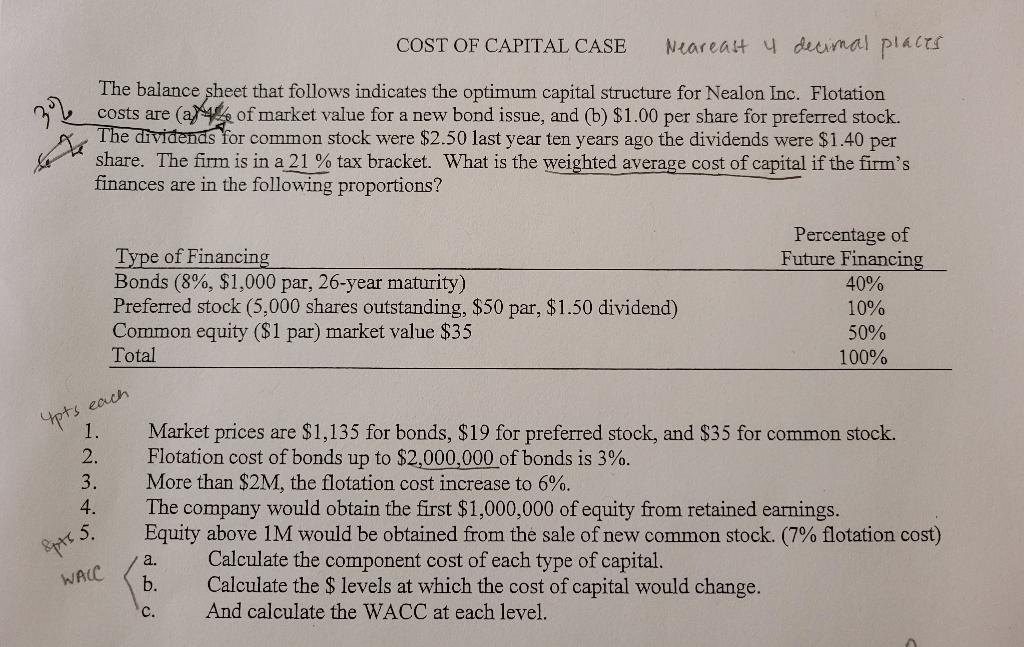

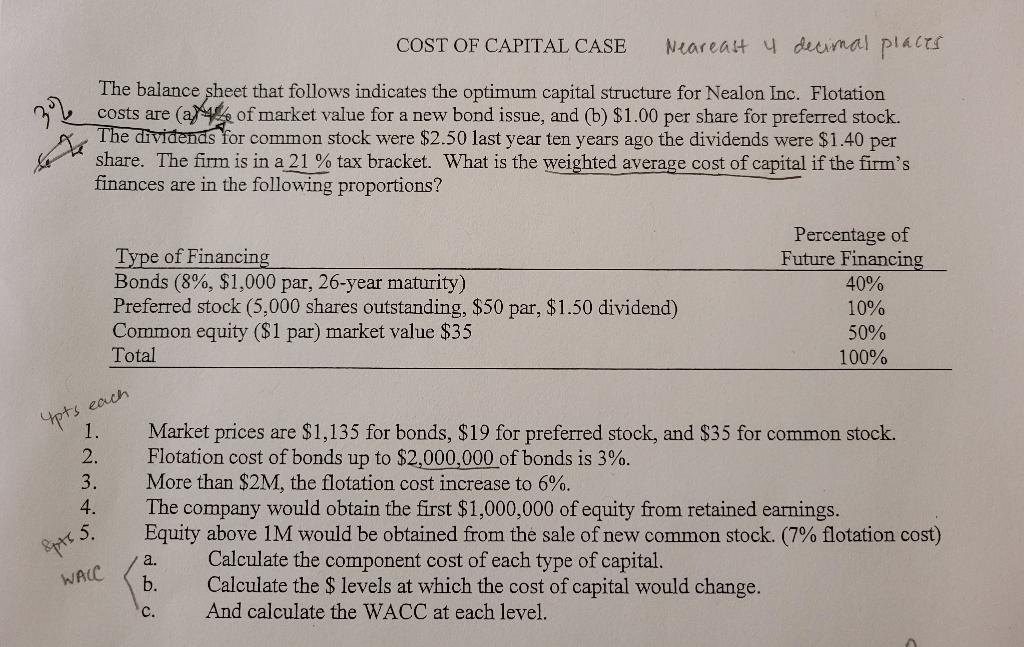

COST OF CAPITAL CASE Neareast 4 decimal places 32 The balance sheet that follows indicates the optimum capital structure for Nealon Inc. Flotation costs are cause of market value for a new bond issue, and (b) $1.00 per share for preferred stock. The dividends for common stock were $2.50 last year ten years ago the dividends were $1.40 per share. The firm is in a 21 % tax bracket. What is the weighted average cost of capital if the firm's finances are in the following proportions? Type of Financing Bonds (8%, $1,000 par, 26-year maturity) Preferred stock (5,000 shares outstanding, $50 par, $1.50 dividend) Common equity ($1 par) market value $35 Total Percentage of Future Financing 40% 10% 50% 100% Upts each 1. 2. 3. 4. Market prices are $1,135 for bonds, $19 for preferred stock, and $35 for common stock. Flotation cost of bonds up to $2,000,000 of bonds is 3%. More than $2M, the flotation cost increase to 6%. The company would obtain the first $1,000,000 of equity from retained earnings. Equity above 1M would be obtained from the sale of new common stock. (7% flotation cost) Calculate the component cost of each type of capital. b. Calculate the $ levels at which the cost of capital would change. c. And calculate the WACC at each level. Epts 5. a. WACC COST OF CAPITAL CASE Neareast 4 decimal places 32 The balance sheet that follows indicates the optimum capital structure for Nealon Inc. Flotation costs are cause of market value for a new bond issue, and (b) $1.00 per share for preferred stock. The dividends for common stock were $2.50 last year ten years ago the dividends were $1.40 per share. The firm is in a 21 % tax bracket. What is the weighted average cost of capital if the firm's finances are in the following proportions? Type of Financing Bonds (8%, $1,000 par, 26-year maturity) Preferred stock (5,000 shares outstanding, $50 par, $1.50 dividend) Common equity ($1 par) market value $35 Total Percentage of Future Financing 40% 10% 50% 100% Upts each 1. 2. 3. 4. Market prices are $1,135 for bonds, $19 for preferred stock, and $35 for common stock. Flotation cost of bonds up to $2,000,000 of bonds is 3%. More than $2M, the flotation cost increase to 6%. The company would obtain the first $1,000,000 of equity from retained earnings. Equity above 1M would be obtained from the sale of new common stock. (7% flotation cost) Calculate the component cost of each type of capital. b. Calculate the $ levels at which the cost of capital would change. c. And calculate the WACC at each level. Epts 5. a. WACC