D) 100. E) between 0 and 0.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started