Question: Based on the ratios calculated in the excel sheet, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency,

Based on the ratios calculated in the excel sheet, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency, operational efficiency, and profitability. Ensure to choose right ratios to discuss a specific part.

-Find the relationships among ratios and trends over the two years compared. Also, compare these relationships and trends with those of Ford.

-In the last part of your discussion, you will show your investment decision: buy or not buy Tesla. You may want to split your investment between two companies. Tell me your rationale for your decision.

-Your discussion and final investment decision should solely be based on the ratio analysis, although investors also use various non-financial information in their investment decision-making.

PLEASE WRITE ABOUT TWO PAGES EXPLAINING EACH POINT.

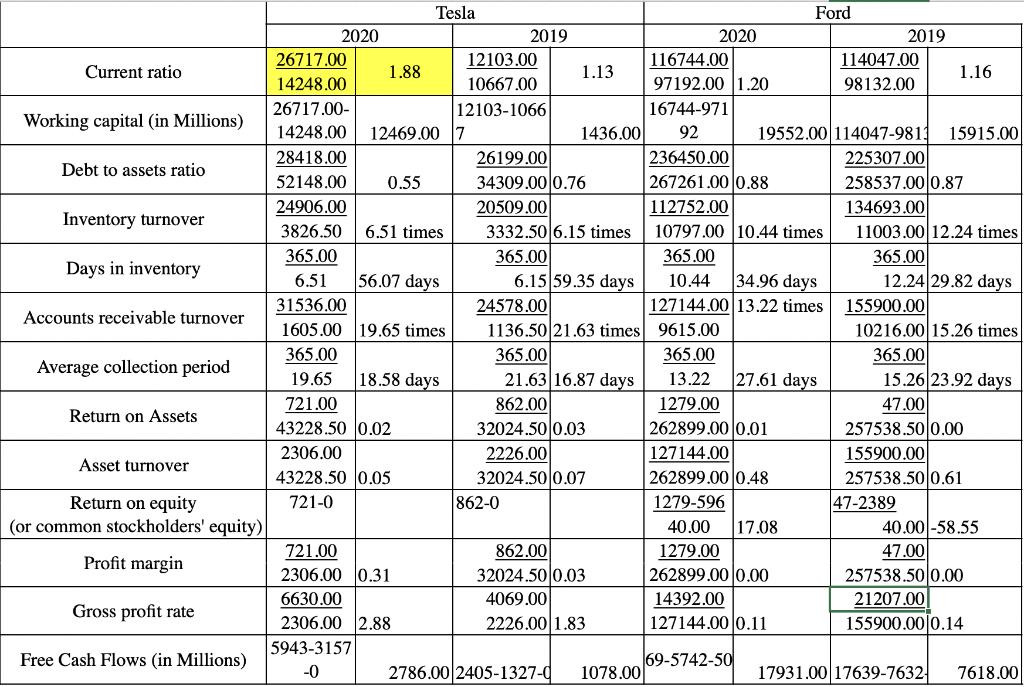

Current ratio Working capital (in Millions) Debt to assets ratio Inventory turnover Days in inventory Accounts receivable turnover Average collection period Return on Assets Asset turnover Return on equity (or common stockholders' equity) Profit margin Gross profit rate Free Cash Flows (in Millions) 2020 26717.00 14248.00 26717.00- 14248.00 12469.00 7 28418.00 52148.00 24906.00 3826.50 6.51 times 365.00 6.51 31536.00 1605.00 19.65 times 1.88 0.55 Tesla 56.07 days 365.00 19.65 721.00 43228.50 0.02 2306.00 43228.50 0.05 721-0 18.58 days 721.00 2306.00 0.31 6630.00 2306.00 2.88 5943-3157 -0 2019 12103.00 10667.00 12103-1066 1.13 26199.00 34309.00 0.76 20509.00 3332.50 6.15 times 365.00 6.15 59.35 days 862-0 1436.00 365.00 21.63 16.87 days 862.00 32024.50 0.03 2226.00 32024.50 0.07 24578.00 1136.50 21.63 times 9615.00 365.00 13.22 2786.00 2405-1327-0 862.00 32024.50 0.03 4069.00 2226.00 1.83 2020 1078.00 116744.00 97192.00 1.20 16744-971 92 236450.00 267261.00 0.88 112752.00 10797.00 10.44 times 365.00 10.44 34.96 days 127144.00 13.22 times Ford 27.61 days 1279.00 262899.00 0.01 127144.00 262899.00 0.48 1279-596 40.00 17.08 19552.00 114047-9813 15915.00 225307.00 258537.00 0.87 134693.00 11003.00 12.24 times 365.00 12.24 29.82 days 1279.00 262899.00 0.00 14392.00 127144.00 0.11 69-5742-50 2019 114047.00 98132.00 1.16 155900.00 10216.00 15.26 times 365.00 15.26 23.92 days 47.00 47-2389 257538.50 0.00 155900.00 257538.50 0.61 40.00-58.55 47.00 257538.50 0.00 21207.00 155900.00 0.14 17931.00 17639-7632 7618.00

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Based on the ratios calculated in the excel sheet you will perform a ratiobased analysis You should divide your discussion into four parts liquidity solvency operational efficiency and profitability E... View full answer

Get step-by-step solutions from verified subject matter experts