Cost Data for SEWMEX

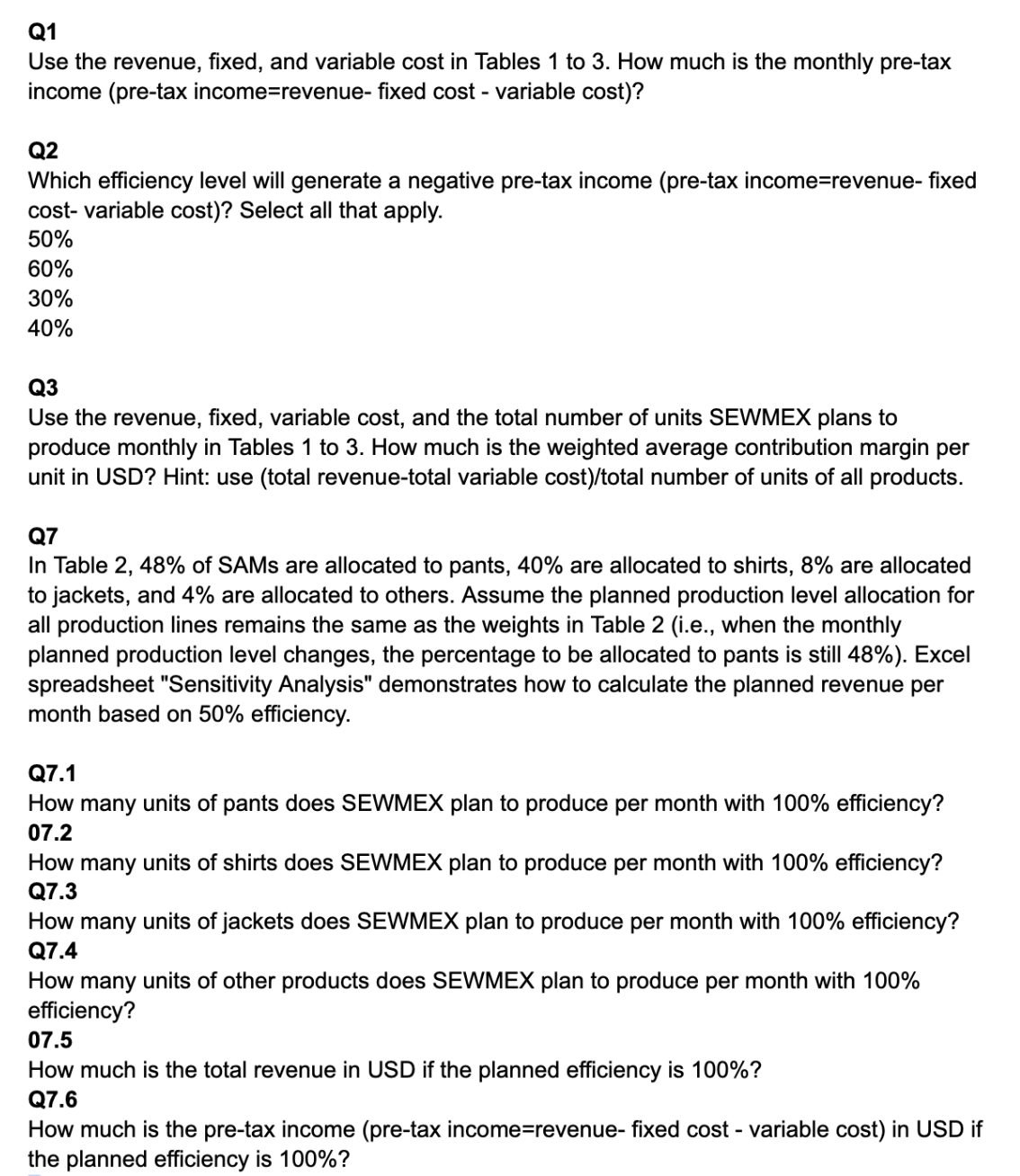

The president provided you with total monthly estimated cost data (Table 3), which were salvaged from the presidents last meeting with the former controller of SEW. The president reminded you that only assembly labor that has SAM values for their operations are considered direct labor and that both he and the former controller had felt that to meet the planned production levels for SEWMEX (Table 2), about 400 machine operators would be required. The data in Table 3 are based on total employment of 500 workers, including 400 machine operators.

Please answer the below questions wit the above data:

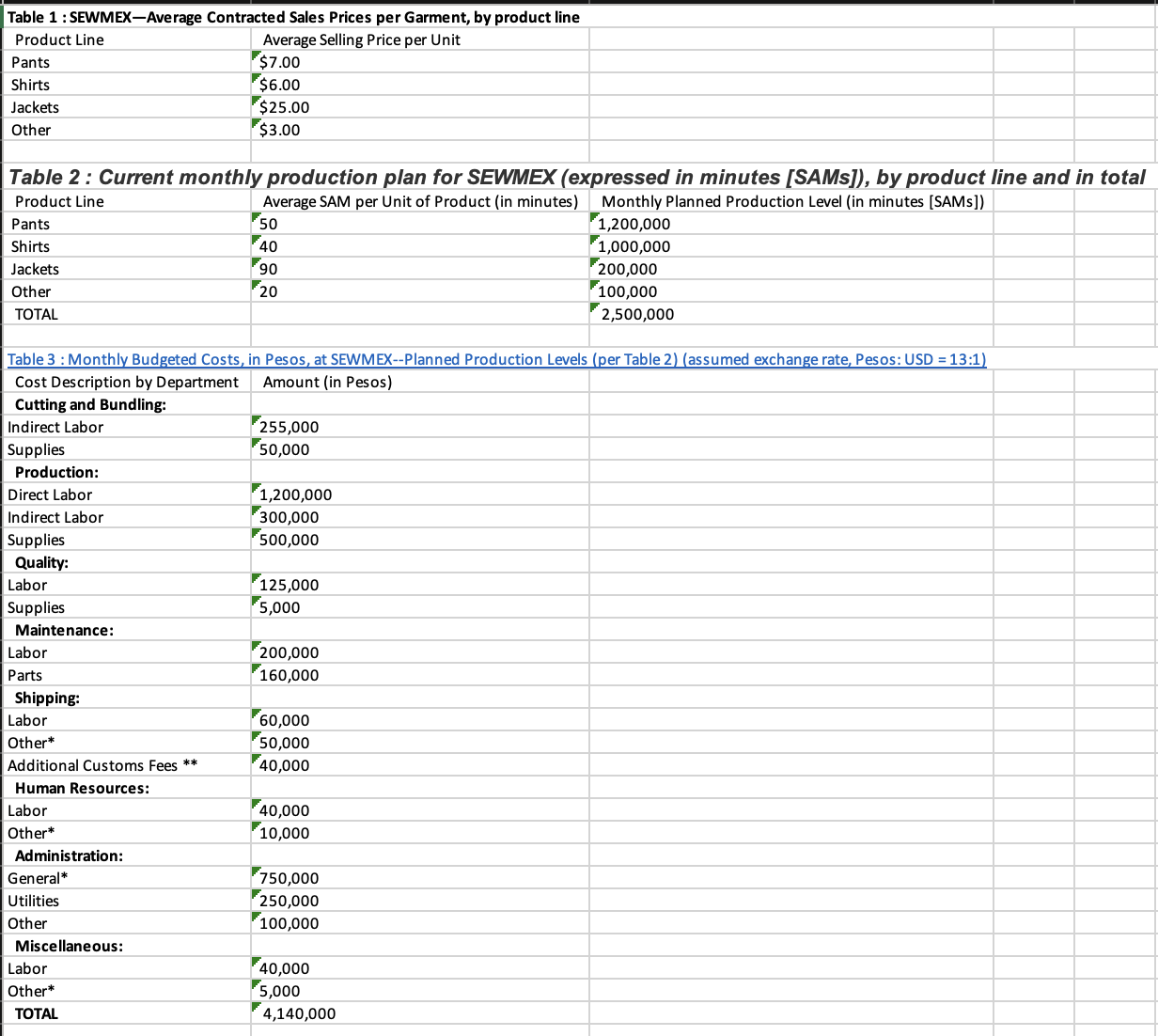

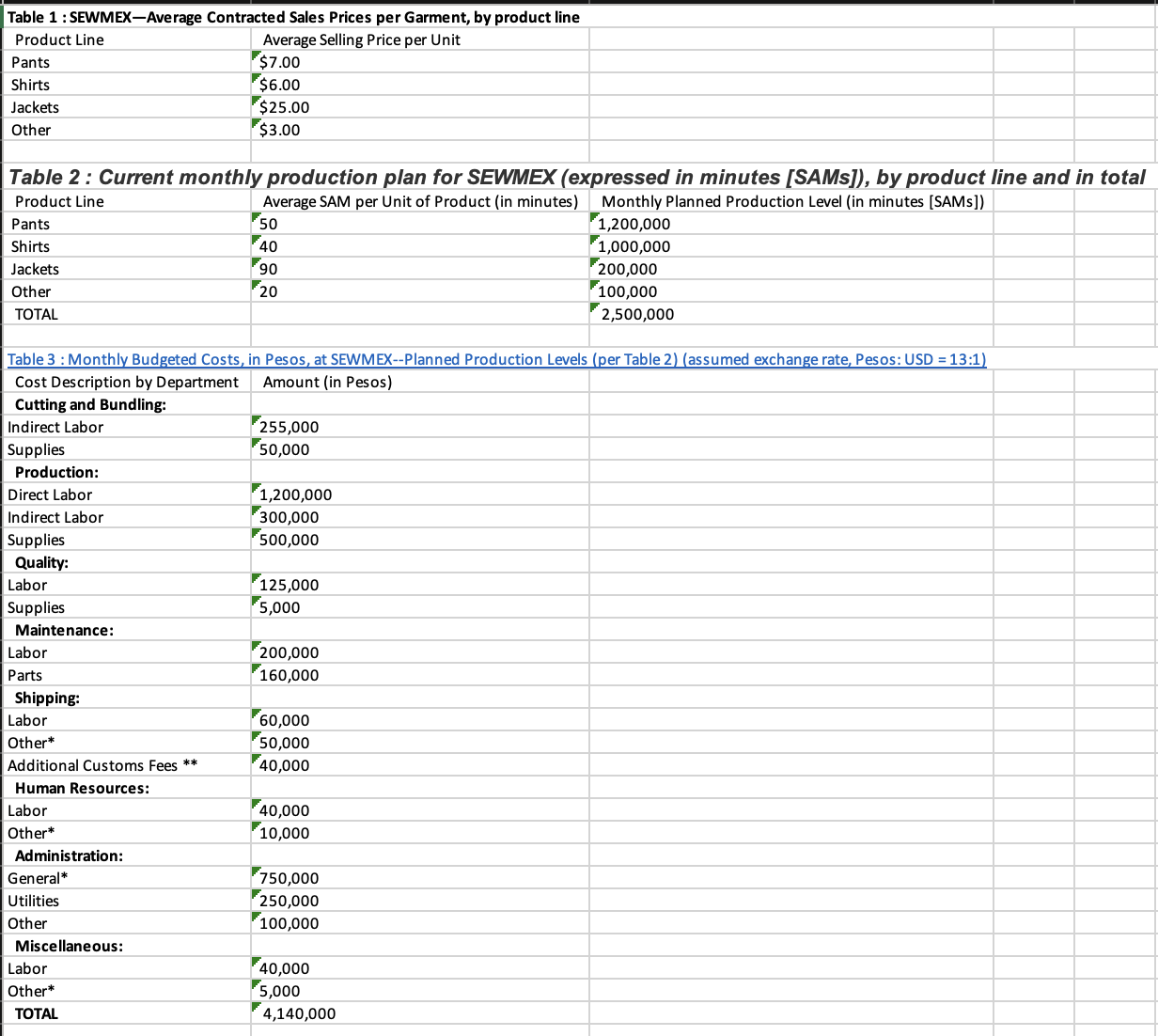

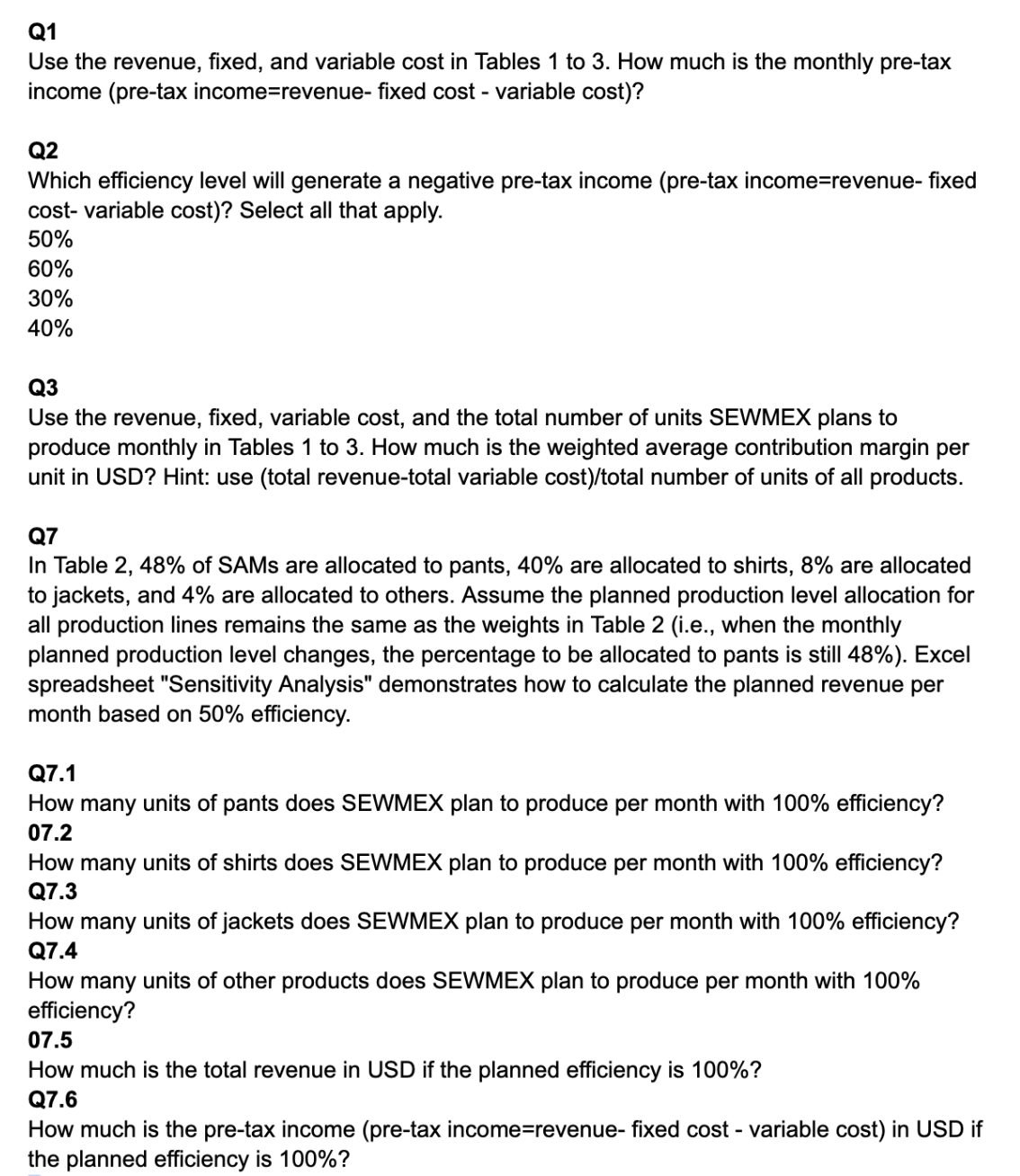

Table 1 : SEWMEX-Average Contracted Sales Prices per Garment, by product line Table 3 : Monthly Budgeted Costs, in Pesos, at SEWMEX--Planned Production Levels (per Table 2) (assumed exchange rate, Pesos: USD = 13:1) Q1 Use the revenue, fixed, and variable cost in Tables 1 to 3. How much is the monthly pre-tax income (pre-tax income=revenue- fixed cost - variable cost)? Q2 Which efficiency level will generate a negative pre-tax income (pre-tax income=revenue- fixed cost- variable cost)? Select all that apply. 50% 60% 30% 40% Q3 Use the revenue, fixed, variable cost, and the total number of units SEWMEX plans to produce monthly in Tables 1 to 3. How much is the weighted average contribution margin per unit in USD? Hint: use (total revenue-total variable cost)/total number of units of all products. Q7 In Table 2, 48% of SAMs are allocated to pants, 40% are allocated to shirts, 8% are allocated to jackets, and 4% are allocated to others. Assume the planned production level allocation for all production lines remains the same as the weights in Table 2 (i.e., when the monthly planned production level changes, the percentage to be allocated to pants is still 48% ). Excel spreadsheet "Sensitivity Analysis" demonstrates how to calculate the planned revenue per month based on 50% efficiency. Q7.1 How many units of pants does SEWMEX plan to produce per month with 100% efficiency? 07.2 How many units of shirts does SEWMEX plan to produce per month with 100% efficiency? Q7.3 How many units of jackets does SEWMEX plan to produce per month with 100% efficiency? Q7.4 How many units of other products does SEWMEX plan to produce per month with 100% efficiency? 07.5 How much is the total revenue in USD if the planned efficiency is 100% ? Q7.6 How much is the pre-tax income (pre-tax income=revenue- fixed cost - variable cost) in USD if the planned efficiency is 100% ? Table 1 : SEWMEX-Average Contracted Sales Prices per Garment, by product line Table 3 : Monthly Budgeted Costs, in Pesos, at SEWMEX--Planned Production Levels (per Table 2) (assumed exchange rate, Pesos: USD = 13:1) Q1 Use the revenue, fixed, and variable cost in Tables 1 to 3. How much is the monthly pre-tax income (pre-tax income=revenue- fixed cost - variable cost)? Q2 Which efficiency level will generate a negative pre-tax income (pre-tax income=revenue- fixed cost- variable cost)? Select all that apply. 50% 60% 30% 40% Q3 Use the revenue, fixed, variable cost, and the total number of units SEWMEX plans to produce monthly in Tables 1 to 3. How much is the weighted average contribution margin per unit in USD? Hint: use (total revenue-total variable cost)/total number of units of all products. Q7 In Table 2, 48% of SAMs are allocated to pants, 40% are allocated to shirts, 8% are allocated to jackets, and 4% are allocated to others. Assume the planned production level allocation for all production lines remains the same as the weights in Table 2 (i.e., when the monthly planned production level changes, the percentage to be allocated to pants is still 48% ). Excel spreadsheet "Sensitivity Analysis" demonstrates how to calculate the planned revenue per month based on 50% efficiency. Q7.1 How many units of pants does SEWMEX plan to produce per month with 100% efficiency? 07.2 How many units of shirts does SEWMEX plan to produce per month with 100% efficiency? Q7.3 How many units of jackets does SEWMEX plan to produce per month with 100% efficiency? Q7.4 How many units of other products does SEWMEX plan to produce per month with 100% efficiency? 07.5 How much is the total revenue in USD if the planned efficiency is 100% ? Q7.6 How much is the pre-tax income (pre-tax income=revenue- fixed cost - variable cost) in USD if the planned efficiency is 100%