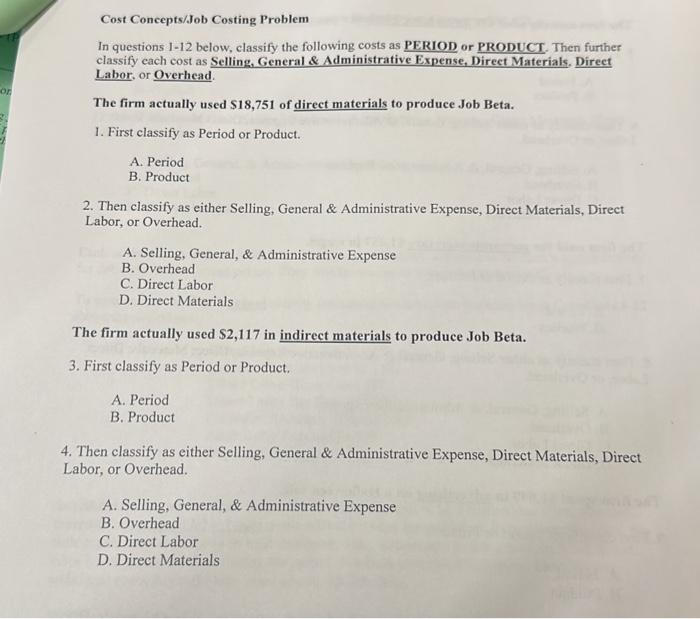

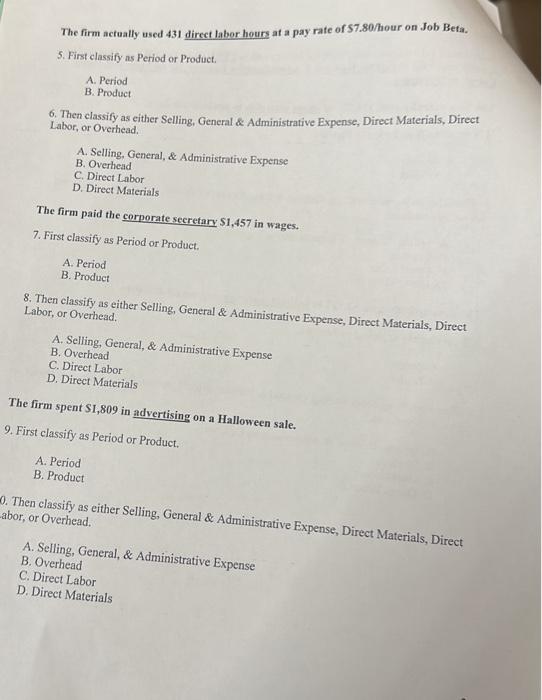

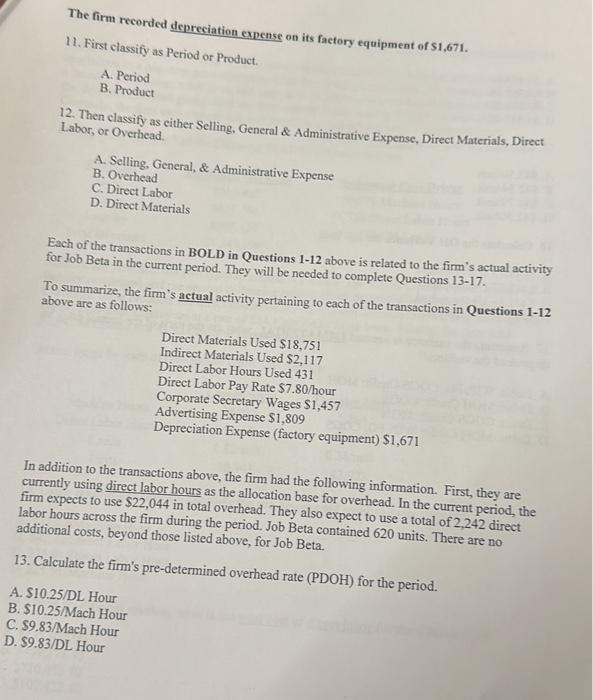

Cost Concepts/Job Costing Problem In questions 1-12 below, classify the following costs as PERIOD or PRODUCT. Then further classify each cost as Selling, General \& Administrative Expense, Direet Materials, Direet Labor, or Overhead. The firm actually used $18,751 of direct materials to produce Job Beta. 1. First classify as Period or Product. A. Period B. Product 2. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct Labor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials The firm actually used $2,117 in indirect materials to produce Job Beta. 3. First classify as Period or Product. A. Period B. Product 4. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct Labor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials The firm actually used 431 direct labor hours at a pay rate of 57.80/hour on Job Befa. 5. First classify as Period or Product. A. Period B. Product 6. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct Labor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials The firm paid the corporate secretary $1,457 in wages. 7. First classify as Period or Product. A. Period B. Product 8. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct. Labor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials The firm spent SI,809 in advertising on a Halloween sale. 9. First classify as Period or Product. A. Period B. Product 0. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct abor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials The firm recorded depreciation expense on its factory equipment of $1,671. 11. First classify as Period or Product. A. Period B. Product 12. Then classify as either Selling, General \& Administrative Expense, Direct Materials, Direct Labor, or Overhead. A. Selling, General, \& Administrative Expense B. Overhead C. Direct Labor D. Direct Materials Each of the transactions in BOLD in Questions 1-12 above is related to the firm's actual activity for Job Beta in the current period. They will be needed to complete Questions 13-17. To summarize, the firm's actual activity pertaining to each of the transactions in Questions 1-12 above are as follows: Direct Materials Used $18,751 Indirect Materials Used \$2,117 Direct Labor Hours Used 431 Direct Labor Pay Rate \$7.80/hour Corporate Secretary Wages \$1,457 Advertising Expense $1,809 Depreciation Expense (factory equipment) $1,671 In addition to the transactions above, the firm had the following information. First, they are currently using direct labor hours as the allocation base for overhead. In the current period, the labor hours to use $22,044 in total overhead. They also expect to use a total of 2,242 direct additional costs, beyond those listed above, for Job Beta. 13. Calculate the firm's pre-determined overhead rate (PDOH) for the period. A. $10.25/DL Hour B. $10.25/ Mach Hour C. $9.83/Mach Hour D. $9.83 /DL Hour