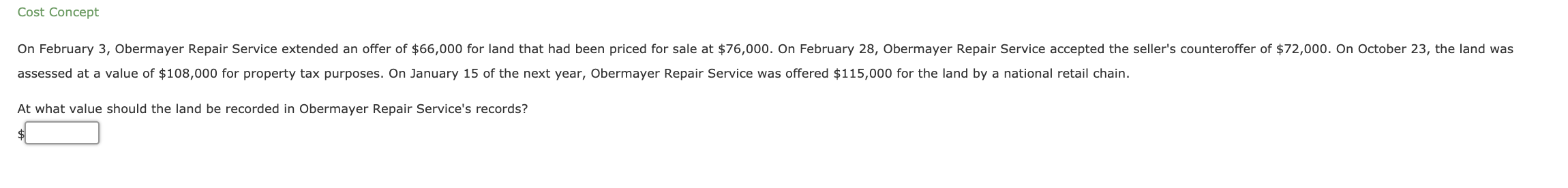

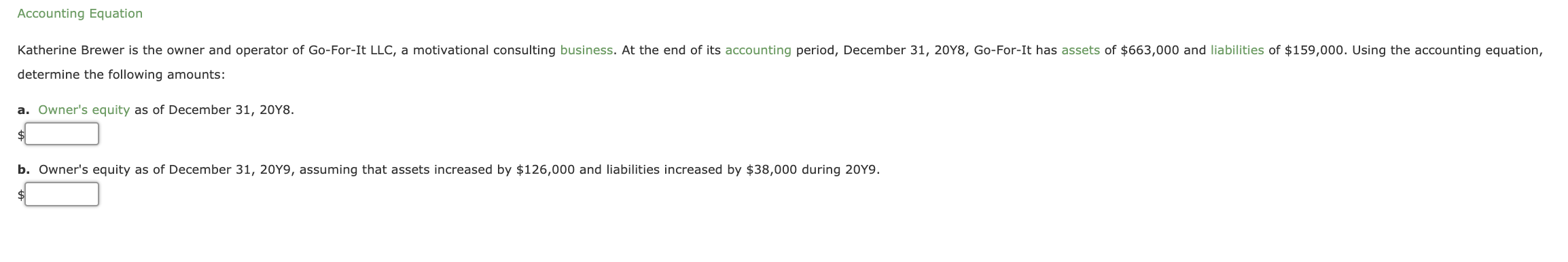

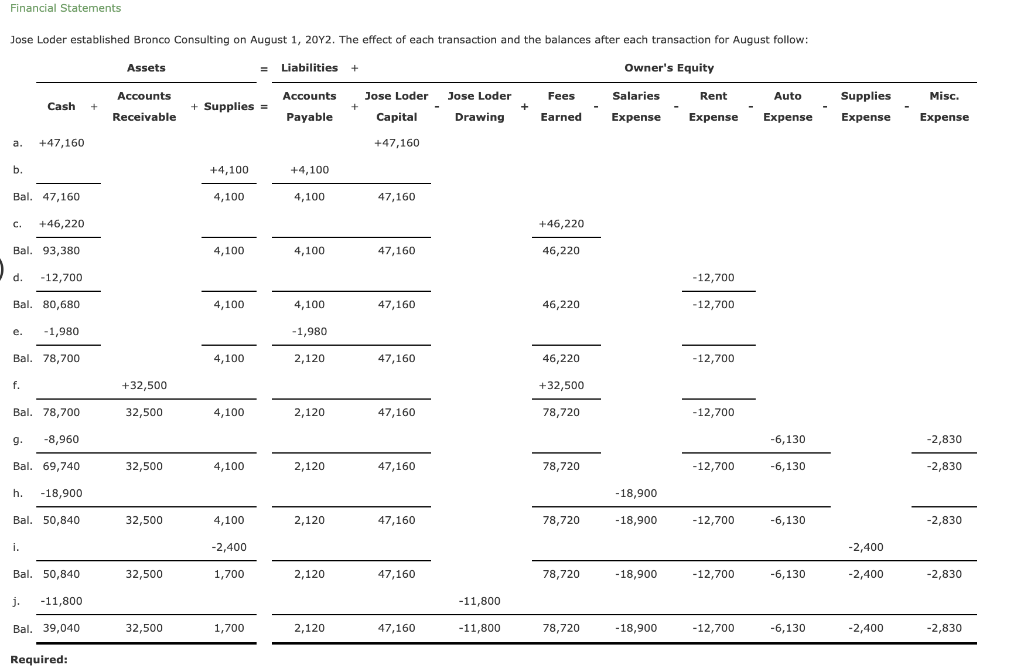

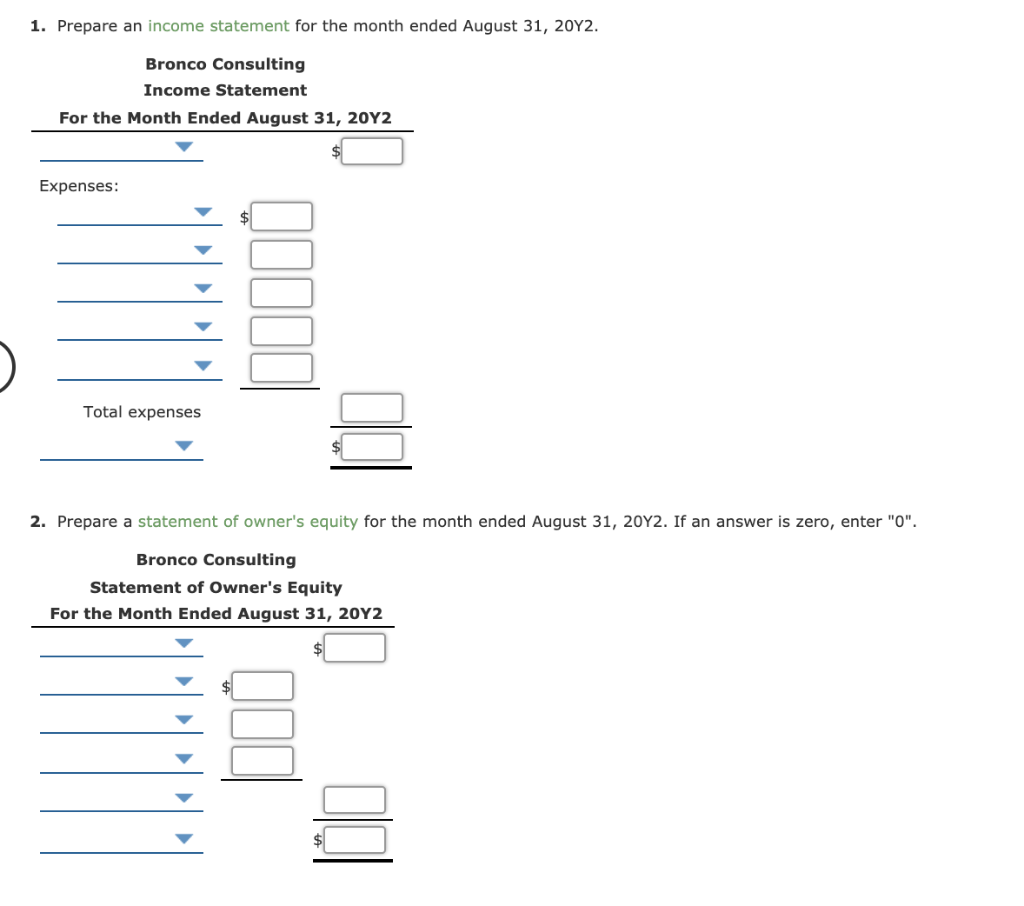

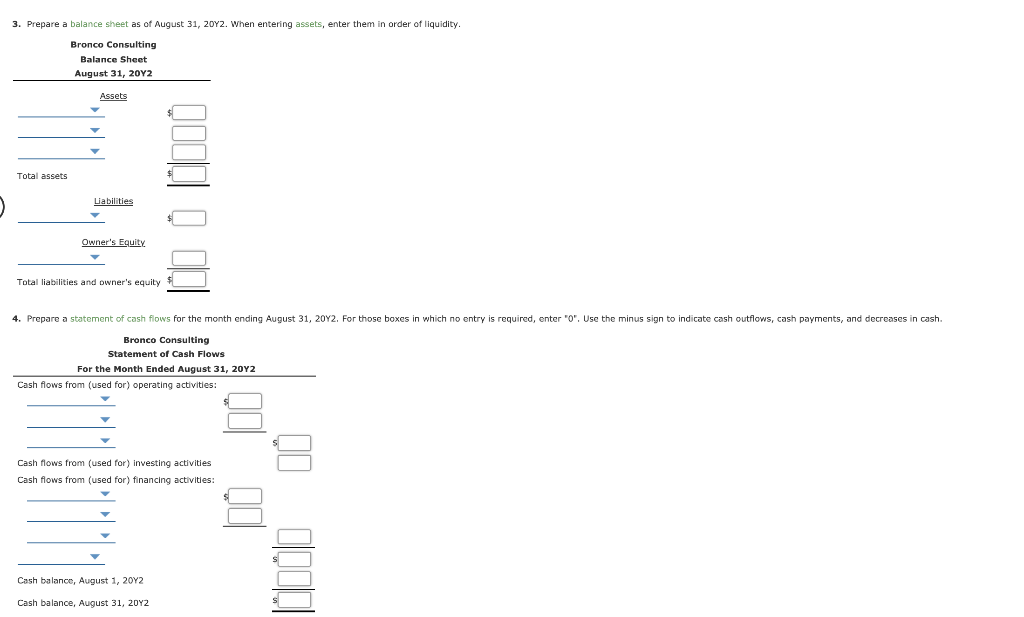

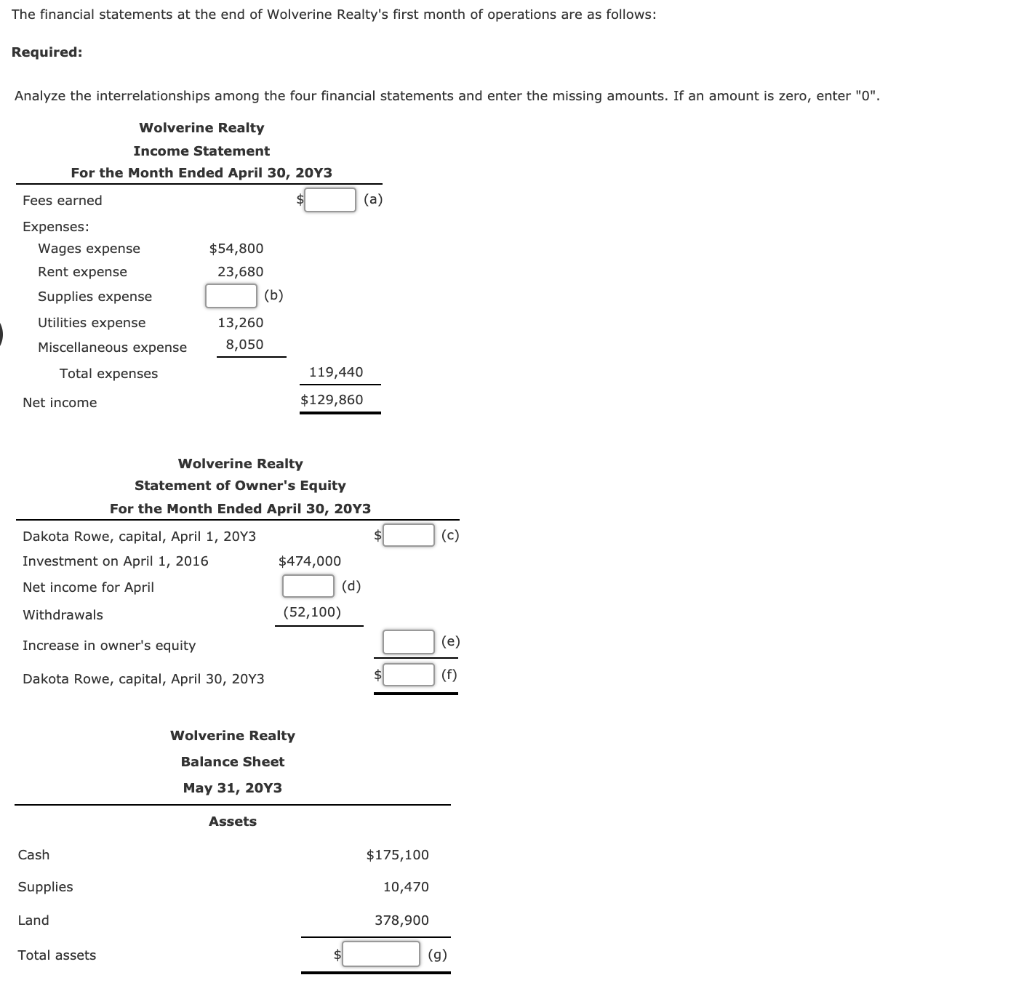

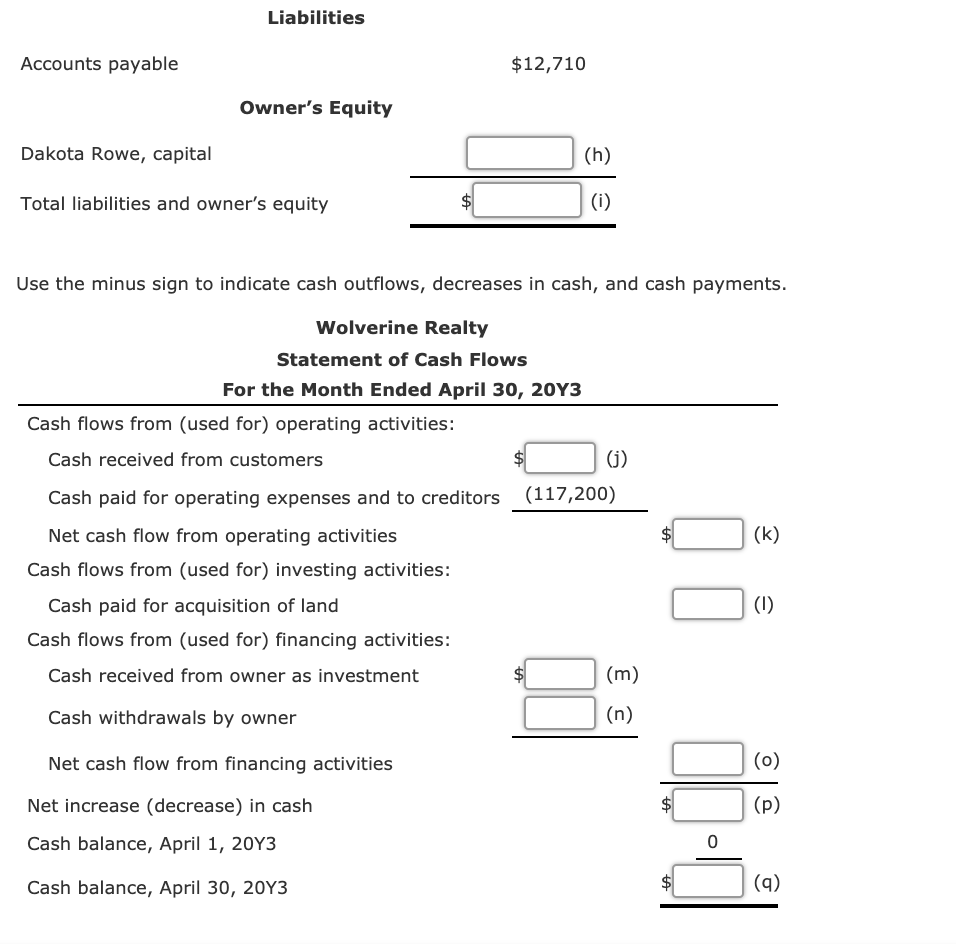

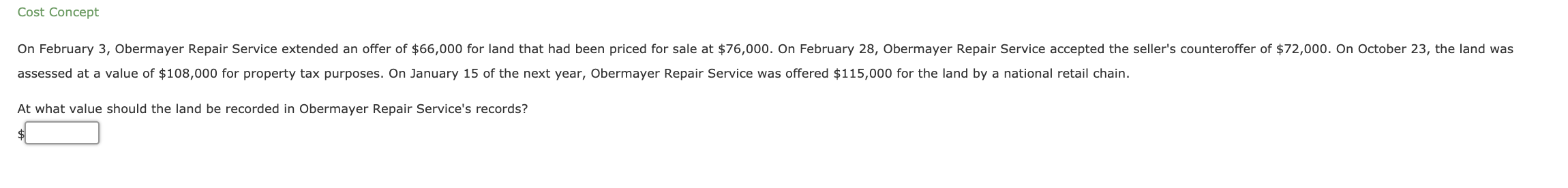

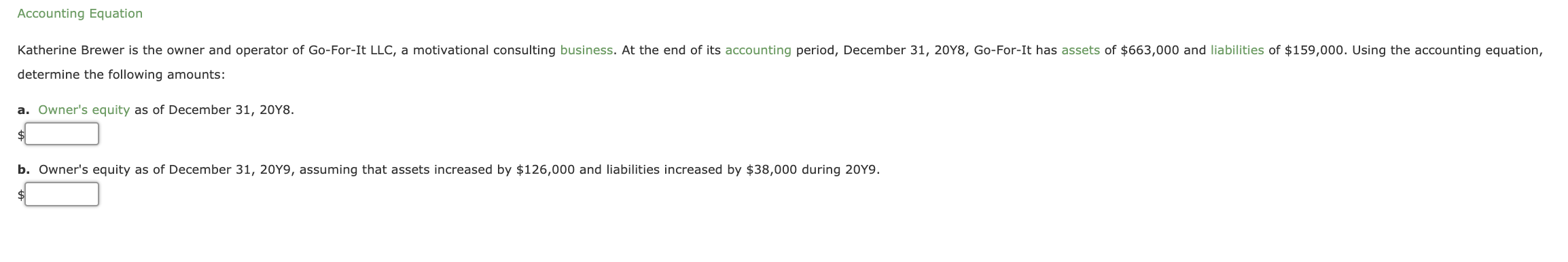

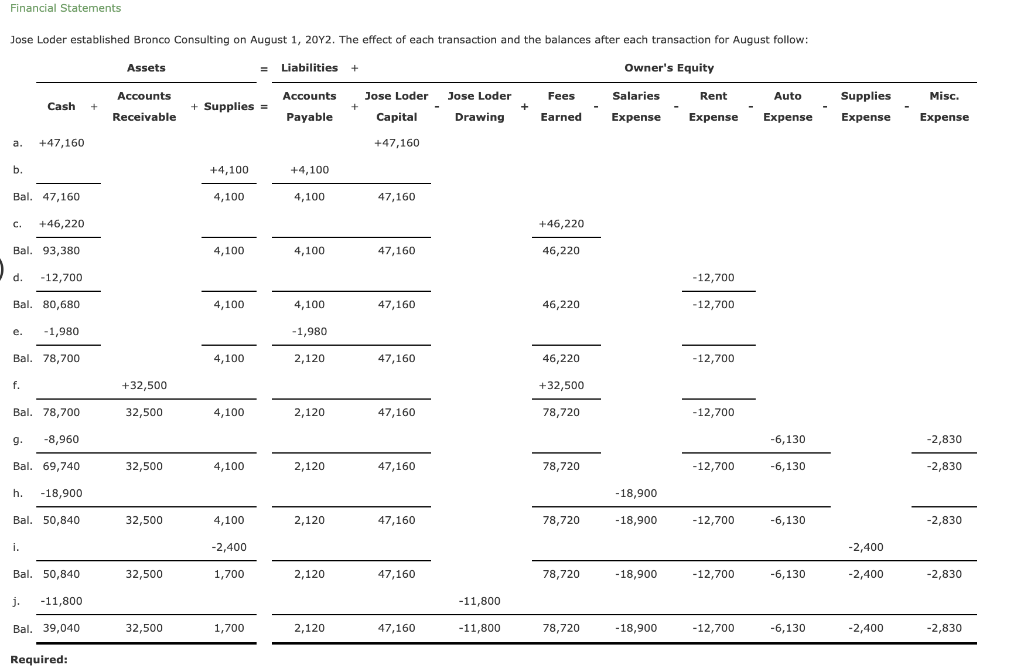

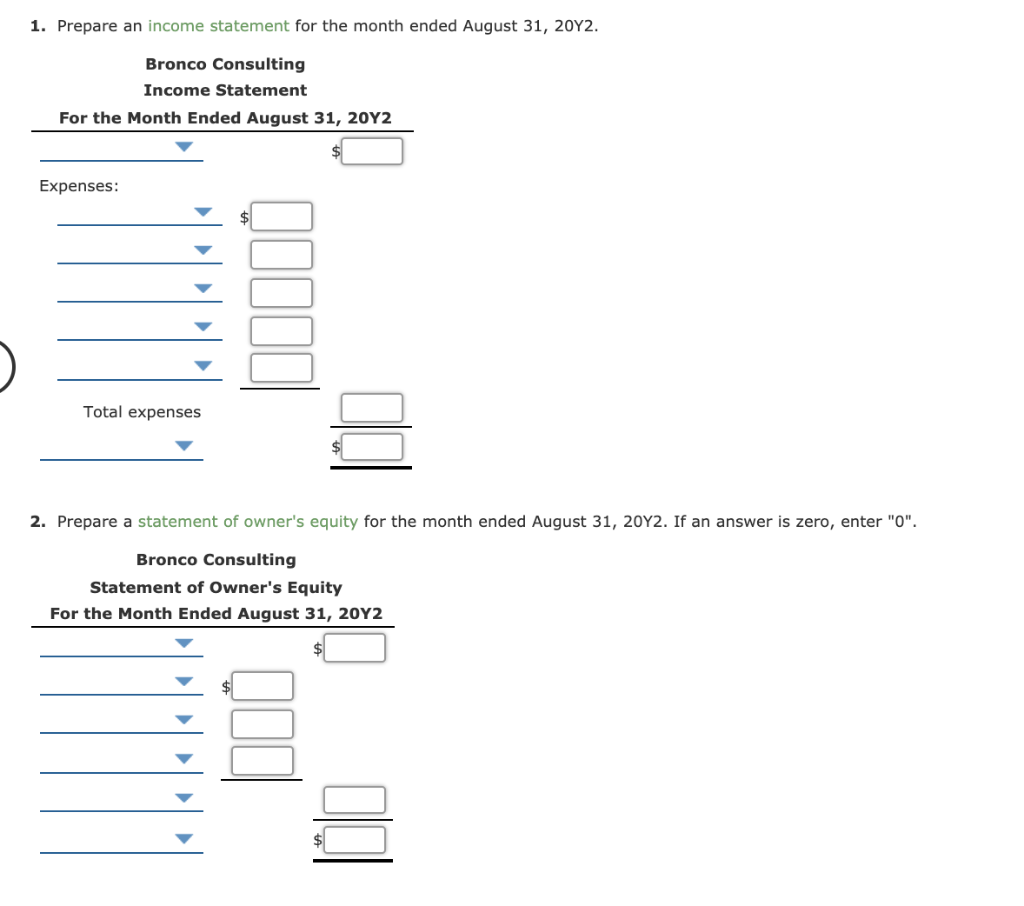

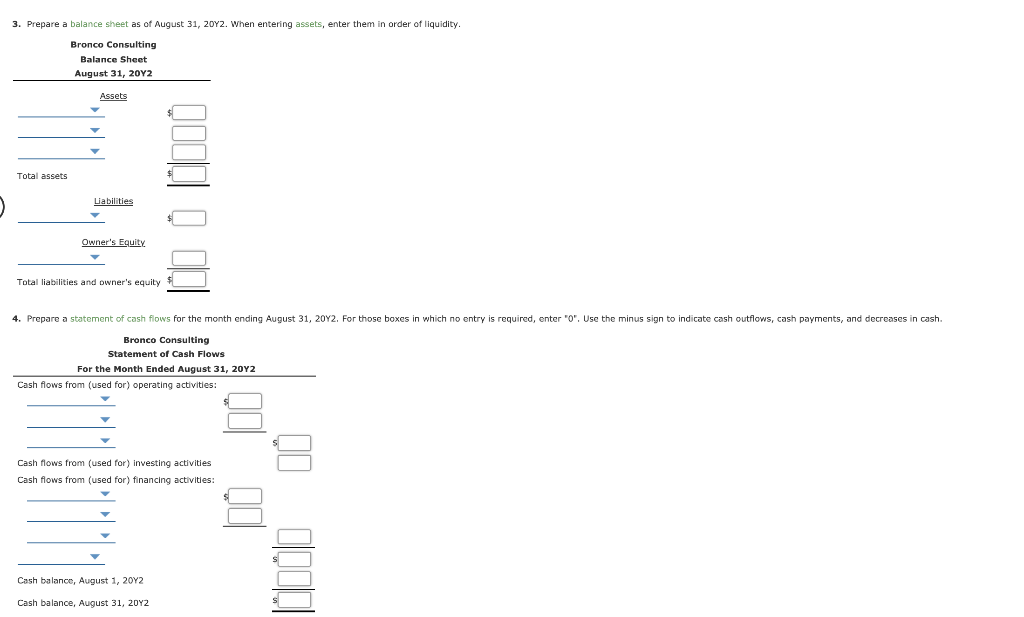

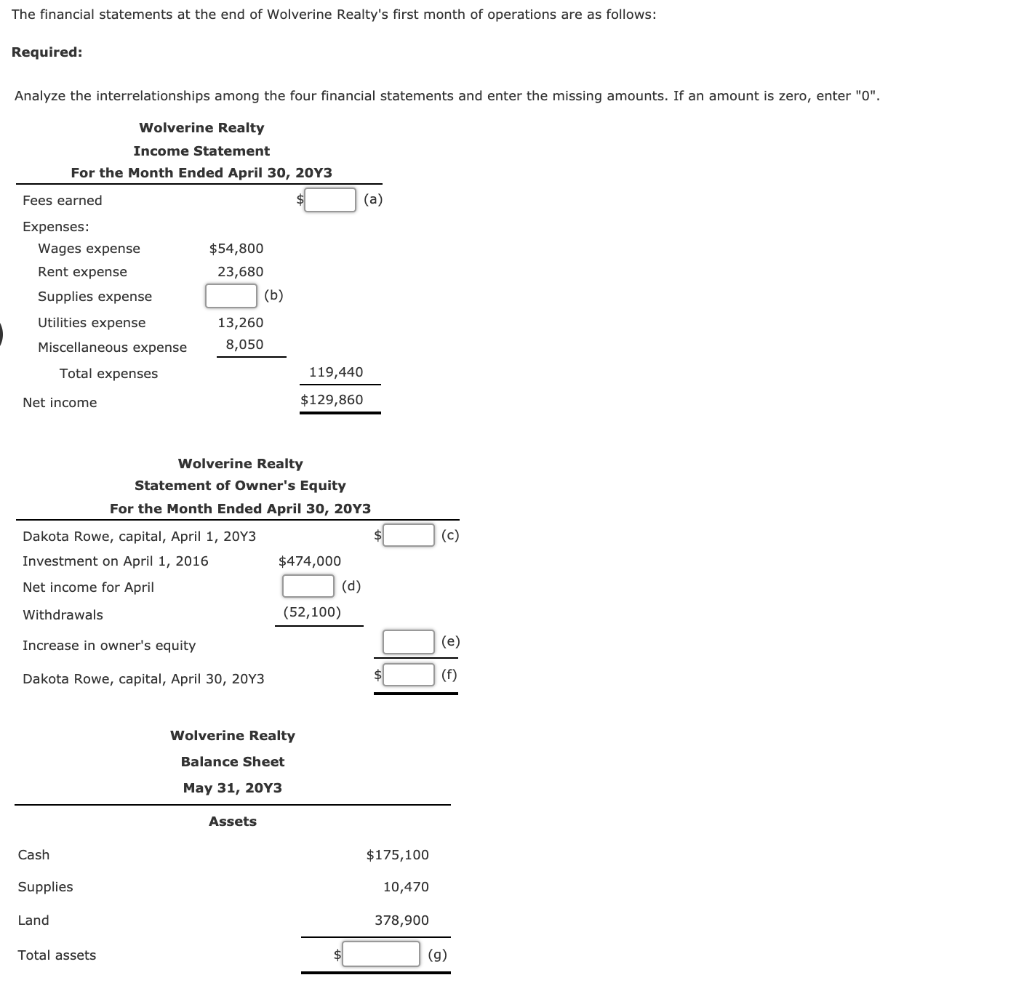

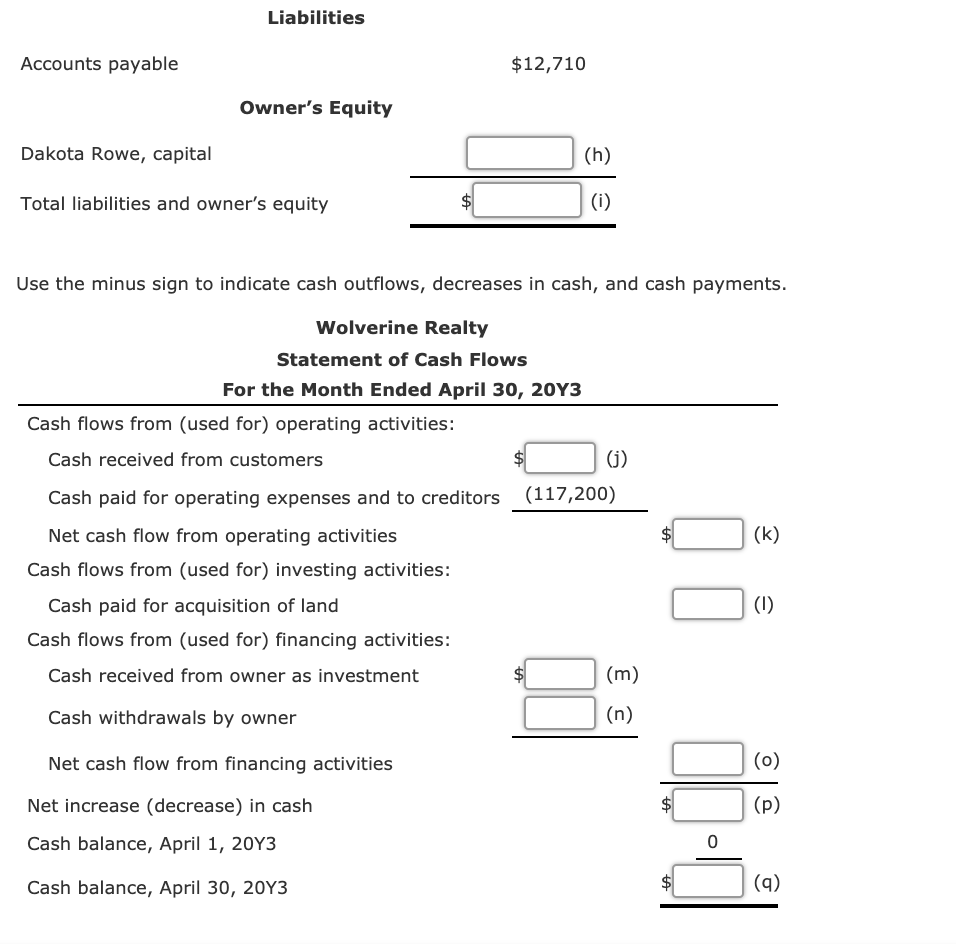

Cost Concept On February 3, Obermayer Repair Service extended an offer of $66,000 for land that had been priced for sale at $76,000. On February 28, Obermayer Repair Service accepted the seller's counteroffer of $72,000. On October 23, the land was assessed at a value of $108,000 for property tax purposes. On January 15 of the next year, Obermayer Repair Service was offered $115,000 for the land by a national retail chain. At what value should the land be recorded in Obermayer Repair Service's records? Accounting Equation Katherine Brewer is the owner and operator of Go-For-It LLC, a motivational consulting business. At the end of its accounting period, December 31, 20Y8, Go-For-It has assets of $663,000 and liabilities of $159,000. Using the accounting equation, determine the following amounts: a. Owner's equity as of December 31, 20Y8. b. Owner's equity as of December 31, 2019, assuming that assets increased by $126,000 and liabilities increased by $38,000 during 2049. Financial Statements Jose Loder established Bronco Consulting on August 1, 2022. The effect of each transaction and the balances after each transaction for August follow: Assets = Liabilities + Owner's Equity Accounts Accounts Jose Loder Fees Salaries Rent Auto Supplies Misc. Cash + + Supplies = Jose Loder + Capital + Receivable Payable Drawing Earned Expense Expense Expense Expense Expense a. +47,160 +47,160 b. +4,100 +4,100 Bal. 47,160 4,100 4,100 47,160 c. +46,220 +46,220 Bal. 93,380 4,100 4,100 47,160 46,220 d. -12,700 -12,700 Bal. 80,680 4,100 4,100 47,160 46,220 -12,700 e. -1,980 -1,980 Bal. 78,700 4,100 2,120 47,160 46,220 -12,700 f. +32,500 +32,500 Bal. 78,700 32,500 4,100 2,120 47,160 78,720 -12,700 g. -8,960 -6,130 -2,830 Bal. 69,740 32,500 4,100 2,120 47,160 78,720 -12,700 -6,130 -2,830 h. -18,900 -18,900 Bal. 50,840 32,500 4,100 2,120 47,160 78,720 -18,900 -12,700 -6,130 -2,830 i. -2,400 -2,400 Bal. 50,840 32,500 1,700 2,120 47,160 78,720 -18,900 -12,700 -6,130 -2,400 -2,830 j. -11,800 -11,800 Bal. 39,040 32,500 1,700 2,120 47,160 -11,800 78,720 -18,900 -12,700 -6,130 -2,400 -2,830 Required: 1. Prepare an income statement for the month ended August 31, 20Y2. Bronco Consulting Income Statement For the Month Ended August 31, 20Y2 Expenses: Total expenses 2. Prepare a statement of owner's equity for the month ended August 31, 20Y2. If an answer is zero, enter "O". Bronco Consulting Statement of Owner's Equity For the Month Ended August 31, 2012 OJ 3. Prepare a balance sheet as of August 31, 2012. When entering assets, enter them in order of liquidity. Bronco Consulting Balance Sheet August 31, 2012 Assets Total assets $ abilities Owner's Equity Total liabilities and owner's equity $ 4. Prepare a statement of cash flows for the month ending August 31, 20Y2. For those boxes which no entry is required, enter "O". Use the minus sign to indicate cash outflows, cash payments, and decreases in cash Bronco Consulting Statement of Cash Flows For the Month Ended August 31, 2012 Cash flows from (used for) operating activities: Cash fram used for) investing activities Cash flows from (used for) financing activities: Cash balance, August 1, 2012 Cash balance, August 31, 2012 The financial statements at the end of Wolverine Realty's first month of operations are as follows: Required: Analyze the interrelationships among the four financial statements and enter the missing amounts. If an amount is zero, enter "0". Wolverine Realty Income Statement For the Month Ended April 30, 2013 Fees earned (a) Expenses: Wages expense $54,800 Rent expense 23,680 Supplies expense (b) Utilities expense 13,260 Miscellaneous expense 8,050 Total expenses 119,440 Net income $129,860 Wolverine Realty Statement of Owner's Equity For the Month Ended April 30, 20Y3 Dakota Rowe, capital, April 1, 20Y3 (c) Investment on April 1, 2016 $474,000 Net income for April (d) Withdrawals (52,100) Increase in owner's equity (e) Dakota Rowe, capital, April 30, 2013 (f) Wolverine Realty Balance Sheet May 31, 20Y3 Assets Cash $175,100 Supplies 10,470 Land 378,900 Total assets (9)