Answered step by step

Verified Expert Solution

Question

1 Approved Answer

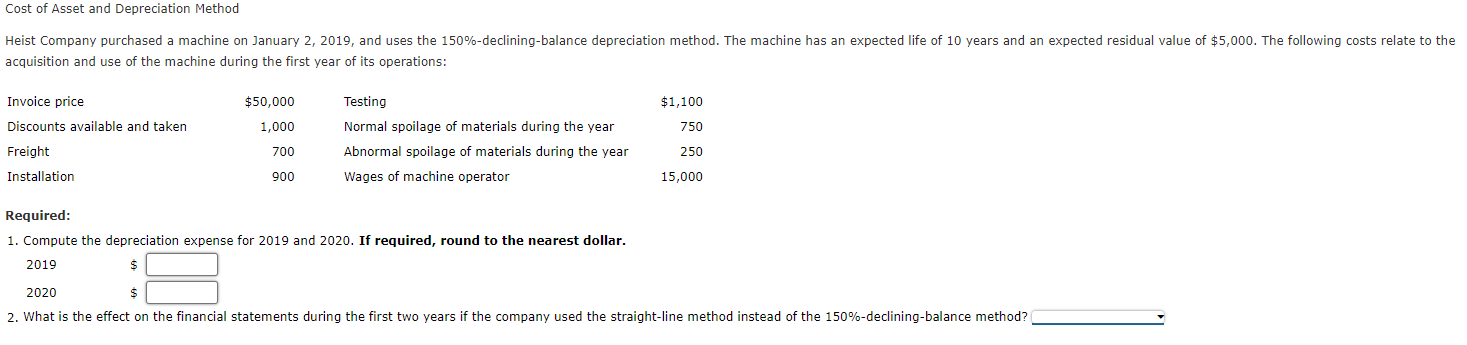

Cost of Asset and Depreciation Method Heist Company purchased a machine on January 2, 2019, and uses the 150%-declining-balance depreciation method. The machine has

Cost of Asset and Depreciation Method Heist Company purchased a machine on January 2, 2019, and uses the 150%-declining-balance depreciation method. The machine has an expected life of 10 years and an expected residual value of $5,000. The following costs relate to the acquisition and use of the machine during the first year of its operations: Invoice price $50,000 Testing $1,100 Discounts available and taken 1,000 Normal spoilage of materials during the year 750 Freight 700 Installation 900 Abnormal spoilage of materials during the year Wages of machine operator 250 15,000 Required: 1. Compute the depreciation expense for 2019 and 2020. If required, round to the nearest dollar. 2019 2020 $ 2. What is the effect on the financial statements during the first two years if the company used the straight-line method instead of the 150%-declining-balance method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started