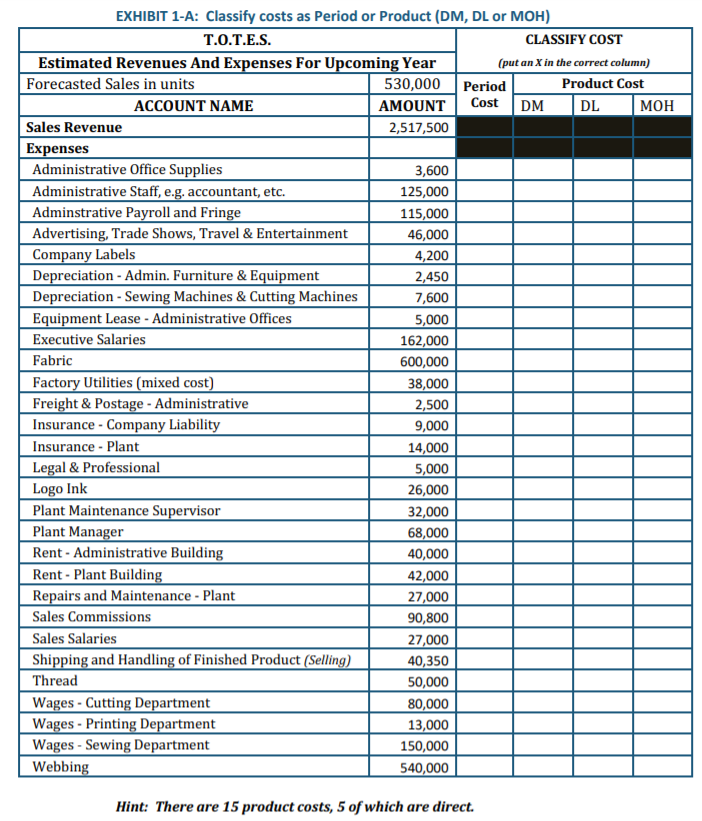

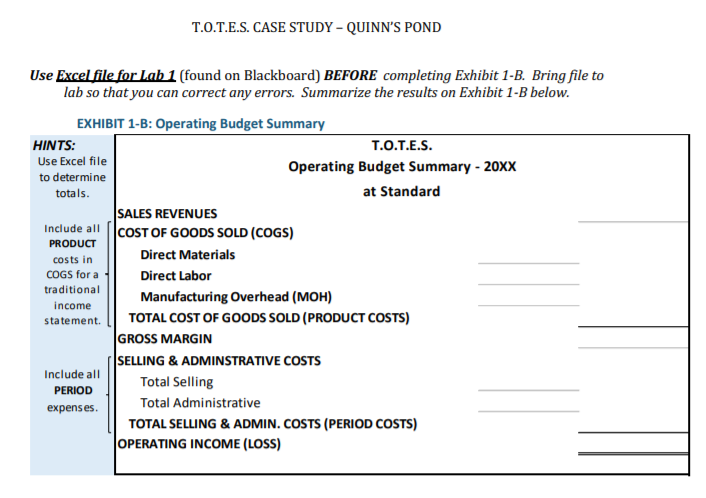

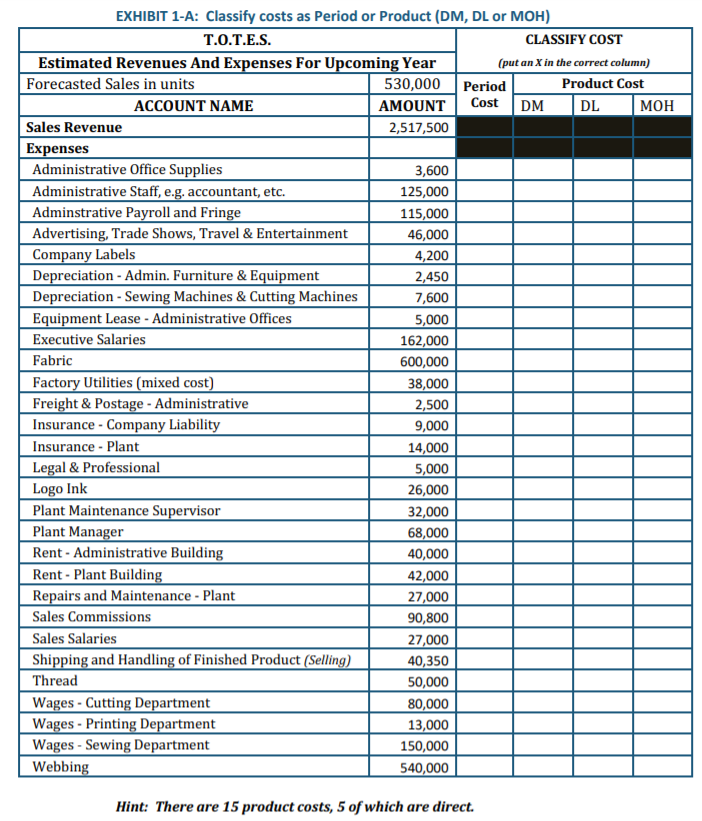

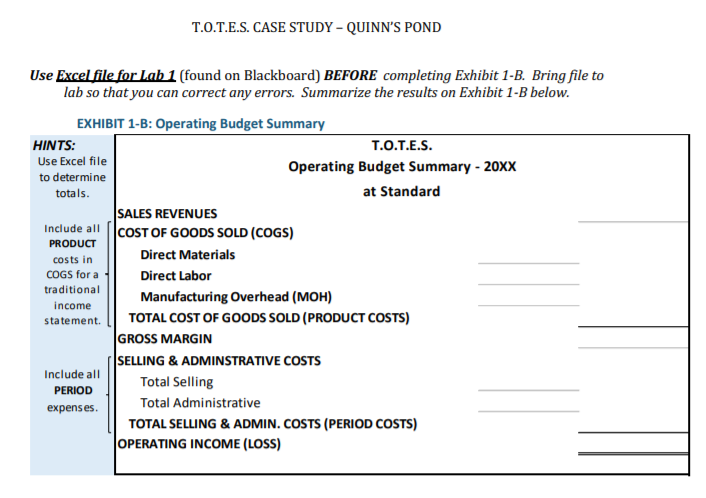

COST CLASSIFICATIONS AND OPERATING BUDGET LAB 1 T.O.T.E.S. is a manufacturing company and keeps close tabs on their costs in order to price their tote bags competitively and maintain profitability. Costs are assigned different classifications depending on the information needed for various managerial decisions. In this lab, students will classify costs as either product or period costs in order to prepare a basic operating budget. Product costs will then be classified as direct material, direct labor or manufacturing overhead (all indirect manufacturing costs) costs so as to calculate estimated direct material costs, direct labor costs and manufacturing overhead. PART 1: Identify costs in Exhibit 1-A as a period or a product cost with respect to the totes. Further identify whether product costs are direct material (DM), direct labor (DL) or manufacturing overhead (MOH) during classification process. After verifying that costs are classified correctly, go on to PART 2. PART 2: On your computer open Excel file for Lab I - Complete the Operating Budget. Use classifications from Exhibit 1-A to complete the company's operating budget for 20XX using a Traditional Income Statement Format. PART 3: Using information from PART 2, complete Exhibit 2-B. EXHIBIT 1-A: Classify costs as Period or Product (DM, DL or MOH) T.O.T.E.S. CLASSIFY COST Estimated Revenues And Expenses For Upcoming Year (put an X in the correct column) Forecasted Sales in units 530,000 Period Product Cost ACCOUNT NAME AMOUNT Cost DM DL MOH Sales Revenue 2,517,500 Expenses Administrative Office Supplies 3,600 Administrative Staff, e.g. accountant, etc. 125,000 Adminstrative Payroll and Fringe 115,000 Advertising, Trade Shows, Travel & Entertainment 46,000 Company Labels 4,200 Depreciation - Admin. Furniture & Equipment 2,450 Depreciation - Sewing Machines & Cutting Machines 7,600 Equipment Lease - Administrative Offices 5,000 Executive Salaries 162,000 Fabric 600,000 Factory Utilities (mixed cost) 38,000 Freight & Postage - Administrative 2,500 Insurance - Company Liability 9,000 Insurance - Plant 14,000 Legal & Professional Logo Ink 26,000 Plant Maintenance Supervisor 32,000 Plant Manager 68,000 Rent - Administrative Building 40,000 Rent - Plant Building 42,000 Repairs and Maintenance - Plant 27,000 Sales Commissions 90,800 Sales Salaries 27,000 Shipping and Handling of Finished Product (Selling) 40,350 Thread 50,000 Wages - Cutting Department 80,000 Wages - Printing Department 13,000 Wages - Sewing Department 150,000 Webbing 540,000 5,000 Hint: There are 15 product costs, 5 of which are direct. T.O.T.E.S. CASE STUDY - QUINN'S POND Use Excel file for Lab 1 (found on Blackboard) BEFORE completing Exhibit 1-B. Bring file to lab so that you can correct any errors. Summarize the results on Exhibit 1-B below. EXHIBIT 1-B: Operating Budget Summary HINTS: T.O.T.E.S. Use Excel file to determine Operating Budget Summary - 20XX totals. at Standard SALES REVENUES Include all (COST OF GOODS SOLD (COGS) PRODUCT Direct Materials COGS for a Direct Labor traditional Manufacturing Overhead (MOH) income statement TOTAL COST OF GOODS SOLD (PRODUCT COSTS) GROSS MARGIN SELLING & ADMINSTRATIVE COSTS Include all PERIOD Total Selling expenses. Total Administrative TOTAL SELLING & ADMIN. COSTS (PERIOD COSTS) OPERATING INCOME (LOSS) costs in