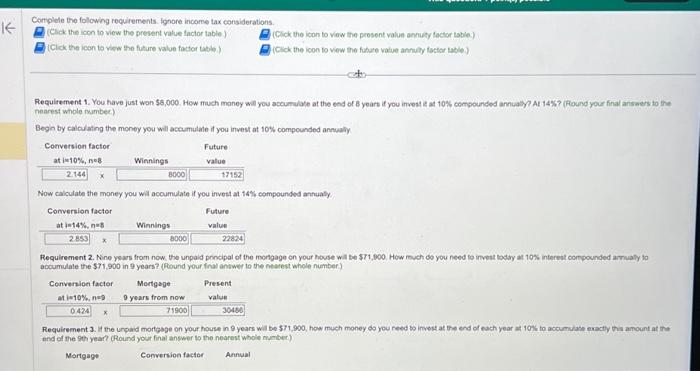

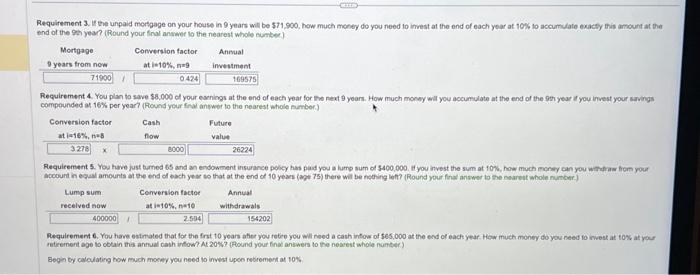

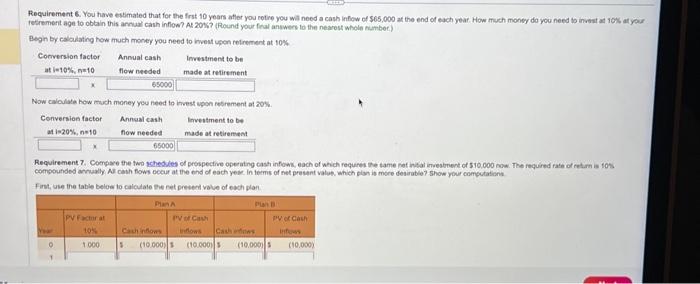

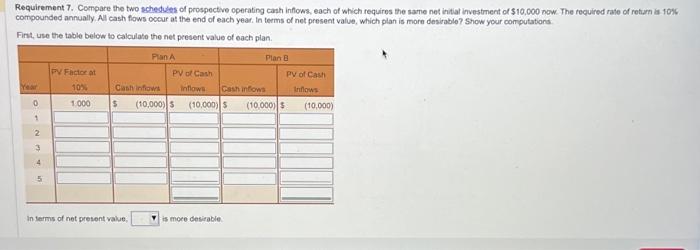

Cortplele the following roqurements. fonore income tax considerations. (Click the icon to view the present vatue factor table) (Click the icon to view the prosent value annuby foclor tabiec) (Click the icon to vies the fulure value factor table.) (Ctck the icon to viow the future value annuly tacter table) Requltement 1. You have just won $6,000. How much maney will you accumulate at the end of B years it you invest a at 10\% compounded annualy? Al 14W? (Round your final answers to the nearest whole numbec) Begn by calculating the money you will aceumulabe it you invest at 10% compounded annualy Now calculate the money you wal acoumulate if you invest at 14% compounded antualy. Requirement 2. Nine years from now, the unpald proncipal of the mongage on your howse wil be $71,900. How rouch 60 you need to invest todity at 10% interest compounded arruaty to abcumulate the $71,900 in 9 years? (Round your fral antwer to the nearest whole number) Requirement 3. it the unpaid mortese on your hove in 9 years wal be 571,900 , how much money do you reed bo imvest at the end of each year at 10% to acoumulahe exactly thin amount at me and of the gth year? (Round your final answer to the noorest whole mumber) Mortgage Arnual Requirement 3. If the unpaid morfage on your house in 9 years will be 571,900 , how much money do you need to imest at the end of each year at 10 . 10 accumulate exacty this amount at the tend of the 9 th year? (Round your final anwwer lo the nearest whole sumbec) Requirement 4. You plan to save $8,000 of your esenings at the end of each year for the next 9 yoans. How much monyy will you accumulate at the end of the gen year it you invest your sarvings compounded as 16% per year? (Found your fina antwot to the nearest whole mumber.) Requirement 5. You have just burned 65 and an endowment insurance polcy has pad you a lump sum of 5400,000 . Hyou invest the sum at 107 , how much money can you withatra form your account in equal amounts at the end of bach yes to that at the end of 10 yeass (mot 75) there wit be nothing left? (Round your firal arswer to the noureut whole number. Mequirement 6. You have estroted that for the frat to yean afier you rebire you will need a cash infor of 565,000 at the end of each year- How much money do you need fo nvest at tos at yeer Begin by calculatirg tow much morey you need to invest upoe rebremert at 10% Requirement 6. You heve estimated that for the frst 10 yours afler you retre you wit need a cash infow of $65,000 at the end of each year. How much money do you need to inveat at 1015 at yeur Begn by calculating how much moner you need to iwest upon retrement at tow. Now calculda how much money you need to inest vogn restement at 20% Fint, use the table below to calcuate Bwe ret preved value of esch plan Requirement 7. Compare the two schedules of prospective operating cash inflows, each of which requires the same net initiar investment of \$10,000 now . The required rate of retum is 10\%6 compounded annually. Al cash fows cocur at the end of each year. In terms of net present value, which plan is more desirable? Show your computations Fint, use the table below to calculate the net present value of each plan. In terms of net present value. is more desirable Cortplele the following roqurements. fonore income tax considerations. (Click the icon to view the present vatue factor table) (Click the icon to view the prosent value annuby foclor tabiec) (Click the icon to vies the fulure value factor table.) (Ctck the icon to viow the future value annuly tacter table) Requltement 1. You have just won $6,000. How much maney will you accumulate at the end of B years it you invest a at 10\% compounded annualy? Al 14W? (Round your final answers to the nearest whole numbec) Begn by calculating the money you will aceumulabe it you invest at 10% compounded annualy Now calculate the money you wal acoumulate if you invest at 14% compounded antualy. Requirement 2. Nine years from now, the unpald proncipal of the mongage on your howse wil be $71,900. How rouch 60 you need to invest todity at 10% interest compounded arruaty to abcumulate the $71,900 in 9 years? (Round your fral antwer to the nearest whole number) Requirement 3. it the unpaid mortese on your hove in 9 years wal be 571,900 , how much money do you reed bo imvest at the end of each year at 10% to acoumulahe exactly thin amount at me and of the gth year? (Round your final answer to the noorest whole mumber) Mortgage Arnual Requirement 3. If the unpaid morfage on your house in 9 years will be 571,900 , how much money do you need to imest at the end of each year at 10 . 10 accumulate exacty this amount at the tend of the 9 th year? (Round your final anwwer lo the nearest whole sumbec) Requirement 4. You plan to save $8,000 of your esenings at the end of each year for the next 9 yoans. How much monyy will you accumulate at the end of the gen year it you invest your sarvings compounded as 16% per year? (Found your fina antwot to the nearest whole mumber.) Requirement 5. You have just burned 65 and an endowment insurance polcy has pad you a lump sum of 5400,000 . Hyou invest the sum at 107 , how much money can you withatra form your account in equal amounts at the end of bach yes to that at the end of 10 yeass (mot 75) there wit be nothing left? (Round your firal arswer to the noureut whole number. Mequirement 6. You have estroted that for the frat to yean afier you rebire you will need a cash infor of 565,000 at the end of each year- How much money do you need fo nvest at tos at yeer Begin by calculatirg tow much morey you need to invest upoe rebremert at 10% Requirement 6. You heve estimated that for the frst 10 yours afler you retre you wit need a cash infow of $65,000 at the end of each year. How much money do you need to inveat at 1015 at yeur Begn by calculating how much moner you need to iwest upon retrement at tow. Now calculda how much money you need to inest vogn restement at 20% Fint, use the table below to calcuate Bwe ret preved value of esch plan Requirement 7. Compare the two schedules of prospective operating cash inflows, each of which requires the same net initiar investment of \$10,000 now . The required rate of retum is 10\%6 compounded annually. Al cash fows cocur at the end of each year. In terms of net present value, which plan is more desirable? Show your computations Fint, use the table below to calculate the net present value of each plan. In terms of net present value. is more desirable