corresponding template to be filled out:

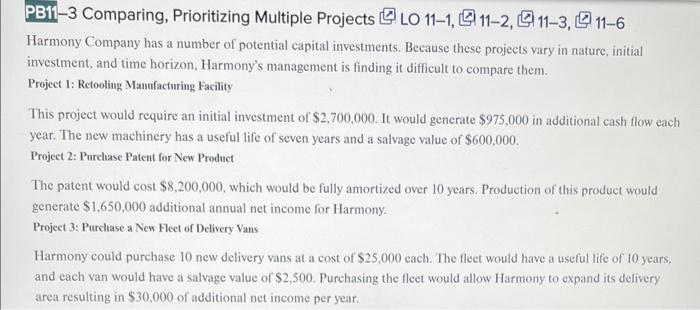

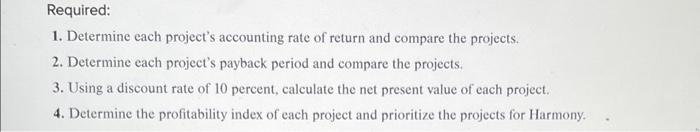

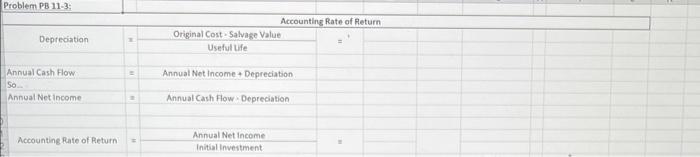

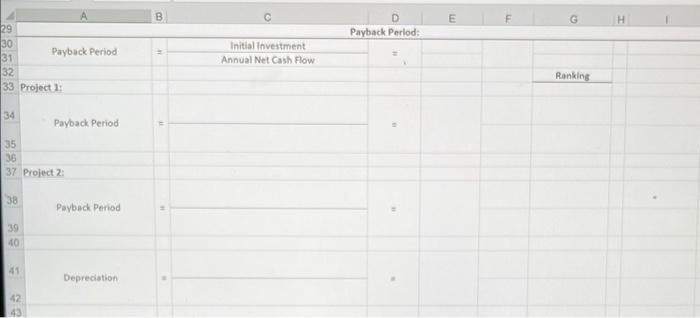

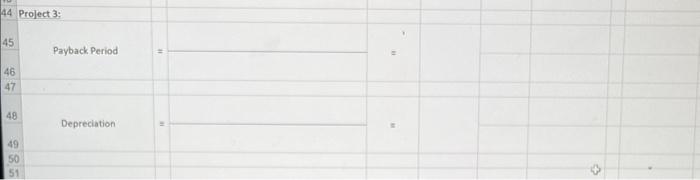

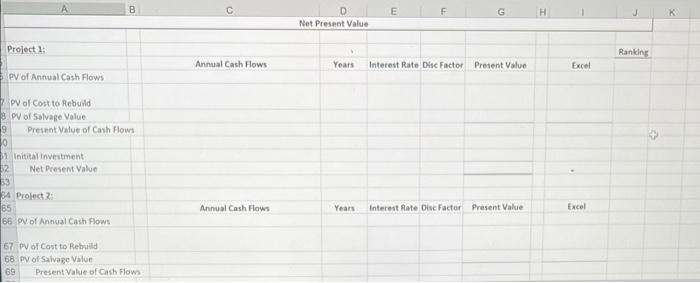

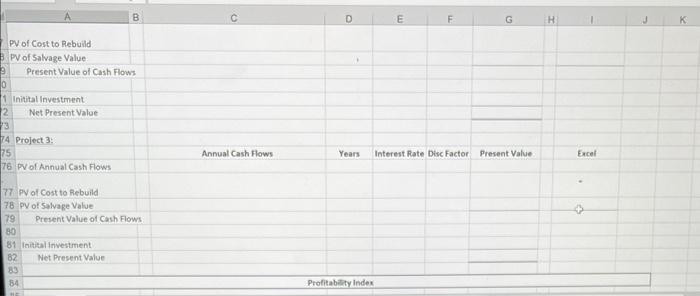

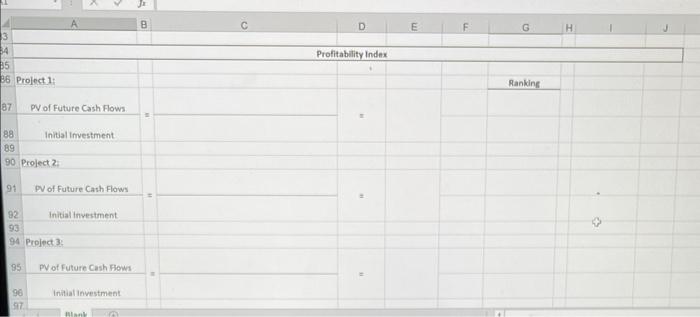

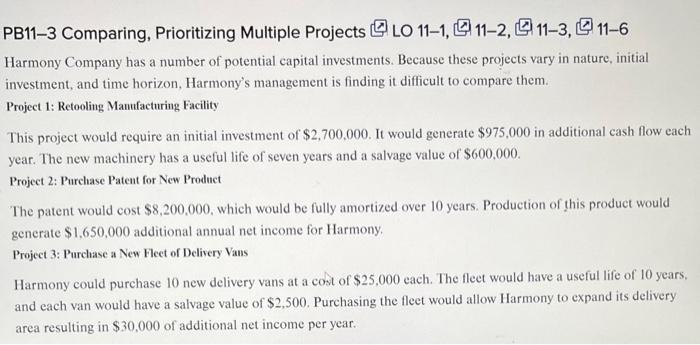

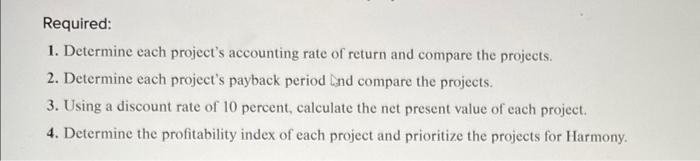

Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding it difficult to compare them. Project 1: Retooling Maunfacturing Facility This project would require an initial investment of $2,700,000. It would generate $975,000 in additional cash flow each year. The new machinery has a useful life of seven years and a salvage value of $600,000. Project 2: Purchase Patent for New Product The patent would cost $8,200,000, which would be fully amortized over 10 years. Production of this product would generate $1,650,000 additional annual net income for Harmony. Project 3: Purchase a New Fleet of Delivery Vans Harmony could purchase 10 new delivery vans at a cost of $25,000 each. The fleet would have a useful life of 10 years. and each van would have a salvage value of $2,500. Purchasing the fleet would allow Harmony to expand its delivery area resulting in $30,000 of additional net income per year. Required: 1. Determine each project's accounting rate of return and compare the projects. 2. Determine each project's payback period and compare the projects. 3. Using a discount rate of 10 percent, calculate the net present value of each project. 4. Determine the profitability index of each project and prioritize the projects for Harmony. Problem PB 11-3: \begin{tabular}{|l|l|l|} \hline 14 & Project 1: & A \\ \hline 15 & Accounting Rate of Return = \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & Depreciation \\ 19 & \\ \hline 20 & Project 2: \\ \hline 22 & Accounting Rate of Return \\ \hline 23 & \\ \hline 24 & Project 3 ; \\ \hline \end{tabular} 26 Accounting Rate of Return = 44. Prolect 3: 45 Payback. Period = 46 Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding it difficult to compare them. Project 1: Retooling Manufacturing Facility This project would require an initial investment of $2,700,000. It would generate $975,000 in additional cash flow each year. The new machinery has a useful life of seven years and a salvage value of $600,000. Project 2: Purchase Patent for New Product The patent would cost $8,200,000, which would be fully amortized over 10 years. Production of this product would generate \$1,650,000 additional annual net income for Harmony. Project 3: Purchase a New Fleet of Delivery Vaus Harmony could purchase 10 new delivery vans at a cost of $25,000 each. The fleet would have a useful life of 10 years, and each van would have a salvage value of $2,500. Purchasing the fleet would allow Harmony to expand its delivery area resulting in $30,000 of additional net income per year. Required: 1. Determine each project's accounting rate of return and compare the projects. 2. Determine each project's payback period Ind compare the projects. 3. Using a discount rate of 10 percent, calculate the net present value of each project. 4. Determine the profitability index of each project and prioritize the projects for Harmony