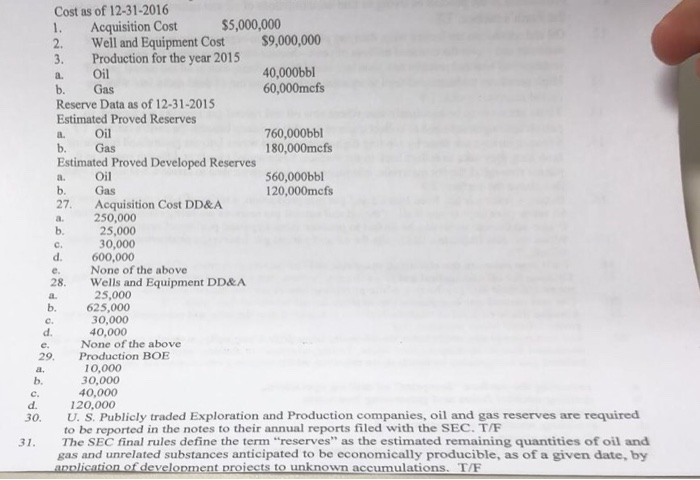

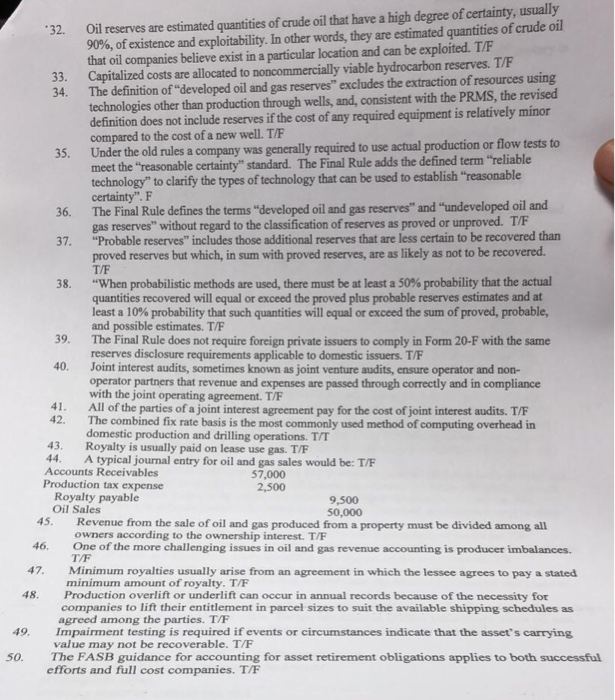

Cost as of 12-31-2016 1. Acquisition Cost$5,000,000 2. Well and Equipment Cost $9,000,000 3. Production for the year 2015 a. Oil b. Gas Reserve Data as of 12-31-2015 Estimated Proved Reserves a. Oil b. Gas Estimated Proved Developed Reserves a. Oil b. Gas 27. Acquisition Cost DD&A a. 250,000 b. 40,000bbl 60,000mcfs 760,000bbl 180,000mcfs 560,000bbl 120,000mcfs 25,000 30,000 d. 600,000 e. None of the above 28. Wells and Equipment DD&A 25,000 b. 625,000 30,000 d. e. 29. a. b, 40,000 None of the above Production BOE 10.000 30,000 40,000 C. d. 120,000 U. S. Publicly traded Exploration and Production companies, oil and gas reserves are required to be reported in the notes to their annual reports filed with the SEC. T/F The SEC final rules define the term "reserves" as the estimated remaining quantities of oil and gas and unrelated substances anticipated to be economically producible, as of a given date, by pplication of develooment proiects to unknown accumulations. TF 30. 31. 90% of existence and exploitability. In other words, they are estimated quantities of crude oil that oil companies believe exist in a particular location and can be exploited. T/F 32. Oil reserves are estimated quantities of crude oil that have a high degree of certainty, usually 33. Capitalized costs are allocated to noncommercially viable hydrocarbon reserves. T/F 34. The definition of "developed oil and gas reserves" excludes the extraction of resources using technologies other than production through wells, and, consistent with the PRMS, the revised definition does not include reserves if the cost compared to the cost of a new well. T/F Under the old rules a company was generally required to use actual production or flow tests to meet the "reasonable certainty" standard. The Final Rule adds the defined term "reliable technology" to clarify the types of technology that can be used to establish "reasonable certainty". F The Final Rule defines the terms "developed oil and gas reserves" and "undeveloped oil and gas reserves" without regard to the classification of reserves as proved or unproved. T/F "Probable reserves" includes those additional reserves that are less certain to be recovered than proved reserves but which, in sum with proved reserves, are as likely as not to be recovered T/F "When probabilistic methods are used, there must be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves stimates and at least a 10% probability that such quantities will equal or exceed the sum of proved, probable, and possible estimates. T/F oft i relatively minor 35. 36. 37. 38, 39. The Final Rule does not require foreign private issuers to comply in Form 20-F with the same 40. Joint interest audits, sometimes known as joint venture audits, ensure operator and non- reserves disclosure requirements applicable to domestic issuers. T/F operator partners that revenue and expenses are passed through correctly and in compliance with the joint operating agreement. T/F All of the parties of a joint interest agreement pay for the cost of joint interest audits. T/F The combined fix rate basis is the most commonly used method of computing overhead in domestic production and drilling operations. T/T 41. 42. 43. Royalty is usually paid on lease use gas. T/F 44. A typical journal entry for oil and gas sales would be: T/F Accounts Receivables Production tax expense 57,000 Royalty payable 9,500 50,000 Oil Sales 45. 46. 47. Revenue from the sale of oil and gas produced from a property must be divided among all owners according to the ownership interest. T/F One of the more challenging issues in oil and gas revenue accounting is producer imbalances. T/F Minimum royalties usually arise from an agreement in which the lessee agrees to pay a stated minimum amount of royalty. T/F Production overlift or underlift can occur in annual records because of the necessity for companies to lift their entitlement in parcel sizes to suit the available shipping schedules as 48. agreed among the parties. T 49. Impairment testing is required if events or circumstances indicate that the asset's carrying value may not be recoverable. T/F The FASB guidance for accounting for asset retirement obligations applies to both successful efforts and full cost companies. T/F 50. Cost as of 12-31-2016 1. Acquisition Cost$5,000,000 2. Well and Equipment Cost $9,000,000 3. Production for the year 2015 a. Oil b. Gas Reserve Data as of 12-31-2015 Estimated Proved Reserves a. Oil b. Gas Estimated Proved Developed Reserves a. Oil b. Gas 27. Acquisition Cost DD&A a. 250,000 b. 40,000bbl 60,000mcfs 760,000bbl 180,000mcfs 560,000bbl 120,000mcfs 25,000 30,000 d. 600,000 e. None of the above 28. Wells and Equipment DD&A 25,000 b. 625,000 30,000 d. e. 29. a. b, 40,000 None of the above Production BOE 10.000 30,000 40,000 C. d. 120,000 U. S. Publicly traded Exploration and Production companies, oil and gas reserves are required to be reported in the notes to their annual reports filed with the SEC. T/F The SEC final rules define the term "reserves" as the estimated remaining quantities of oil and gas and unrelated substances anticipated to be economically producible, as of a given date, by pplication of develooment proiects to unknown accumulations. TF 30. 31. 90% of existence and exploitability. In other words, they are estimated quantities of crude oil that oil companies believe exist in a particular location and can be exploited. T/F 32. Oil reserves are estimated quantities of crude oil that have a high degree of certainty, usually 33. Capitalized costs are allocated to noncommercially viable hydrocarbon reserves. T/F 34. The definition of "developed oil and gas reserves" excludes the extraction of resources using technologies other than production through wells, and, consistent with the PRMS, the revised definition does not include reserves if the cost compared to the cost of a new well. T/F Under the old rules a company was generally required to use actual production or flow tests to meet the "reasonable certainty" standard. The Final Rule adds the defined term "reliable technology" to clarify the types of technology that can be used to establish "reasonable certainty". F The Final Rule defines the terms "developed oil and gas reserves" and "undeveloped oil and gas reserves" without regard to the classification of reserves as proved or unproved. T/F "Probable reserves" includes those additional reserves that are less certain to be recovered than proved reserves but which, in sum with proved reserves, are as likely as not to be recovered T/F "When probabilistic methods are used, there must be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves stimates and at least a 10% probability that such quantities will equal or exceed the sum of proved, probable, and possible estimates. T/F oft i relatively minor 35. 36. 37. 38, 39. The Final Rule does not require foreign private issuers to comply in Form 20-F with the same 40. Joint interest audits, sometimes known as joint venture audits, ensure operator and non- reserves disclosure requirements applicable to domestic issuers. T/F operator partners that revenue and expenses are passed through correctly and in compliance with the joint operating agreement. T/F All of the parties of a joint interest agreement pay for the cost of joint interest audits. T/F The combined fix rate basis is the most commonly used method of computing overhead in domestic production and drilling operations. T/T 41. 42. 43. Royalty is usually paid on lease use gas. T/F 44. A typical journal entry for oil and gas sales would be: T/F Accounts Receivables Production tax expense 57,000 Royalty payable 9,500 50,000 Oil Sales 45. 46. 47. Revenue from the sale of oil and gas produced from a property must be divided among all owners according to the ownership interest. T/F One of the more challenging issues in oil and gas revenue accounting is producer imbalances. T/F Minimum royalties usually arise from an agreement in which the lessee agrees to pay a stated minimum amount of royalty. T/F Production overlift or underlift can occur in annual records because of the necessity for companies to lift their entitlement in parcel sizes to suit the available shipping schedules as 48. agreed among the parties. T 49. Impairment testing is required if events or circumstances indicate that the asset's carrying value may not be recoverable. T/F The FASB guidance for accounting for asset retirement obligations applies to both successful efforts and full cost companies. T/F 50