Answered step by step

Verified Expert Solution

Question

1 Approved Answer

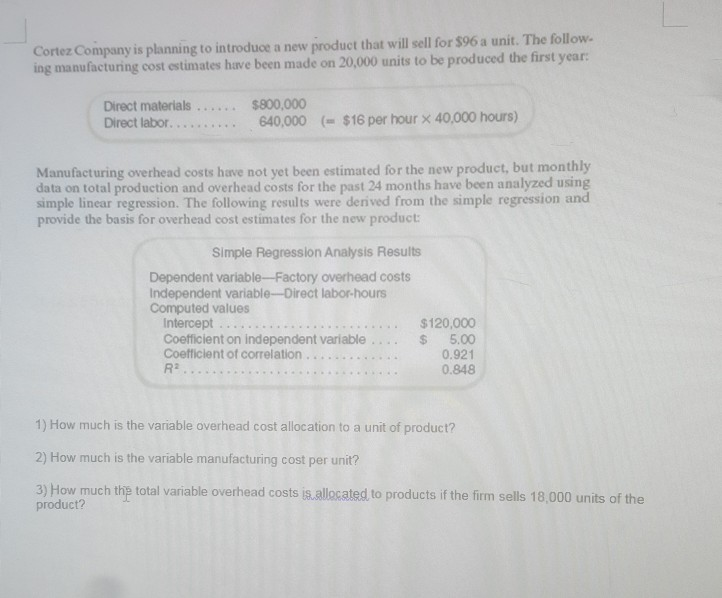

Cortez Company is planning to introduce a new product that will sell for $96 a unit. The follow. ing manufacturing cost estimates have been made

Cortez Company is planning to introduce a new product that will sell for $96 a unit. The follow. ing manufacturing cost estimates have been made on 20,000 units to be produced the first year: Direct materials $800,000 Direct labor....640,000 ($16 per hour x 40,000 hours) Manufacturing overhead costs have not yet been estimated for the new product, but monthly data on total production and overhead costs for the past 24 months have been analyzed using simple linear regression. The following results were derived from the simple regression and provide the basis for overhead cost estimates for the new product Simple Regression Analysis Results Dependent variable-Factory overhead costs Independent variable-Direct labor-hours Computed values Coefficient on independent variable . .. Coefficient of correlation R2 $ 5.00 0.921 0.848 1) How much is the variable overhead cost allocation to a unit of product? 2) How much is the variable manufacturing cost per unit? 3) How much thg total variable overhead costs is.allocated to products if the firm sells 18,000 units of the product

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started