Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COST ACCT Crane, Inc. applies overhead cost based on direct labor hours in completing the 200 units in Job #120, the company incurred $12600 in

COST ACCT

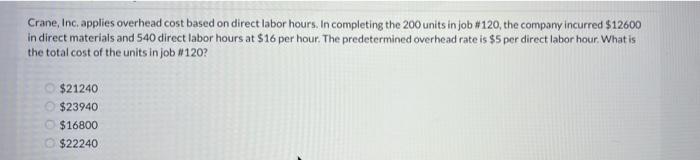

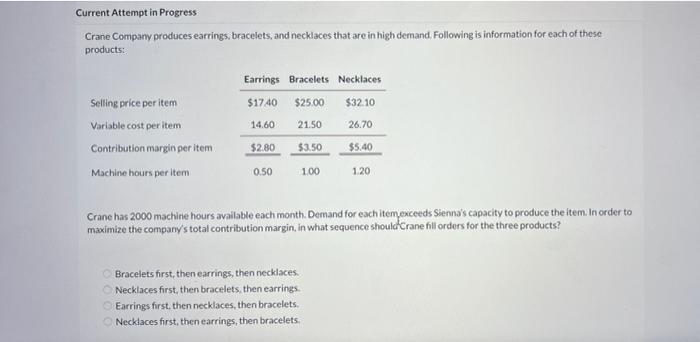

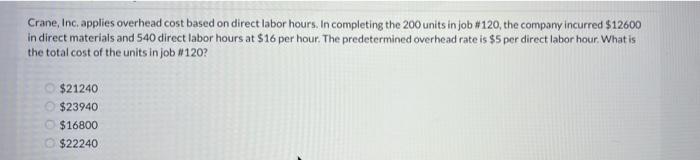

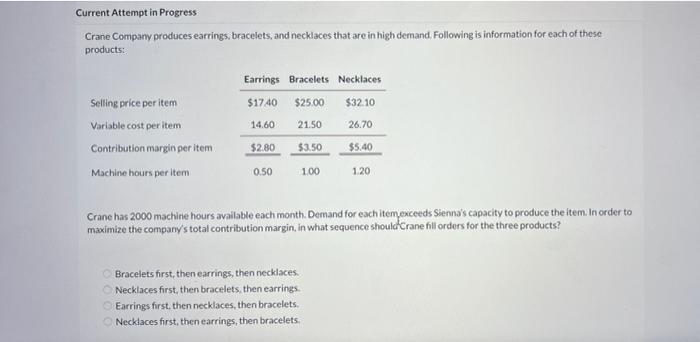

Crane, Inc. applies overhead cost based on direct labor hours in completing the 200 units in Job #120, the company incurred $12600 in direct materials and 540 direct labor hours at $16 per hour. The predetermined overhead rate is $5 per direct labor hour. What is the total cost of the units in job #120? $21240 $23940 $16800 $22240 Current Attempt in Progress Crane Company produces earrings, bracelets, and necklaces that are in high demand. Following is information for each of these products: Earrings Bracelets Necklaces $17.40 $25.00 $32.10 14.60 21.50 26.70 Selling price per item Variable cost per item Contribution margin per item Machine hours per item $2.80 $3.50 $5.40 0.50 100 1.20 Crane has 2000 machine hours available each month. Demand for each item exceeds Sienna's capacity to produce the item. In order to maximize the company's total contribution margin, in what sequence should Crane hill orders for the three products? Bracelets first, then earrings, then necklaces. Necklaces first, then bracelets, then earrings Earrings first, then necklaces, then bracelets Necklaces first, then earrings, then bracelets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started