Cost allocation to divisions Refer to Exercise 14-22. For both requirements below, create and populate an Excel-based spreadsheet reflecting the allocation of corporate overhead costs of $10,100,000 based on the basis of :

(a) Divisional Revenues. Note that the Pulp Division's revenues are $9,800,000

(b) Divisional net assets, where the pulp Division reports total asserts of $53.3 million and total liabilities of $14.6 million; the Paper Division reports total assets of $105.2 million and total liabilities of $83.6 million; and the fibers Division reports total assets of $77.6 million and total liabilies of $68.7 million.

Fot each division, Briefly explain which of the above two allocation schemes the divisional manager would prefer.

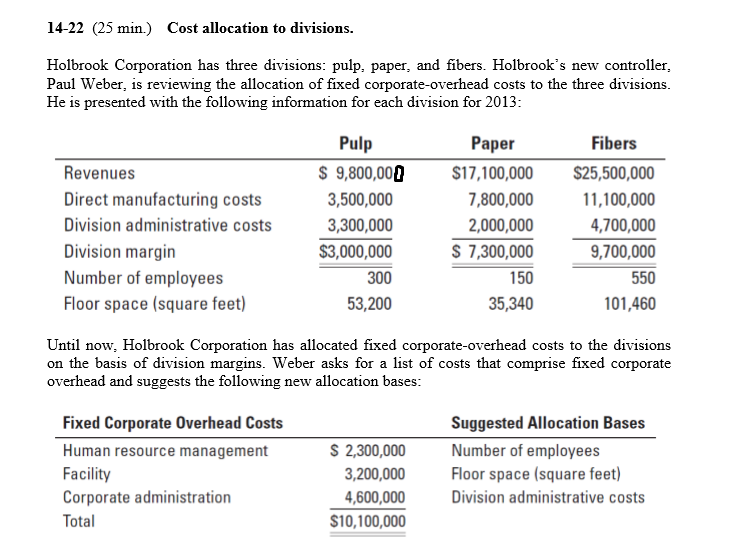

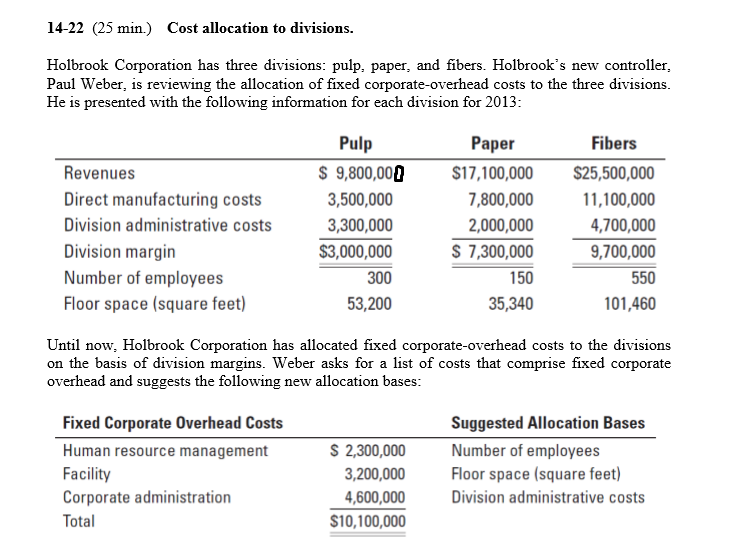

14-22 (25 min. Cost allocation to divisions Holbrook Corporation has three divisions pulp, paper, and fibers. Holbrook's new controller, Paul Weber, is reviewing the allocation of fixed corporate-overhead costs to the three divisions He is presented with the following information for each division for 2013 Pulp Fibers Paper Revenues 9,800,00 $17,100,000 $25,500,000 Direct manufacturing costs 3,500,000 7,800,000 11,100,000 3,300,000 2,000,000 Division administrative costs 4,700,000 9,700,000 Division margin $3,000,000 7,300,000 300 150 550 Number of employees Floor space (square feet) 53,200 35,340 101,460 Until now, Holbrook Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Weber asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases Fixed Corporate 0verhead Costs Suggested Allocation Bases Human resource management S 2,300,000 Number of employees Facility 3,200,000 Floor space (square feet) Corporate administration 4,600,000 Division administrative costs Total $10,100,000 14-22 (25 min. Cost allocation to divisions Holbrook Corporation has three divisions pulp, paper, and fibers. Holbrook's new controller, Paul Weber, is reviewing the allocation of fixed corporate-overhead costs to the three divisions He is presented with the following information for each division for 2013 Pulp Fibers Paper Revenues 9,800,00 $17,100,000 $25,500,000 Direct manufacturing costs 3,500,000 7,800,000 11,100,000 3,300,000 2,000,000 Division administrative costs 4,700,000 9,700,000 Division margin $3,000,000 7,300,000 300 150 550 Number of employees Floor space (square feet) 53,200 35,340 101,460 Until now, Holbrook Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Weber asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases Fixed Corporate 0verhead Costs Suggested Allocation Bases Human resource management S 2,300,000 Number of employees Facility 3,200,000 Floor space (square feet) Corporate administration 4,600,000 Division administrative costs Total $10,100,000