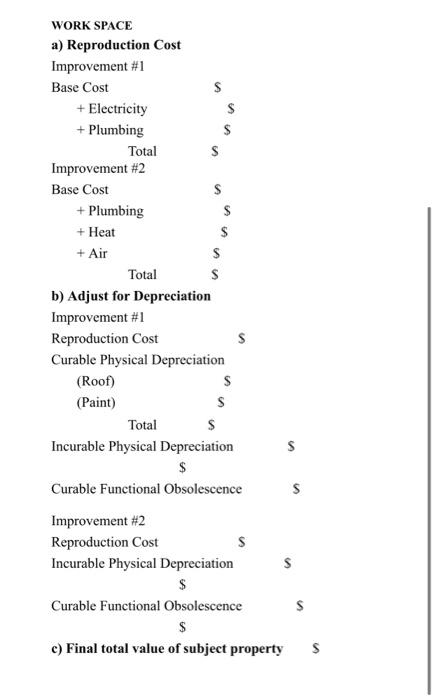

Cost Approach Use the information below to answer a), b), and c). Assume that the bare land value of the property is $1,077,000. Round to the nearest dollar. a) Calculate the reproduction cost of each improvement b) Adjust the reproduction cost of each improvement for depreciation. Indicate whether the depreciation is curable physical depreciation, incurable physical depreciation, curable functional obsolescence or incurable functional obsolescence. c) Estimate the final total value of the subject property using the cost approach to valuation. Improvement #1 - Machinery Shed. The machinery shed is a 30 x 50 foot structure, with a base cost of $35 per square foot. That cost includes the walls, roof, doors, and a concrete floor. The structure was fully wired for electricity at a cost of S1,600 and plumbing was added at a cost of $1,100. The shop currently needs a new roof, costing $5,500, and the shop exterior needs a coat of paint, costing $1,100. The estimated physical life of the shed is 50 years. The shed has an effective age of 20 years. To be useful under the current conditions, the machinery shed needs to have a higher entry-way to the building. This can be corrected for $4,000. If the entry-way had been built higher at the time of the original construction, there would have been no addition cost. Improvement #2 - Work Shop The property also has a 15 x 20 foot workshop that had a base construction cost of $40 a square foot. When the workshop was constructed the owner also added plumbing to the building (bathroom, water heater, additional faucet inside and out) for $3,500. He also added permanent space heaters, costing $600, and a window air conditioner for $300. To be useful under current conditions, structural alteration to support an equipment hoist is needed, costing $3,000. If the hoist had been installed with the original construction, it would have added 1,800 to the cost of the building. The estimated physical life of the work shop is 40 years. Actual age is 20 years. Effective age is 10 years. Be sure to show your calculations for each part of the problem. Use the workspace on the next page. S $ $ s S S WORK SPACE a) Reproduction Cost Improvement #1 Base Cost + Electricity + Plumbing Total Improvement #2 Base Cost + Plumbing + Heat + Air $ Total $ b) Adjust for Depreciation Improvement #1 Reproduction Cost Curable Physical Depreciation (Root) $ (Paint) $ Total $ Incurable Physical Depreciation S $ Curable Functional Obsolescence Improvement #2 Reproduction Cost $ Incurable Physical Depreciation $ $ Curable Functional Obsolescence $ $ c) Final total value of subject property $ $ S