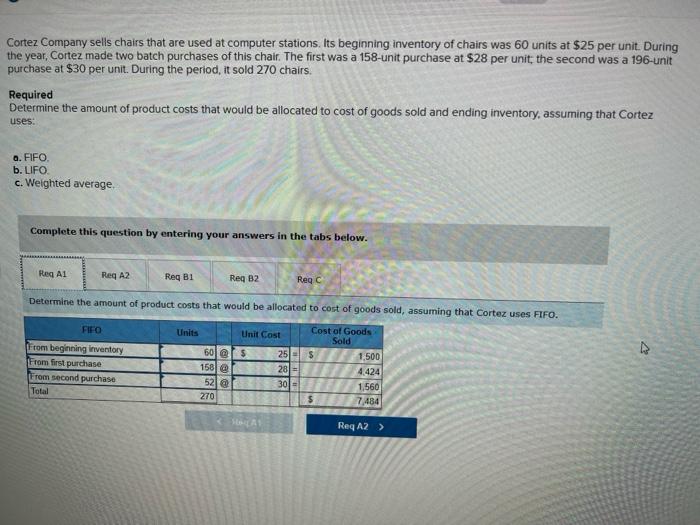

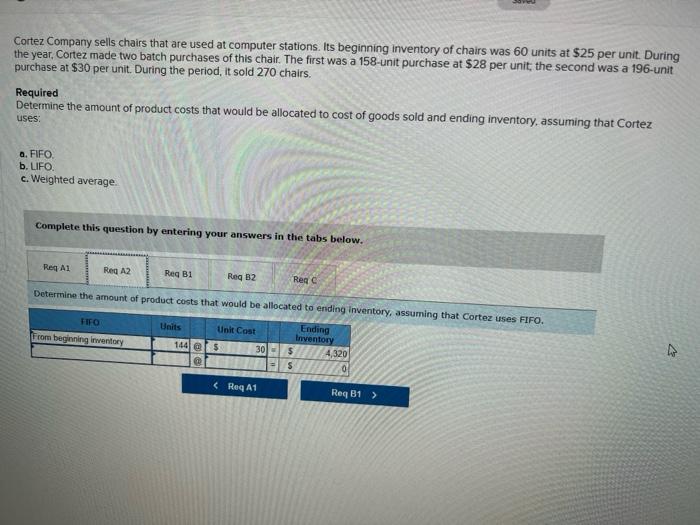

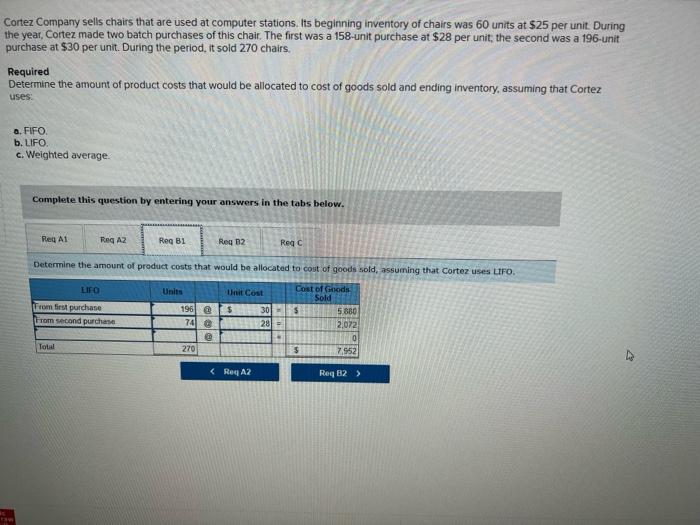

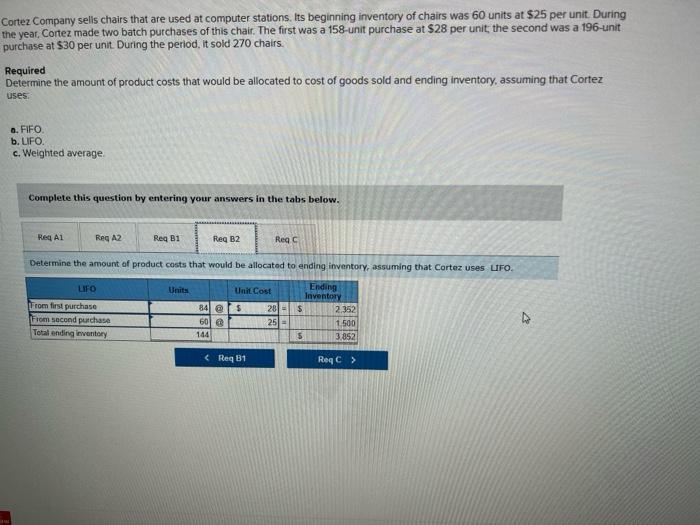

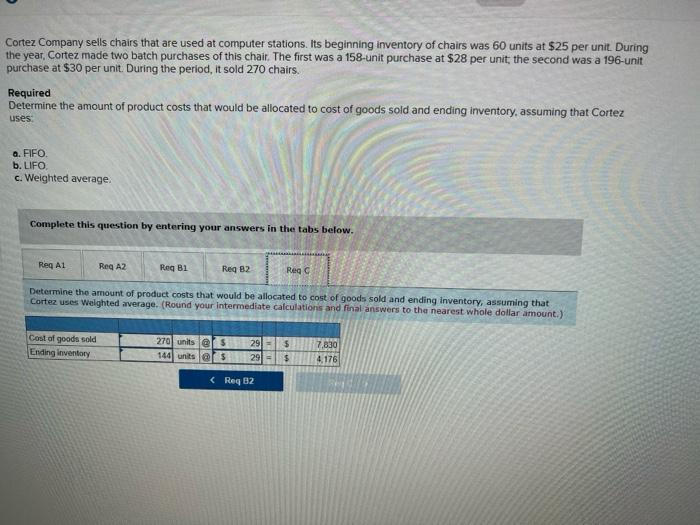

Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 60 units at $25 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 158 -unit purchase at $28 per unit, the second was a 196 -unit purchase at $30 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FFO b. LIFO. c. Weighted average, Complete this question by entering your answers in the tabs below. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses Fifo. Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 60 units at $25 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 158-unit purchase at $28 per unit, the second was a 196 -unit purchase at $30 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO. b. LIFO. c. Weighted average. Complete this question by entering your answers in the tabs below. Determine the amount of product costs that would be allocated to endina inventory, assuming that Cortez uses FIFO. Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 60 units at $25 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 158 -unit purchase at $28 per unit, the second was a 196-unit purchase at $30 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses:- a. FIFO. b. LIFO. c. Weighted average. Complete this question by entering your answers in the tabs below. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that cortez uses Lifo. Cortez Company selis chairs that are used at computer stations, its beginning inventory of chairs was 60 units at $25 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 158-unit purchase at $28 per unit, the second was a 196 -unit purchase at $30 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO. b. LFO. c. Weighted average. Complete this question by entering your answers in the tabs below. Determine the amount of product costs that would be allocatod to ending inventory, assuming that Cortez uses Uro. Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 60 units at $25 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 158-unit purchase at $28 per unit, the second was a 196 -unit purchase at $30 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO. b. LIFO. c. Weighted average: Complete this question by entering your answers in the tabs below. Determine tho amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Welghted iverage. (Round your intermediate calculations and final answers to tha nearest whole dollar amount.)