Question

Cost Flows under Activity-Based Costing; Partial T-Accounts Products, Inc. , installed an activity-based costing system several years ago. The company manufactures four products in a

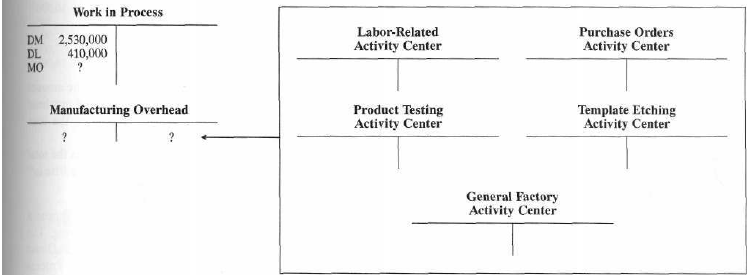

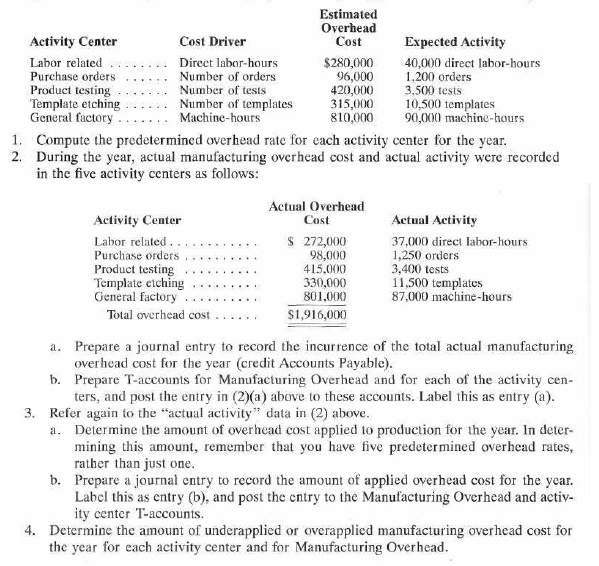

Cost Flows under Activity-Based Costing; Partial T-Accounts Products, Inc. , installed an activity-based costing system several years ago. The company manufactures four products in a single facility and has identified five major activity centers relating to manufacturing overhead. As shown in the following T-accounts, direct materials and direct labor costs for the current year have been added to Work in Process. However, no entries have been made for either actual or applied manufacturing overhead cost.

At the beginning of the year, the company made the following estimates of cost and activity in the five activity centers for the purpoose of computing predetermined overhead rates:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started