Cost of borrowing is 5%

bank lending rate = 5%

Salary in 2016 was $600,000 and increased by $100,000 each year.

Equipment cost, fixtures and leasehold costs = $750,000

Upgrade costs = $50,000

Create DCF model to determine fair market value of shares.

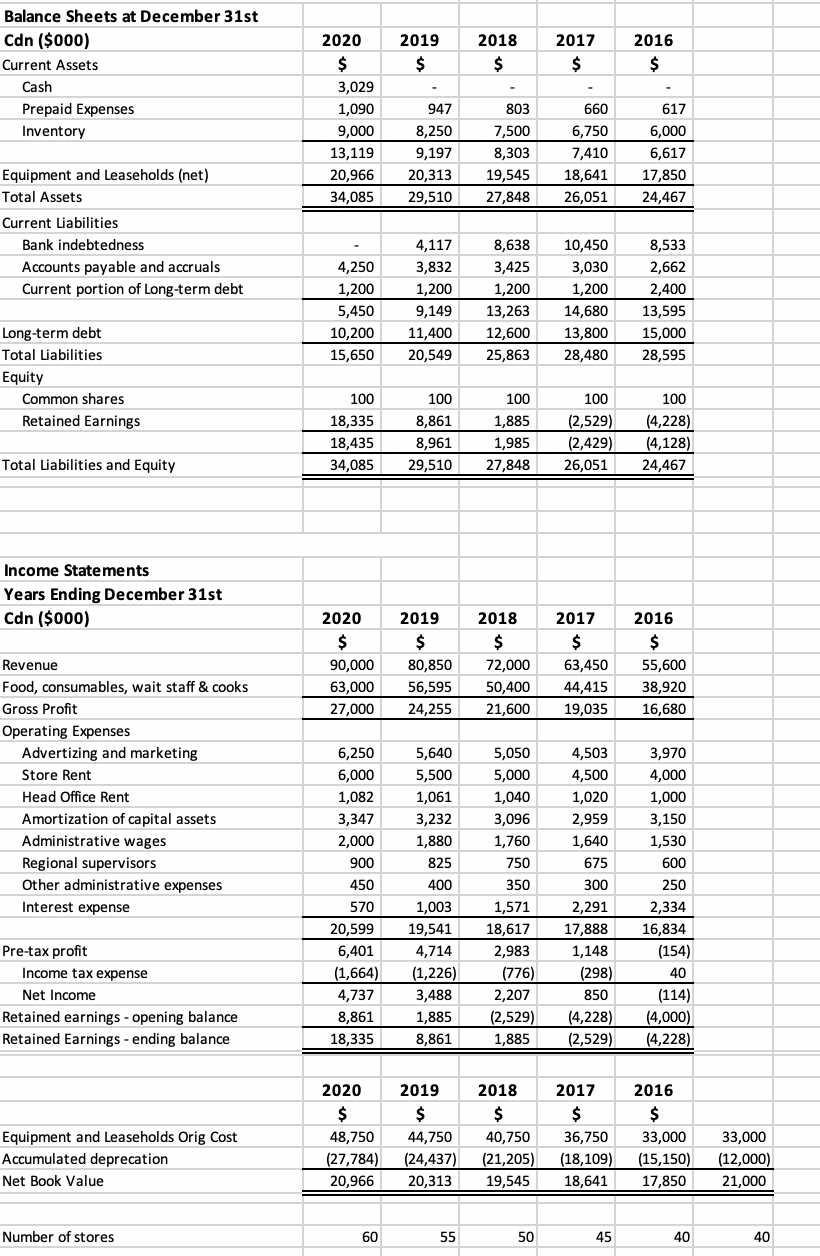

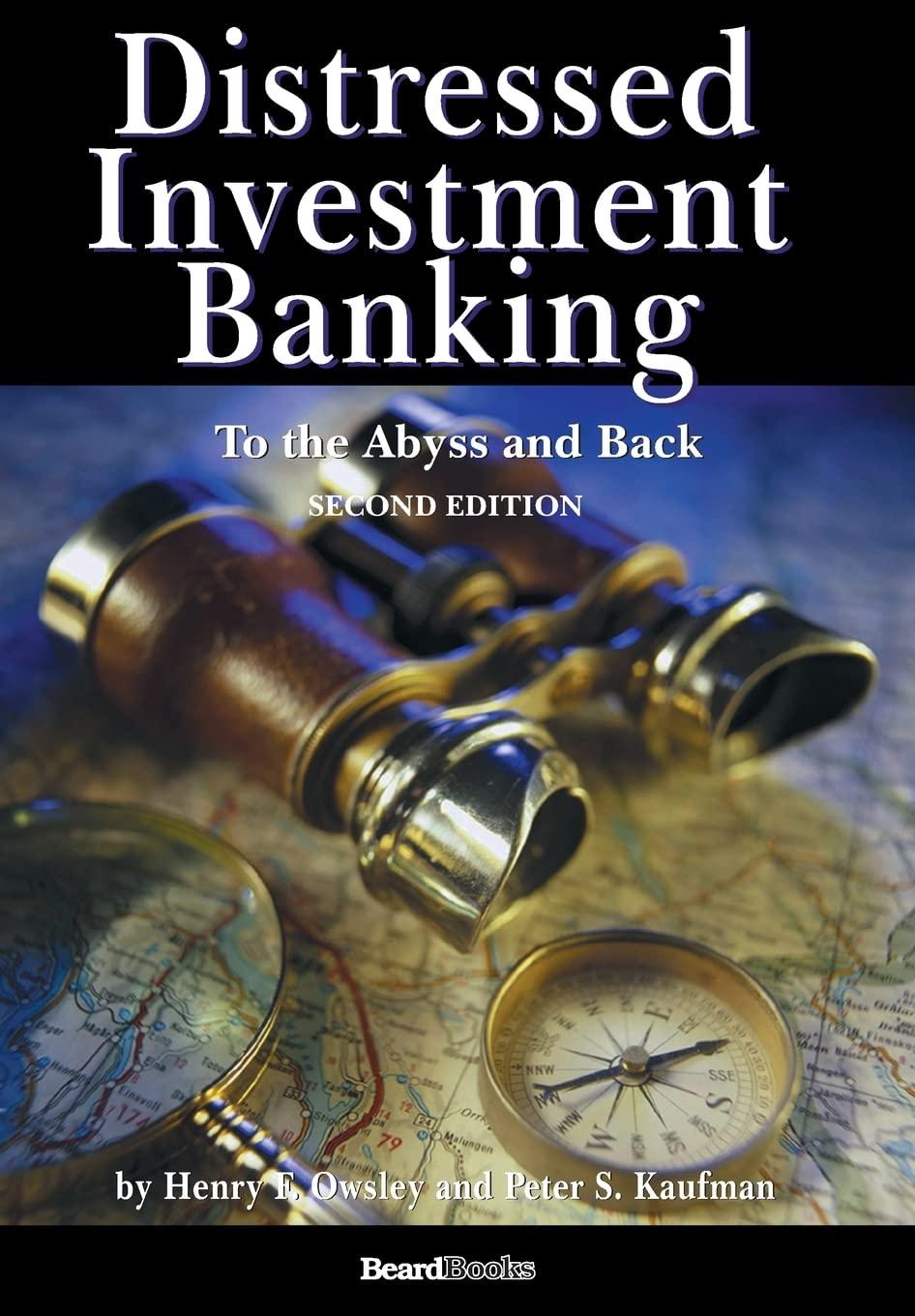

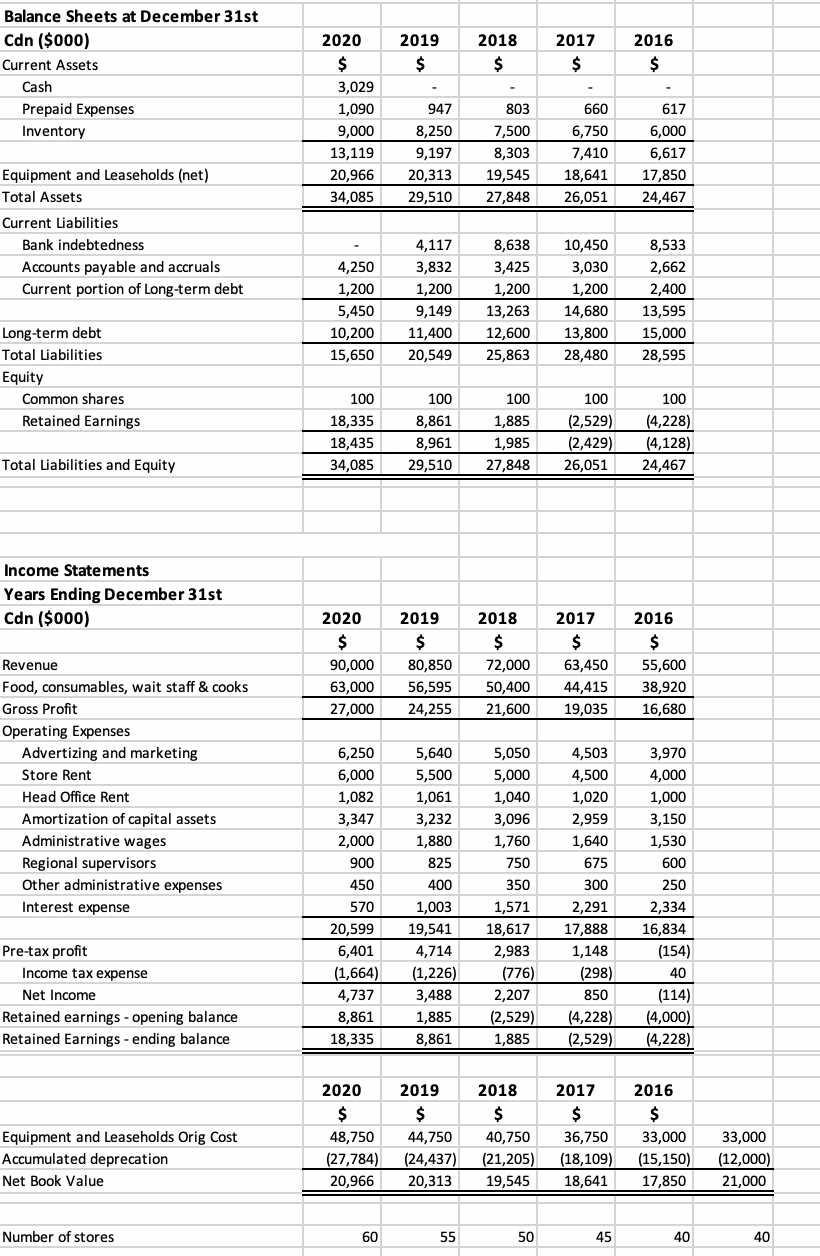

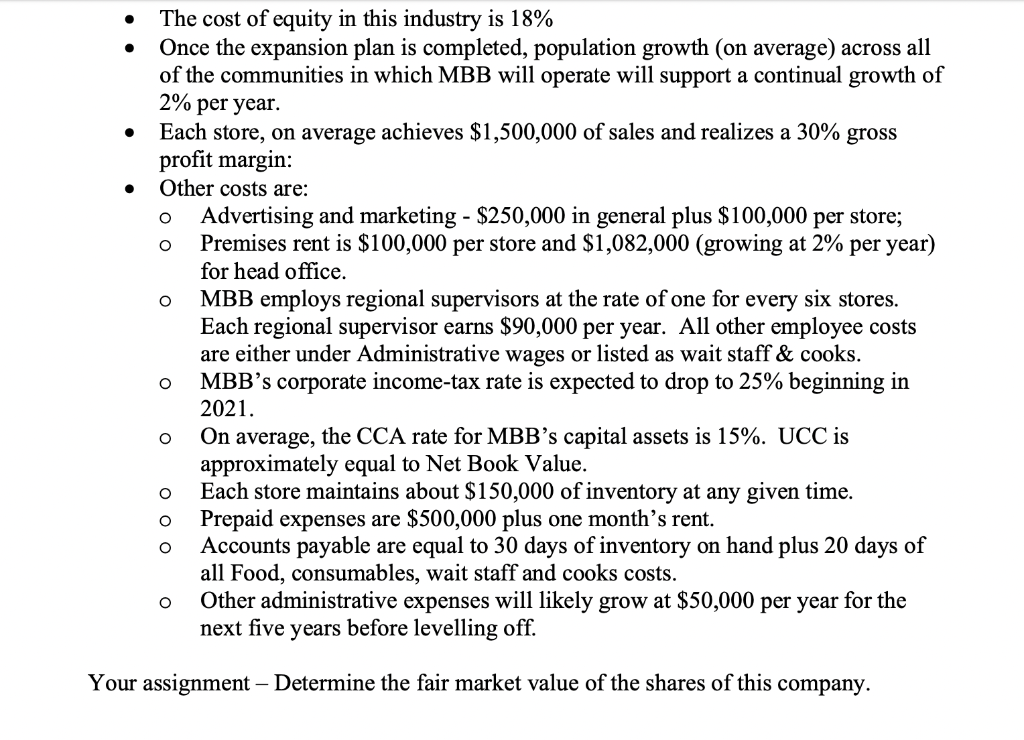

2019 $ 2018 $ 2017 $ Balance Sheets at December 31st Cdn ($000) Current Assets Cash Prepaid Expenses Inventory 2016 $ 2020 $ 3,029 1,090 9,000 13,119 20,966 34,085 803 7,500 660 6,750 947 8,250 9,197 20,313 29,510 8,303 7,410 617 6,000 6,617 17,850 24,467 19,545 27,848 18,641 26,051 Equipment and Leaseholds (net) Total Assets Current Liabilities Bank indebtedness Accounts payable and accruals Current portion of Long-term debt 4,250 1,200 5,450 10,200 15,650 4,117 3,832 1,200 9,149 11,400 20,549 8,638 3,425 1,200 13,263 12,600 25,863 10,450 3,030 1,200 14,680 13,800 28,480 8,533 2,662 2,400 13,595 15,000 28,595 Long-term debt Total Liabilities Equity Common shares Retained Earnings 100 18,335 18,435 34,085 100 8,861 8,961 29,510 100 1,885 1,985 27,848 100 (2,529) (2,429) 26,051 100 (4,228) (4,128) 24,467 Total Liabilities and Equity Income Statements Years Ending December 31st Cdn ($000) 2020 2019 2018 2017 $ 90,000 63,000 27,000 $ 80,850 56,595 24,255 $ 72,000 50,400 21,600 $ 63,450 44,415 19,035 2016 $ 55,600 38,920 16,680 Revenue Food, consumables, wait staff & cooks Gross Profit Operating Expenses Advertizing and marketing Store Rent Head Office Rent Amortization of capital assets Administrative wages Regional supervisors Other administrative expenses Interest expense 6,250 6,000 1,082 3,347 2,000 900 450 570 20,599 6,401 (1,664) 4,737 5,640 5,500 1,061 3,232 1,880 825 400 1,003 19,541 4,714 (1,226) 3,488 5,050 5,000 1,040 3,096 1,760 750 350 1,571 18,617 2,983 (776) 2,207 (2,529) 1,885 4,503 4,500 1,020 2,959 1,640 675 300 2,291 17,888 1,148 (298) 850 (4,228) (2,529) 3,970 4,000 1,000 3,150 1,530 600 250 2,334 16,834 (154) 40 (114) (4,000) (4,228) Pre-tax profit Income tax expense Net Income Retained earnings - opening balance Retained Earnings - ending balance 8,861 1,885 18,335 8,861 Equipment and Leaseholds Orig Cost Accumulated deprecation Net Book Value 2020 $ 48,750 (27,784) 20,966 2019 $ 44,750 (24,437) 20,313 2018 $ 40,750 (21,205) 19,545 2017 $ 36,750 (18,109) 18,641 2016 $ 33,000 (15,150) 17,850 33,000 (12,000) 21,000 Number of stores 60 55 50 45 40 40 The cost of equity in this industry is 18% Once the expansion plan is completed, population growth (on average) across all of the communities in which MBB will operate will support a continual growth of 2% per year. o O O O Each store, on average achieves $1,500,000 of sales and realizes a 30% gross profit margin: Other costs are: Advertising and marketing - $250,000 in general plus $100,000 per store; Premises rent is $100,000 per store and $1,082,000 (growing at 2% per year) for head office. MBB employs regional supervisors at the rate of one for every six stores. Each regional supervisor earns $90,000 per year. All other employee costs are either under Administrative wages or listed as wait staff & cooks. MBB's corporate income-tax rate is expected to drop to 25% beginning in 2021. On average, the CCA rate for MBB's capital assets is 15%. UCC is approximately equal to Net Book Value. Each store maintains about $150,000 of inventory at any given time. Prepaid expenses are $500,000 plus one month's rent. Accounts payable are equal to 30 days of inventory on hand plus 20 days of all Food, consumables, wait staff and cooks costs. Other administrative expenses will likely grow at $50,000 per year for the next five years before levelling off. O O Your assignment Determine the fair market value of the shares of this company. 2019 $ 2018 $ 2017 $ Balance Sheets at December 31st Cdn ($000) Current Assets Cash Prepaid Expenses Inventory 2016 $ 2020 $ 3,029 1,090 9,000 13,119 20,966 34,085 803 7,500 660 6,750 947 8,250 9,197 20,313 29,510 8,303 7,410 617 6,000 6,617 17,850 24,467 19,545 27,848 18,641 26,051 Equipment and Leaseholds (net) Total Assets Current Liabilities Bank indebtedness Accounts payable and accruals Current portion of Long-term debt 4,250 1,200 5,450 10,200 15,650 4,117 3,832 1,200 9,149 11,400 20,549 8,638 3,425 1,200 13,263 12,600 25,863 10,450 3,030 1,200 14,680 13,800 28,480 8,533 2,662 2,400 13,595 15,000 28,595 Long-term debt Total Liabilities Equity Common shares Retained Earnings 100 18,335 18,435 34,085 100 8,861 8,961 29,510 100 1,885 1,985 27,848 100 (2,529) (2,429) 26,051 100 (4,228) (4,128) 24,467 Total Liabilities and Equity Income Statements Years Ending December 31st Cdn ($000) 2020 2019 2018 2017 $ 90,000 63,000 27,000 $ 80,850 56,595 24,255 $ 72,000 50,400 21,600 $ 63,450 44,415 19,035 2016 $ 55,600 38,920 16,680 Revenue Food, consumables, wait staff & cooks Gross Profit Operating Expenses Advertizing and marketing Store Rent Head Office Rent Amortization of capital assets Administrative wages Regional supervisors Other administrative expenses Interest expense 6,250 6,000 1,082 3,347 2,000 900 450 570 20,599 6,401 (1,664) 4,737 5,640 5,500 1,061 3,232 1,880 825 400 1,003 19,541 4,714 (1,226) 3,488 5,050 5,000 1,040 3,096 1,760 750 350 1,571 18,617 2,983 (776) 2,207 (2,529) 1,885 4,503 4,500 1,020 2,959 1,640 675 300 2,291 17,888 1,148 (298) 850 (4,228) (2,529) 3,970 4,000 1,000 3,150 1,530 600 250 2,334 16,834 (154) 40 (114) (4,000) (4,228) Pre-tax profit Income tax expense Net Income Retained earnings - opening balance Retained Earnings - ending balance 8,861 1,885 18,335 8,861 Equipment and Leaseholds Orig Cost Accumulated deprecation Net Book Value 2020 $ 48,750 (27,784) 20,966 2019 $ 44,750 (24,437) 20,313 2018 $ 40,750 (21,205) 19,545 2017 $ 36,750 (18,109) 18,641 2016 $ 33,000 (15,150) 17,850 33,000 (12,000) 21,000 Number of stores 60 55 50 45 40 40 The cost of equity in this industry is 18% Once the expansion plan is completed, population growth (on average) across all of the communities in which MBB will operate will support a continual growth of 2% per year. o O O O Each store, on average achieves $1,500,000 of sales and realizes a 30% gross profit margin: Other costs are: Advertising and marketing - $250,000 in general plus $100,000 per store; Premises rent is $100,000 per store and $1,082,000 (growing at 2% per year) for head office. MBB employs regional supervisors at the rate of one for every six stores. Each regional supervisor earns $90,000 per year. All other employee costs are either under Administrative wages or listed as wait staff & cooks. MBB's corporate income-tax rate is expected to drop to 25% beginning in 2021. On average, the CCA rate for MBB's capital assets is 15%. UCC is approximately equal to Net Book Value. Each store maintains about $150,000 of inventory at any given time. Prepaid expenses are $500,000 plus one month's rent. Accounts payable are equal to 30 days of inventory on hand plus 20 days of all Food, consumables, wait staff and cooks costs. Other administrative expenses will likely grow at $50,000 per year for the next five years before levelling off. O O Your assignment Determine the fair market value of the shares of this company