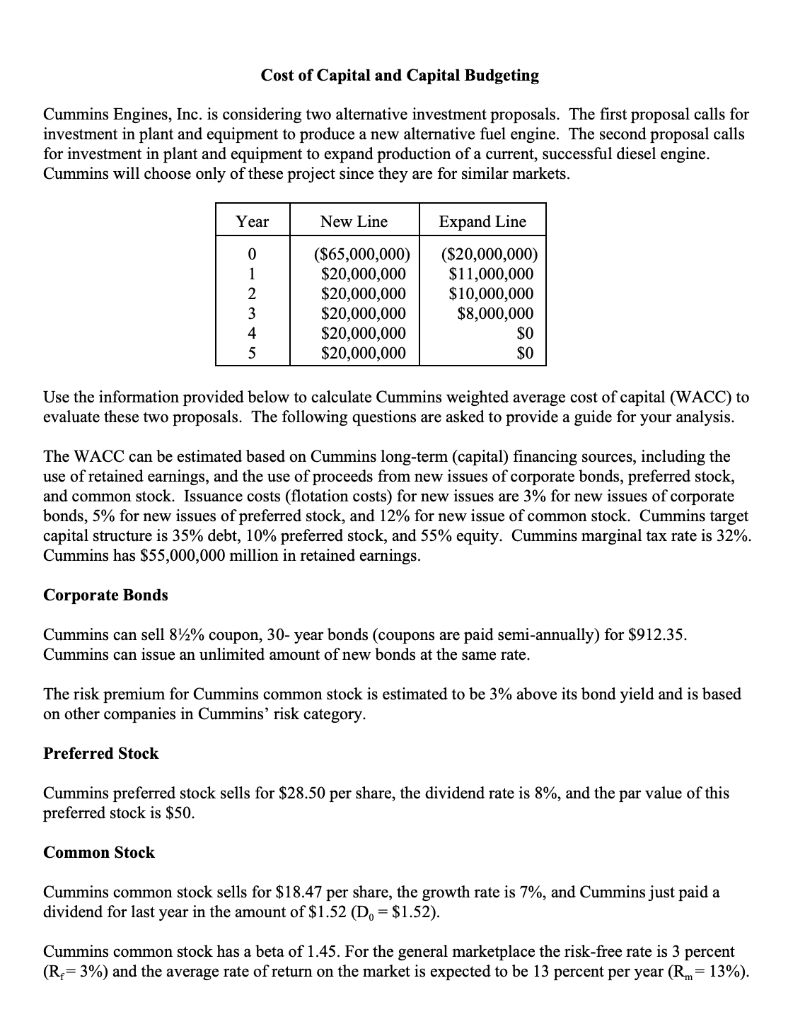

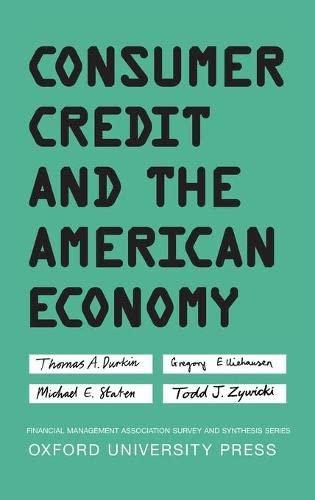

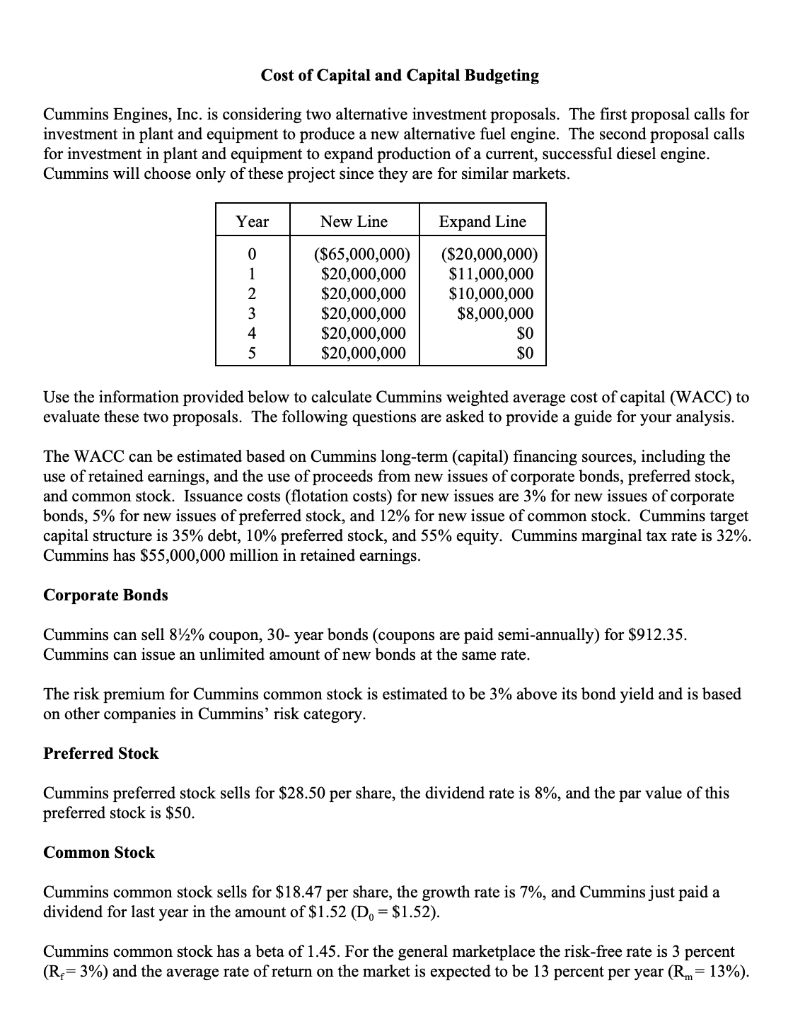

Cost of Capital and Capital Budgeting Cummins Engines, Inc. is considering two alternative investment proposals. The first proposal calls for investment in plant and equipment to produce a new alternative fuel engine. The second proposal calls for investment in plant and equipment to expand production of a current, successful diesel engine Cummins will choose only of these project since they are for similar markets New Line Expand Line Year ($65,000,000 (20,000,000) $11,000,000 $10,000,000 $8,000,000 S0 S0 $20,000,000 $20,000,000 S20,000,000 S20,000,000 S20,000,000 4 Use the information provided below to calculate Cummins weighted average cost of capital (WACC) to evaluate these two proposals. The following questions are asked to provide a guide for your analysis The WACC can be estimated based on Cummins long-term (capital) financing sources, including the use of retained earnings, and the use of proceeds from new issues of corporate bonds, preferred stock, and common stock. Issuance costs (flotation costs) for new issues are 3% for new issues of corporate bonds, 5% for new issues of preferred stock, and 12% for new issue of common stock. Cummins target capital structure is 35% debt, 10% preferred stock, and 55% equity. Cummins marginal tax rate is 32%. Cummins has S55,000,000 million in retained earnings Corporate Bonds Cummins can sell 82% coupon, 30- year bonds (coupons are paid semi-annually) for S912.35 Cummins can issue an unlimited amount of new bonds at the same rate The risk premium for Cummins common stock is estimated to be 3% above its bond yield and is based on other companies in Cummins' risk category Preferred Stock Cummins preferred stock sells for $28.50 per share, the dividend rate is 8%, and the par value of this preferred stock is $50 Common Stock Cummins common stock sells for $18.47 per share, the growth rate is 7%, and Cummins just paid a dividend for last year in the amount of $1.52 (Do-$1.52) Cummins common stock has a beta of 1.45. For the general marketplace the risk-free rate is 3 percent (R,-3%) and the average rate of return on the market is expected to be 13 percent per year (Rm-13%) 12. Calculate the net present value (NPV) of each project and based on this criteria for which project would you recommend acceptance (use WACC, as the discount rate)? 13. Calculate the profitability index (PI) of each project and based on this criteria for which projedt would you recommend acceptance (use WACC, as the discount rate)? Calculate the internal rate of return (IRR) of each project and based on this criteria for which project would you recommend acceptance? 14. Calculate the modified internal rate of return (MIRR) of each project and based on this criteria for which project would you recommend acceptance (use WACC, as the discount rate)'? 15. 16 Overall, you should find conflicting recommendations based on the various criteria. Why is this occurring? Cost of Capital and Capital Budgeting Cummins Engines, Inc. is considering two alternative investment proposals. The first proposal calls for investment in plant and equipment to produce a new alternative fuel engine. The second proposal calls for investment in plant and equipment to expand production of a current, successful diesel engine Cummins will choose only of these project since they are for similar markets New Line Expand Line Year ($65,000,000 (20,000,000) $11,000,000 $10,000,000 $8,000,000 S0 S0 $20,000,000 $20,000,000 S20,000,000 S20,000,000 S20,000,000 4 Use the information provided below to calculate Cummins weighted average cost of capital (WACC) to evaluate these two proposals. The following questions are asked to provide a guide for your analysis The WACC can be estimated based on Cummins long-term (capital) financing sources, including the use of retained earnings, and the use of proceeds from new issues of corporate bonds, preferred stock, and common stock. Issuance costs (flotation costs) for new issues are 3% for new issues of corporate bonds, 5% for new issues of preferred stock, and 12% for new issue of common stock. Cummins target capital structure is 35% debt, 10% preferred stock, and 55% equity. Cummins marginal tax rate is 32%. Cummins has S55,000,000 million in retained earnings Corporate Bonds Cummins can sell 82% coupon, 30- year bonds (coupons are paid semi-annually) for S912.35 Cummins can issue an unlimited amount of new bonds at the same rate The risk premium for Cummins common stock is estimated to be 3% above its bond yield and is based on other companies in Cummins' risk category Preferred Stock Cummins preferred stock sells for $28.50 per share, the dividend rate is 8%, and the par value of this preferred stock is $50 Common Stock Cummins common stock sells for $18.47 per share, the growth rate is 7%, and Cummins just paid a dividend for last year in the amount of $1.52 (Do-$1.52) Cummins common stock has a beta of 1.45. For the general marketplace the risk-free rate is 3 percent (R,-3%) and the average rate of return on the market is expected to be 13 percent per year (Rm-13%) 12. Calculate the net present value (NPV) of each project and based on this criteria for which project would you recommend acceptance (use WACC, as the discount rate)? 13. Calculate the profitability index (PI) of each project and based on this criteria for which projedt would you recommend acceptance (use WACC, as the discount rate)? Calculate the internal rate of return (IRR) of each project and based on this criteria for which project would you recommend acceptance? 14. Calculate the modified internal rate of return (MIRR) of each project and based on this criteria for which project would you recommend acceptance (use WACC, as the discount rate)'? 15. 16 Overall, you should find conflicting recommendations based on the various criteria. Why is this occurring